Chipotle Mexican Grill, Inc. – Intrinsic Value for Value Investing

Provide Food With Integrity – Chipotle Mexican Grill, Inc. Mission Statement

Chipotle Mexican Grill, Inc.’s current (01/24/22) market price is around $1,400 per share, trading as high as $1,930 late last summer (summer of 2021). Chipotle is a non-member of the fast-food restaurants pool for this site’s Value Investment Fund. The market price is hyped up on the strong belief that this company will generate incredible results over the next few years. The truth of the matter is this: even if you took the absolute best quarterly result from the last five years, extrapolated that value as the normal value for Chipotle, and then doubled its growth rate, the maximum best value for Chipotle would equal $480 per share. To put this succinctly, the market price for stock is so overpriced that the best term to describe this is ‘irrational exuberance’ (Alan Greenspan, December 5, 1996).

This article was written two years prior to the 50:1 stock split in June of 2024. Readers should divide the results by 50 for a more comparative outcome.

There is no doubt this company produces a great product that is loved by millions of consumers. Even more, Chipotle has grown in leaps and bounds with the volume of restaurants over the last ten years (adding 1,300 restaurants in eight years); it currently has 2,900 locations. More importantly, Chipotle’s gross margin has improved to a respectable 11.9%. Add to this, Chipotle has not recorded a loss during the last ten years. However, Chipotle’s financial model does not mirror the fast-food restaurant financial model customarily found with franchised operations such as McDonald’s, Wendy’s, Restaurant Brands International, and Domino’s. Furthermore, the law of diminishing returns will begin to dampen growth and impact the ability of Chipotle to maintain a high-quality meal. In effect, the growth experience that Chipotle has seen can not endure. Instead of the seven and eight percent annual growth rates experienced over the last ten years, growth will shrink to a more realistic four and five percent per year.

The growth rate is one of the three most important elements when determining value. Using Graham and Dodd’s famous intrinsic value formula advocated from their life’s work (Security Analysis), value equals average yearly earnings over the last three years times ((8.5 plus (2 times expected growth, as an absolute value, over the next seven years)). This turns out as follows:

VALUE = Average Earnings of $10.57 times ((8.5 + (2X5)), assumes a 5% average growth rate for the next seven years;

VALUE = $10.57 times 18.5;

VALUE = $195.55

In general, Chipotle Mexican Grill, Inc. is worth about $196 per share. Many readers will find this unbelievable given the fact that the market’s current price is over $1,400 per share. How can this dramatic difference exist? This article will answer this and substantiate that indeed the intrinsic value is less than $180 per share. The optimum buy price is around $153 per share, which provides a reasonable margin of safety for the investor. Furthermore, it will explore how the market has driven the share price to such an irrational level of value.

To the reader, you have to be realistic about this situation. NO COMPANY THAT EARNS LESS THAN $25 PER SHARE PER YEAR IS WORTH MORE THAN $600 PER SHARE. There are no justifiable characteristics that can substantiate such ludicrous values over $600 per share. Any credible resource, accountant, finance guru, or economist will tell you this. If anyone says otherwise, their educational background and experience should be questioned. The simple truth is that buyers and sellers of this stock are conducting business on speculation and not sound business principles. Do not get caught up in that foolish behavior.

To gain an understanding of intrinsic value for any company, the first step is to gather the core financial elements of the operation; one must understand the company’s financial matrix. Next, using this information, a value investor generates several different value points and compares them against industry models to determine this particular member’s position in the hierarchy of potential investment among this member’s pool. With this knowledge, several different intrinsic value formulas are applied, and using a compare/contrast thought process, the value investor can develop a reasonable intrinsic value for this investment. Furthermore, risks are explained, and why it is so important to create a margin of safety related to intrinsic value as the buy point for this security.

The final sections will explain how the market has driven this particular stock’s price so high. It finishes with the optimum sale price if the opportunity to buy develops and is exercised. But to get to this point, the value investor must first understand the core financial elements.

