Economic Bubble – The Great Dutch Tulip Craze

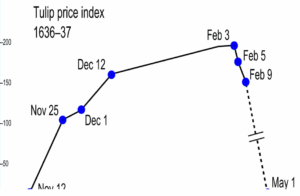

Universally accepted as the first economic bubble, the Great Dutch Tulip Craze, also known as Tulipmania, of the late 1620s to February 1637, serves as a reminder to all of us involved in business that value can be driven by greed and not intrinsic worth. During this period, the price of a tulip bulb rose from 60 times its original value to over 150 times the original price. Think of this in terms of the modern era; imagine buying a stock and selling this stock within a year for over 100 times what you paid for that share of stock.

To understand the first economic bubble burst, I’ll explain a little history leading up to the expansion of the tulip price. From there, a new financial term will be introduced and explained – Futures. Then we’ll look at the continuation of the story and how new players or buyers got involved, driving the price up further. At this point, I’ll discuss the importance of knowing the situation is superior to having financial resources. The last step in any bubble is the ‘POP’ element. What burst the bubble? The last section will describe how this compares to some modern-day business operations, such as real estate flippers and even the popular TV series about buying storage units.

Prelude

An economic bubble is defined by Robert J. Schiller as “a situation in which temporarily high prices are sustained largely by investors’ enthusiasm rather than by consistent estimation of real value”. This statement is coined in his book Irrational Exuberance. Interestingly enough, the phrase ‘irrational exuberance’ was a reference made by Alan Greenspan in a speech back in December 1996. Mr. Greenspan’s statement was “But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions …”. As you read this story, refer back to the above two comments, and you’ll begin to understand the concept of an economic bubble.

Although the Dutch Tulip Craze is considered the first economic bubble, it was not widespread as to affect millions of people. It was rather localized to many towns within Holland. The reason was that the rest of Europe had not taken a liking to the tulip. Most Europeans at that time did not see the value because the tulip offered no fragrance like the rose, nor did it last for an extended period once the flower bloomed.

Economic Bubble – History

Tulips were introduced to Europe from Turkey in the mid-1500s. They began to gain popularity over time and grew well in the climate and soil of the Netherlands and Germany. A typical bulb has a life expectancy of 8 – 12 years and produces offshoots from the bulb after about 3 years of growth. The offshoots are cut from the bulb and replanted to start a new plant. Unbeknownst to the growers, the tulips experienced a viral infection, causing the plant to produce multicolored flowers. These bright differences generated a strong desire within the elite society to own them. The price of the bulbs began to increase in the late 1620s. This is similar to a novice good becoming a luxury item.

As the price started going up, more and more folks began to grow and covet the rarer colors. The picture on the left is of a rare color combination, and this particular pattern is called the Semper-Augustus. Ultimately, this particular bulb sold for the highest amount in early 1637.

Due to the risk that a rare color combination bulb would not create a similar pattern in the offshoot bulb, tulip trading remained within the circle of wealthy families. More importantly, these individuals became aware of optimum growing conditions and only traded when the flower was in bloom. However, others desired to get in on the act of owning and trading bulbs. A creative tool was designed to trade the bulb/offshoots throughout the balance of the year – Futures Contract.

Futures Contract

A Futures Contract is simply a document that a seller of a commodity will deliver the commodity at a given date for a set sum. That sum can be paid today or on the day of delivery. Because this is a document, the owner of the contract can sell this financial instrument at any time.

For more information about futures contracts, please read the following: A Core Definition of a Futures Contract.

Now, an owner of a bulb that is in the ground can sell his offshoots or the bulb itself via this futures contract. This satisfied the need to trade throughout the rest of the year. The new owner of the futures contract can sell this contract to someone else. Notice how we are no longer selling the bulb itself, but a piece of ownership rights to the bulb. This is similar to stock, but it is for a physical item in the future. Naturally, as the transactions become more complex, the risk begins to increase significantly.

