Learn About Value Investing

Value Investing – Guidance and Knowledge for Value Investors

Value investing, in its simplest terms, means buying securities at a low price and selling them at a higher price. Value investing is defined as a systematic process of purchasing high-quality stocks at an undervalued market price, quantified by intrinsic value and justified through financial analysis, then selling the stock promptly upon market price recovery. You can learn about value investing on this site.

There are numerous different investment methods. Even within the realm of value investing, there are distinct mindsets. This site advocates value investing based on the concepts and theories promulgated by Benjamin Graham and David Dodd, the fathers of value investing, and their philosophy and techniques as presented in the book “Security Analysis.”

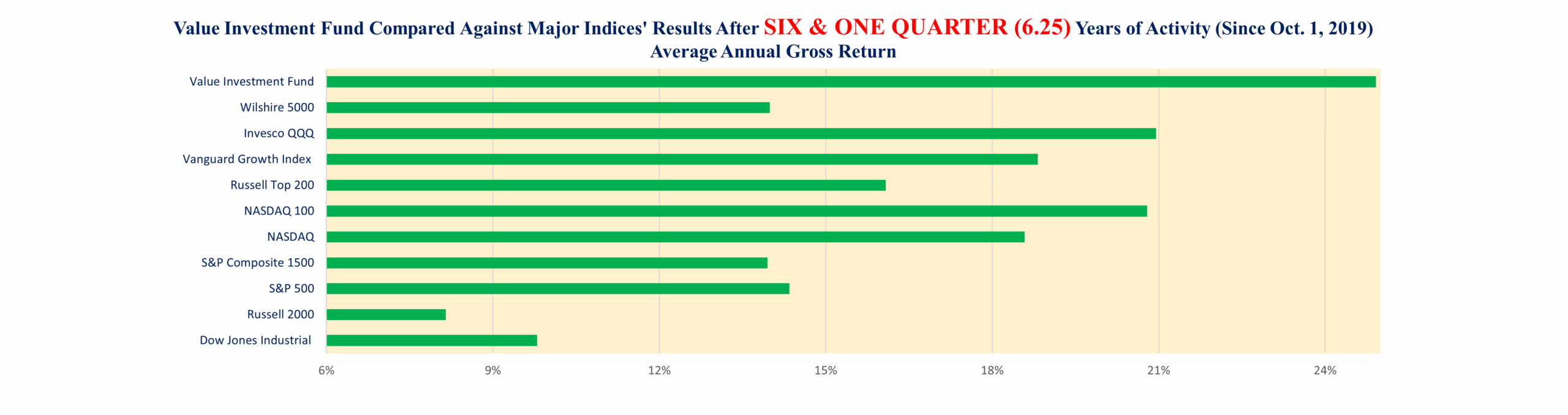

To prove this program works, this site’s facilitator started a Value Investment Fund six years ago and followed strict principles and rules. In six years, the fund has generated an annualized return greater than 24% before taxes and slightly under 21% after taxes. The risks of adverse value adjustment are highly mitigated due to a rigid set of security purchase requirements.

Value Investing has proven to be a superior program to any other model of investing. Over the course of six years, it has doubled in value and then DOUBLED AGAIN! Here are the Results of Six and One Quarter (6.25) Years of Investing:

How Much More Proof Do You Need?

Seriously, it is highly unlikely this pattern will deviate dramatically over the next two to three years. Furthermore, these results include the Bear Market decline during 2022. The principles of Value Investing work!

. Annual Returns (Pre-Tax Basis)

. Value Investment Fund NASDAQ 100 S&P 500

. 2019 (1/4 Year) 15.71% 38.09% 27.56%

. 2020 34.41% 46.94% 16.26%

. 2021 41.08% 26.63% 26.89%

. 2022 (11.35%) (32.97%) (19.44%)

. 2023 41.51% 53.81% 24.23%

. 2024 28.20% 24.88% 23.31%

. 2025 19.89% 20.37% 16.64%

. Annual Average 24.92%😯 20.79% 14.34%

. Six & 1/4 Years Thru 12/31/25

This includes all fees/interest charges and future disposal/terminal costs. Whereas there are no costs with either the NASDAQ 100 or the S&P 500.

