Intrinsic Value of Essex Property Trust

Intrinsic value of stock is a company’s realistic value per share at any given moment. Intrinsic value is not book value; it is the most likely dollar amount a reasonable person would pay for the underlying net assets. In most cases, an investor would include some value for the near-term future earnings of the investment, but the core amount in determining the intrinsic value of a share of stock is tied to the net assets at fair market value.

Intrinsic value of stock is a company’s realistic value per share at any given moment. Intrinsic value is not book value; it is the most likely dollar amount a reasonable person would pay for the underlying net assets. In most cases, an investor would include some value for the near-term future earnings of the investment, but the core amount in determining the intrinsic value of a share of stock is tied to the net assets at fair market value.

The intrinsic value formula is different for every sector of the economy and for the respective industries within that sector. Equity-based real estate investment trusts (REITs) consist of six different types. One of the types of REITs is apartment complex-based operations. In effect, they are apartment rentals. With real estate, specifically those in the home rental industry, which includes apartments, condos, townhomes, and traditional individual homes, intrinsic value is strongly tied to the fair market value of the rental properties less the assigned associated debt (mortgage). In addition, some value is included for future near-term earnings and the other assets on the balance sheet. It is no different than how your traditional home rental operation would value its investment.

Essex Property Trust, this REIT has been around for almost 30 years. It owns 246 apartment complexes with 60,272 units. There are an additional 1,853 units under construction. To determine intrinsic value, one would simply appraise all 246 complexes, determine the full fair market value, and then deduct the total debt to get net asset value. Add to this value the other assets on the books, and get a full net assets value at fair market value. In addition, you would simply add about three years of profits. With this cumulative sum, divide by the number of shares and determine an approximate intrinsic value per share.

This appears relatively simple. For Essex, assume each unit can be sold for $350,000; it seems like a reasonable value per unit. Total fair market value would approximate $21.1 billion. The other assets on the books are equal to around $900 million; thus, total assets at fair market value would approximate $22 billion. Total debt and current liabilities on the books are approximately $7.2 billion. Once the liabilities are satisfied upon the sale of the units, the net remaining amount available to all shareholders results in $14.8 billion. There are 67.5 million shares outstanding. Thus, each share has a net worth of about $219 tied to net asset value at fair market value.

Currently, the company’s net operating income is just a little over $8 per share. Using three years of net income, the investor would add about $24 to the net asset value outcome to get the total intrinsic value. Three years of net income is used as this would be a reasonable and normal period to dispose of all the complexes, i.e., it would be the period to negotiate an arm’s length transaction (fair and normal). Thus, Essex Property Trust’s intrinsic value is approximately $243 per share.

Of course, there is more to it than this simple approach. But the core idea is there; the intrinsic value should be in the neighborhood of $243 per share. As a value investor, you should anticipate that the intrinsic value isn’t going to deviate greatly from this simple, quick calculation. In effect, a value investor would expect the actual outcome to end up within 20% of this quick calculation. Thus, the final intrinsic value should end up between $195 per share (20% less) and $292 per share (20% more). From Lesson 7, there is no definitive intrinsic value calculation for any stock. Intrinsic value has a range; the key for value investors is to narrow this range as much as possible to determine a reasonable intrinsic value for any potential stock investment. Ideally, getting the range down to plus or minus 3% is the goal. In effect, the final intrinsic value calculation is somewhere between the two given outcomes, and the value investor’s goal is to have a high level of confidence in the outcome.

What is important here is that if you end up with a conservative outcome (tending towards $195/share), it is likely the market price will never dip this low (the last time was in November 2014), thus eliminating opportunities for the value investor. If the result is too high (tending towards $292/share), you end up with more opportunities, but the end result with the investment is fewer gains from the respective buy/sell turnovers, and therefore the overall return for a value investor decreases. In effect, it defeats the purpose of value investing, which is to buy low and sell high. Thus, it is extremely important to walk through the exercise of calculating a reasonable intrinsic value that results in reduced risk and adequate opportunities to make buy and sell transactions, assuring an excellent return for the portfolio, i.e., the pool of similar investments.

