Primary Tenet of Business (Lesson 5)

“Buy not on optimism, but on arithmetic.” – Benjamin Graham

The one statement that best explains business is ‘Buy Low, Sell High’. It is a universal principle referred to as a tenet of business. It is commonly stated in other terms, such as control costs or focus on the best customer. In effect, it is a simple math equation of revenue minus costs equals profit.

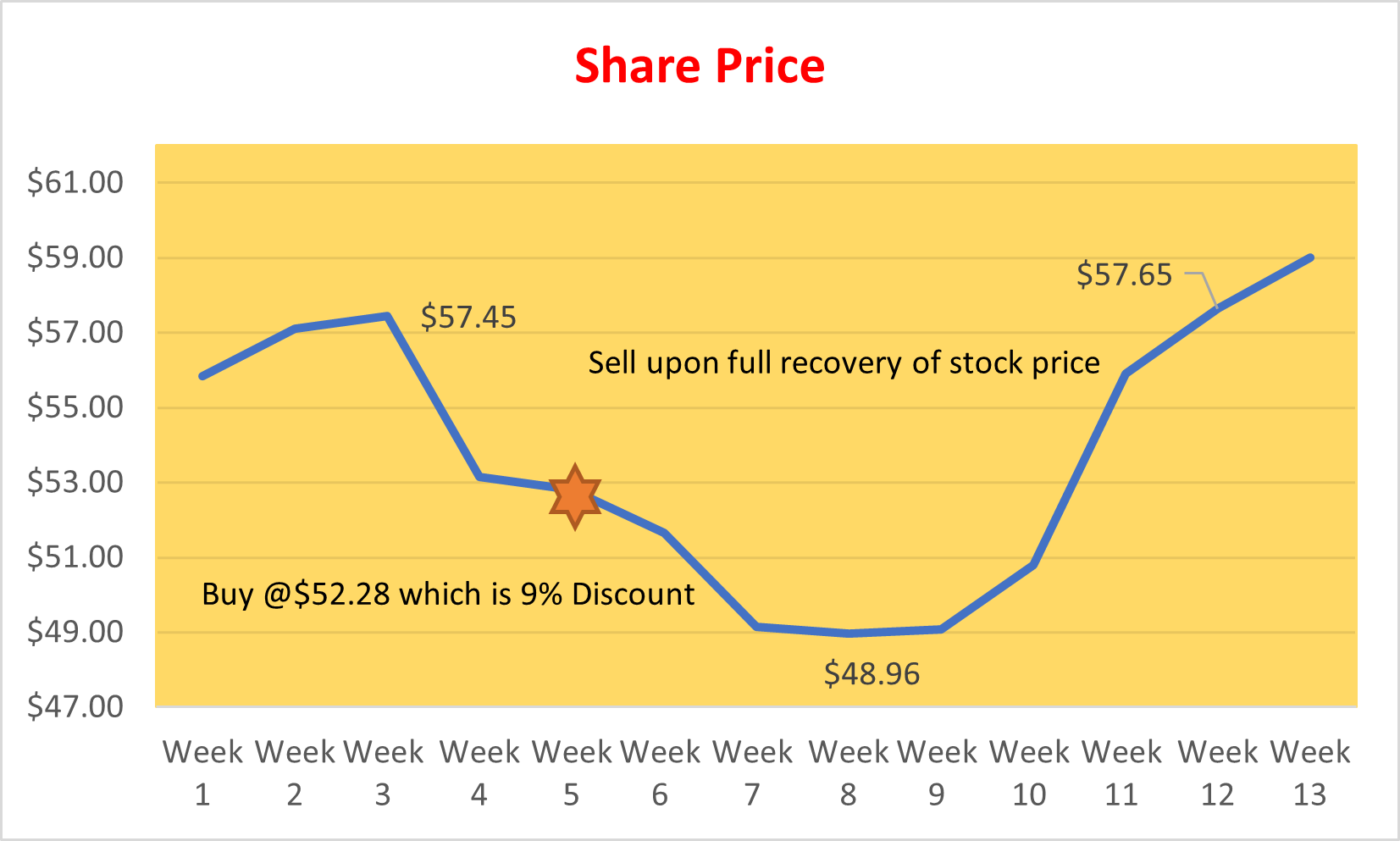

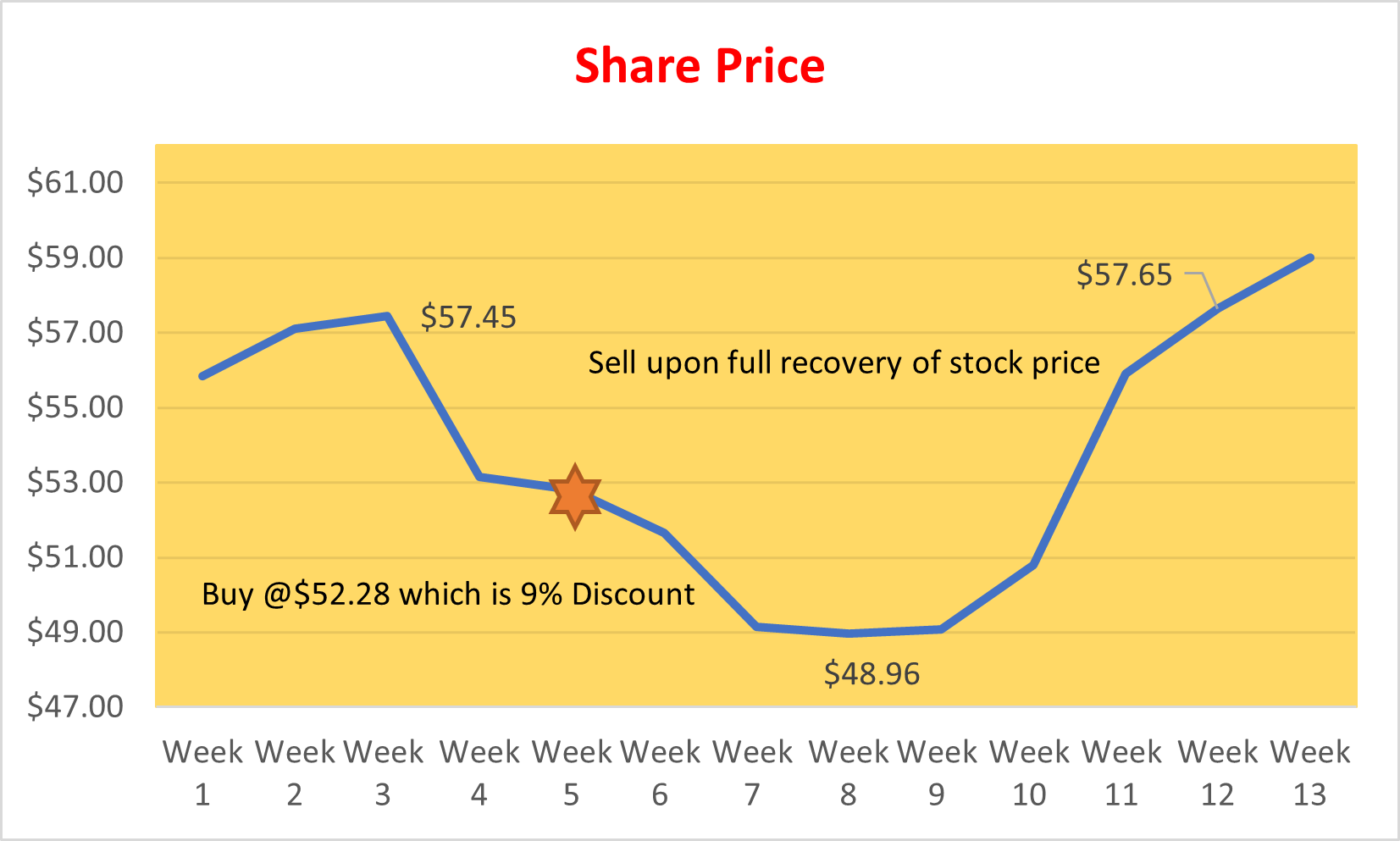

With the stock market, buying low and selling high is the goal for any investor. But the real problem, and it is depicted well in the illustration above, is knowing when the lows and highs exist. If you purchase the stock at its absolute lowest point in a cycle and then sell it at the highest point in the cycle, well, you are either God or lucky. The simple truth is that nobody can predict either extreme. Value investors are not trying to predict either extreme; value investors only wish to identify acceptable lows (good value points) and reasonable highs to dispose of the investment. In effect, value investors merely take advantage of a good portion of this volatility with stock.

The buy low, sell high tenet is not an absolute statement; it does not mean to buy the stock at the absolute lowest price and then sell it when it reaches the highest point. It means to buy the stock when its value is appropriate and then sell the stock when its high price seems unsustainable in the market. Look at this graph for a better depiction of the buy low, sell high concept.

