Intrinsic Value – Application of Discounted Cash Flows

“Money makes money. And the money that money makes, makes money”– Benjamin Franklin.

“Money makes money. And the money that money makes, makes money”– Benjamin Franklin.

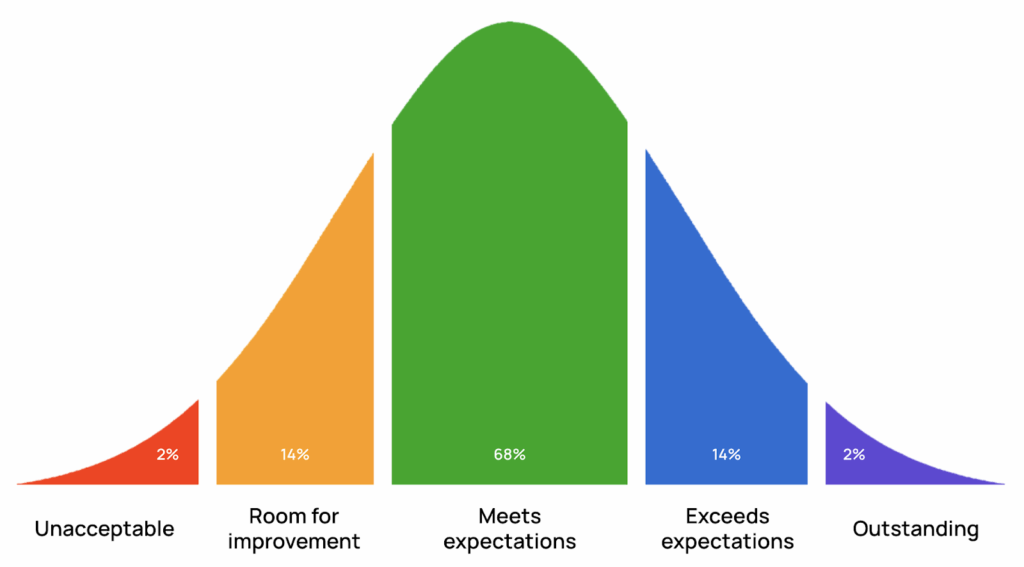

Every student of investing is taught the core principle of discounted cash flows. This business principle is also used with intrinsic value. The application of discounted cash flows assists value investors in determining intrinsic value. Academia, major investment brokerages, and the majority of investment websites place unquestionable belief in this single formula to equate value for a security. The problem is that all of them forget or ignore the underlying requirements to use and then rely on the outcome of the formula’s solution. In effect, with intrinsic value and the application of discounted cash flows, there is a very narrow set of highly defined parameters whereby this tool is applicable and useful. Used outside of this framework, the result’s reliability quickly drops to nearly zero, similar to how the bell curve moves from the most likely outcome in the center to extremes on either side.

Look at this bell curve. Application of discounted cash flows can produce an excellent solution contingent on NO or limited deviation from the norm (the highest point in the curve). This article starts by identifying the highly restrictive requirements for applying discounted cash flows. There are at most 20% of all marketable securities where this formula succeeds in determining intrinsic value. Secondly, the formula is explained to the investor and why it is so important to apply it properly. There are several terms and values the user must include in the formula; this section explains them in layman’s words.

The third section below goes into the corporate financial matrix to explain how to determine cash flows. Furthermore, cash flows are not just the past year or years; it is really about future cash flows. How do you equate value from an unknown variable well into the future?

The final section puts it together when determining intrinsic value. Unlike what others state, intrinsic value is not a definitive value; it is a range. The job of the value investor is to narrow that range to a set of values that are reasonable and effective in generating gains with the value investor’s mindset of ‘buy low, sell high’.

The overall goal of value investing is to buy a security at less than its intrinsic value, commonly referred to as creating a margin of safety, then waiting for the market price to recover to a reasonable high, and then selling that security. The depiction here illustrates this concept well.

The most popular method to determine intrinsic value is the discounted cash flow method. Experts espouse this tool because it is advocated in the book Security Analysis, written by Benjamin Graham and David Dodd, the fathers of value investing. However, most so-called experts didn’t read the entire book. Graham and Dodd only used this method under certain conditions. The same conditions as explained in the first section below. They strongly encouraged calculating intrinsic value from the assets valuation perspective (balance sheet basis) and not as a function of earnings plus cash adjustments (cash flow). What so-called intelligent professionals fail to recognize and embrace is that the discounted cash flows method is only used under a limited set of parameters. The discounted cash flows method is taught in every business major and is most commonly used with the finance (banking) degree. The bleed over into investing propelled this formula to the forefront of investment lingo because it appears to resolve several complex needs. The reality is utterly different. The following section goes into detail about this particular finance algorithm and the restrictive set of conditions with which to apply the formula.

