Business Ratios

Value investing is defined as a systematic process of buying high-quality stocks at an undervalued market price, quantified by intrinsic value and justified through financial analysis, then selling the stock promptly upon market price recovery.

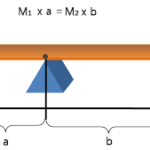

Business ratios are used with financial information to compare companies of different sizes within the same industry. The goal is to discover the best investment for a return on your stock purchase. Business ratios essentially equalize different-sized companies within the same industry. A common mistake is to compare two different industries within the same economic sector.

Business ratios are strictly a function of the financial reports audited by Certified Public Accountants. There are five widely accepted categories of financial business ratios. Each category has at least two different ratios.

1) Liquidity Ratios – measures the relationship between current assets and the corresponding current liabilities.

2) Activity Ratios – are used to compare balance sheet assets against the volume of sales or an income statement value.

3) Leverage Ratios – assist with evaluating the use of debt to capitalize a company.

4) Performance Ratios – designed to reveal income statement performance.

5) Valuation Ratios – market-driven information customarily tied to the market share price; it is the only set of business ratios not internally generated.

The ratios accepted as outstanding in one industry do not apply to a different industry, even one within the same sector. Utilizing ratios for comparisons is restricted to comparing companies within the same industry. Act on Knowledge.

High Price to Book Ratios – Proper Interpretation and Evaluation

Valuation Ratios

Price-to-Sales Ratio: A Poor Indicator of Value

Performance Ratios

Leverage Ratios

Price to Cash Flow

Activity Ratios

20 Private Industry Sectors

Liquidity Ratios

Return on Equity