With this particular stock, the value investor determined that during the upcoming year, any price discount of 9% from a peak price warrants a buy, and once the price fully recovers to its prior peak, it warrants selling the stock and reaping the respective rewards.

Notice how the value investor doesn’t wait until the stock gets to its lowest point; value investors have no idea when this will happen. A value investor only knows that the stock is underpriced once it dips 9% from a prior peak price and thus buys this stock during Week 5 when the price hits 91% of the peak of $57.45. Thus, the buy is at $52.28.

The sell trigger is set for full recovery with this particular stock; thus, once the stock recovers to its prior peak of $57.45, it is time to sell.

In Week 12, the stock is fully recovered, and via a computer order, the stock is automatically sold at $57.45.

Altogether, the value investor earns $5.17 per share or 9.89% on the investment of $52.28.

Immediately, novice investors will proclaim that 9.89% is not a lot. In reality, it is an outstanding return. Why? Look at the time period the investment was held. Assuming that during Week 5, the stock was purchased early in the week and sold late in Week 12. Thus, the stock was held for eight weeks inclusive. Therefore, the annualized return is equal to 68.5%. The math is that the investment was held for 56 days, thus earnings equal 9.94 cents per day or $36.19 for an entire year. $36.19 divided by the investment of $52.28 equals 68.54%.