Given this, how do you determine a REIT’s intrinsic value to within plus or minus 3%?

There is no single method to calculate the intrinsic value of an investment. There are multiple widely accepted tools for determining value. With relatively young or small businesses, there are easy and accurate valuation methods. As companies mature and begin to move up on the market capitalization spectrum of value, there begins to be a greater separation between intrinsic and market value for a share of stock. The tools to measure intrinsic value become more sophisticated and diverse. With high-quality top 2000 companies, a value investor must use several different methods and provide some weighted value portion to each method, and sum up the weighted values for a cumulative per-share value.

Since Essex is a REIT, there are four widely accepted financial measurement methods available. They are:

- Book Value

- Net Assets at Fair Market Value

- Cash Flows from Operations as an Annuity Stream

- Dividend Payments Yield

Intrinsic value starts with book value. Book value reflects a widely accepted measure of the balance sheet’s interpretation of the shareholder’s portion of the dollar value of all assets. There are several reasons that book value is inappropriate, especially with high fixed cost-based companies. Therefore, with REITs, book value has a limited weighted portion of the total value. In the first section below, Essex’s book value is calculated, and the formula’s weighted portion is derived based on subjective criteria. In addition, it is explained why Essex’s book value is a poor indicator of intrinsic value for this company.

The most complex and highly accurate method is the net assets at fair market value. This is also referred to as the liquidation value of the assets if the assets were sold under normal and reasonable conditions. There are several adjusting factors that greatly impact the final value, and those applying the formula must take into consideration these factors and use a conservative approach to determine the final overall value per share under this method. In the second section below, this is explained in detail, along with how to determine this method’s weighted portion of the final intrinsic value calculation.

The third method, cash flow from operations as an annuity, looks at the company’s financial performance as the source of value. In the third section, this method is explained and illustrated to the reader. This particular method is weighted lower than the net asset value from above. This section explains why its weighted portion in the formula is so much less than the net assets value.

The final method is the traditional dividend payments in the form of yield. The trend line for dividend payments is averaged, and then a particular growth rate is used in the financial formula to determine the final value. There are several important financial points of interest to note with this formula. Here, too, just as with the cash flows from operations formula above, its weighted portion is much less than the net assets at fair market value method in section two below.

All four methods contribute a portion to a final value, which is then considered a reasonable intrinsic value for this REIT. The last section in this article goes into detail about how the result is highly reliable and how it is adjusted annually to reset the intrinsic value of Essex. There is a spreadsheet to download at the end of this article for the reader to use in determining Essex’s intrinsic value. All assumptions and subjective decisions are explained and sourced from the quarterly and annual reports of Essex. In addition, Essex puts out a set of auxiliary reports that support their respective financial results. The supplementary information augments the financial calculations when determining intrinsic value.

Book Value of Essex Property Trust

Novice or naive value investors rely strongly on book value as similar to or equal to intrinsic value. They believe the two terms are interchangeable. Sophisticated value investors understand that the two terms are distinctly different. Book value is a generally accepted accounting term commonly used with business ratios. Intrinsic value reflects the core value of the company.

When a company is young or highly reliant on current assets for its intrinsic value, book value and intrinsic value are more aligned. As a company matures, retained earnings add to book value; thus, the book value per share increases over time. Because assets have different market values, for example, cash is equivalent to full market value, whereas a vehicle, as a fixed asset, has less and less market value as that asset is used, book and intrinsic value diverge over time.

For those companies with strong current asset portfolios, such as banks and insurance companies, the corresponding book and intrinsic value will trend together. The greater the ratio of current assets to total assets, the more likely the two values stay together. For those companies that are highly reliant on fixed assets on their balance sheet, it the more likely that there is a greater separation of book and intrinsic value.

Real estate investment trusts are highly reliant on fixed assets, e.g., the apartment complexes are their primary asset. Look at Essex’s simplified balance sheet:

Essex Property Trust, Inc.

Consolidated Balance Sheet – Assets Only (Simple Format)

September 30, 2020

Real Estate $12,501,970,000

Cash 569,075,000

Other 329,997,000

Total Assets $13,401,042,000

Real estate is 93% of all assets.