Chipotle Mexican Grill, Inc. – Core Financial Elements

With restaurants, an investor must remember the distinct business model (Lesson 19). Informal dining out (fast-food) operations are high-volume, low-margin models. Rarely does any single transaction exceed $30 as the final sales price. Furthermore, fast-food companies are highly competitive, and as such, the consumer is price sensitive too. Thus, any ability to generate operating margins over 16% is unrealistic. The key to financial success is volume. Each store must prepare as many orders as possible and maintain high levels of throughput to generate enough gross margin to cover the location’s occupancy and other traditional operating expenses.

With restaurants, an investor must remember the distinct business model (Lesson 19). Informal dining out (fast-food) operations are high-volume, low-margin models. Rarely does any single transaction exceed $30 as the final sales price. Furthermore, fast-food companies are highly competitive, and as such, the consumer is price sensitive too. Thus, any ability to generate operating margins over 16% is unrealistic. The key to financial success is volume. Each store must prepare as many orders as possible and maintain high levels of throughput to generate enough gross margin to cover the location’s occupancy and other traditional operating expenses.

Thus, one of the core financial elements is volume; how much the stores are producing in sales, and is it growing? For Chipotle Mexican Grill, Inc., look at their sales volume per store for the last seven years:

Sales/Store # of Stores

2014 $2,472,000 1,783

2015 $2,424,000 2,010

2016 $1,868,000 2,250 *Sales drop dramatically due to E. Coli incident.

2017 $1,940,000 2,408

2018 $1,984,000 2,491

2019 $2,205,000 2,622

2020 $2,223,000 2,768

Yes, sales are growing per store, and the number of stores is also growing each year. But there is a catch here; notice how sales per store in 2020 have not reached the same volume of sales as recorded at the peak back in 2014. Though some good news here, as of the third quarter 2021 and extrapolating into the fourth quarter 2021, sales volume per store has reached a lifetime new peak of $2,554,000.

Thus, there are two distinct growth contribution factors. First, sales per store are improving two to three percent per year, with a significant increase in 2021 (which was experienced by the entire fast-food industry across the board). Secondly, the number of stores is increasing by five to six percent per year, which is the primary reason overall sales are having such an outstanding increase from one period to the next. Overall, better-than-average industry growth exists for Chipotle. When evaluating growth, the value investor is interested in a reasonable expectation of growth over the next seven years. Assuming no economic downturns such as a recession and the lifting of all COVID-19 restrictions, it is reasonable to expect a good growth of four to six percent per year for the next seven years. Therefore, any value within this range would be considered Chipotle’s growth rate.

In addition to growth, other financial-related values are necessary. One of the critical pieces is the overall operating margin per year. Basically, a value investor wants to know how much the company as a whole nets with its income from one year to the next and what this particular value’s growth rate is. Here is Chipotle’s operating income from the last eight years and the expected amount for 2021, given information through the third quarter of 2021, extrapolated into the fourth quarter.

. Values are in Thousands

Sales Operating Profit Margin

2014 $3,214,591 $710,800 22.11%

2015 $4,108,269 $763,589 18.59%

2016 $4,501,223 $34,567 7.68% * E. Coli Issue

2017 $4,476,412 $270,794 6.05%

2018 $4,860,626 $258,368 5.32%

2019 $5,561,036 $443,958 7.98%

2020 $5,920,545 $290,164 4.90%

2021 $7,450,173 $886,327 11.89% *Estimated the 4th Qrt Results Based on 3rd Qrt Actuals

Even with a banner year in 2021, the operating margin at 11.89% is respectable but not at the standard McDonald’s has set at 14.23%. This means that if Chipotle could perform at the standard McDonald’s has set, Chipotle’s operating profit would be around $1,059,995,000. After taxes and interest, Chipotle’s bottom-line net profit could reach as much as $670,460,000 per year. Thus, with $7.5 billion in sales, Chipotle could net as much as $700,000,000. This means the bottom-line net profit is about 9.3% at optimal operations. This is important because this value is used in one of the intrinsic value formulas.

