Value Investing Program

Value investing, in its simplest terms, means buying securities at a low price and selling them at a higher price. Value investing is defined as a systematic process of purchasing high-quality stocks at an undervalued market price, quantified by intrinsic value and justified through financial analysis, then selling the stock promptly upon market price recovery. You can learn about value investing on this site.

The primary tenet of value investing is to buy low and sell high. If done properly, average annual returns on an investment fund will exceed 21% after taxes. Value investing requires the investor to spend some time creating a decision matrix for each security within a pool of similar companies. This model is then implemented and updated annually. Value investing is, in effect, the exact opposite of day trading. Value investing takes advantage of time, and this reduces the overall stress for a fund manager. As an example, this site’s Value Investment Fund completed 36 full trades over a course of six years, realizing a net profit of $239k. The initial starting basis (investment) was $100,000.

Value investing relies on four principles to ensure success.

Risk Reduction

The first is risk reduction by only working with high-quality stocks; in general, work with the top 2,000 companies in the United States. Avoid penny and small-cap financial instruments at all costs. Top companies reduce risk significantly due to their stable earnings. Stability of earnings is the most important value derivative in business that reduces risk.

Intrinsic Value

Secondly, value investors rely on intrinsic value to set the buy/sell range of the market price for the respective stock. Intrinsic value has a dynamic definition and is covered deeply in this website’s education channel; in effect, it means the company’s true worth. There are several different intrinsic valuation formulas, and their application is a function of the company’s business model. There is no single universal intrinsic valuation formula; it must be modified per industry based on the standards and business model of that industry.

Financial Analysis

In addition, value investors use financial analytics to validate operational and financial performance. This analysis allows the value investor to determine the most likely market price recovery point and its associated time frame. Financial analysis also provides the confidence that the investment will indeed pay out as calculated.

Patience

Finally, patience is required. Time is on the value investor’s side. This is the most difficult of all four principles to follow due to ‘fear of missing out’, FOMO, or presentation of other opportunities. Thus, decision models are developed to assist the value investor as to when to sell.

This site’s value investing program is a dual-channel program. The first channel is the Value Investment Club. Participation in the club requires a subscription. The second channel is the educational channel. This channel is FREE. It teaches the reader about value investing. The end goal is to inform the value investor about the four core principles and how to perform analysis. This channel has three phases of lessons along with in-depth tutorials and videos to teach value investing and basic business principles used in certain industries.

Registration for the Value Investment Club begins November 1, 2025.

First Channel – Value Investment Club

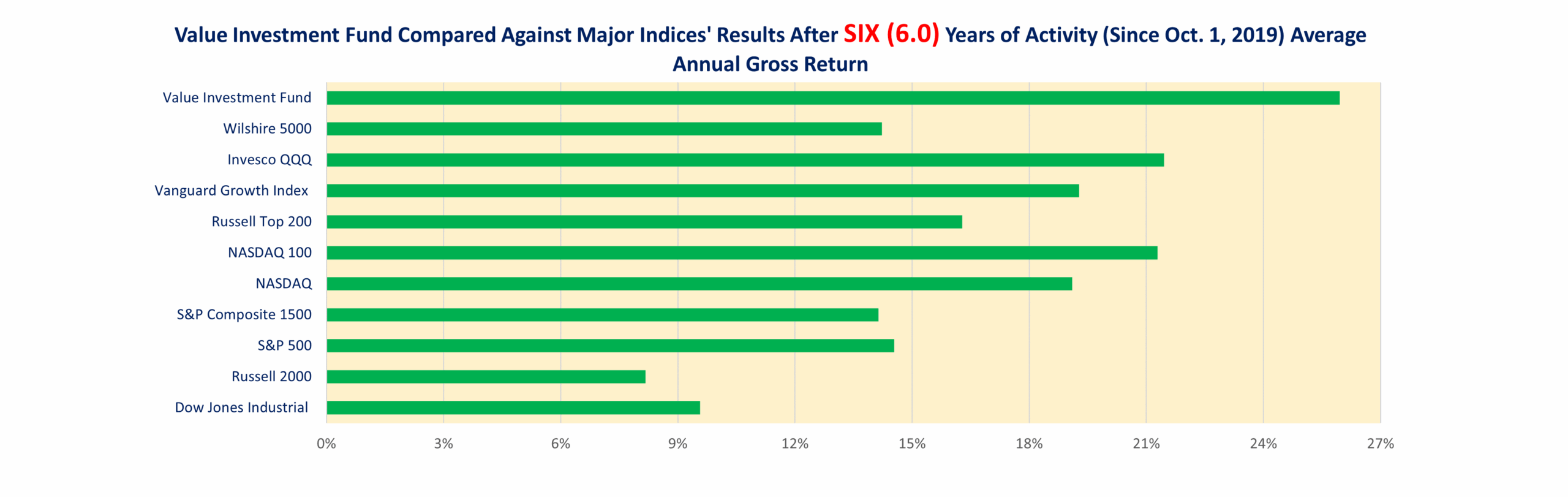

The facilitator on this channel has demonstrated a successful program of adherence to the primary business tenet of ‘buy-low, sell-high’ by developing a Value Investment Fund. Every transaction over the last six years is recorded along with spreadsheets, and a full report is available here for FREE. Over the course of six years, the facilitator has demonstrated an annual return of 25.9%, almost 21% after taxes. See below downloadable spreadsheets below. On the respective pools of investment opportunities page, are the transaction activity related to that pool.