KEY FACTS:

- Starting Fund Balance $100,000

- Comparative Balance (No Taxes) $402,776

- Six and One Qrt Years Ending Balance Net of Taxes $324,658 *Net of all trading costs/fees and taxes

- Taxes Paid Lifetime to Date $82,733

- Unrealized Gains Net of Taxes @12/31/25 $11,866

- Total Cost of All Fees (Trading, Admin, Margin Fees) $40,683

- Total Number of Trades (Includes PUT Options) 68

- Comparative Annualized Growth 24.9%

- Annualized Growth Net of Taxes 20.80%

For a Summary Accounting through 09/30/25, please download this report: .

The following reports identify the respective detailed activity over the last six years ending 09/30/25:

Value Investing Now – Guidance and Knowledge for Value Investors is dedicated to value investing and keyed to the primary business tenet of ‘Buy Low, Sell High’.

This site’s value investing program is designed for thoughtful investors and not for those seeking a get-rich-quick stock tip. For those of you unfamiliar with investing via security analysis, and who desire to learn and can appreciate a well-thought-out and planned program, then this site is for you.

Those of you who are currently knowledgeable about the market and how to perform security analysis can join the Value Investment Club. You will have access to this site’s seven existing pools of investments to augment your portfolio.

Value Investing History

The value investing concept was initially developed by Benjamin Graham and David Dodd and updated in their sixth edition of Security Analysis, first published in 1934. The core premise of value investing is ascertaining the intrinsic value of a particular stock. It is essential to purchase the stock at a low price to maximize a return on investment. In the revised edition of Security Analysis, updated in 1962, Benjamin Graham identified a formula to calculate the intrinsic value of a stock:

Value = Earnings times (a constant of 8.5 plus two times an average expected growth rate over the next seven years).

In mathematical shorthand:

V= Earnings (8.5 + 2g)

Since the time period of the formula’s presentation, there have been many documented reviews and suggested modifications. With the inclusion of financial analysis, industry knowledge, and patience, value investing is considered the irrefutable leader of investing methodologies.

Value Investing Now

Value Investing Now takes this formula and, along with other intrinsic valuation algorithms, educates the investor about this proven systematic method to buy and sell stocks. This method is rooted in four core principles:

- Risk Reduction – Buy only high-quality stocks;

- Intrinsic Value – The underlying assets and operations are of good quality and performance;

- Financial Analysis – Use core financial information, business ratios, and key performance indicators to create a high level of confidence that recovery is just a matter of time;

- Patience – Allow time to work for the investor.

The lessons, tutorials, webinars, white papers, and spreadsheets on this site are designed to teach these four principles. Furthermore, this site has over 200 supporting articles that augment the lessons and the program. It is effectively the best resource center available to learn about and implement a personal value investment fund. The annual goal is to achieve 24% plus returns.

Results

To prove the system works, the author created an investment fund. Look at the results from the first six years. During this period, the Value Investment Fund outperformed the DOW Jones Industrial Average by a factor of 2.7!

To prove the system works, the author created an investment fund. Look at the results from the first six years. During this period, the Value Investment Fund outperformed the DOW Jones Industrial Average by a factor of 2.7!