Real estate appreciates over time. It is the number one personal finance principle advocated by financial advisors. If you reviewed Essex’s apartment communities list, they have two apartment complexes acquired in 1988. There are more than 20 complexes purchased in the 90s. All of these complexes were recorded at cost value in the real estate section of the balance sheet. Some of them are fully depreciated and currently carry little value on the balance sheet. Thus, any average business thinker understands that the fair market value of the assets is far more than the book value on the balance sheet.

This is why value investors apply a proportionately lower weighted value for book value with REITs in the intrinsic value formula. The more mature the REIT, the lower the weighted value for book value. In reality, giving any weighted portion of the final intrinsic value to book value is really not much more than adding a conservative or dampening effect on the outcome value. It acts as an assurance that the outcome is not skewed towards that higher range of intrinsic values as determined above.

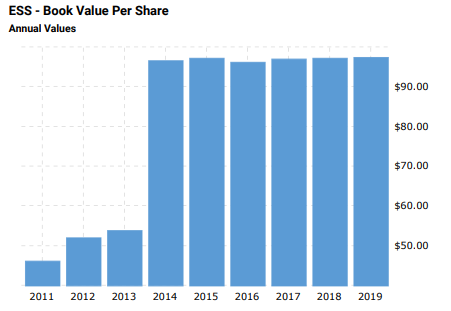

Below are Essex Property Trust’s historical book values over the last nine years:

In the first half of 2014, Essex merged with BRE Properties, which added $4 billion to the equity section of the balance sheet.

Take note that since 2014, the book value has stayed relatively constant. Remember, REITs must pay out over 92% of their net operating income as dividends to their shareholders. The current book value for Essex is $96.11 per share.

Because book value does not truly reflect the intrinsic value as justified in the prior paragraphs and the fact that Essex Property Trust is over 25 years old, book value as a portion of the weighted variables in the intrinsic value formula is given a weighting factor of 10%.

Therefore, book value contributes $9.61 towards the final intrinsic value formula’s final outcome.

The most weighted portion of the intrinsic value formula is reserved for the net asset value at fair market value.

Net Assets at Fair Market Value With the Intrinsic Value Formula

The most common business principle related to real estate is fair market value. Fair market value is the amount a reasonable person would pay for an asset, knowing all the variables and fully independent of the seller. In a legal sense, it is the amount paid in an arm’s length transaction, a fair and legitimate deal.

It is quite common for REITs to buy and sell pieces of their portfolio. For Essex Property Trust, the customarily sells about two to three properties per year. In turn, they buy them too. In addition, they build new ones to keep the portfolio current with real estate. This means that the cost basis on the balance sheet is constantly increasing. However, there are still many complexes on the balance sheet that were bought more than 10 years ago. Of the 246 active complexes, 127 them were acquired in the last 10 years. Thus, almost half are at least 10 years old, and many are more than 20 years old. This means the fair market value of the portfolio is much greater than the cost value without depreciation on the books of record.

Essex’s balance sheet reveals that the cumulative purchase price for all the existing real estate is $15,129,478,000, which exceeds ALL ASSETS on the balance sheet by $1.7 billion. This difference alone adds $26.50 per share to the current book value of $96 per share. AND THIS IS NOT FAIR MARKET VALUE, but simply real estate at cost for Essex Property Trust.

Thus, fair market value will unquestionably increase the intrinsic value beyond book value. The question is how much?

Since appraisals do not exist for the 246 complexes, there must be a relatively simple and easy method to determine the fair market value of all the complexes. There is.

With typical real estate appraisals, the appraiser uses recent and similar sales and adjusts slightly for some minor differences to estimate the value of a piece of real estate. The term they use is ‘Comps’ for comparative sales. A value investor does the same thing for valuing REITs. The only difference is that a value investor uses the most recent seven sales the particular company has conducted to average out the pool in order to determine the overall average.