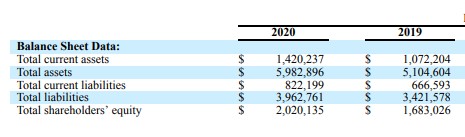

A third set of financial data important to determine intrinsic value is rooted in the balance sheet. This is a summary presentation of Chipotle Mexican Grill, Inc.’s balance sheet.

One of the interesting data points related to many fast-food restaurants is how lease obligations are always greater than the leased assets. This is not unusual, but it reflects how the lessor typically does site improvements that will go beyond the term of the lease, but in effect, gets the tenant to pay for this in the lease negotiations. For Chipotle, leased assets are worth about $2.8 billion at the end of 2020, and the corresponding lease obligation exceeds $3.1 billion. This difference is customarily amortized out during the first seven to eleven years of a lease. In effect, Chipotle is paying more each month than what the asset that is booked is worth each month.

As Chipotle builds more restaurants, this long-term obligation will continue to grow.

There is one glaring value on this summary report. Shareholders’ equity is 33.7% of the assets. This is pretty strong for a company this size. The reason is simple: Chipotle Mexican Grill, Inc. pays no dividends. In its entire history, not once has it issued dividends. This is a very important point when it comes to value investing. Chipotle reinvests every dime it has made, which accounts for the huge growth rate it has experienced over the last ten years. Since Chipotle’s business model does not include franchising like most other informal eating out (fast-food) operations, it must retain all earnings to fund the growth of company-owned restaurants. Not one restaurant in its entire portfolio is a franchised eating establishment. Just like the net operating income value is used with some intrinsic value formulas, so too does this non-dividend status impact balance sheet-based intrinsic value formulas.

Chipotle Mexican Grill, Inc. – Value Points Within Its Industry

The informal eating out industry (fast-food) adheres to a particular financial model for success. McDonald’s is the absolute standard bearer with this model. Simply put, the model has three segments. The first is the traditional corporate-owned restaurants segment. In general, McDonald’s has over 2,700 corporate-owned establishments. This serves a dual purpose; the primary purpose is to act as the model of performance for the second segment, franchisees. Secondly, the corporate-owned locations produce a profit. This segment generates an operating margin of more than 14% and once adjusted for interest and taxes, this segment easily contributes at least a 10% net profit to this segment’s revenue.

The second segment is the real money producer for McDonald’s, as it is for other fast-food chains. Franchising is by far the most important financial segment of any well-run fast-food chain. In general, the corporate office charges a 4% franchise fee on every dollar of revenue the franchisee generates. There are costs to this franchise fee, mostly monitoring, compliance enforcement, and general administration of the program. But overall, franchising generates operating margins that often exceed 45% for most corporations. McDonald’s has over 36,000 franchised outlets. This single segment is what elevates the overall profit margin as a whole for McDonald’s. In general, McDonald’s net profit is over 22% per year. This segment is the driving force of value for any fast-food chain.

The third segment is a real estate management operation. The idea is straightforward: the corporate office goes out and finds the ideal sites/locations for future franchisees. The corporate office negotiates long-term leases for this land and gets the property prepped (zoning/water/sewage/utilities/access/egress/cleared/site development) for the franchisee to build their restaurant. Then, they in turn lease this location to the franchisee. There is a significant markup in the difference between what the corporate office pays for the rights to the land and what they in turn charge the franchisee. Margins with this segment exceed 25% and often, on some individual leases, more than 50%. Although not the driving force of absolute dollars contributed to the overall profit of the company, the real estate arm of a fast-food chain leverages the overall profit of the company.