Discounted Cash Flows – Highly Defined Set of Parameters

In the perfect world, there is no inflation, there is no cost of money, and a particular investment would return the same amount of interest year after year without risk; without failure to continue; with constant demand by the market for the product, and no deviations from performance. It is simply flawless. Here, one can easily determine the return on one’s investment; it is simply the cumulative sum of all future earnings in the form of cash, less one’s investment.

As an example, a farmer is selling you a goose, yep, the one that lays a golden egg every day, and the goose never dies. The farmer is just tired of watching the goose. You agree to buy it for $10,000. The market never changes, the egg weighs exactly one ounce, and the goose produces one egg a day forever. Gold prices never change; gold is $10 an ounce. Thus, after one year, you earn exactly $3,650. Each year after, you earn another $3,650, and this goes on forever. As stated above, the conditions are perfect:

- The goose requires no maintenance;

- The goose will live forever (doesn’t get run over, doesn’t run away, nor gets eaten by a predator);

- The goose is never stolen;

- The goose requires no food, no water; just sits there and lays an egg a day;

- Gold prices stay the same, $10 for an ounce;

- There is no inflation.

- Every egg is exactly one ounce of pure gold;

- There is constant demand for gold;

- Life is good.

Well, this investment seems easy to calculate. After 3 years, you have earned $10,950, and you’ve gotten your original investment back plus some. Now, the investment will just continue to provide you with $10 a day for the rest of your life, your children’s, and your grandchildren’s lives. This is just too good to be true.

Notice how unrealistic this is. First off, there is inflation! Because inflation is the number one issue with lending money, an investor has to consider this. Buying a security is very similar to lending money. Financial resources leave your pocket, and in return, you get a piece of paper with a promise to pay or some type of rights to control the outcome. This desired payment, whether as interest on a bond or as a dividend for stock, is the return on the investment you crave. This so-called return will not happen immediately. You will receive these incremental payments over time. Thus, inflation decreases the value of each incremental payment. Assuming each incremental payment is equal and inflation is nominal, the payment received 30 years from now will be almost half in comparison to the first payment you will receive. A simple annual inflationary rate of 2% means that the payment received 30 years from now is only worth 55 cents on the dollar. If the inflationary rate is 4%, the value of that future payment drops to 31 cents on the dollar.

This is what the discounted cash flows refer to when talking about making an investment. Again, all other parameters are perfect; it’s just inflation you need to consider.

This, too, is unrealistic. Other factors come into play. Now the formula starts to get more difficult to calculate. The most obvious is that the core formula assumes the cash payments are equal. The market doesn’t work that way. With bond payments, yes; with dividends, the answer is no. Dividends are constantly changing. Value investors only consider high-quality, top 2,000 companies to invest in; these companies have continuously improving dividend payments. With most, dividend payments almost double every ten years. Now, there is a new dynamic brought into the formula. Not only do we have to discount the cash flows for inflation, but the cash flows are not even throughout the life of the investment.

For the discounted cash flows method of determining value to work well, it assumes a highly defined set of restrictions, including:

- The discount rate is stable throughout the life of the investment;

- Cash inflows (periodic payments) are positive and predictable;

- There is a high degree of certainty for future cash inflows;

- The investment is pure, i.e., little to no chance of default (bankruptcy, insolvency, etc.).

There are only so many publicly traded securities that meet this criterion. Immediately, any reasonable investor would automatically eliminate penny and small-cap investments. These types of investments are tied to young, growing companies. It is highly unlikely that the discount rate will remain stable even in the short-term forecast (next three years). Any new product or service this company provides is unpredictably related to market acceptance and, more importantly, competition. It is nearly impossible to state with a high degree of confidence that there will be future net positive cash inflows for this company. The simple truth of the investment is that companies that fall within this market capitalization spectrum have a much higher degree of default, both in the form of bankruptcy and, almost certainly at times, insolvency.

Mid-cap companies are in a much better position than penny and small caps. However, they lack the one key element in exercising the discounted cash flows formula – the stability of earnings. Only high-quality, top 2,000 companies can demonstrate a long history of continuous positive earnings. It is from earnings that an investor begins the necessary adjustments to determine cash flows. This is explained further in the third section below. The key for the investor is that the discounted cash flows method to determine value is only effective with top-notch corporations. The required attributes include:

- Large market capitalization-based companies, in general, the top 2,000 companies; this supports the attribute of longevity of existence into the future (the goose will live forever).

- A highly stable history of positive earnings demonstrates the ability to produce cash; think of the goose laying the golden egg each day.

- The company produces goods/services that will remain in demand by consumers for the foreseeable future; this matches the attribute of demand for gold.

