Value Investing – Superior Performance

Guidance and Knowledge for Value Investors

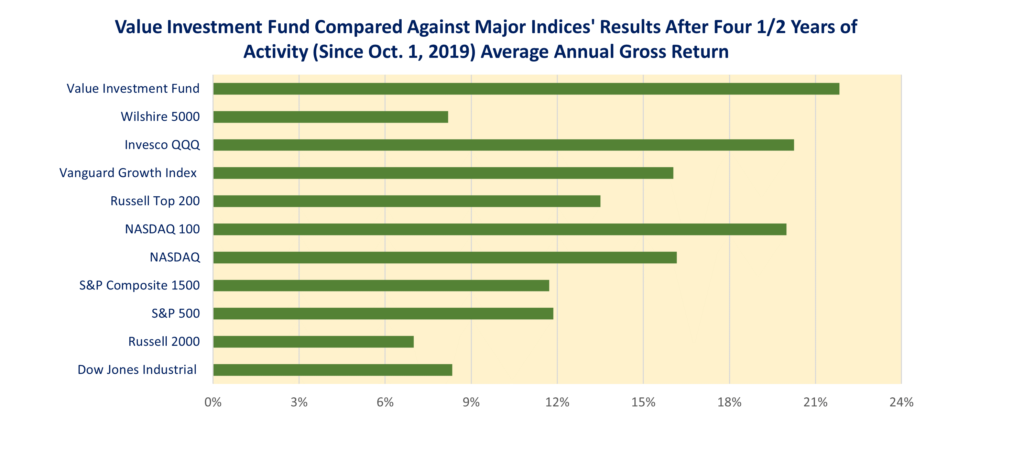

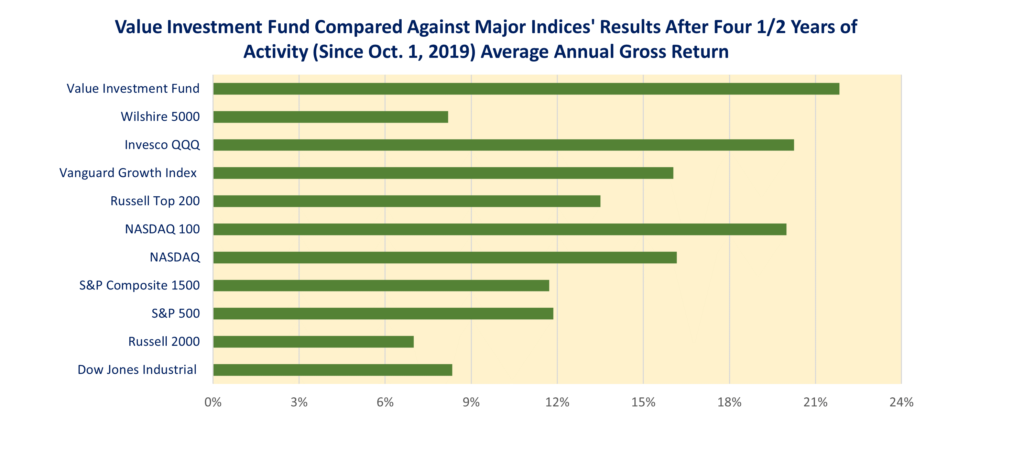

After FOUR and 1/2 YEARS, Value Investing Has Proven it is a Superior Program to any Other Model of Investing. Here is the Proof:

How Much More Proof Do You Need?

Seriously, it is highly unlikely this pattern will deviate dramatically over the next two to three years. Furthermore, these results include the Bear Market decline during 2022. The principles of Value Investing work!

. Annual Returns (Pre-Tax Basis)

. Value Investment Fund NASDAQ 100 S&P 500

. 2019 (1/4 Year) 15.71% 38.09% 27.56%

. 2020 34.41% 46.94% 16.26%

. 2021 41.08% 26.63% 26.89%

. 2022 (11.35%) (32.97%) (19.44%)

. 2023 41.51% 53.81% 24.23%

. 2024 YTD 12.12% 7.62% 9.11%

. Annual Average 23.47%😯 20.74% 13.34%

. 4.51 Years Thru 04/05/24

This includes all fees/interest charges and future disposal/terminal costs. Whereas, there are no costs with either the NASDAQ 100 or the S&P 500.

Value Investing Now – Guidance and Knowledge for Value Investors is dedicated to value investing and keyed to the primary business tenet of ‘Buy Low, Sell High’.

Value investing is a systematic approach to buying and selling financial instruments (securities/options), more specifically, stocks. The ideal method is to find publicly traded stocks that are currently priced lower than their intrinsic value, buy them at a low price and sell them once the market price reaches maximum price tolerance. In effect, buy low, sell high.