The third segment is a real estate management operation. The idea is straightforward: the corporate office goes out and finds the ideal sites/locations for future franchisees. The corporate office negotiates long-term leases for this land and gets the property prepped (zoning/water/sewage/utilities/access/egress/cleared/site development) for the franchisee to build their restaurant. Then, they in turn lease this location to the franchisee. There is a significant markup in the difference between what the corporate office pays for the rights to the land and what they in turn charge the franchisee. Margins with this segment exceed 25% and often, on some individual leases, more than 50%. Although not the driving force of absolute dollars contributed to the overall profit of the company, the real estate arm of a fast-food chain leverages the overall profit of the company.

Of the three segments of revenue customarily found with a chain of restaurants, Chipotle Mexican Grill, Inc., only operates the first segment. Thus, of the three segments noted above, the standard operating model known as corporate-owned restaurants, which produces the lowest overall operating margin, is the ONLY segment Chipotle utilizes to generate sales. Take note, franchising utilizes others’ (franchisees’) capital to construct/equip and start up a new restaurant. Chipotle must use its capital to carry out the construction, equipping, and initial start-up of a new restaurant. This model difference impacts the ability to truly grow at exceptional rates for extended periods of time.

Thus, at the industry level, Chipotle Mexican Grill, Inc. can not match what other similar operations can do with potential growth.

Within the corporate-owned restaurant segment, Chipotle has trouble matching the industry standards, too. Again, McDonald’s has set the standard. Utilizing a vast supply chain, a marketing/advertising program, strict conformance requirements, and a deep management program, McDonald’s has proven year in and year out that generating between 12 and 16% operating profit margins is expected. This includes this segment’s share of the overall corporate organization’s costs. Net profits from this segment are between 9 and 11% annually. On average over the last six years, Chipotle’s operating profit is a mere 7%. Only during this last year has Chipotle demonstrated dramatic improvement in the operating margin, driven by economies of scale with sales. Just understand, one year of reasonable performance does not justify ‘irrational exuberance’.

One last area of industry standards that impacts value. Every company reports ‘risk factors’ in its annual reports. McDonald’s risk factors are similar to Chipotle’s. They both mention the overall economy and how important it is that consumer demand impacts their ability to generate sales, etc. But there are differences between the two operations. For example, McDonald’s writes about their food supply chain and how they have management systems and a wide variety of suppliers. They are exposed to risk for certain products due to limited suppliers. In the end, McDonald’s states that supply may ‘increase costs or reduce revenues’.

Whereas, when Chipotle Mexican Grill, Inc. writes about their supply chain risks, they state it as ‘… supply of ingredients could adversely affect our operating results’. Notice the difference in the language, in effect, the economy of scale and the long-term relationships McDonald’s has developed limit their exposure to increased costs or reduction in sales. Chipotle Mexican Grill, Inc. uses stronger terms to indicate that issues within the supply chain can substantially impact the profit of company.

This example of risk comparison is just one of the many that the two entities face, but McDonald’s has the upper hand. Other risk factors include:

- Ingredient costs due to climate or sustainability;

- Federal and state laws;

- Labor;

- Cybersecurity;

- Reliance on information technology;

- Litigation;

- Lease negotiations for new sites;

- Financing

With all of these, McDonald’s has the upper hand due to experience, size, and stable operations. Chipotle still has many more years of operations to gain the experience necessary to control the associated risks and their costs.

Thus, the ability of Chipotle to match the operating profit margin of other organizations is still several years away. Although improving, Chipotle’s risks will impact the ability to instantly match the operating profits of other large operations.

With the knowledge of both the financial performance and the industry’s standards of performance, a value investor can now determine intrinsic value.