Even among the top 2,000 companies, a recognizable portion are unable to demonstrate these three required attributes to apply the discounted cash flows tool. A perfect example is Tesla. Tesla lacks a history of earnings, and secondly, Tesla has competition, and therefore, it is difficult to have a high level of confidence that there will be demand by consumers for its vehicles six to seven years from now. To further validate this, General Motors recently announced its intention to develop and sell electric autos starting in the mid part of this decade. This will eat into Tesla’s market share of the electric car market. The novelty of owning a Tesla has worn off.

The above attributes can be summed up as follows:

- Security – low-risk companies

- Positive earnings

- Stable and desired product mix

For those of you who are savvy investors, the attributes mirror those used with the dividend yield theory. The difference is that value investors are not buying solely for dividends; they are buying low to ultimately sell high shortly, generally within two years. The dividend is just an additional benefit. The real value is the growth in the market price for the respective security.

If the attributes exist to apply this formula, then the investor needs to understand the formula’s two most important elements.

Discounted Cash Flows – Formula Analysis

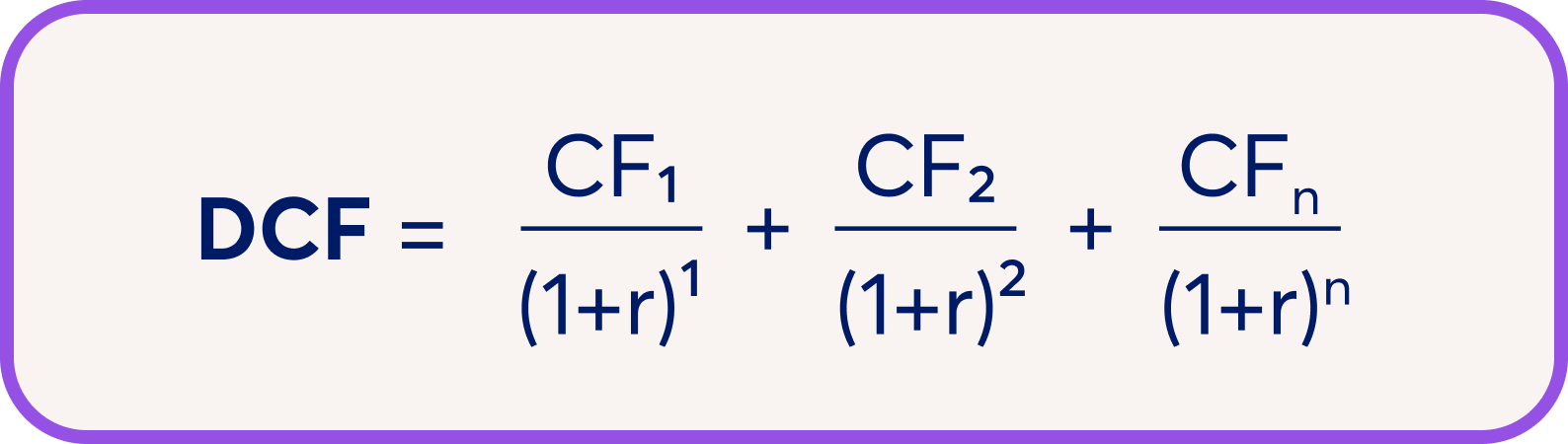

The discounted cash flows formula is straightforward. How much is a certain set amount paid in a given period in the future worth today? If the payments are made as a stream over several periods of time, the net result is the cumulative sum of each period.

All the periodic payment periods are spaced equally apart, like a month, a quarter, or a year. Each successive period has the discounted rate raised to the power of that period. Therefore, the formula is:

Discounted Cash Flow Value = Cash Flow Period 1 PLUS Cash Flow Period 2 PLUS Cash Flow Period 3 PLUS …

. (1 + Discount Rate)¹ Power of One (1 + Discount Rate)² Power of Two (1 + Discount Rate)³ Power of Three