There is more to this than this simple example. There are costs involved; typically, transaction fees equate to 7% of gains; therefore, a typical return is closer to $4.80 ($5.17 *93%). In addition, recovery periods are generally longer than eight weeks. More common recovery periods are in the 16 to 30-week range. Thus, assuming 30 weeks to recover and earning $4.80 on a $52.28 investment equates to an annualized return of 15.9%. But still, a 15.9% return is high quality. But there are bonuses.

Almost all high-quality stocks pay dividends. Assume this stock pays 75 cents per quarter. Actual final earnings, assuming two quarters of dividends and gain on the sale, equal $6.30 ($1.50 dividends plus $4.80 net gain). This equates to an annualized return of 20.9%.

This is more realistic with what happens with value investing. The buy low and sell high tenet merely provides a good foundation to earn positive gains. Go back to the four principles which will each be examined in Lessons 6 through 9; 1) Risk reduction via quality stocks only, thus quality stocks generally pay dividends during the holding period; 2) Intrinsic value provides confidence that the share price will not further decline dramatically as the underlying assets act as insurance of the company’s worth; 3) Financial analysis validates a fair and reasonable market share price thus assuring the value investor the stock price will recover; and finally, 4) Patience is required to simply wait for the stock price to recover; if it takes longer, it is OK; it just means that the annualized return on the investment will not be as high as predicted.

