Value Investment Fund – Status on June 30, 2021

There are no secrets to success. It is the result of preparation, hard work, and learning from failure. – Colin Powell

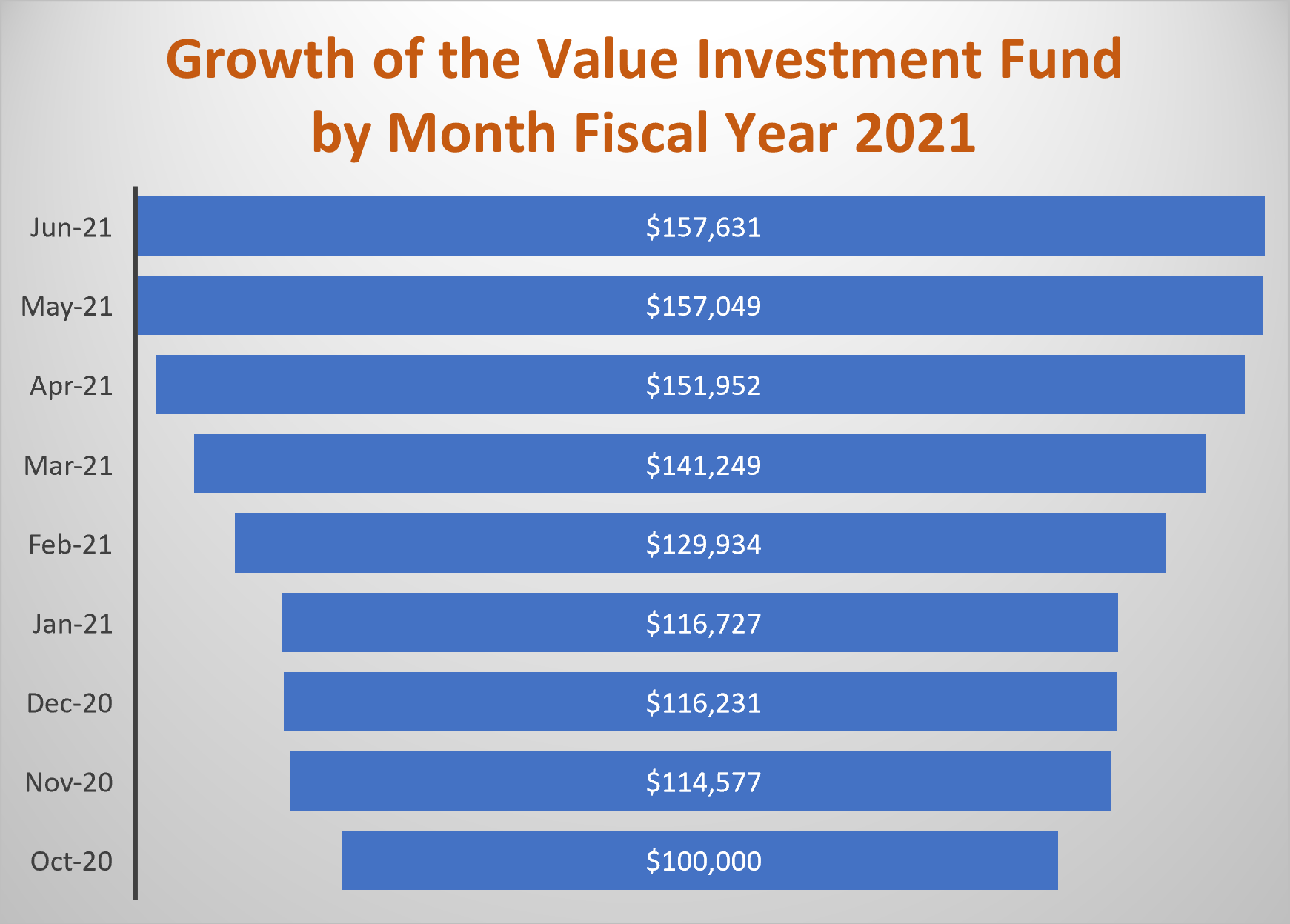

The Value Investment Fund glided along during June 2021. The Fund grew a meager .4% driven by the sale of Essex Property Trust on June 18, 2021. Total actual gain during June was $582, as illustrated in the report below. During this period, the Dow Jones Industrial Average decreased by about one-tenth of a percent.

As stated multiple times throughout the lessons and tutorials, high-quality stocks have less risk and thus, resist remarkably well when the market goes down or is stagnant and recover quickly upon market rebound. Furthermore, high-quality stocks provide many opportunities to earn good rewards if properly purchased at less than intrinsic value and sold upon market price recovery. Here is the Value Investment Fund’s status report for the end of June 2021.