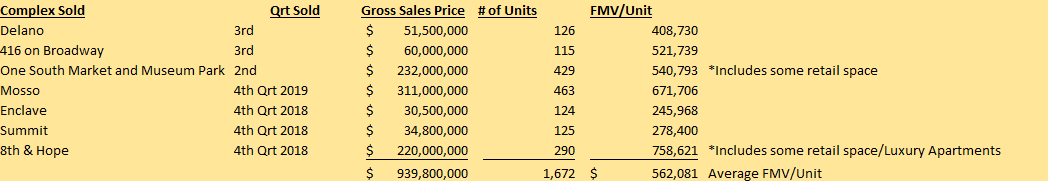

Each quarter, in the quarterly earnings report, Essex reveals the particulars about any dispositions of assets. This is Essex’s write-up for the third quarter of 2020.

Dispositions

In July 2020, the Company sold a community in Redmond, WA, containing 126 apartment homes, for a total contract price of $51.5 million. The Company recognized a $22.7 million gain on sale, which has been excluded from Core FFO. Subsequent to quarter end, the Company sold a community located in Glendale, CA, containing 115 apartment homes, for a total contract price of $60.0 million.

Notice that three essential pieces of information are provided. What was sold, the total gross sales price, and the number of individual apartment units in the deal? This is Essex’s last seven transactions and the respective totals and average per unit sold.

Notice that 1,672 units were sold over the last three years. This is almost 3% of the portfolio of units. Thus, it will approximate the entire portfolio of units. There is some risk that the average is too high and it doesn’t reflect the net value received per unit, only the gross sales price per unit. Thus, a user must make some minor adjustments to the average fair market value per unit to determine the average net proceeds per unit. These are the adjustments required:

- Cost to Dispose – With most real estate transactions, a HUD real estate form is used to reconcile all the common costs of the transactions. If you have ever seen one, costs include real estate agent fees, legal fees, cost to acquire the loan (loan origination and discount fees), taxes, fronted insurance, and more. The common aggregated costs to complete a real estate transaction are more than 8% of the gross sales or contract price. Since this is technically a commercial transaction, the transaction fee is customarily greater as a percentage. Thus, 13% is a reasonable adjustment to reflect the net sales price per unit.

- Market Adjustment – If you look at the seven transactions, you will note that the 8th & Hope transaction at the bottom of the list includes some retail space, and of course, these are luxury units. Essex’s portfolio of units is not entirely luxury apartments. With most of them, they are the traditional garden-style apartments. This means that this single transaction greatly skews the results higher. Thus, a prudent and reasonable investor needs to dampen the overall result. If you were to exclude this transaction and repeat the averaging of the transactions, the result is $520,000 per unit. However, at the same time, look at Enclave. This particular sale dampens or reduces the overall average. Thus, there already exists a counterbalance to the 8th and Hope result. But a value investor still needs to dampen the overall average because it is better to have a more conservative value than a liberal value as the average net fair market value per unit. The author uses a 9% reduction factor in order to reduce the overall average and increase the confidence that the final value per unit is appropriate.

Some final notes on this portfolio. The average per unit is reasonable. First, Essex Property Trust is a West Coast REIT; all units are in California along the coast or in the state of Washington in its major metropolitan zones. This is prime real estate, thus any average below $400,000 just seems inappropriate. The author reviewed several complexes in the portfolio that were built in the 1960s and 70’s. The rents for these complexes were greater than $3,200 per unit. Even at a 1% capitalization rate per dollar of rent, the complex is worth more than $320,000 per unit. Thus, a value investor should expect the average to exceed $400,000 per unit.

Here is the outcome:

Average price per unit from the schedule above – $562,081

Cost to Dispose at 11% (73,071)

Market Adjustment at 9% (50,587)

A REASONABLE ESTIMATE OF NET FMV/UNIT – $438,423

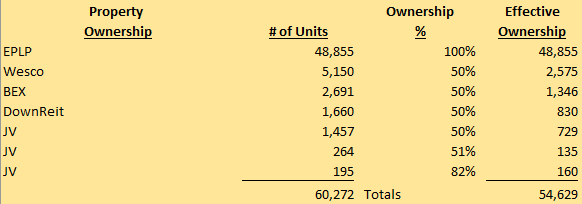

There are 60,272 units that Essex Property Trust controls. Notice the word is controls, not owns. Essex is no different than many other REITs; they do not own every single unit. When building a portfolio of complexes, it is common to buy some complexes as part of a partnership. With Essex, it co-owns 11,417 units with six other companies. Essex’s actual effective ownership is equal to 54,629 units. See the schedule below.