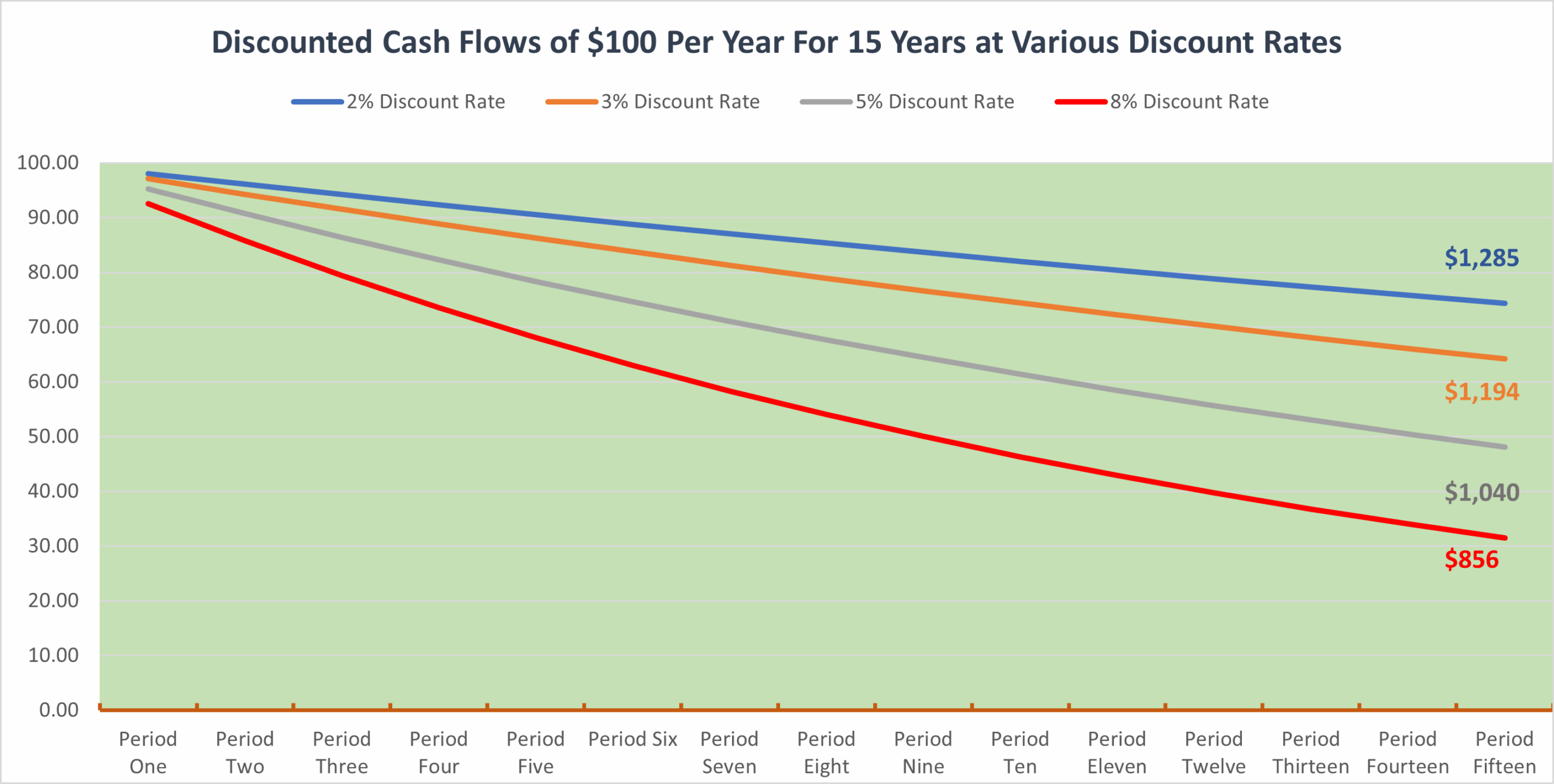

The impact of time reduces the value of a future payment significantly. Look at the following table for a payment of $100 per year over 15 years, given four different discount rates.

Period 2% 3% 5% 8%

1 $98.04 $97.09 $95.24 $92.59

2 96.12 94.26 90.70 85.73

3 94.23 91.51 86.38 79.38

4 92.38 88.85 82.27 73.50

5 90.57 86.26 78.35 68.06

6 88.80 83.75 74.62 63.02

7 87.06 81.31 71.07 58.35

8 85.35 78.94 67.68 54.03

9 83.68 76.64 64.46 50.02

10 82.03 74.41 61.39 46.32

11 80.43 72.24 58.47 42.89

12 78.85 70.14 55.68 39.71

13 77.30 68.10 53.03 36.77

14 75.79 66.11 50.51 34.05

15 74.30 64.19 48.10 31.52

Totals $1,285 $1,194 $1,040 $856

If you study the table and look at the graph, there are several important aspects of the discount rate that an investor must understand to give the discount rate its proper respect. First off, as the discount rate increases, the results decrease. Furthermore, the longer the time frame involved, the lower the value each extending period produces for the investment. In effect, what this table and graph illustrate is that a $100 per year cash inflow for 15 years will return $1,500. However, depending on the discount rate involved, the value of that $1,500 is going to be only effectively worth so much today.

