Speculation with Investing

“You must never delude yourself into thinking you’re investing when you’re speculating” – Benjamin Graham (Father of Value Investing).

“You must never delude yourself into thinking you’re investing when you’re speculating” – Benjamin Graham (Father of Value Investing).

There is no distinctive crossover point between investing and gambling. Both have elements of speculation involved. Speculation refers to ‘Guessing’. To guess, one relies on their gut feeling. What is interesting is that the gut feeling is directly tied to the availability of good information and one’s experience gained from speculating in the past. The latter, most folks refer to as ‘An Educated Guess’. Speculating is more commonly associated with gambling than with investing, but in reality, it exists in both to a certain degree. It is speculation that incorporates risk. In effect, speculation and risk are somewhat synonymous with each other. As you rely more on guessing, the risk factor also increases.

To illustrate, games of chance such as flipping a coin, rolling a die, or roulette have certain mathematical chances of winning for their respective outcomes. There is no speculation here because guessing is eliminated by the fact that chance is predetermined; the information is maximum because it is well known what the chances are for the respective outcomes. However, if you step up into a greater level of risk in the gambling zone, such as playing Blackjack or Poker, the player has less information input because the information available is based on the cards that have been played or discarded. This information allows the player to evaluate the chances of winning; as such, the player has to add speculation. Risk increases from pure chance games of flipping a coin or a dice. With pure chance, the house has an automatic percentage of winning; whereas with the next level of gambling, the house has increased risk of losing because the table players have an opportunity to incorporate speculation and take ‘An Educated Guess’ at the most probable outcome. With greater speculation comes greater risk.

This is also true with investing. At the extreme, investing is the most conservative investment, such as the purchase of a Federal Treasury Note. Similar to the extreme with gambling (games of pure chance), it has a hint of risk involved. The information about the bond is boundless. However, there is a remote possibility that the U.S. Government will fail to honor its obligations. But since this minute risk is so negligible, there isn’t any real speculation involved with this highly conservative investment.

In between these two extreme points of the gambling/investment spectrum lie all forms of risks, which are often dictated by the level of good information available to the gamer/investor.

Speculating is the act of taking risks in exchange for sizable returns with investing resources. The greater the reliance on speculation, the more likely the increase in the reward. The key is this: the more reliable information available, the less speculation involved. As information dissipates, speculation increases as the gambler/investor must rely more on their ‘Gut Feeling’ than on information available.

Pure speculation does exist. Speculation peaks at around 90% of the decision related to certain types of gambling/investing. At this level, it is pretty much pure speculation with maximum risk involved. The perfect example is a crypto investment. There is very little reliable information about crypto, but it does exist, and many folks call this investing. The reality is that it is absurd to spend sums of money in hopes that the market price will continue to rise and at some point, you exit this particular so-called security (technically, it is not a security). This is about as much ‘Gut Feeling’ as anyone can get related to investing or gambling. The nearest historical similarity is the ‘Great Dutch Tulip Craze‘ from back in the 1630s. The author DOES NOT endorse readers even considering risking their money with crypto or non-fungible tokens (NFTs).

This article explores the various levels of speculation with both gambling and investing. The key element is information; is it available and reliable? Both forms of risking money are similar when comparing risk/speculation. However, there is one key difference between the two venues. With gambling, the risk of loss is pure, i.e., one loses all of one’s money put up to get involved. With investing, it is rare to lose all one’s invested money. Typically, the investment takes longer to come to fruition, or the level of return is diminished due to either unrealistic expectations or market/management factors that lowered the outcomes.

Finally, the article explores why value investing practically eliminates risk and assures an investor of a reasonably good return because speculation is almost eliminated. Note how it is stated that ‘speculation is almost eliminated’. This is because there will always be some hint of speculation with investing. Just as with government bonds, there are no such investments that ‘GUARANTEE‘ a return.

Speculation with Investing – Gambling/Investing Spectrum

Speculation exists in both gambling and investing. Many novice investors believe speculation only exists with gambling. This is not true. Speculation refers to guessing. Even with investing, there is some guessing going on. The key is the degree of guessing. To reduce risk, which is one of the primary principles of value investing, the degree of guessing is reduced by only utilizing companies with extensive available information, especially those that report production regularly. As an example, all the Class I railways report their weekly loads hauled. This allows an investor to monitor the trend towards revenue generation and ultimately the expected profitability at the quarter’s end.