This site’s value investing program is designed for thoughtful investors and not for those seeking a get rich quick stock tip. For those of you unfamiliar with investing via security analysis, and you desire to learn and can appreciate a well-thought out and planned program, then this site is for you.

Those of you that are currently knowledgeable about the market and how to perform security analysis, you can join the Value Investment Club. You will have access to this site’s seven existing pools of investments to augment your own portfolio.

Value Investing History

The value investing concept was initially developed by Benjamin Graham in his first edition of Security Analysis written in 1934. The core premise of value investing is ascertaining what the intrinsic value of a particular stock equals. It is essential to purchase the stock at a low price in order to maximize a return on investment. In the revised edition of Security Analysis updated in 1962, Benjamin Graham identified a formula to calculate intrinsic value with stock:

Value = Earnings times (a constant of 8.5 plus two times an average expected growth rate over the next seven years).

In mathematical short-hand:

V= Earnings (8.5 + 2g)

Since the time period of the formula’s presentation, there have been many documented reviews and suggested modifications. With the inclusion of financial analysis, industry knowledge and patience, value investing is considered the irrefutable leader of investing methodology.

Value Investing Now

Value Investing Now takes this formula and along with other intrinsic valuation algorithms educates the investor about this proven systematic method to buy and sell stocks. This method is rooted in four core principles:

- Risk Reduction – Buy only high quality stocks;

- Intrinsic Value – The underlying assets and operations are of good quality and performance;

- Financial Analysis – Use core financial information, business ratios and key performance indicators to create a high level of confidence that recovery is just a matter of time;

- Patience – Allow time to work for the investor.

The lessons, tutorials, webinars, white papers, spreadsheets on this site are designed to teach these four principles. Furthermore, this site has over 500 supporting articles that augment the lessons and the program. It is effectively the best resource center available to learn about and implement a personal value investment fund. The annual goal is to achieve 21% plus returns.

Value Investing Results

To prove the system works, the author created an investment fund. Look at the results from the first four and one-quarter years. During this time period, the Value Investment Fund outperformed the DOW Jones Industrial Average by a factor of 2.5!

The Fund started with $100,000 at the beginning of the 4th quarter 2019. Since then, it has grown to $253,373. Thus, in just four and a half years, it is earning an average annual return of 23.4%. This includes the dramatic downturn in the market through all of 2022. NOT ONE single investment has lost money; the average holding period is slightly more than nine months; and the worst return recorded to date single transaction activity was an annualized positive 14.97%.

The Fund started with $100,000 at the beginning of the 4th quarter 2019. Since then, it has grown to $253,373. Thus, in just four and a half years, it is earning an average annual return of 23.4%. This includes the dramatic downturn in the market through all of 2022. NOT ONE single investment has lost money; the average holding period is slightly more than nine months; and the worst return recorded to date single transaction activity was an annualized positive 14.97%.

Click on the chart to the left, it illustrates how this Fund has outperformed all major indices during the last fifty-one months. This a direct reflection of how the four core principles of value investing provide superior results.

The only other form of investing that can beat value investing is ‘Speculation‘. Speculation is nothing more than reliance on ‘LUCK’.

Value Investing Now’s Program

The program advocates the creation of ‘Pools’ of similar industry potential investments. It is essential for the investor to become an expert in a particular or a few industries. Each pool consists of no more than 8 companies, all with similar market capitalization positions and compliance requirements. A value investor utilizes six or seven pools of investments to take advantage of different economic wide, industry specific and corporate level influences on stock prices. In addition, the club provides other pools of investments including the research and analysis to augment the investor’s pools to provide 40 to 60 companies for each member participating in the membership club.

A member of this website’s investment club has access to seven pools provided by the club and all the associated analysis and individual corporate buy/sell models used to set the buy low and sell high points for each stock.

If you are interested in learning more, go to the Membership Program page under the Value Investing section in the header above.

Value Investment Fund

Join the value investing club and learn about value investing and how you can easily acquire similar results with your own investment fund. Upon joining, you’ll receive the book Value Investing with Business Ratios, a reference guide used with all the decision models you build.

Each month, you receive an e-mail with a full update on the pools. Follow along as the Investment Fund grows. Start investing with confidence from what you learn. Create your own fund and over time, accumulate wealth. Joining entitles you to the following:

- Full access to all decision matrixes for each pool;

- E-mail alerts to pending possible opportunities mimicking this site’s Value Investment Fund;

- Lessons about value investing and the principles involved, Phase I of the program;

- Free webinars from the author following up the lessons;

- Charts, graphs and resources to use when you create your own pool, Phase II of the program;

- Access to the existing pools and their respective data models along with buy/sell triggers, Investment Fund Pools;

- Follow along with the investment fund and its monthly updates;

- White papers addressing financial principles and proper interpretation methods, Phase III of the program; AND

- Some simple good advice.