To illustrate, assume a company proposes to sell its bond to you for exactly $1,000 of value. In exchange, you will receive exactly $100 per year for 15 years. There is no terminal payment; just a flat $1,500 in equal installments. Remember, this bond must meet all three ot the criteria to qualify to use the discounted cash flows method when evaluating an investment. First, it must be a secure investment (assume it’s a Walmart Bond). Secondly, the company must have a history of positive earnings; Walmart qualifies for this particular required attribute. And finally, the company provides a highly desired product mix; Walmart fits this attribute, too. Thus, this investment offer meets all the required criteria as a solid investment.

Now the question is – What is my discount rate? Looking at the table above, if you use 5% as the discount rate, it means you get $1,040 of value over 15 years. Since you are paying $1,000 for the investment, you are technically increasing your wealth by $40 over these 15 years.

As an alternative, the bank is offering to pay you 4% interest per year on a $1,000 Certificate of Deposit. This means that over 15 years, you will receive $1,400 ($1,000 of principal and $400 of interest). Whereas with the bond, Walmart is willing to give you $1,500 over the same period. Thus, the discount rate with the Walmart bond is slightly more than 5.5%.

The key for the investor is that the discount rate is your desired rate of return on an investment. If your rate is 6% return, then the bond isn’t worth $1,000 up front; you are forced to offer a lower value for the rights to receive $100 per year for the next 15 years. It turns out, at 6%, you are willing to pay $971.22 for the rights to the $100 annual payments. This doesn’t mean the seller, in this case, Walmart, will accept that; what it means is that the two parties are close. Walmart is willing to pay 5.5% interest, and the buyer wants 6% interest. If another investor is willing to accept a 5.5% return on their investment, then Walmart will sell to the other party. This is supply and demand.

This is the same relationship with any security in the market. How much are you, the buyer, willing to pay to own a certain set of rights? The most coveted right is a financial reward for your investment. With bonds, investors want interest and, of course, the original principal back. With stocks, investors want both dividends and an increase in value of the market price of that stock. The right to vote your shares has little to no value for the common stock trader.

For the market price to increase, other buyers in the market must be willing to pay more than you paid for the same stock certificate. There is only one way this is going to happen. The company must be growing, which in turn creates desire among other investors. The industry is stable, and the economy is not in a recession. Growth is defined as continuously increasing earnings.

Don’t forget, time with the discounted cash flows formula works against value. The further out the cash inflows are received, the lower the overall worth of that respective inflow. Go back to the table, look at the 8% column, and go out 15 years. With a discount rate of 8%, the $100 payment is only worth about 32 cents on the dollar. Time is of the essence with the discounted cash flows formula.

For value investors, what they seek to do is to set a low buy price for a particular security. They also want some assurance that the particular security’s market price will increase in a reasonable period of time in order to sell this security at a higher price and earn gains. The discounted cash flows formula is used with certain types of companies because it can effectively provide a comfortable buy price if the discount rate is tolerable to investors. The key is that the value investor’s discount rate must be higher than the market’s tolerated discount rate. This allows the value investor to buy the security at a lower price and then sell the security in a market that believes a lower discount rate is reasonable and acceptable. This part is explained in more detail in the final section below. For now, the investor wants to know how you determine cash inflows. What exactly are cash inflows?

Discounted Cash Flows – Corporate Cash Flows

In the last section, emphasis was placed on both the discount rate and the period of the investment. But the formula has another essential element necessary to equate a final value – cash inflows. If you asked 20 professionals to define cash flows for the discounted cash flows formula, you would get 24 to 30 different responses. There is no single correct answer; there are good answers and poor responses.

At one end of the spectrum of responses, an investor will tell you that the only cash inflow that counts with the formula is the actual cash the investor receives, i.e., dividends and the proceeds from the final sale of the security. Is this the appropriate outcome for cash flows in the formula?

At the other end of the spectrum, a professional investor will state that cash inflows equal earnings net of taxes, plus depreciation/amortization and any other non-cash adjustments. This is commonly referred to as cash flow from operations. The thinking here is that this cash flow covers both the reward to the shareholders and any remaining cash is used to maintain or expand the company’s operations, which ultimately benefits shareholders as growth results in greater dividends in the future.

If you look at how profits are typically used, they are used for four different purposes:

- Pay dividends to shareholders (this is the preferred outcome for most stockholders);

- Expand operations by investing in new property, plant, and equipment and/or research and development;

- Reduce debt; AND

- Set some money aside for adverse economic conditions that may arise in the future.

Other investors will take a more conservative approach than the extreme position of cash flow from operations and state that cash inflows equal cash flow from operations less the amount necessary to keep the company in the same economic position as it started at the beginning of the year. In effect, it equals cash flow from operations less investment in property, plant, and equipment. This particular point along the cash inflows spectrum is referred to as ‘Free Cash Flow’.