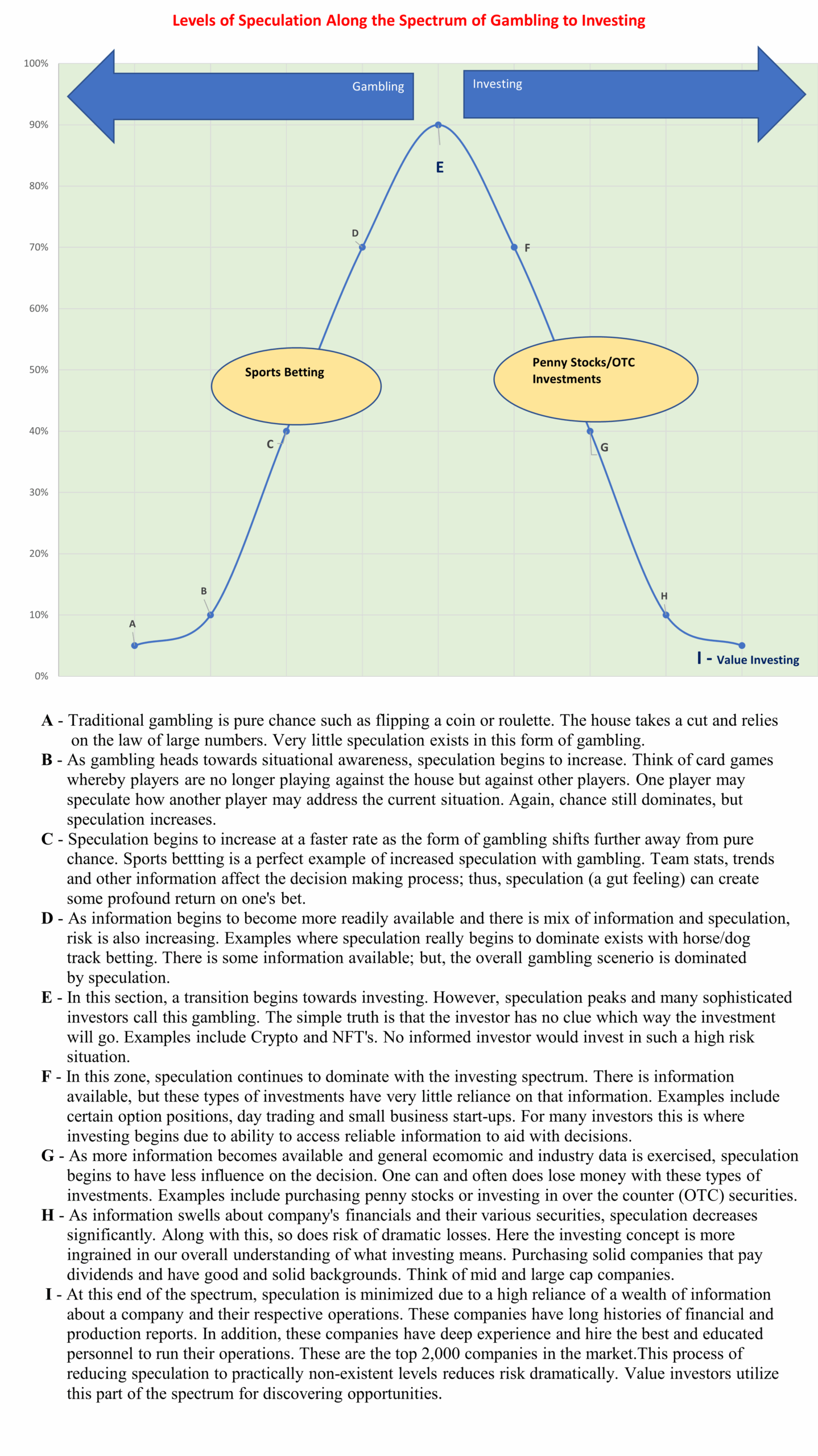

This graph/depiction below illustrates the various levels of speculation for both gambling and investing. Take note, speculation peaks with certain types of gambling and with certain types of investments. The absolute worst level is with crypto and NFTs (non-fungible tokens). With these types of investments/gambling venues, there are no underlying assets, no reliable information, and neither pays dividends nor even has formal audits to validate their existence.

With gambling, it is known upfront that this risky adventure is for entertainment purposes and is not a legitimate form of methodical investment to grow a portfolio of securities. As gambling begins to shift from pure chance to information-based decision making, think of sports betting, the risk/reward relationship begins to take on a new dynamic. In this case, speculating begins to create a greater emphasis, and as such, there can be some unusual outcomes. However, these infrequent explosive returns do not constitute investing; they still tend towards gambling than legitimate well well-thought-out out risk risk-reward transactions.

Moving along the spectrum towards investing is another form of gambling, but it is perceived by many as investing. This involves crypto. Just because something is publicly traded doesn’t make it investing.

As the graphical line moves more towards investing, investment opportunities begin to have good information available. But in many cases, the information is inadequate or unreliable, and thus, speculation is required in order to guess at the return. Great examples include new start-ups, penny stocks, and day trading. Information exists, but either the method of investing or the information is unreliable; thus, speculation is required.

Moving further down the graph line, speculation begins to dissipate rapidly, especially as you move towards highly reliable and more secure forms of securities. The underlying companies are more forthcoming because they are stable and highly reputable operations. Value investors thrive in this zone. Information is plentiful, accurate, and reliable. In addition, these companies are run by some of the best and brightest managers available. They rarely disappoint with their financial results. When a value investor buys in this zone, the odds that the investment’s value will decline further or in an extreme downturn are remote. Speculation is practically eliminated.

It is important to note that there is some element of speculation even with good quality investments. The level of speculation is so low with high-quality investments that it is considered irrelevant to one’s decision model, but it still exists. It is possible for the company to have a series of setbacks or have an accident that greatly affects value; think of the Exxon Valdez oil spill or Enron. Value investors look to eliminate as much risk or speculative element as possible when considering investments. Act on Knowledge.