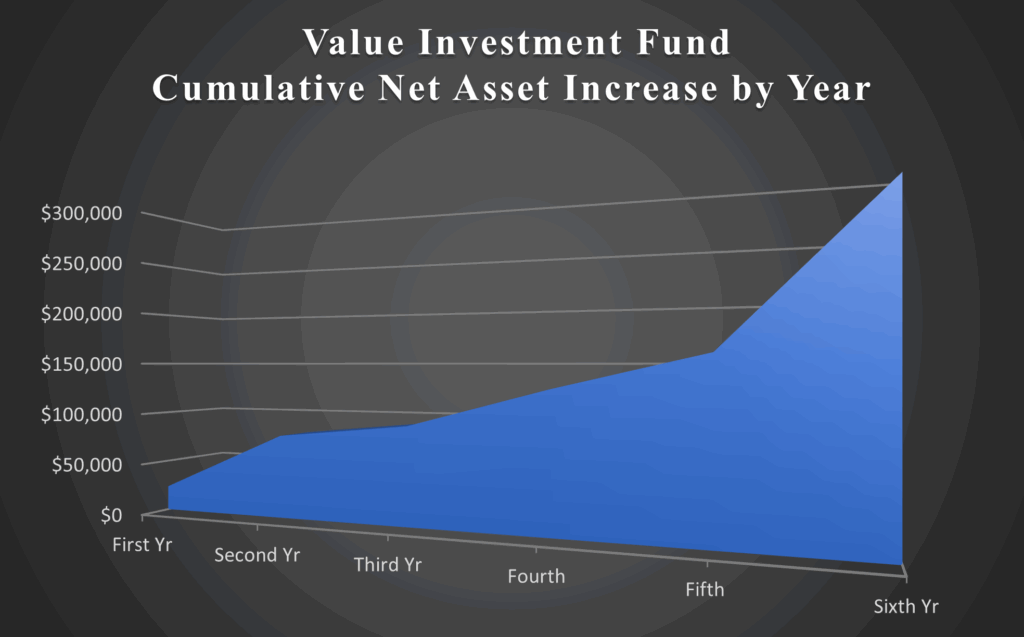

The Fund started with $100,000 at the beginning of the 4th quarter of 2019. Since then, it has grown to $310,709 after taxes. Thus, over six years, it has earned an average annual return of 25.95%, 21% after taxes. This includes the dramatic downturn in the market throughout all of 2022. NOT ONE single investment has lost money; the average holding period is slightly more than nine months; and the worst return recorded to date, single transaction activity, was an annualized positive 3%.

Look at the graph to the left, which illustrates how this Fund has accumulated value over the last seventy-two (72) months. This is a direct reflection of how the four core principles of value investing provide superior results.

The only other form of investing that can beat value investing is ‘Speculation‘. Speculation is nothing more than reliance on ‘LUCK’. The risk factor is off the charts, and ultimately, the investor loses.

Value Investing Now’s Program

The program advocates the creation of ‘Pools’ of similar industry potential investments. It is best if the investor becomes an expert in a particular industry or a few industries. Each pool consists of no more than 8 companies, all with similar market capitalization positions and compliance requirements. A value investor utilizes six or seven pools of investments to take advantage of different economic, industry-specific, and corporate-level influences on stock prices. In addition, the club provides other pools of investments, including research and analysis, to augment the investor’s pools to provide 40 to 60 companies for each member participating in the membership club.

A member of this website’s investment club has access to seven pools provided by the club and all the associated analysis and individual corporate buy/sell models used to set the buy low and sell high points for each stock.

If you are interested in learning more, go to the Membership Program page under the Value Investing section in the header above.

Value Investment Fund

Join the value investing club and learn about value investing and how you can easily acquire similar results with your investment fund.

Each month, you receive an email with a full update on the pools. Follow along as the Value Investment Fund grows. Start investing with confidence in what you learn. Create your fund and, over time, accumulate wealth. Joining entitles you to the following:

- Full access to all decision matrices for each pool;

- E-mail alerts to pending possible opportunities mimicking this site’s Value Investment Fund;

- Lessons about value investing and the principles involved, Phase I of the program;

- Free webinars from the author following up on the lessons;

- Charts, graphs, and resources to use when you create your pool, Phase II of the program;

- Access to the existing pools and their respective data models, along with buy/sell triggers, Investment Fund Pools;

- Follow along with the investment fund and its monthly updates;

- White papers addressing financial principles and proper interpretation methods, Phase III of the program; AND

- Some simple good advice.