About the Author – ValueInvestingNow.com

After serving 6 years in the US Navy, I completed 7 years of education in accounting and earned a Master of Science in Accounting. I practiced as an accountant and controller, providing bookkeeping, accounting, and tax services for over 33 years. During that time, I feel that I learned about business principles through practical application.

I have written over 220 articles about value investing that are posted to this site. It all started with an economic theory called ‘marginal value’; i.e., those companies that are marginally better than other similar operations outperform their competition dramatically in the stock market. In turn, this marginal value prevents deep losses, provides faster recoveries, and higher-than-normal post-recovery highs with their stock price. When an investor pays attention to this, a lot of value can be acquired.

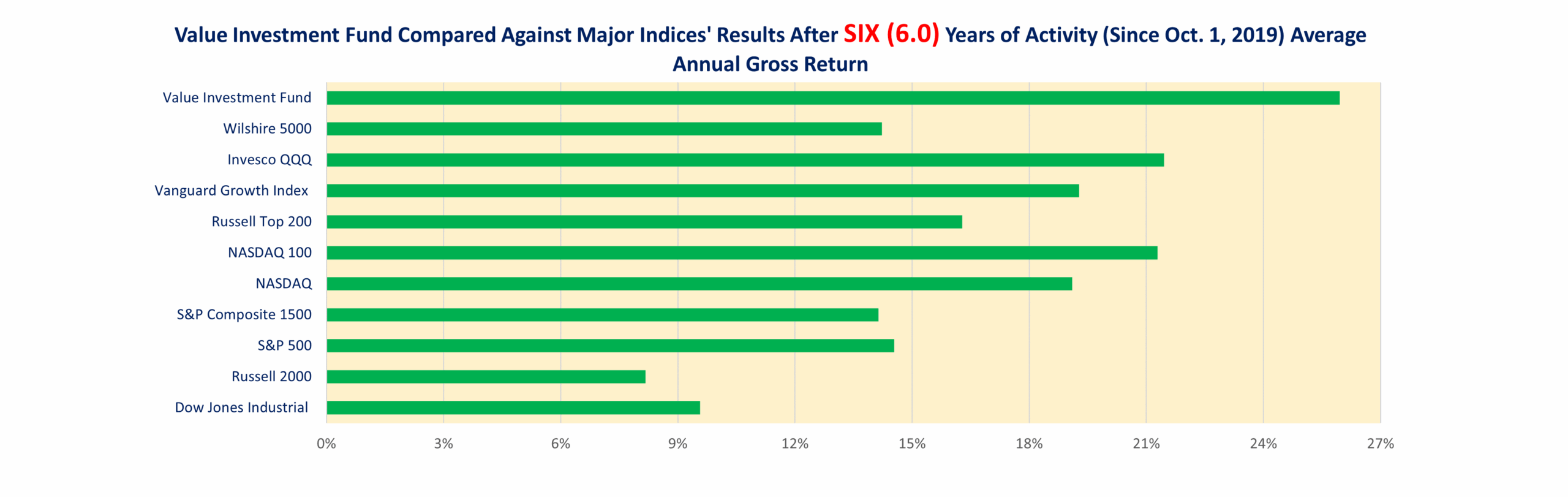

After eight years of preparing the foundation of resources, I tested value investing principles by creating an investment fund that adhered to the single tenet and the four core principles of value investing. Over the last six years, this Fund has outperformed the best major index by 8 percent!

Look at the results lifetime to date through September 30, 2025.