Chipotle Mexican Grill, Inc. – Intrinsic Value of a Share of Stock

There are about six popular intrinsic value formulas. Add to this another two dozen or so variations of those six, and there are more than 30 intrinsic value formulas. The key to identifying intrinsic value is using reasonable data points, expectations, and thoughts. A reader can visit the internet and request intrinsic value for Chipotle and get some crazy numbers. Go back to the purpose of intrinsic value, which is the amount a rational individual would pay to own the rights to the respective security. Thus, it is important to understand what a buyer of stock would receive in exchange for owning a respective share of Chipotle Mexican Grill, Inc. As illustrated in all articles on this site related to intrinsic value, the intrinsic value formula outcomes are broken out into the three major groupings of balance sheet, income statement, and cash flows.

Balance Sheet Based Intrinsic Value

There are three ownership rights to any investment. The primary right is a return on one’s investment. With stock, this is characterized by dividends. Secondly, the owner has the right to vote their share to set the course of policies, management, and directors. Lastly, an owner of stock has the right to sell the stock at any time in the future.

To be clear here, only the last ownership right is what a value investor would receive for this investment. Chipotle pays NO DIVIDENDS whatsoever. Thus, there is no value tied to dividends. Secondly, ownership of a few hundred shares isn’t going to change the policies or management style, or even who directs the company. Thus, the only benefit is the right to sell the stock in the future. With Chipotle, the only financial gain is to buy the stock low and sell it high, and earn a good gain from the interim holding period.

This immediately eliminates one of the popular intrinsic value formulas, dividend yield.

Since the dividend yield is an equity section intrinsic value formula, let’s continue with another equity value formula, book value. Chipotle’s book value per share is $83.

With the balance sheet, a third and informative intrinsic value formula is tied to liquidation; how much would an owner of a share of stock get in case of bankruptcy or forced liquidation, i.e., the extreme step of folding up the company. Unfortunately, Chipotle only owns a few legitimate assets with any permanent value. Both sides of the balance sheet are oriented around those leases explained above. In effect, Chipotle can not just easily liquidate; it would take years to wind down the affairs of this company, and this process will effectively consume the non-leased assets, such as investments, cash, etc. The best possible outcome under a liquidation plan would be about 40 cents on the dollar of book value per share. The most likely outcome would be zero value for shareholders, IF the company had to liquidate. Thus, the book value is the best intrinsic value tied to the balance sheet formulas. And this value is contingent on the requirement that Chipotle continue with operations for several years into the future. It is unlikely that Chipotle will simply fold up; after all, it is a good operation and its product is well-received by consumers. Thus, there is certainty related to continued operations.

Income Statement Based Intrinsic Value

Income statement-based intrinsic value formulas key in on earnings. However, the formula requires three distinct pieces of information. The first is, of course, earnings. Not just the most recent earnings, but the average over the past three to five years. In addition, are the earnings increasing or decreasing? Secondly, the formula requires a discount rate. A discount rate is a complex outcome taking into consideration four major factors. For brevity in this article, Chipotle’s discount rate is set at 11.5%. The third and final piece of information is the growth rate. This is the expected growth rate over the next seven years. What is the expected growth rate on average during this upcoming period? As determined in the financial data section above, Chipotle can expect a growth rate between four and six percent per year for the next seven years.

Now, with the three pertinent pieces of information, intrinsic value can be derived based on earnings. To illustrate the extreme outcomes that can be generated, the formula will have three outcomes. The first is ‘Conservative’ based. The second outcome and the one preferred and advocated by this site’s facilitator is ‘Reasonable’ in nature. The final result is ‘Liberal’ with its intrinsic value formula inputs. Each of them is explained and calculated in the following subsections.

Conservative Approach

When determining intrinsic value with a conservative approach, the idea is to use stronger discount rates and slower growth rates in order to generate an overall lower outcome value with the intrinsic value formula. The formula itself is the standard net present value formula commonly used in finance. Here, future earnings each year are determined based on the historical input, and then these outcomes are discounted back to today’s dollars. Basically, what are the current average earnings, and then with a conservative growth rate, how much is expected to be earned over many years into the future? Then, applying a discount rate against that future set of earnings, what is the aggregated value in today’s dollars?

