Value Investment Club – Membership

Value investing, in its simplest terms, means buying securities at a low price and selling them at a higher price. Value investing is defined as a systematic process of purchasing high-quality stocks at an undervalued market price, quantified by intrinsic value and justified through financial analysis, then selling the stock promptly upon market price recovery. You can learn about value investing on this site.

There are four key principles used with value investing. Each is required. They are:

- Risk Reduction – Buy only high-quality stocks.

- Intrinsic Value – The underlying assets and operations are of good quality and performance, and there is a core value for the security.

- Financial Analysis – Use core financial information, business ratios, and key performance indicators to create a high level of confidence that recovery is just a matter of time.

- Patience – Allow time to work for the investor.

This site is divided into two separate channels. Most readers are only interested in the educational curriculum. This channel is FREE, and you do not need to register for the program. Simply click on the KNOWLEDGE tab of the menu above and start reading. It is access to this site’s primary channel, which requires membership. This is a subscription to the Value Investment Fund information stream.

Membership provides access to current activity, alerts, and the decision models for all pools of potential investments. This immediate access to information allows the member to take action for their own value investment portfolio.

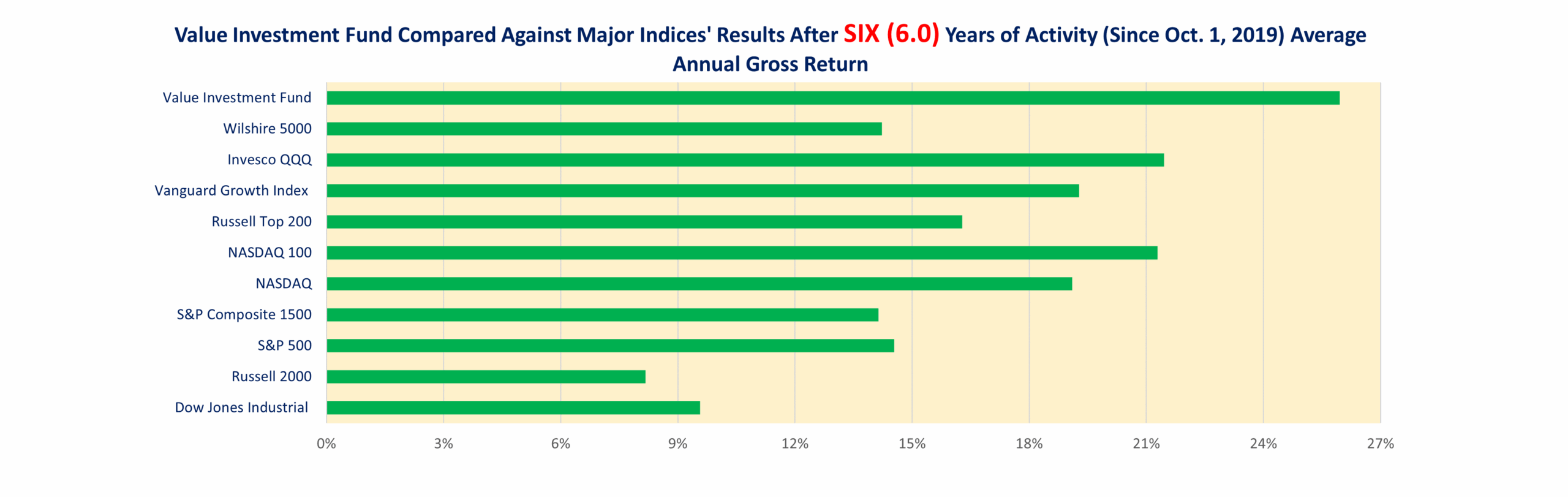

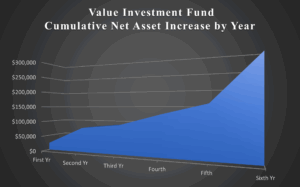

Here, a subscription allows you to access the seven pools of investments. Each pool has its own buy/sell model, which is updated regularly. In addition, subscribers have access to recently posted alerts to buy or sell certain investments. Furthermore, the subscription gives you access to all the white papers about each member of the respective industry pool of investments. These papers identify book, intrinsic, buy, and sell value points. If you follow along, your portfolio will grow in a similar pattern to this site’s Value Investment Fund. Over the last six years, the Value Investment Fund has grown from a starting point of $100,000 to $310,000 after taxes! That is an impressive 21% annual growth rate after taxes! For comparative purposes, the Fund has an annual return greater than >25% as compared to other non-taxed market indices (DOW Jones, S&P 500, NASDAQ 100, NASDAQ). It has outperformed the next best index by more than 16%! See this chart for clarity:

As evidence of success, the following downloadable PDFs provide a summary report and the actual details of all transactions over the last six years.