This information comes directly from the real estate information report dated 10/28/2020.

This information comes directly from the real estate information report dated 10/28/2020.

This means, the fair market value of all the units in the portfolio of Essex, the equivalent ownership position, discounted for some market issues and net of closing costs, equals $23,950,432,701.

If you were to include real estate under construction at cost plus the other assets (mostly cash) and deduct $7.133 billion for liabilities, the net asset value at fair market value for Essex Property Trust equals $19,131,932,701. Using fully diluted shares as the denominator in the formula, the value per share at fair market value adjusted for costs to dispose of and market issues equals $283.46.

Notice the shift in value from the traditional book value and how this dollar amount is within the corridor of intrinsic values determined (low of $195 and a high of $292) at the beginning of this article. Again, note the dampening adjustment in the formula. This outcome is a reasonable value per share for the units in the portfolio of apartments Essex controls.

To validate this outcome, a value investor can make some further adjustments in order to feel more comfortable with the result. If you were to increase the market adjustment to 13% from 9%, the final value per share would drop to $265 per share. Thus, the $283 per share determination under this method of intrinsic value calculation is REASONABLE.

Now the question is, how much weight should this value be given in the overall intrinsic value formula? Since market appraisals are the most common tool used in real estate to determine value, and since this formula uses a very high cost percentage to close on a unit and a good dampening percentage to reflect possible market issues, a weighted factor of 60% is quite conservative. Since this method is so extensive and the internal adjustment factors are so high, a higher weighted portion is justifiable. However, value investors should be conservative with their formulas in order to increase confidence in the final intrinsic value outcome.

Many value investors prefer to use more common market formulas to determine the value of a share of stock. One of the more popular ones is the operating cash flow per share, as if this were an annuity payment. What would this annuity be worth?

Cash Flow from Operations as an Annuity Stream

Cash flows refer to the use of cash beyond the standard costs to run operations. It includes using the money to purchase additional fixed assets, pay down debt, and reward shareholders with dividend payments. Therefore, the common presentation format for a cash flows statement is divided into three major sections. First is cash flow from operations, the normal conduct of business. Then a second section (investing) reports the use of cash to either buy new assets or receive proceeds from the sale of existing assets. The final section is called cash flow from financing. It refers to borrowing and paying down debt.

Thus, a typical growing REIT will have a cash flows statement that mirrors this:

Cash Flow from Operations Positive

Cash Flow from Investing Negative (When a REIT expands, it spends more money buying/building new complexes than disposing of complexes.)

Cash Flow from Financing Positive (If growing, the REIT typically borrows more money to leverage the purchase than it uses to pay down debt and pay dividends.)

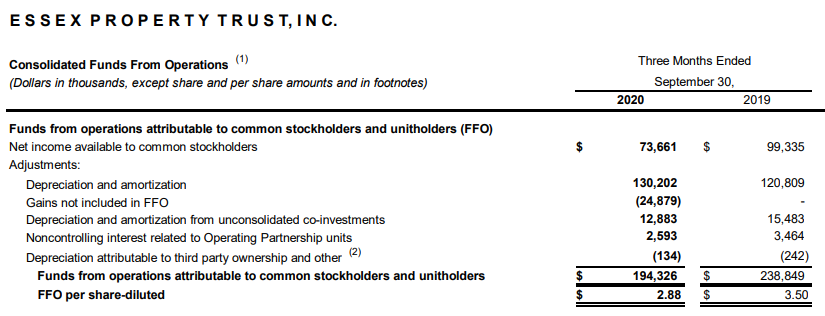

With every good operation, it is normal to have cash flow from operations exceed the net profit of the company. The reason is simple – depreciation. A REIT is no exception; its cash flow from operations must exceed the net profit (the common term with REITs is Net Operating Income) because depreciation is often a very large value. Take a look at Essex’s cash flow from operations report:

Notice how the net operating income of $73.7 million increases to $194.3 million of cash flow during the 3rd quarter of 2020. Depreciation and amortization increase the value $143 million (regular operations and co-shared investments; remember that Essex cooperates with six other companies and partially owns over 11,000 units; this is why there is a separate line indicating $12.9 million of depreciation/amortization).