Using the average earnings of the last three years at $540.15 million per year with a more conservative discount rate of 12% and a growth rate of 3.5%, cumulative earnings over the next 25 years, discounted to today’s dollars, equals $5.5 billion market value. With 28.16 million shares, each share is worth around $196. Adjusting this outcome for interest and income taxes, the net result is around $161 per share.

Reasonable Approach

Changing this formula to a more reasonable set of data points, i.e., a discount rate of 11.25% and a growth rate of 4.75% provides an overall market value of $6.172 billion, or $219 per share. As with the conservative approach, adjusting this outcome for interest and income taxes, the intrinsic value per share is approximately $178 per share. Take note, some so-called experts with net present value formulas will state that a terminal value should be included in the formula to present a cashing out, i.e., winding up of affairs at the end of this formula. With Chipotle, there is no terminal value. This is because the entire operation is a function of leases. Once those leases expire, Chipotle no longer has rights to those sites. If they do not renegotiate an extension, the respective restaurant must close up shop, and it’s over. In effect, Chipotle must make its money during the lease. The earnings reflect the earnings during the leases. Yes, there will be cash in the bank at the end, but this cash is directly associated with the earnings made during those final years of operations. The ending cash and other current assets are already included in the formula. Again, there is NO TERMINAL VALUE. Chipotle will have no fixed assets to sell, no real estate that has appreciated, nothing other than current assets that are directly there because of prior years’ earnings.

Liberal Approach

Using the same formula but utilizing more liberal values will result in a higher valuation. However, with a liberal approach, the average earnings are also increased to reflect the best year of the three look-back periods. In this case, earnings start at $886,327 (the value tied to 2021). Furthermore, the discount rate is dropped to 10% and an improved growth rate of 6.5% is factored into the result. The market value jumps dramatically to $14.05 billion or $499/Share. Adjusting for interest and taxes, the final intrinsic value is right around $395 per share.

In summary, the liberal approach doesn’t even come close to the current market valuation of $1,400 per share. The liberal approach reflects the best year with overall earnings over the lifetime of this company and an incredible growth rate of 6.5% (which, in layman’s terms, means that Chipotle will double in size every 11 years). This is simply unrealistic. Add to it a low discount rate of 10% for this kind of operation, and you have a very liberal formula outcome. To give you an idea, McDonald’s discount rate is around 9% and it’s been in business for 60 years and is a Dow-listed company. Even the reasonable approach uses a strong growth rate of 4.5% but only because Chipotle has demonstrated a good growth over the last ten years, and since it issues no dividends, it is likely to continue funding this high growth rate for several years to come. Under the reasonable approach, if the starting point is a reflection of the most current year’s earnings and not the look-back average of the last three years, the outcome improves dramatically to $369/share, $295 per share adjusted for interest and taxes. But without confidence that Chipotle can continue to maintain this level of operating profits, using a higher starting point is unwarranted.

In summation, on a per-share basis, the outcomes are as follows:

Approach Pre-Tax Value Net Profit Value

Conservative $196 $161

Reasonable $219 $178

Liberal $499 $395

Reasonable (Using Current Earnings as Starting Point) $369 $295

Cash Flows Based on Intrinsic Value

The cash flows approach is similar to the income statement approach. Certain investors claim the cash approach is superior to the income statement approach as it also takes into consideration the impact related to the balance sheet. For those of you new to understanding financial statements, the cash flows statement reflects the net profit adjusted for how other forms of cash inflows and outflows are documented on the balance sheet. For example, Chipotle’s net profit on 12/31/2020 was $356 million. This is considered the accrual net profit and gets adjusted based on whether certain expenditures were paid or prepaid. Thus, the net profit is adjusted for these cash-related issues. During 2020, Chipotle had $613 million of non-cash adjustments, mostly related to depreciation/amortization, deferred taxes, and stock compensation taken as a deduction on the income statement but wasn’t paid out in the form of cash. On the flip side, Chipotle did have to pay out in cash for past deductions, about $446 million for income taxes recorded in prior periods, lease obligations, and prepayments required in their business. Altogether, the net cash Chipotle earned from its normal operations was $664 million. Thus, cash from operations exceeded their net profit by $308 million.