The best answer the author has researched and agrees with is that cash flows equal the actual value a shareholder will receive, whether immediately in the form of dividends, AND/OR via growth of the company in the future. The key is that growth is different for each industry. Some industries are expanding at phenomenal rates (think of geriatric care, home health, and mining), and others are contracting, i.e., in decline (coal, paper, information such as periodicals, newspapers, etc.). Thus, any retention of profits to fund expansion has a different return on that investment depending on the industry’s position in the economy. Invariably, any dollar retained is not going to grow at the rate a dollar in the hands of the investor can earn via reinvestment. In effect, the discount rate for retained dollars must be higher than the discount rate an investor would use with actual cash received in the form of dividends or interest. The result is a highly complex formula to derive a current value for cash inflows.

Fortunately, the very restrictive nature of the formula’s requirements eliminates industries in decline; remember, one of the required attributes to apply the discounted cash flows formula is a strong and desirable services/product mix for the investment under scrutiny. For the investor, growth from the respective retained earnings will never match the return on reinvestment from immediate cash returned to the investor (dividends and interest); thus, utilize a slightly higher discount rate to compensate for this dampening impact growth has with retained dollars.

Thus, a good answer to determine cash inflows is as follows.

Cash inflows equal net earnings adjusted for:

-

- Unusual or extraordinary events (most often losses) net of the respective tax effect from the event;

- Adding back depreciation/amortization;

- Less a reasonable reinvestment into existing property/plant/equipment to maintain the company’s respective position in its industry; AND

- Less of a reasonable investment to expand the company’s position within its industry.

This formula almost mimics free cash flow as commonly defined by academia. It is different in that there is an additional deduction to fund growth. This additional dampening value reduces cash inflows with the formula and ultimately the net present value of those inflows. In most cases, this dampening value approximates 20% of average depreciation from the most recent three years.

The key to making this work is to use the average earnings adjusted for the respective four items above from the last seven years. If the company is growing, there will be an average growth determinant from this history. This growth rate is used for determining future inflows over the next five years. In addition, to keep the formula straightforward, the sixth iteration is the projected cash inflow for the sixth year times a factor of 20, discounted back to today’s dollars. This way, the investor doesn’t have to project out for another 20 years. The core intrinsic value outcome using the discounted cash flows method has a marginal contribution beyond 25 years. Go back to the table above, the results are dropping by more than 3% per year after 15 years. Thus, there is not much contribution from a value in the 26th year, utilizing the discounted cash flows formula.

To illustrate this, look at the historical earnings and the adjusted earnings for Norfolk Southern Railroad.

Norfolk Southern Railroad

Values are in Millions of Dollars

Year Reported Earnings Unusual Items Depreciation/Amortization PPE Maint Growth Invest Adjusted Earnings

2014 $2,000 $281 $956 (1,219) (191) $1,827

2015 $1,550 $290 $1,059 (1,276) (212) $1,412

2016 $1,663 $181 $1,030 (1,309) (206) $1,359

2017 $5,400 ($3,001)* $1,059 (1,335) (212) $1,911

2018 $2,660 $2 $1,104 (1,368) (221) $2,177

2019 $2,717 $288 $1,139 (1,391) (228) $2,525

2020 $2,013 $484 $1,154 (1,379) (231) $2,041

Total $13,252

Average Earnings Per Year $1,893

Growth Rate (Approximate Value using Compounded Growth Rate) 5.6%

*This reflects the adjustment for the tax rate change under the new law passed in December 2017.

This means the cash flows for the next six years, including the sixth year as a multiplier of 20, equals:

2021 $2,002 Million

2022 $2,114 Million

2023 $2,233 Million

2024 $2,358 Million

2025 $2,490 Million

2026 $52,579 Million (Factor of 20 for sixth year result)

Reasonable discount rates are between 3.5% and 8% depending on the industry. The greater the stability of earnings, the lower the discount rate. The railway industry has six publicly traded companies, and not a single one has lost money in any year in the last 20 years. The stability of earnings for this industry is highly reliable; railroads are a very secure investment. Thus, the discount rate for this industry is 4%. The discounted cash flows result at a 4% discount rate for the above inflows equals:

$51,481 Million

The number of shares outstanding today is 252.1 million. Thus, each share’s intrinsic value using the discounted cash flows method at 4% equals $204. If the investor used a 3.5% discount rate, which is not an unreasonable value, the value per share would increase by about $5 per share. Today’s market price (03/15/21) for Norfolk Southern is $261 per share, and the entire industry’s market prices are at their all-time highs. This site’s value investment fund currently has its buy trigger set at $180 per share for Norfolk Southern; i.e., there is a 12% margin of safety against the intrinsic value. The 2022 intrinsic value reset is conducted at year’s end. All the above elements in the formula are updated, and the algorithm is rerun to derive the updated intrinsic value based on discounted cash flows.