For a Summary Accounting, please download this report: .

The following reports identify the respective detailed activity over the last six years:

All transaction activity was recorded in real time on this site. In addition, the facilitator has created spreadsheets of the buy/sell points for the respective securities within the industry pools, you must be a member of the Value Investment Club to access these respective buy/sell points for the 60+ potential investments. The following is a summary of the results of activity with this site’s Value Investment Fund Pools:

. Earnings Over Six Years Through 09/30/25

- Real Estate Investment Trusts $78,894

- Railways 54,447

- Fast Food Restaurants 420

- Insurance (Property and Casualty) No Activity

- Banks 45,271

- Entertainment 39,180

- Hotels 1,609

- Retail 14,500

- Military Contractors 67,950

- Total Realized Earnings – Six Years Thru 09/30/25 $302,271

There are over 60 different securities involved. The respective buy/sell points are updated regularly, and it is this information that a subscriber receives. Information includes:

- Intrinsic Value Calculations

- Suggested Margin of Security (Buy Points)

- Expected Hold Period

- Selling Point

Each pool of investments has the respective spreadsheet as a downloadable document, again, membership in the Value Investment Club is required. In addition, associated research and industry standards require a login to review. This information is not available to the casual site visitor. The subscriber can use this information to create their value investment fund with their own industry pools or, if they so desire, mimic this site’s Value Investment Fund activity.

As a subscriber to the Investment Club, you get the following benefits:

- Email Alerts for any pending transactions or actual activity for this site’s Value Investment Fund;

- Monthly Newsletter regarding the activity within the Value Investment Fund;

- Quarterly Spreadsheets for each active pool of investments with this facilitator’s calculated intrinsic value, buy and sell points;

- Weekly Article regarding one of the 60-plus potential investments outlining the respective business dynamics, issues, standards, and calculated buy/sell metrics;

- Watch Notices for possible opportunities along with suggested buy and stop loss points.

Each month, you get regular e-mails that provide recent activity and directives related to the buying and selling of the pool’s potential opportunities. In addition, sometimes alerts are sent when opportunities exist with buys and sells of certain securities. In effect, you can mimic the performance of this site’s Value Investment Fund. The particular program venue provides the following benefits:

- Access to at least six pools of industries and their corresponding potential corporate information (currently 46 members in the aggregate);

- Each pool has its own decision matrix for buy and sell points.

- Documented intrinsic values for the respective corporations;

- Updated buy/sell points as companies report their financial achievements;

- Alerts as securities get close to their buy and sell points;

- Regular updates on the Value Investment Fund’s financial performance;

- Access to a wealth of knowledge about value investing.

Although not required, it is encouraged for the subscriber to learn about value investing. This is the second channel of this program.

Second Channel – Education

Learn about value investing and how you can easily acquire similar results with your personal investment fund. Start investing with confidence in what you learn. Create your fund and, over time, accumulate wealth. THIS CHANNEL IS FREE AND OPEN TO THE PUBLIC.

This channel provides the following:

- Lessons about value investing and the principles involved, Phase I of the program;

- Charts, graphs, and resources to use when you create your pool, Phase II of the program;

- White papers addressing financial principles and proper interpretation methods, Phase III of the program; AND

- Some simple good advice.

When you join the Value Investing Club, you can access both channels. The first channel (Value Investment Club) requires subscription (Registration for the Value Investment Club begins November 1, 2025) and is the one most visitors to this site are interested in, including access to the activity and models of the Value Investment Fund.

The second channel (FREE and openly available to any site visitor) is oriented around educating readers about value investing. There are three phases to this part of the program. The first phase consists of lessons 1 through 18 and introduces the concepts and principles of value investing. This Phase I – Four Core Principles of the program teaches about the one core tenet of value investing and the four principles that make value investing so successful.

The second phase consists of 80 additional lessons, Lessons 19 – 98. These lessons go into deep detail about the respective individual steps to create a pool of similar investments and design the respective buy/sell model used with value investing. Issues covered in great detail include:

- Understanding and interpreting financial statements;

- Calculating intrinsic value;

- Evaluating financial status and potential returns; AND

- Construction of a buy/sell model for the pool and its members.

Included in this phase are spreadsheets, formulas, graphs, and resources for the value investor. An investment pool creation (retail) is illustrated throughout this batch of lessons. Phase II – Financial Analysis

The third phase is referred to as the sophistication phase. Here, the author explores additional tools a value investor uses to improve their overall return on investment and reduce risk. Topics covered include how to create counterpositions that guarantee profitability; how to read the notes sections of annual reports to gain an advantage over institutional investors; when to dispose of underperforming investments; and finally, learn how to utilize the formulas of value investing to leverage your return without any additional risk.

Phase III – Sophisticated Investing

In this phase of the value investing program, ‘Sophistication’, the value investor is taught certain techniques of investing that further reduce risk and increase overall marginal return by two to three percent per year. Techniques taught include:

- Utilizing PUTs to add cash to the Fund;

- How arbitrage rewards those who pay attention to details (simultaneous buying and selling of a security);

- Preferred stock investing;

- How hedging works;

- Owning convertible bonds;

- Intangible asset valuations;

- Leveraging the portfolio via margin trading;

- And more.

Unlike traditional practices with the above techniques, value investors do their homework and adhere to the core tenet of buying low and selling high. This applies to the above techniques, too. Act on Knowledge.

Value Investment Club Membership