Banking Pool

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” – Henry Ford.

The third pool of similar investments used with the Investment Fund is banking. Banking is a highly regulated industry, governed by the Federal Reserve, and thinly capitalized in comparison to other industries. The balance sheet is strongly weighted with current assets and liabilities. It is rare for the stock to trade at more than 1.5 times traditional book value. The top three key performance indicators are 1) the spread between interest earned and interest paid; 2) revenue from non-interest sources; and 3) the quality of the loans issued.

There are different tactics taken when reading and interpreting a bank’s set of financial statements. The articles that follow in this area explain the respective interpretations of financial reports, how to key in on important bits of information, and how to properly set the buy and sell points for the respective member stocks.

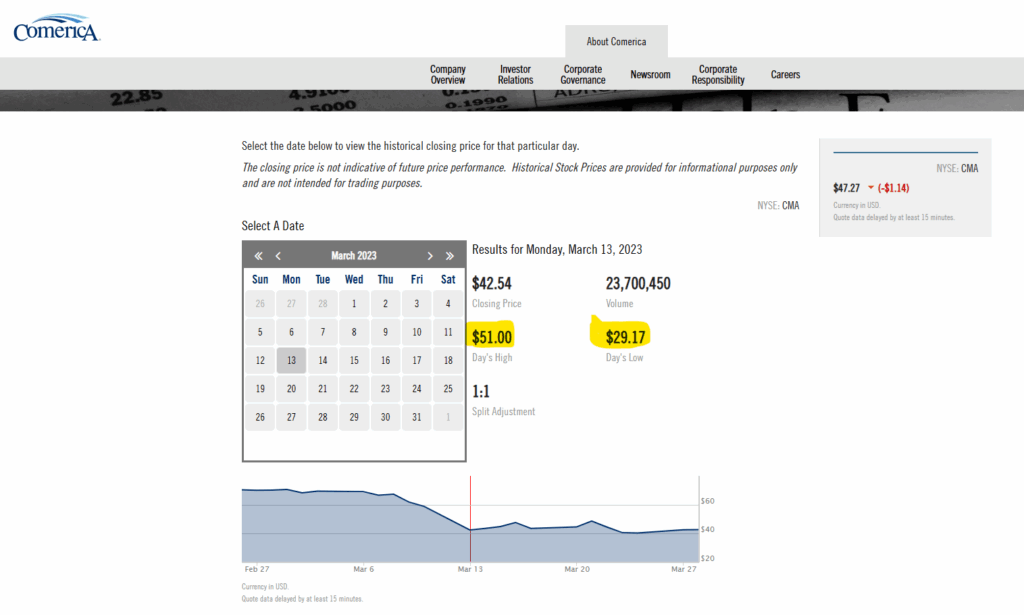

The key advantage of bank stocks is the increased volatility of the stock’s price. In general, the stock’s price for banks vacillates at a higher frequency than the other two pools of the Club’s Investment Fund. This allows for short-term opportunities to fill the voids when holding cash. A perfect example was the intraday price change for Comerica Bank on March 13, 2023. Knowing this industry’s standards allowed this site’s Value Investment Fund to earn $20,400 on a $38,400 investment within 3 hours.

There is an in-depth explanation of why knowing an industry’s business principles is essential to success in the articles below.

Over the last six years, this pool of investments generated $42,209 in realized gains across eight buy/sell transactions. The following is the summary of value from this banking pool from the last six years:

- Realized Gains $42,208.87

- Average Investment Basis $15,177.11

- Annualized Return 46%

- Dividends Earned $2,627.83

- PUT Options’ Earnings $434.71

- Total Earnings Banking Pool $45,271.41

The following downloadable pdf provides the details of all activity during the last six years:

Banking Pool - Six Years of Results Through 09-30-25 Value Investment Fund

To access the articles, models, spreadsheets, and tutorials related to the banking pool, you must be a member of the Value Investment Club. To join, go to the Membership page on this site (located in the value investing tab in the main menu above).

Below are articles related to the banking pool. Only the excerpts are available to non-members. Full access to the respective article requires a membership status.

Sold Wells Fargo – 34.59% Annualized Return

Bought 400 Shares – Wells Fargo

Sold Comerica Bank Two Hours Later

Bought Comerica Bank

Sold Wells Fargo Position

Sold PUTs on JPMorgan Chase & Co.

Bank of New York Mellon – Monitor Closely

Wells Fargo Bank – One Year Report

Calculating Intrinsic Value for Bank Stocks

Purchased Bank of New York Mellon Corporation