Some investors place greater importance on this additional cash as value tied to intrinsic value. This is true within a very restrictive set of circumstances. This is not the case with a company needing this cash to fund the growth of new restaurants. Altogether, Chipotle used $373 million to invest in new operating leases. In effect, the benefit gained from operations of $308 million was all used, plus more to acquire new leases to add more restaurants to the portfolio. Thus, calculating intrinsic value tied to cash flow will result in a LOWER value than the methods under the income statement section above. For those readers not familiar with this intrinsic value formula, it is often referred to as the discounted FREE CASH FLOWS method. The free cash flows method is much more effective with highly stable, fixed asset-intensive operations such as REITs, hotels, and mining operations. It is generally frowned upon for companies that will not end up with terminal assets with some kind of market value.

To add to this, Chipotle doesn’t pay out dividends; however, it did spend $54 million to buy back stock. Here’s a company wanting to finance growth, yet it buys back some of the stock in the market. It is buying back stock at market prices that far exceed the intrinsic value of the stock. This is a RED flag in any value investor’s book.

Chipotle Mexican Grill, Inc. – Summary of Intrinsic Value

With a book value of $83 and a long list of significant risks, value investors should err with caution towards more conservative data as the basis in the intrinsic value formula. However, Chipotle has reached the level of a stable operation, not yet a highly stable operation, but stable nonetheless. This allows a value investor the necessary substantiation to elevate the data towards reasonable expectations. Liberal rates for intrinsic value are not only troublesome, but also create unrealistic results, and with any fast-growing company. Any outcome other than the required tremendous growth into the foreseeable future will result in losses to a value investor.

Overall, using the reasonable guidelines as stated above, the intrinsic value of a share of stock for Chipotle Mexican Grill, Inc. is $178 per share. Any value higher is fraught with too much risk that is just unbearable for any prudent, responsible investor. Remember, this is NOT a highly stable company yet; it does not have full economies of scale, nor does it have the long-term experience to address corporate-wide issues with the least amount of costs. In ten years, it will be a different story.

With this said, the intrinsic value will move forward in leaps and bounds IF the company continues to improve its bottom line and can continue its current growth rate. It is possible that the intrinsic value could grow at $40 per year over the next three years, provided Chipotle adheres to the performance standards it set in 2021. For now, the intrinsic value for 2022 is set at $178 per share.

This article was written two years prior to the 50:1 stock split in June of 2024. Readers should divide the results by 50 for a more comparative outcome.

Chipotle Mexican Grill, Inc. – Margin of Safety

As with any investment, there are risks. The goal with a margin of safety is to buy the stock at less than its intrinsic value to accommodate those risks. Risks include using the wrong formula or data points. There are also economic-wide risks, industry-related risks, and risks at the company level. Above, it was explained about the various risks fast-food restaurants must address to keep moving forward. Unlike better-established operations, Chipotle’s risks are inherently greater due to its novice experience and economy of scale. Risks at the company level are worth four to five percent, and at the industry level, another two to three percent. But the real risk factor is the data points used in the intrinsic value formula. Here, overstating growth by as much as one percent equals $12 to $15 of value in this range. Thus, a value investor must maintain some perspective here.

Overall, it is a good company, great product, and so Chipotle will always be in demand by the consumer. Assuming the corporate level risks and industry risks, a discount of seven percent is warranted. In addition, another $12 discount is required to compensate for the risk of using incorrect values in the intrinsic value formula. The result is a discount of $13 for risk and $12 for formula error. Total discount or margin of safety is $25; thus, the buy price is set at $153 per share.