Value Investment Fund – End of Month Report

. June 30, 2021 May 31, 2021 June 30, 2021

REIT Pool # of Shares Cost Basis Market Price* Fair Market Value* Fair Market Value*

– Equity Residential 574.459 $30,000 $76.00 $43,917.39 $43,658.88

– Essex Property Trust (Tranche #1) 48.9644 – – 14,409.73 Sold

– Essex Property Trust (Tranche #2) 43.2994 – – 12,742.58 Sold

– UDR 606.9803 20,000 47.98 28,303.49 29,122.91

Sub-Totals $50,000 $99,373.19 $72,781.79

Railways Pool

– No Stock Holdings (All six railroads are at or near their all-time highs)

Banking Pool

– Bank of New York 232.9373 10,000 50.23 11,898.44 11,700.44

. – Wells Fargo (Tranche #1) 292.0560 10,000 44.29 13,352.80 12,935.16

. – Wells Fargo (Tranche #2) 558.9715 20,000 44.29 25,556.18 24,756.85

. – Wells Fargo (Tranche #3) 234.3292 10,000 44.29 -0- 10,378.44

. Sub-Totals 50,000 50,807.42 59,770.89

Dividend Receivables (Equity Residential) 85.10 346.40

Cash on Hand (Gains, Dividends, PUTS) 6,783.38 24,732.15

Totals (Starting Cost Basis = $100,000) $100,000 $157,049.09 $157,631.23

*Net of transaction fees of $1.00 per share; thus, the amount in the schedule equals the actual market price per share at closing, less $1.00 per share.

On June 18th, the Fund sold 92.2638 shares of Essex Property Trust, netting $302 per share after transaction fees. Net gain earned was $7,864. This equates to an annual return of 74%.

Value Investment Fund – Activity

During June, the following transactions occurred.

- Dividends were recorded for UDR for $346.40;

- Sold Essex Property Trust for a realized gain of $7,863.67;

- Purchased 234.32.92 for a total basis including fees of $10,000.

To date, the fund has realized earnings as follows:

Gains

Gain on sale of Norfolk Southern $2,678.26

Gain on sale of Union Pacific Railroad 4,620.06

Gain on sale of Comerica Bank 3,677.40

Gain on sale of Essex Property Trust (06/18/21) 7,863.67

Sub-Total Gains $18,839.39

Dividends

Norfolk Southern (Nov) 92.39

Union Pacific (Dec) 111.50

Equity Residential (Dec/March/June) 1,039.20

Essex Property Trust (Dec/March) 294.58

Comerica Bank (Dec) 251.57

UDR (Jan/April) 438.84

Bank of New York Mellon (Jan/May) 144.42

Wells Fargo (Feb/May) 170.20

Sub-Total Dividends $2,542.70

Sale of PUTs

Union Pacific Puts (Nov @$170/Sh) Expires Feb 19, 2021 330.40

Norfolk Southern Puts (Dec @$210/Sh) Expires March 19, 2021 426.54

Union Pacific (Jan @$175/Sh) Expires May 21, 2021 595.45

Union Pacific (Feb @$170/Sh) Expires June 18, 2021 239.77

Union Pacific (Feb @$155/Sh) Expires January 20, 2023 1,769.23 – Market price is currently at $219.93.

Norfolk Southern (March @$190/Sh) Expires January 21, 2022 335.07 – Market price is currently at $265.41.

Sub-Total PUTS $3,696.46

Total Realized Earnings $25,078.55

Total dividends earned in Year Two, year-to-date, equals $2,543. Cash and dividends receivable equal the total amount realized to date. Realized earnings during June 2021 equal $8,210.07.

This means the fund has realized a 25.08% return in 253 days for a realized annual return of approximately 36.18%. The unrealized portion is the difference between the fund’s increase since the start date, which stands at $57,631, and the realized amount of $25,079. Thus, the unrealized amount is $32,552. If the fund had sold the entire portfolio on June 30th, 2021, it would realize after fees the entire $57,631, which would equate to a return of 57.6% in 253 days. On an annualized basis, this equals an 83.1% return.

The key for value investors is time. The risk of the respective holdings going down dramatically is extremely low, as the intrinsic value tied to those respective holdings indicates an excellent margin of safety. Thus, the most likely outcome over the next three to four months is continuous improvement in value, albeit slower growth than the first eight full months in this fiscal year. Current indications for the respective investments are:

- Equity Residential – Current target market recovery price is $83 per share.

- UDR – Current target recovery point is $52 per share, and it is anticipated that this will occur during the summer of 2021.

- Bank of New York – this investment is in the banking pool. The current target market price is $55. The Fund may continue to hold this respective stock once it surpasses $55, as there are no other options for investment currently. A stop-loss order may be used to protect the downside risk.

- Wells Fargo – the historical high for Wells Fargo is $58 per share. The current value is a direct reflection of the inability to grow due to the cap penalty imposed by the Federal Reserve. It is expected that this cap will be released by the end of the first quarter of 2022. In the interim, the stock will continue to grow slowly into the upper-40s. Once this cap is released, the facilitator of this pool firmly believes the stock price will surpass the $58 per share prior peak price. The overall quality of Wells’ loan pool, along with the offsetting liability pool, has improved significantly over the last three years while the bank makes improvements to its internal controls. This is a stock poised to explode once that cap is removed.

Overall, the current status of the fund is performing at a better-than-satisfactory rate and tending towards the initial calculated return anticipated.

The standard for transaction fees is $1 per share, which is well above actual trading costs. Thus, the reported position above is very conservative, and it is now a matter of waiting for results to happen (patience). Act on Knowledge.