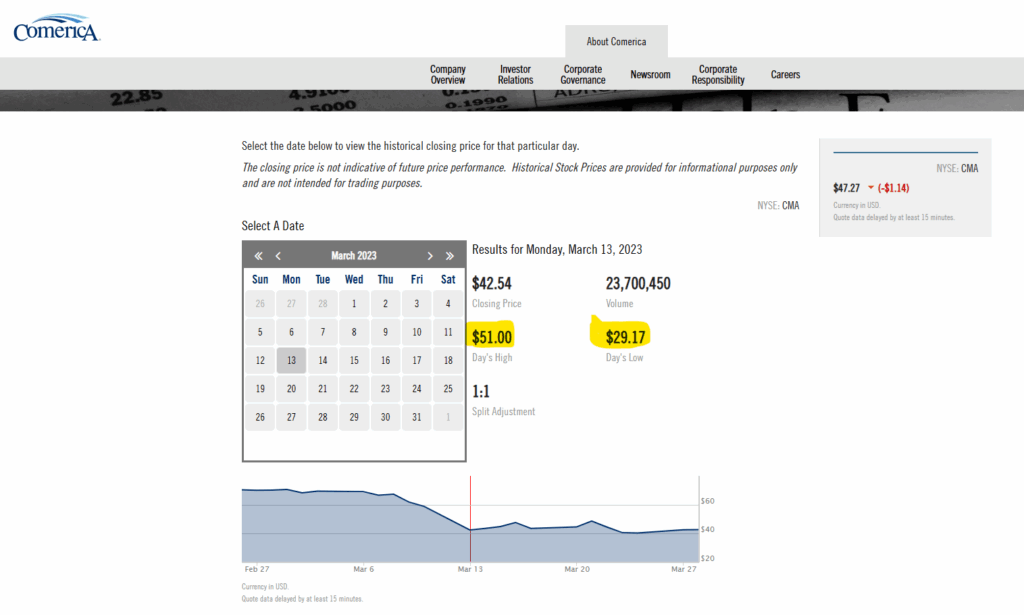

No other website documents and puts forth the results of their investments and updates readers regularly with the respective activities and performance. They will not do this because, at some point, their system fails or the risk dramatically increases, undermining their position and statements put forth. I have no problem identifying an error in my posts. It has happened a few times already. I look at it as an opportunity to learn or discover a flaw with the formulas used. Thus far, every trade has been beneficial to the Investment Fund. Only two investments to date underperformed the expected outcome. It simply took longer to recover to the sales price desired. Thus, instead of a minimum 20% return on the investment, it was just slightly more than 11% for one and 14% for the other. It is going to happen every now and then. To offset this, there are some one-time dramatic winners, such as the banking trade made back in March of 2023 that earned over 100% in one day. When aggregated together, the entire Fund simply outperforms all other major indices during the same period.

For a Summary Accounting, please download this report: .

The following reports identify the respective detailed activity over the last six years:

Given the exceptional results, I’ve turned this site into a value investing club through membership, including an education channel whereby any visitor may read about the three phases of learning how to value invest. The last phase allows them to share their knowledge with other members of the club. Click on the Investment Club button above in the main menu bar and click on the member program to join. Registration begins November 1, 2025.

If you need to contact me, use the ‘Contact Me’ tab in the menu board. I generally respond within 24 hours. YES, I do respond. I’m an educator, I love a good thought-provoking question, and I want to hear others’ insight into problem resolution or their unique business thinking.

I consider myself well-read and an educator. I have the necessary formal education, job history, input from mentors, and lifetime experiences to prepare me to write and document the primary tenet of business (buy low, sell high) and correlating four principles of value investing.

Credentials:

- Undergraduate Degree in Accounting – Christopher Newport University

- Master of Science in Accounting – Old Dominion University

- 33 Years as an Accountant/Controller

- Certificate in Financial Planning – Old Dominion University 1994 (One-Year Program Exploring the 5 Areas of Personal Financial Planning)

I’m actively involved in the community and enjoy getting out there and helping others. It is how I meet new friends and hear wonderful stories about business and life.

Community Service:

- Nine Years as a Boy Scout Adult Leader (Committee Positions, Eagle Scout Mentor, Den Leader)

- Eight Years as a Little League Coach (And Yes, I’ve Been Beaned by Many a Baseball)

- Two Years as a Volunteer Little League Umpire (Parents take this game too seriously)

- Five Years as Committee Member for a Big Brothers/Big Sisters Chapter (2 Years as President of the Chapter)

- Two Years – Kiwanis Member

Two clients in particular were astute businesspeople. One was an engineer, the other an RV dealer. Thank you, Bob V. and Crosby Forrest, for what you taught me about business and life. Along the way, I have performed services for many different industries and learned that each industry has its own set of principles and standards to earn a good profit. The lessons learned are what I write about on this site.

This site is designed to help investors utilize an excellent well well-tested, and thorough process of systematic buying and selling of stock; it is commonly referred to as value investing.

Value investing, in its simplest terms, means buying securities at a low price and selling them at a higher price. Value investing is defined as a systematic process of purchasing high-quality stocks at an undervalued market price, quantified by intrinsic value and justified through financial analysis, then selling the stock promptly upon market price recovery. You can learn about value investing on this site.

If you need help or want some particular answers to any questions, use the ‘Contact Me’ tab in either the main or footer menu. I’m not at my desk 24/7, so please be patient; I will respond.

Thanks for reading, and I hope I have helped in some way.

DAVE