There are several keys to success with the buy low, sell high tenet of business, especially stock transactions. First, note that if a value investor decides to take less risk and buys at a much deeper discount, it is possible that further declines will not materialize, thus negating or limiting opportunities to buy stock at a good price. In most cycles of stock values, the typical share price does not even get to the desired buy price. In general, they will fluctuate down and up past the prior peak price; thus, value investors never get to exercise their preset buy and sell points for the stock. Therefore, setting the buy price must be reasonable, i.e., not too deep of a discount or not enough of a discount, as the return on the investment may not warrant the associated risk of holding the stock.

Go back to the above graph. Suppose the value investor sets the discount at 5% instead of 9%. Now the buy price is $54.58. If the sell point is the prior peak, the gain equals $2.87. Look at other negative contributing factors towards the annualized return on the investment.

- The value investor buys the stock during the early part of Week 4, thus adding additional time holding the shares.

- The actual investment is now $54.58 and not $52.28, which significantly impacts the return on the investment.

- Unknowingly, you have increased your risk factor because intrinsic value warrants a lower share price to buy the stock; thus, there is a possibility of having to hold the stock for a longer period than is justifiable.

Overall, at a 5% discount and with the other conditions remaining stable, the actual final earnings are $4.17 (including two dividend payments and a 7% transaction fee for the buy and sell activity with the broker). The annualized return equals 12.8%, earning $4.17 over 217 days (one week longer than the prior example) on an investment of $54.58.

A second key to success is at the other end of this formula. The selling point must also be determined with some accuracy. If it is too high, it may not materialize with enough frequency to make a good return. In effect, too high a sell point will and does often take a lot longer to achieve. Too low, and the value investor misses an opportunity to reap really good returns on their investment.

Understanding both the buy and the sell points is essential with value investing. There are some rough figures for most investments, but good research will provide the necessary decision model that will earn outstanding returns on an investment. Some rough rules include:

- Discounts should rarely be less than 9%; common discounts are in the 11 to 16% range. Typically, high-quality stocks (this is taught in Phase Two of the membership program) require even deeper discounts, like more than 18% discounts.

- Sell points are rarely less than the prior peak, unless the prior peak was an aberration. In many cases, selling points are customarily 102 to 104% of the prior peak price. Again, this is explained in further detail during Phase Two of this program.

- Stocks should have a history of a least a minimum annual swing and have some kind of stronger reaction to economic-wide market fluctuations; see Lesson 3.

In general, value investors create a pool of similar investments and thus have multiple opportunities to buy and sell from within this group. The money is continuously at work and rarely held as cash. This refers to the effective utility of the funds. This is also explained and illustrated in Phase Two of the program.

Section ‘B’ of Phase One of this program focuses on the four principles of value investing. This lesson provides insight into the overall concept of buying stock at a low price and then waiting to sell it at a high price. There are several factors that impact the final annualized return on the investment. They include the discount desire, i.e., when to buy stock; the sell point, as it impacts the gain and the holding period. The longer the holding period, the lower the return on the investment with the formula. Finally, the risk of buying too early or selling too early is covered.

During the next four lessons, this is covered in more detail with more examples and illustrations. At this point, members of this program begin to understand that the underlying buy and sell triggers are a function of some good research, analysis, and the creation of a set of metrics. The good news is that the student doesn’t have to continuously update their metrics formula. It is merely refined each year, typically once the annual reports are presented by the respective members within the pool of investments. The buy discounts and the sell points are merely adjusted for each member, and the new cycle begins.

For many of you, you may feel some sense of apprehension related to creating a set of metrics for a pool of investments. Phase Two will walk you through this, and even those of you without a formal business education or background will easily grasp the respective formulas used as the lessons demonstrate how to find the information. There is nothing advanced about this; it is presented at the level of a sophomore student in college. It includes spreadsheets with the formulas built in for you. All you have to do is just pull the basic pieces of data from financial statements and insert them into the spreadsheet, and get your results. All of this is provided with the lessons in Phase Two of this program.

The result is a high level of confidence that your metrics produce a good model to follow, and now it is simply a matter of patience to earn your wealth.

The next lesson in this section covers risk reduction. It covers risk overall with the market and how one goes about reducing risk to almost nil for their investments. Act on Knowledge.