From this section, with application of discounted cash flows, the reader learned that determining cash flows from the prior seven years is a derivative of adjusting earnings for unusual items, depreciation, investment back into property, plant, and equipment, and finally, a reasonable cash investment to fund growth. The outcomes are averaged, and a growth rate is calculated. The final adjusted earnings average is then extrapolated out for the next five years, and a terminal value is merely a factor of 20 for the sixth year of growth. All six final values are discounted based on a reasonable discount rate as determined by the industry’s performance. Some helpful guidelines are:

- Growth rates for the top 2,000 companies RARELY exceed 8% per year, and a more common growth rate is between three and six percent per year;

- Discount rates are from 3.5% to 8% depending on the nature of the industry and the economy as a whole.

- In most cases, the adjusted average earnings will always be less than the most recent reported traditional financial earnings due to reinvestment requirements.

- Do not apply a growth rate to any value beyond six years;

- Stability of earnings is the number one factor when determining the discount rate; the better the stability, the lower the discount rate.

- Only use the discounted cash flows formula contingent on the respective entity meeting the restrictive attributes for application:

- Low-risk companies (long and positive history of performance)

- Always positive earnings

- Service/Product mix desired by consumers

Discounted Cash Flows – Intrinsic Value Range

There is no such thing as a definitive dollar value for intrinsic value. Intrinsic value is constantly changing, just like the market price for stock. Each quarter, earnings are reported, and the result is a change to intrinsic value. When intrinsic value is less than $50 per share, it is important to get the result within plus or minus 5% (approximately $2.50 per share). As the intrinsic value increases towards $200 per share, the investor should be able to get the intrinsic value to within plus or minus 3% (up to $6 per share).

Thus, certain factors in the above formula drive accuracy in determining intrinsic value using the discounted cash flows method. Since the formula is only effective with highly stable and profitable companies, the formula user must accept that the outcome is going to be an estimate. Look at all the variables involved with determining an outcome:

- Determining Adjusted Earnings

- Calculating a Growth Rate

- Establish a Discount Rate

Which of the above variables has the greatest impact on the outcome for intrinsic value? Let’s explore.

Discount Rate

The discount rate has a recognizable impact on the outcome. A mere 1% change in the discount rate changes the final intrinsic value output by $7 per share. This is just a little over 3%. Thus, it is important to have a proper discount rate. Remember, the higher the discount rate, the more conservative the intrinsic value result. For example, if the discount rate for the above Norfolk Southern Railroad were 5.5% and not 4%, the intrinsic value drops to $189 per share from $204.

Factors that impact the discount rate include:

-

- Current Inflation Rate

- Industry’s Position Within the Gross Domestic Product Algorithm – Is it improving? If no, an investor ups the discount rate by about .5%; a positive gain in the overall GDP does not impact the discount rate.

- Investor’s Cost of Capital – If an investor has to utilize borrowed funds to invest, the results need to be more conservative; thus, the discount rate must increase. Add 1.5% to the discount rate for every 1% interest an investor must pay beyond the current 15-year mortgage interest rate.

- Personal desire for risk: a higher discount rate reduces risk.

- The stability of earnings for the respective potential investment, the better and longer the history of stable earnings, the lower the rate.

These factors are covered in more detail during Phase Three of the membership program on this site.

Growth Rate

A company’s growth rate is driven by many variables. The most important thing is, of course, the management team’s decisions about the future of the company. How are they pursuing additional revenue streams, reducing costs, and improving efficiencies? Most mature companies do not have high growth rates. If they are performing well and have introduced plans to make improvements or broaden the sources of revenue, growth for mature companies can hit as high as 8%. Realize that mature companies have already completed their respective fast-growth periods in their life cycle. The respective industry can only garner a certain percentage of the economic sector they exist within. Thus, growth often comes at the expense of other members within their industry.

The growth rate includes the expanding economy. Thus, most companies have at least 1.5 to 2% annual growth, as this is the growth rate for the entire economy. The industry may experience its growth due to new products or a shift in consumer needs. Thus, for most large mature companies, growth rates of more than 4% require objective justification; in effect, the investor must provide substantial evidence of this growth.

For Norfolk Southern, above, their growth was driven by several factors over these six years. First, the company grew the volume of trainloads by more than 3%. In addition, it was able to reduce its operation ratio by almost 10% during this time period. This alone added more than 3% of the 5.6% growth rate used in the formula above. Therefore, these two factors, along with economic wide growth, are how this company ended up above 4% growth rate.

