Sold PUTs on JPMorgan Chase & Co.

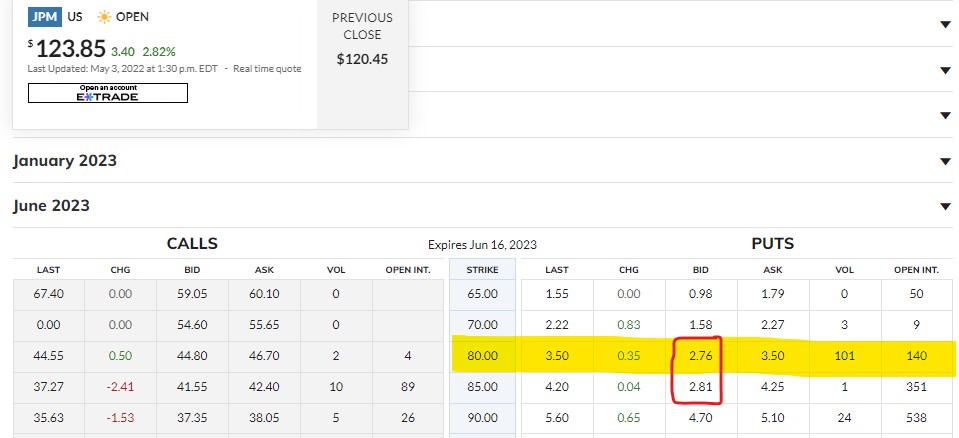

Yesterday, May 3rd, 2022, the Value Investment Fund sold 246.9135 PUTs on JPMorgan Chase & Co. with a strike price of $80 per share. These PUTs expire on June 16, 2023 (13 months). The Fund sold the PUTs for $2.76 each and netted $1.76 each after fees. Total realized income was $434.57 (246.9135 * $1.76/ea).

PUTs are options that act as insurance for the buyer. In effect, the buyer is buying the right to force the seller, in this case the Fund, to purchase the buyer’s shares at a preset price. The goal is to minimize the buyer’s downside risk associated with owning the respective stock. In this case, the Fund has determined that JPMorgan Chase & Co.’s intrinsic value is at or around $105 per share with a book value of $98 per share and a buy price of $95 per share. Thus, the opportunity to purchase the shares at a much lower price by selling a financial instrument that pays the Fund money is irresistible.

Here were the options trading points when the sale was made:

Take note of something fascinating. For an additional $5 of protection against further downside risk, the Fund gave up a mere five cents per option.

The key for value investors and PUTs is to sell PUTs at a discount in trading price as deep as you can tolerate and still make good cash. Here, you are paid to provide this instrument. The Fund nets $434.57 and now has some risk exposure, but what kind of risk exposure?

JPMorgan Chase & Co. – Risk Exposure at $80 per Share

Value investors utilize intrinsic value as the primary point of financial security. In essence, intrinsic value represents a fair and impartial point of value for a respective security. It is determined through an extensive set of analyses. For JPMorgan Chase & Co., intrinsic value was calculated at $105 per share. This financial institution averages slightly more than $10 per share in earnings with a five-year look back. With banks, there is greater emphasis placed on risk reduction when determining intrinsic value. Thus, intrinsic value outcomes with banks are generally more conservative than with other industries. Thus, the $105 per share intrinsic value point is relatively very conservative, especially with JPMorgan Chase & Co. as the standard bearer in this industry pool.

Once intrinsic value is set, a buy point is determined using intrinsic value as the ceiling. With the banking industry, eight to twelve percent discounts are appropriate, depending on the institution’s relative position to others. In this case, JPMorgan Chase & Co. is a standard bearer within this pool of possible investments. However, JPMorgan does have a few historical issues to resolve; thus, this discount rate to intrinsic value is set at 9% making the buy point $95 per share.

Value investors would sweep up shares if the market price for JPMorgan Chase & Co. ever dips to this point. With the PUTs sold, the market price would have to go another 16% lower to force a value investor to buy stock they were already wanting to own. It is a situation that is very appealing.

The risk exposure at $95 per share is already well within the maximum allowed by value investors. At $80 per share, risk exposure is further reduced; thus, risk exposure is practically non-existent at $80 per share. The last time JPMorgan’s share price was at $80 per share was in the last quarter of 2016.

If the buyer forces the Fund to honor the PUTs, the Fund would own 246.9135 shares with a cost basis of $81 per share (includes transaction fees) for a total investment of $20,000. An opportunity like this is rare, and the Fund is taking advantage of this unique situation. Act on Knowledge.