Since the net profit includes the gain on the disposal of a complex during the quarter, that gain is backed out, the negative $24.9 million. That gain is a function of cash flow from investing. Recall from above, the investing section of the cash flows statement addresses the buying and selling of complexes.

The result is that cash flow from operations per share is $2.88, whereas the net profit per share is $1.13.

A REIT must have positive cash flow from operations to use some of the cash to make principal payments on the debt, pay dividends, and use any excess cash for the purchase of additional complexes. Since the tax code for REITs requires that more than 92% of the net operating income is paid out in dividends (this maintains the income tax-free status at the corporate level), this REIT must pay out at least $1.03 per share of this cash flow from operations. The company paid out $2.08 per share.

The uses of the cash flow from operations, either directly via dividend payments or indirectly via reduction of debt, benefit the shareholders. Thus, cash flow from operations is similar to an annuity stream to the shareholder. This annuity stream’s only drawback is time. As time goes by, the annuity payment is impacted by inflation. The most recent historical inflationary rate is around 2%. Thus, discounting this annuity stream by at least 2% or slightly higher to account for the unknown is a reasonable discount to use in determining the net present value of this annuity stream.

The question is, what is the amount to use as the annuity stream? Here is the cash flow from operations over the last five years:

2016 $11.12

2017 $11.91

2018 $12.76

2019 $13.73

2020 $12.41 (Estimated due to no 4th Qrt Results at the time of this article)

The average over the last five years is $12.39. With a discount rate of 3.5%, this annuity stream is worth approximately $264.50. Again, it is assumed there is no growth in the annuity stream.

It is always wise to use the average over the last five to seven years and not the most recent amount. A common error for analytics is to use the most recent value and not the average. An average is more conservative than a recent value in a formula.

The remaining issue is to assign a weighted value to this result in the intrinsic value formula. From the two sections above, it was noted that book value is assigned a 10% weighted value due to its only impact is to act as a dampening factor in the overall results. Net assets at fair market value are given the greatest weight due to their role in determining a more accurate picture of the intrinsic value of the company. That is, intrinsic value is more accurate when there is greater reliance on the underlying asset values.

Traditional valuation principles give a lot of credence to cash flow streams as an indicator of value. The core issue with this is that it is assumed that cash flow will continue indefinitely. The longer out the window for reliance on cash flow, the greater the discount rate on cash flow to determine its net present value. Thus, physical value in the form of net assets at fair market value is more reliable than a future value discounted to today. Thus, cash flow from operations is given a weighted value of 20% in the intrinsic value formula.

Dividend Yield

There is a theory in economics called the dividend yield theory. It states that with high-quality investments, the return on the investment tends towards the mean or a reasonable fixed level. The question here is what is reasonable? Well, let’s take a look at some current market indicators.

- A 10-Year Treasury Note is currently yielding 1.2%.

- A Walmart Bond is currently yielding 2.33%.

- S&P 500 Average Dividend Yield is 1.75%

- Average Dividend Yield for the DOW Jones Industrial Average is 2.43%

With the above, it appears that a yield greater than 2.5% would be expected given the position the REIT is in based on market capitalization and its overall ranking within the top 2000 companies. For this section, the author has determined that a yield of 3.33% is reasonable. The characteristics of Essex Property Trust meet the characteristics required by the dividend yield theory:

- Secure Dividends – over the last five years, Essex has paid a dividend; a REIT is required to pay dividends. Its historical dividend payouts over the last five years are:

-

- 2016 $6.40

- 2017 $7.00

- 2018 $7.44

- 2019 $7.80

- 2020 $8.31

-

- Generous Payouts – as stated in the cash flow section above, Essex’s dividend payouts are high and often exceed the net operating income per quarter.