Growth comes from multiple sources. Broadening revenue streams is the most common growth impact factor. But some industries are already at their maximum revenue capture; thus, revenue growth can only occur by expanding market share or introducing new venues (with railroads, think of new lines or customer cooperation agreements). Other sources of growth include reducing the costs of sales, reducing overhead costs, or changing the product mix for a better margin.

With Norfolk Southern above, the 5.6% compounded rate reflects the continuously improving bottom line as a percentage of revenue. The result was derived using the compounded growth rate formula, which is more conservative than the average growth rate formula.

The growth rate impacts the volume of earnings expected in the following year, and then the compounding over the next five cycles for six full cycles. Since profits for highly stable top 2,000 companies are in the hundreds of millions of dollars, a single percentage change with growth can extrapolate out into about a couple of hundred million dollars, with the cumulative absolute cash inflows determined. The discount rate dampens the final value the growth rate generates. Thus, the growth rate can impact the final intrinsic value by about one to two percent. It is important to pay attention to it, but in the overall equation, it has the least impact.

Adjusted Earnings

Adjusted earnings have the greatest impact on the intrinsic value formula. A mere $10 million on average from the prior seven years will affect the intrinsic value by at least $1 per share. Thus, being off $100 million per year with a railroad formula can result in an outcome that is more than 3% off.

With the formula above, the averaging effect dampens any incorrect result from a single year. The key is to get the data straight from the annual financial reports. The investor must utilize all three of the primary reports – balance sheet, income statement, and cash flows statement. Each of the respective elements is covered in great detail in Phase Three of this site’s membership program. For now, the above is just an introduction to the formula. Don’t forget, as stated above, the formula is often modified or adapted to every industry. The formula above doesn’t work as well with highly leveraged industries such as banking and insurance. It can work with real estate and the hospitality industry, but it does require some slight modification. The adjusted earnings formula is customized for every industry.

The key is that intrinsic value is never a single dollar value. It is a range. The goal is to keep the range narrow by selecting the most appropriate values (discount, growth, and earnings) that will shift this range higher or lower. Ideally, intrinsic value will have a range of plus or minus 3%. With an estimated $200 per share intrinsic value, the value investor’s range will be $194 to $206, with $200 as the most likely intrinsic value. With lower market price shares, getting to within plus or minus 5% is the target. The risk factor does increase with lower price shares, but an investor offsets this with a higher margin of safety, such as 25% safety margins from the mid-point of the intrinsic range. Getting that range as narrow as possible is mostly impacted by determining adjusted earnings (cash inflows for the prior seven years). The discount and growth do have a bearing on the final result, but nowhere near the impact adjusted earnings have on the result.

Summary – Application of the Discounted Cash Flows to Determine Intrinsic Value

Discounted cash flows are a popular but highly misused investment formula. As it pertains to calculating intrinsic value, it is almost always improperly applied. The discounted cash flows formula is highly reliable within certain parameters. The respective security under scrutiny must be backed by a highly stable, historically top 2,000 company in the market. There are three required conditions:

- Security – low-risk companies

- Positive earnings

- Stable and desired product mix

If the conditions are met, the formula is viable. The formula is:

Discounted Cash Flow Value = Cash Flow Period 1 PLUS Cash Flow Period 2 PLUS Cash Flow Period 3 PLUS …

. (1 + Discount Rate)¹ Power of One (1 + Discount Rate)² Power of Two (1 + Discount Rate)³ Power of Three

This formula merely states the current value of future cash inflows. Cash inflows are a function of several factors that greatly affect the end result. In general, cash inflow equals net earnings adjusted for:

- Unusual or extraordinary events (most often losses) net of the respective tax effect from the event;

- Adding back depreciation/amortization;

- Less a reasonable reinvestment into existing property/plant/equipment to maintain the company’s respective position in its industry; AND

- Less of a reasonable investment to expand the company’s position within its industry.

This adjusted earnings outcome is slightly modified for every industry. It is not purely applicable across the board. Investors must take into consideration several other factors depending on the industry being considered for investment. This outcome, called adjusted earnings, has the greatest impact on the final intrinsic value result. Two other elements of the discounted cash flows formula also impact the outcome, but not to the degree of adjusted earnings. The discount rate can change the outcome a little more than 3% for every 1% change in the discount rate. The growth rate is the final element and has the least impact on the outcome. However, it is still important to ascertain the growth rate as it does assist in getting a more accurate intrinsic value result.

Finally, intrinsic value is never a single dollar value; it is a range. The goal is to get the final result to plus or minus three percent of a reasonable value. The greater the confidence in the formulas underlying values, the lower the margin of safety necessary when purchasing a security. Always increase your margin of safety percentage with lower market price stocks, i.e., less than $50 per share. ACT ON KNOWLEDGE.