Sold PUTS on Railroad Stocks

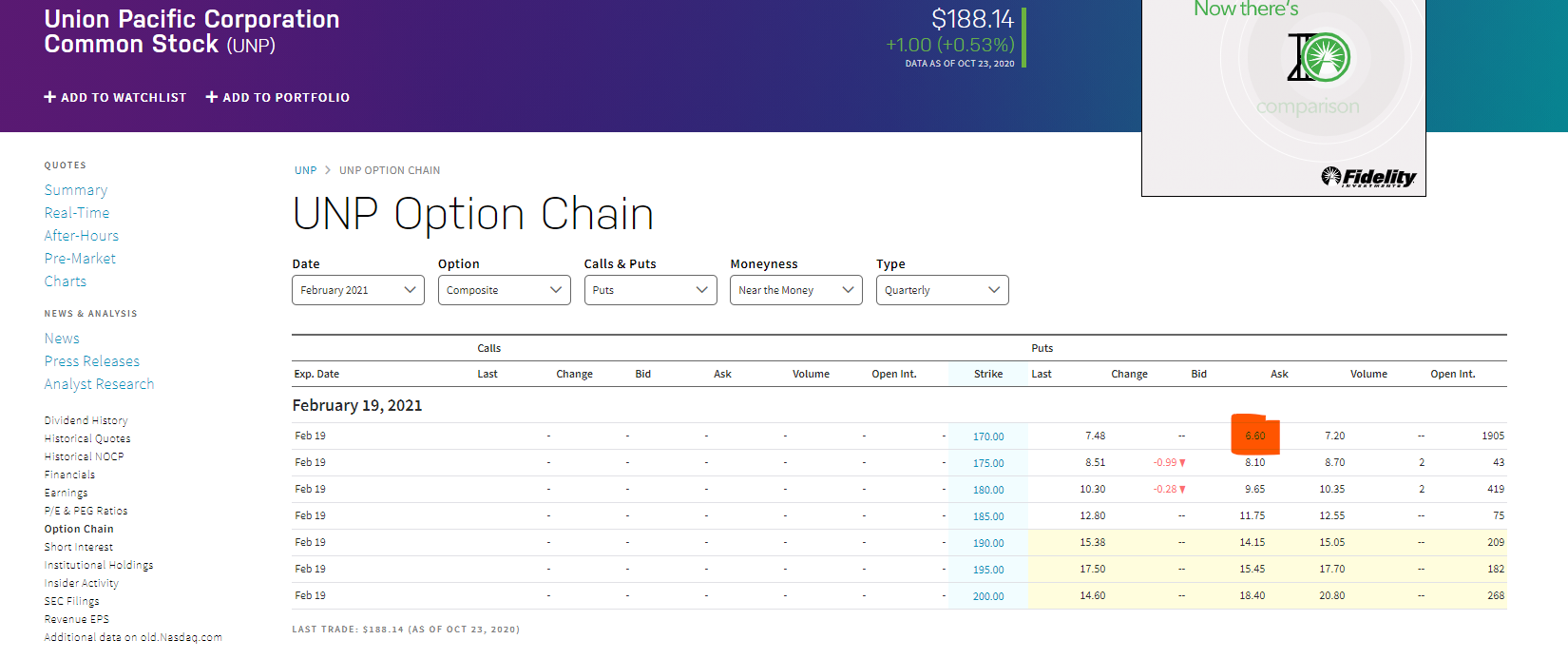

Today, I sold 59 PUT options for Union Pacific with a strike price of $170.00 with a final date of February 19, 2021. PUTs are simply selling insurance that if the stock price drops to $170 per share, the Value Investment Fund will have to buy them from the owner of the puts. Today, the PUT for $170 is selling for $6.60 each. See the BID column and the highlighted reference point. Thus, if exercised, the Fund will have to put up $10,090, including transaction fees.

Since each PUT costs me $1.00 to transact, I net $5.60 each; thus, I earn $330.40 from this. See the table below:

Why do this?

Because I want to own Union Pacific at $170 a share. The most recent high price for Union Pacific was $209.85 on 10/16/2020. Based on my Union Pacific Buy/Sell Model, the Railways Pool desires a 17% market decline from a prior peak to purchase the stock. $170 is exactly a 19% decrease. I would love for someone to put it to me at that price.

I feel comfortable with this decision because I earn $330.40 on this transaction, and the Value Investment Fund is currently holding excess cash.

The time stamp for this transaction is 10/25/2020. Act on Knowledge.