From the home page of the U.S. Commodity Futures Trading Commission:

APPROACH THE FUTURES MARKETS WITH CAUTION

- Trading commodity futures and options is a volatile, complex, and risky venture that is rarely suitable for individual investors or “retail customers”

- Many individuals lose all of their money, and can be required to pay more than they invested initially

History Continued

As the wealthy merchants with the actual product began to sell these futures, others realized that they could get involved and not even own a garden. During this time frame, the Netherlands was experiencing an increase in its overall wealth due to trading overseas. New money and more wealthy individuals became interested in the trading of the bulbs, fueling the price increases.

In 1635 and into 1636, many of the towns began to form small groups of traders that would meet at night in the local tavern and begin to trade contracts like trading stock. Most of the individuals had their gardens, and others became experts by learning from the original owners. Now begins a social group of individuals who begin to correspond and foster the value of owning tulips. This process allowed the middle class to easily trade this commodity, pushing the prices even higher.

Prices began to increase, and for the rarer types of tulips, the prices accelerated. Notice the players involved: we have collectors of rare tulips, growers, traders, and now speculators for the tulip.

Knowledge over Financial Resources

While researching the facts for this article, I came across an abstract written by A. Maurits van der Veen, an assistant professor of government at William & Mary. He wrote The Dutch Tulip Mania: The Social Foundations of a Financial Bubble. He writes about a social understanding between the experts, and that reliance on each other can allow the price (bubble) to expand. At some point, a third party not within the group bids a price beyond the value level tolerated by the experts. Van der Veen goes on to reference Golub and Jackson’s article in American Economic Journal: Microeconomics, 2, pp. 112-149 whereby “… a small number of “prominent” agents in a social network can distort an entire network’s beliefs about a value, even if they have no greater knowledge about that value and everyone else in that network knows this”.

Those individuals aware of the supply and limited varieties available in that town (the knowledge base) were mindful of the newcomers into the market. With the ease of trading future contracts, the prices began to rise rapidly, especially for the rare types of tulips. By the time February of 1637 came around, the experts began to realize that there was no underlying principle to maintain the price of the bulbs. In effect, the ‘investors’ enthusiasm’ maintained and elevated the price of tulips. This irrational exuberance (Alan Greenspan’s phrase) has escalated the price of the asset to the point where the intrinsic value of the asset is no longer the fundamental basis of worth. Those with knowledge of the tulips began to exit the trading and discontinued purchasing contracts. At this point, nobody was willing to bid the price up any further.

Pop Goes the Bubble

There is a story where, in December 1636, an auction was held for an orphanage. The master of the home had left bulbs as a part of his estate to benefit the orphanage. The price fetched for the various rare bulbs earned enough to take care of the children for many years to come; just in time, too.

There is a story where, in December 1636, an auction was held for an orphanage. The master of the home had left bulbs as a part of his estate to benefit the orphanage. The price fetched for the various rare bulbs earned enough to take care of the children for many years to come; just in time, too.

In January, rumors began to circulate that this was getting out of hand, and some of the more knowledgeable began to depart the market.

In early February 1637, bidders for bulbs failed to show up at an auction. News spread quickly to other towns via the social networks that exist in these groups. Within a week, prices dropped to 1/100th of what they were a week earlier. The bubble had burst.

Modern Day Economic Bubbles

The most recent economic bubble burst was the crash of the real estate market and the underlying mortgage notes tied to the real estate back in 2007-2008. This particular bubble burst affected millions of Americans and reverberated throughout the financial markets worldwide. Another example includes the significant change in the stock market back in late 2000 and early 2001 associated with the inflated value of the dot.com stocks. Technology stocks grew significantly during the late 1990’s and more and more money fed the growth. There are many examples where the price paid for stock was way out of alignment with the intrinsic value associated with the underlying assets of the companies. In effect, the price was fueled by the belief that the dot. Coms would continue to expand.

A current example is cryptocurrency. It is mimicking this pattern to the ‘t’. Within a few years, cryptocurrency will ‘Pop’. Right now, in April/May of 2021, many new players who have no real knowledge or background in this unregulated security are getting involved. This is the same concept of new money fueling its growth.