- Stable Business Model – REITs qualify as a stable business model; housing is a required need for consumers. Revenue is recurring every month. Expenses are predictable and easily estimated. In effect, it is easy for a REIT to stay on budget.

The formula for dividend yield is:

Thus, with an average dividend payout of $7.78 and a desired 3.33% yield, the required investment equals $234.

Thus, with an average dividend payout of $7.78 and a desired 3.33% yield, the required investment equals $234.

This particular method is assigned a 10% weighted value in the intrinsic value formula, thus contributing $23.37 towards the final intrinsic value calculation.

Intrinsic Value Per Share of Essex Property Trust

To determine the final intrinsic value per share for Essex Property Trust, each of the above valuation methods is inserted into a table. Each method is then given a weighted portion of the final result. Each method’s end calculation is summed for the final estimated intrinsic value. Recall from above and from Lesson 7, intrinsic value is a ‘REASONABLE ESTIMATE’ of the approximate value of the underlying assets and for the company as a going concern. The key is to gain a high level of confidence that the result is not too low or excessive. Any deviation beyond reasonable will most likely exclude the potential investment as a value investment.

A review of the respective results, and then the final table is presented to determine the intrinsic value of Essex Property Trust.

Book Value – Book value is a straightforward calculation. Essex’s book value equals $96.11. It is given a little portion of the total weighted value due to several reasons. First, book value and intrinsic value begin to separate as a company matures. Book values for high-quality top 2000 companies are not as important a measurement as other methods. For this REIT, it is given a 10% weighted portion of the result, but only as a dampening effect in order to ensure the final intrinsic value result is reduced, ensuring qualification as a value investment.

Net Assets Value at Fair Market Value – This method is the most appropriate for real estate and disproportionately fixed asset weighted balance sheets. If the respective fixed assets on the balance sheet are real estate or appreciating assets, this particular method is the most appropriate method of valuing a company. With Essex, it was determined that the net asset value at fair market value per share equals $283. This value is at the upper end of the initial range expected for intrinsic value; recall that the upper point of the intrinsic value range is estimated at $292. Since this method is extremely detailed and there are several discounts included, it is given a weighted value of 60% of the result. Many value investors will increase the weighted value to 80% or even higher. Remember, this will skew the final result even higher, which will then reduce the overall return when it is time to buy. In effect, the value investor will purchase the stock at a higher price, thus reducing the overall effective return.

Cash Flow from Operations – It is essential that cash flow from operations exceeds the net profit, or in the case of REITs, the net operating income point on the income statement. With REITs, the cash flow from operations is commonly referred to as funds from operations (FFO). Since depreciation is commonly a big expense item on the income statement, reducing net profit, depreciation, as a non-cash expense, is added back. Since most REITs dispose of a complex or two each year, the respective gain or loss is adjusted out of the net profit, as that respective value is customarily a function of cash flow from investing. Cash flow from operations is the most important metric when determining value tied to cash earnings. It is superior to dividend yield, net profits yield, or even total cash flows per share. Cash flow from operations reflects the underlying productivity of the company. To determine the final value of a REIT’s stock, it is given a weighted value of 20%. Some investors will give this respective method more credit because it mirrors traditional discounted cash flow formulas. This author does not. Since REITs are real estate-based, real value is in the growth of the underlying assets. Most companies purchase fixed assets and deplete or use them up in order to earn cash. REITs are a combination of earning rents and earning value from the historical increase in value tied to real estate ownership.

Dividend Yield – The dividend yield theory works best with mature companies that consistently issue dividends and have stable business models. Real estate rentals are a stable business model, especially residential rentals. Thus, this method is an appropriate method to include in the final intrinsic value calculation. There is one key step to determine when using this formula: what is a reasonable yield desired? Since this company is mature and stable, a high yield is unexpected, and a low yield is more in line with DOW and guaranteed government instruments (T-Bills, Treasury Notes, Bonds). A 3.3% dividend yield is used, and this method is weighted at 10%. Again, the real value of real estate is time to allow the underlying assets to develop unrealized equity.