For a Summary Accounting, please download this report: .

The following reports identify the respective detailed activity over the last six years:

Look at this site’s dual path program:

When you join, you participate in an information process.

Here, you receive all the models and activities that occur in the Club. The Value Investment Fund has eight pools (you learn about POOLS during the initial phase of education) of similar companies:

- Railways

- Real Estate Investment Trusts

- Fast-Food Restaurants

- Insurance (Property and Casualty)

- Military Contractors

- Banking

- Hotels

- Entertainment

For example, in the fast-food industry, the companies being monitored include McDonald’s, Wendy’s, Domino’s, Starbucks, Jack in the Box, Chipotle, and Shake Shack. There is a buy/sell decision model that you have access to, which is updated regularly to reflect the annual changes in intrinsic value and the corresponding buy/sell points.

As a subscriber to the Investment Club, you get the following benefits:

- Email Alerts for any pending transactions or actual activity for this site’s Value Investment Fund;

- Monthly Newsletter regarding the activity within the Value Investment Fund;

- Quarterly Spreadsheets for each active pool of investments with this facilitator’s calculated intrinsic value, buy and sell points;

- Weekly Article regarding one of the 60-plus potential investments outlining the respective business dynamics, issues, standards, and calculated buy/sell metrics;

- Watch Notices for possible opportunities along with suggested buy and stop loss points.

Any activity in the Fund is posted as member-only articles along with the underlying decisions and the corresponding explanations. As a member, you may use the information for your self-directed fund or just watch this site’s Fund as it grows and changes.

There is a secondary channel that is educational and teaches the member about value investing and how to quantify intrinsic value and the corresponding buy and sell points for securities. This is done over a course of a hundred-plus lessons; the idea is to give you long-term confidence with your trades. It is a self-paced program. There is no need to rush through the lessons. Although it appears quite extensive with 100-plus lessons, fear not, you still receive information about this site’s Value Investment Fund’s activity. This educational channel is open to all and does not require membership. However, information about respective securities and the buy/sell points is only available via Club Membership.

KEY FACTS:

- Starting Fund Balance $100,000

- Comparative Balance (No Taxes) $396,651

- Six Years Ending Balance Net of Taxes $310,709 *Net of all trading costs/fees and taxes

- Taxes Paid Lifetime to Date $85,942

- Unrealized Gains Net of Taxes @09/30/25 $9,270

- Total Cost of All Fees (Trading Costs, Margin Fees) $39,733

- Total Number of Trades 86

- Comparative Annualized Growth 25.9%

- Annualized Growth Net of Taxes 20.80%

To the left is a graph depicting the cumulative net asset fund balance (through September 30, 2025). This site’s investment fund has outperformed all major indices, from large across-the-board fund groups (S&P 500 and DOW Jones Industrial Average) to indices focused on growth (Invesco QQQ and Vanguard Growth). Average annual returns exceed 25%. The only investment style that outperforms value investing is ‘LUCK‘.

To the left is a graph depicting the cumulative net asset fund balance (through September 30, 2025). This site’s investment fund has outperformed all major indices, from large across-the-board fund groups (S&P 500 and DOW Jones Industrial Average) to indices focused on growth (Invesco QQQ and Vanguard Growth). Average annual returns exceed 25%. The only investment style that outperforms value investing is ‘LUCK‘.

Start out by first learning about value investing and how it works. There are eighteen lessons for Phase One of the program. The lessons are available right now and do not require a login. This is a self-paced program. This phase of the program is currently FREE and accessible to anyone.

In Phase Two, an additional 100 lessons explain how to develop financial metrics to identify opportunities. In this phase, a pool is developed from step one all the way through to the final decision model. This particular phase focuses on hotels. Each lesson builds on the prior set and develops your understanding of how financial information is evaluated. This allows you to create your investment pool in parallel to the hotel’s pool.

The final phase is referred to as sophistication. It teaches the member about some auxiliary tools an investor uses to marginally increase the fund’s overall return. For a more detailed understanding of all three phases, just scroll down a little further for more information.