This article was written two years prior to the 50:1 stock split in June of 2024. Readers should divide the results by 50 for a more comparative outcome.

At $153 per share and a book value of $83 per share, along with the high growth rate of Chipotle, the value investor minimizes the downside potential, and once the market recovers to a fair and reasonable price, the value investor will do extremely well. The initial market recovery price is set at $320; see the liberal intrinsic value outcome.

This article was written two years prior to the 50:1 stock split in June of 2024. Readers should divide the results by 50 for a more comparative outcome.

Current Market Price Experiencing ‘Irrational Exuberance’

Above, a rational approach was illustrated to calculate a reasonable intrinsic value for Chipotle Mexican Grill, Inc. Remember, this is a company that is only 29 years old and only has 2,900 restaurants nationwide. For comparison, Wendy’s has 6,800 locations and McDonald’s has 40,000 restaurants worldwide. So in comparison, this is a young and growing company. It still has a long way to go to mature into a highly stable fast-food operation. It is going to make mistakes while it grows.

As for ownership, 19 million of the 28 million outstanding shares are held by institutional and mutual fund groups. There are another 505,000 held by four individuals who operate Chipotle. The remaining 8.5 million are held by small funds and individuals. So how did this market price come to be? First, let’s look at Chipotle’s lifetime share price in a graph.

This article was written two years prior to the 50:1 stock split in June of 2024. Readers should divide the results by 50 for a more comparative outcome.

The last time the share price was below $200 was back in late 2010. The graph identifies the E. Coli scare in late 2015 and how it took four years for Chipotle to regain its market share, revenue, and, of course, the corresponding share price.

Again, why is the share price so high in comparison to Chipotle’s intrinsic value?

The answer is prestige.

The initial investor during this company’s pre-public existence was McDonald’s! Think about the prestige this single corporation brings when it was the first big investor in this chain back in the late 90s and was the largest stakeholder when the company went public in 2006. Throughout a few offerings, McDonald’s divested itself from Chipotle. But McDonald’s implemented the culture, systems, and processes to make Chipotle the success it is today. The share price is a reflection of the belief by the holders of stock that this company will someday be the next McDonald’s. McDonald’s lent its reputation to Chipotle, and in turn, the shareholders believe this warrants unbridled behavior with the stock price.

This restaurant chain has doubled its number of restaurants in eight years; sales have doubled in seven years, even with the E. Coli incident; and Chipotle is now synonymous with quality fresh food.

The reality is this: Chipotle is still a small fast-food chain. Secondly, it still has a long way to go to secure sourcing of its ingredients and acquire the human resources to continue this growth. It is going to get more and more difficult as the company broadens its footprint to lock down resources. All of this affects earnings, and since Chipotle pays no dividends and still has another ten or more years to become recognized as a highly stable operation, the current market price has nowhere to go but down. The giddiness of owning a good company that was essentially started by a renowned corporate behemoth will wane without rewarding the shareholders for the risk they take when they spend $1,400 for a share of stock that only earns in its best year to date $25 per share. At this rate, it will take more than 50 years to get your money back. And this assumes all of the earnings would be paid out as dividends.

This irrational behavior with this stock price meets reality over time. How long will institutional and fund investors tolerate no dividends? Yes, the company is growing quickly, but at some point, this has to turn into a return on the investment for these investors. Some institutional and fund investors will sell in order to take advantage of these high market prices and take whatever gains they can, but this then requires individuals to buy these positions, and quite honestly, any individual or independent fund that reads and understands value will simply not play that game.

This site’s Value Investment Fund only includes this particular company in its restaurant pool to illustrate how the market can act inappropriately related to certain investments. This is an extreme example of an overpriced investment. The price would have to drop below $250 per share just to begin inclusion in the decision matrix for the restaurant pool. Any purchase of a share of Chipotle for more than $300 is simply not investing but speculation. Act on Knowledge.