The final table and result are as follows:

Method Determined $ Value Weighted Portion Weighted Result

Book Value $96.11 10% $9.61

Net Assets at FMV $283.46 60% 170.07

Cash Flow from Operations NPV $264.50 20% 52.90

Dividend Yield $233.72 10% 23.37

Totals 100% $255.96

Thus, the intrinsic value of Essex Property Trust equals $255.96. It is a conservative estimate due to multiple factors and variables, ensuring a more conservative estimate of Essex’s intrinsic value. In addition, it falls well within the initial estimated range and is higher than the opening estimate above of $243 per share. The value of $256 per share as the intrinsic value of Essex is reasonable and reliable. If a value investor wanted to know the +/- range of 3%, the results are $248 and the upper range is $264.

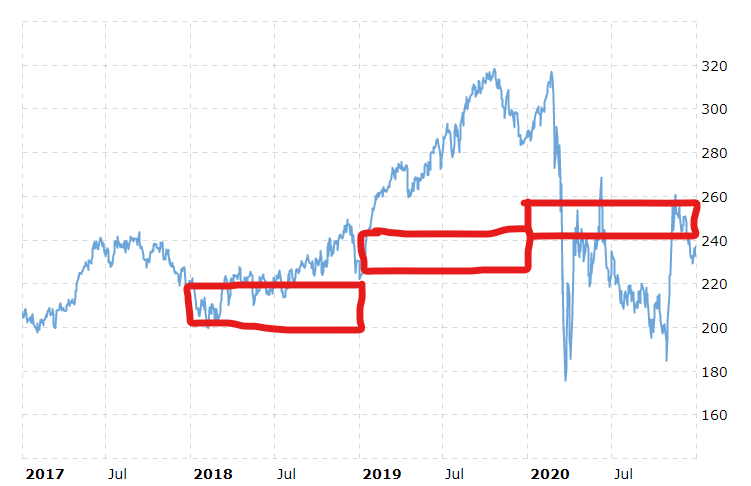

Now for the final test, is $256 a reasonable result? The best way to validate this amount is to look at the historical stock price for Essex. Does it dip below $256, and does it go above the high end of value at $292? Does this occur frequently and in enough cycles to warrant application of the buy/sell model and ultimately end up with a good return? To answer this, let’s first look at the stock price since 2016.

One other note before evaluating this intrinsic value as the buy point. It can be deduced that the intrinsic value adjusts to about $11 to $13 per year for earnings and real estate growth (explained in another article). Thus, the intrinsic value adjusts this much higher per year. With this knowledge, a value investor can only look back about three years to get an idea of the pattern. Thus, in 2018, the intrinsic value would approximate $212 to $220.

This graph illustrates the buy zone for each year. Notice there are opportunities to buy, not many, but adequate opportunities to buy the stock. Had a value investor purchased Essex in the buy zone during 2018 and sold in late 2019 when the stock hit $290 per share, the return on the investment would have been about $70 or more per share. Assuming a $220 investment held for about 20 months, this results in a 20% annual return. With dividends of about $13 during this period of time, the final effective return on the investment is about 22.6% per year.

Any purchase made in the zone during 2020 is still on hold, waiting for a reasonable market recovery price estimated at $300. It is reasonable to expect this market price in about a year, possibly 18 months. Thus, if the stock is purchased now at $250 per share and sold in 18 to 20 months at $300, the return on the investment, including dividends, would approximate $64. This equates to an annual return of 17%.

If the market price recovers sooner, the return on the investment goes way up. If the market recovers in 12 months, the return on the investment jumps to 23%.

Based on this test, it does indeed seem reasonable for the intrinsic value to be approximately $256 per share.

Due to the COVID pandemic, many investors are leery of buying REITs because they are fearful tenants will not pay their respective rents. This particular situation isn’t going to continue indefinitely as a vaccine is now available. Assuming six months to fully distribute and immunize the public, the economy will start heading back towards normalcy in the 2nd quarter of 2021. Thus, owning Essex Property Trust below the intrinsic value of $256 is not only a good buy, but a safe buy. Act on Knowledge.