Educational Program Phase One – Introduction, Terminology, and Conception

The first phase is essentially an introduction to the four core principles of value investing. During this phase, you will learn about value investing and how systematic buying and selling accumulate wealth. Most visitors take about four to six months to complete this part of the curriculum. It includes:

- A set of lessons introducing value investing and the terminology commonly found with this type of investing.

- Tutorials whereby instruction and illustrations are provided to give you a well-rounded perspective of how value investing works and creates wealth.

- An initial set of spreadsheets, templates, and resource venues is introduced before Phase Two of the program.

Educational Program Phase Two – Financial Analysis

Phase Two introduces the concept of pools and why pools of similar investments act as the heart of value investing. The goal is to take the student to the next level of understanding the financial elements of business. This part of the program covers:

- Understanding financial statements: how to read and interpret the information.

- Learn how business ratios act as an equalizer among similar companies and how to properly compare results.

- The AH-HAH moment starts now when you develop a key understanding of intrinsic value and how to measure intrinsic value.

- Finally, learn how to develop more in-depth comparative models and set the buy/sell trigger points for your pool of stocks.

This phase takes about six to twelve months for most members to understand and comprehend the fundamentals.

Education Program Phase Three – Sophistication

During this phase, begin to actively trade in the market with confidence. Some readers create their own pool and join the club to share their findings. Club members use the existing Investment Fund pools and the metrics reported to actively trade. During this phase, the student is introduced to more sophisticated aspects of value investing, including:

- Using different risk reduction methods to improve their overall investment portfolio;

- Gain an elevated understanding of how options can leverage an investment portfolio’s return;

- Learn how to read notes to financial statements and tie the information to their own developed metrics;

- Become a mentor for new members and assist them in developing a pool of similar companies.

Club membership does not require you to develop a pool, but it is highly encouraged. Sharing your knowledge with others broadens your awareness and increases your confidence. All members use similar metrics to develop their investment pool. Furthermore, you are encouraged to review existing pools and comment on them so all members are aware of the respective advantages and risks associated with a particular pool.

The result is access to many stocks that are vetted and meet certain standards for value investors to select from for buys and sells. With this information, value investing will result in 25% plus average annual returns. Wealth accumulation is now just a matter of time.

Each month, you’ll receive an email with any activity actions during the prior month, along with updates about this site’s Value Investment Fund. You may mimic buy/sell orders in the existing investment portfolio exercises. If you decide to create your pool of investments, you are encouraged to have the pool reviewed by the facilitator. Once validated, you may include your pool in the investment club’s portfolio. From here, your pool’s information is shared with all members, and you provide regular updates related to your pool of investments.

Long-term wealth accumulation is a function of knowledge and confidence. When all members exercise similar standards of care, it allows all members to achieve success.

Join today, fill out the application below, or begin by first learning about value investing.

PLEASE BE PATIENT. The instructor may not be at his desk to respond to you immediately; most initial packages are sent within a few hours of application/receipt. If you apply over a weekend, most likely the instructor will not get back to you until Monday.

The Legal Disclaimer

Members receive regular updates on trades made with the example Investment Fund. This serves a two-fold purpose. First, members may mimic the activity the Investment Fund makes for their own gain and as a training tool. At no time is a member entitled to any financial ownership right to this site’s fund. The site facilitator is not a registered broker nor agent and therefore cannot invest on behalf of members. This fund is owned by this site and is not a shared pool. Secondly, your membership only entitles you to all the information about this Investment Fund. Your membership payment provides three benefits:

- Educational information about value investing as explained above;

- Access to the existing pools of the Investment Fund and the particular trades, along with the financial status of the Fund;

- Regular updates, articles, posts, templates, and other resources to assist the member with the development of their pool to use in conjunction with the Investment Fund’s pools.

Finally, remember investing is not for the faint of heart; there is RISK involved. No single individual has control over the market, the government, or consumer behavior. The market can and WILL have periods of decline (calendar year 2022). Sometimes these down periods can endure for several years, e.g., all of 2022 and into early 2023. Thus, only risk that which you can lose financially or set aside for long periods. No investment program is a guarantee of success. Value investing’s number one principle is to reduce risk in the investment by purchasing stock near or for less than its intrinsic value. This single principle has more focus in this series than the other three principles combined.