Notice that the same basic business principles were violated in creating the economic bubbles, as illustrated by the Dutch Tulip Craze. The concept of “… irrational exuberance has unduly escalated asset values …” in all the above cases. Only those with a fundamental understanding of the true intrinsic value of the asset were able to get through the bubble burst without significant financial losses.

The following lessons should guide the small business entrepreneur in day-to-day business deals:

- If it is too good to be true, then don’t do the deal.

- Just because a few knowledgeable individuals claim it’s a great product or deal doesn’t make it so. Ask questions, and if the market is in hyperactivity mode, dealing with this product or situation, odds are that the price is being driven by the high level of activity and not by the intrinsic value it brings. To me, the best example of this is toys at Christmas time or electronic devices/software subscribed to by our youth.

- When individuals without knowledge of the core product or stock get involved, then it is time to exit, as novices will drive the price up, as happened in the Dutch Tulip Craze.

Economic Bubble – Modern Day Business Comparisons

There are numerous examples of modern-day business activities employing similar economic bubble comparisons to the tulip craze of Holland. The following are some examples and how they compare:

House Flippers – in every community in the country, there is a small band of house flippers. Their respective job are to purchase a foreclosed home, repair/renovate the house, and sell the house at fair market value. They conduct their gathering on the courthouse steps and wait for the sale. Each member of this group is acutely aware of the others’ activities and knowledge.

Compare this to the meetings at the taverns at night for the tulip auctions in the 1630s? The gatherings comprised holders of the bulbs (in our modern-day situation, this is the attorney representing the mortgage holder), those knowledgeable in the industry or buyers/sellers (the house flippers themselves), and of course, novice or new buyers (at the courthouse steps is usually somebody wanting to get into this industry). As the price begins to ratchet up for the property, the house flippers are knowledgeable of not only the going fair market value of the house in the neighborhood, but have seen the house and are also aware of the costs of repairs. As the margin for the property begins to decrease, there is a point where the knowledge base stops bidding, just as they did in the tulip craze. Now the novice wants in so bad, he keeps bidding up the house, and finally, those with the knowledge and experience realize that the bid value exceeds the intrinsic value or fair market value in real estate for this house. The novice ends up owning the property at a much higher price than those with experience are willing to pay. Do you see the similarity to the Dutch Tulip Craze?

I have written an article concerning house flipping and the overall average these flippers make per deal. Read The Financial Truth about Flipping Houses for a better understanding of the financial aspect of flipping houses.

Storage Wars – ever seen this show on TV? Just like the house flippers, these guys come in to purchase those storage units where the tenant failed to pay their rent for the unit. The landlord is the supplier in this scenario; the buyers are those who do this for a living. These guys are smart; they have learned over time to pay attention to the details when the door goes up for the respective unit. It is the newcomers who jack up the price for the unit, and the regulars leave it well alone, knowing that the risk is too great for the price.

In this little microeconomic world, sometimes the more experienced buyers allow the first few units to get high in price and pull the dollars out of the group. Then the bubble pops, and the experienced buyers can buy the latter units at a lower price.

Others – there are numerous other examples, including auto and horse auctions.

Summary – Economic Bubble

Many underlying factors contribute to economic bubbles and the ultimate ‘POP’. A common social contribution is ‘irrational exuberance’ as coined by Alan Greenspan – investors inflating the value of a product/service or stock with a disregard towards the underlying intrinsic value starts the process. Next, novices see potential for gain and invest more money into the investment, and the price begins to accelerate further. Finally, those with an understanding of the product/service or stock realize that this can not continue and sell off their ownership. Finally, fewer and fewer buyers are willing to get involved, and the ‘POP’ occurs. The bubble bursts, and finger-pointing begins.

As a value investor, you need to pay attention to the signs of a possible bubble. Remember, bubbles may be limited in nature or span across the entire economy. Depending on the nature and scope of the product/service or stock will determine the effects of the ‘POP’. Act on Knowledge.