Wells Fargo Bank – One Year Report

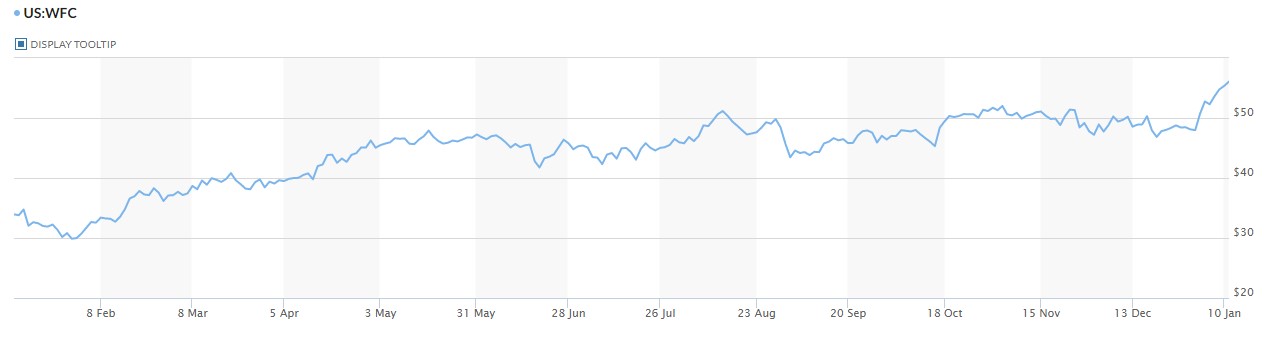

Wells Fargo Bank Share Price January 12, 2021, Through January 11, 2022

One year ago, on January 12, 2021, the Value Investment Fund purchased its first tranche of Wells Fargo Bank. At that time, shares were purchased for $33.24. In addition, financial analysis stated that the price per share would recover to about $53 per share within a year, assuming the Federal Reserve would lift its growth penalty. Today, the stock surpassed $56 per share. The facilitator for the Value Investment Fund has twice raised the sale price. The first time was back about six months ago, when it was increased to $58 per share. Most recently, it was again raised to $63 per share.

There are several positive forces that will see the price per share hit $63 prior to mid-year 2022. One, Wells Fargo Bank is expected to report an outstanding 4th quarter for 2021, not only with good revenues, but outstanding profits too. Secondly, in March of this year, the Federal Reserve will raise the interest rates, which will push the revenues for all banks higher. The net interest earned for Wells Fargo will see a significant bump in earnings. These two reasons alone will push the stock price ever higher. Finally, if the Federal Reserve does remove the growth penalty before year end of 2022, this will solidify the bank’s ability to soar. The facilitator can foresee as much as a $5 per share increase in price just for this penalty release. It stands to reason that Wells Fargo will be able to increase its loan portfolio by another $300 billion or more over the course of three years. This by itself will generate a net interest increase of at least $5 billion per year to as much as $11 billion per year, adding at least $2.8 billion to the bottom line per year after associated costs. This additional profit will add about $14 billion of market value to the shares, which equates to $3.33 per share. Thus, the release is worth at least $3.30 per share in additional market value.

If the market holds to greed, on the day the Federal Reserve may announce the release, Wells Fargo’s market price could jump as much as $7 per share. It is possible that if all three reasons occur before June 30, 2022, the market price per share could hit $75.

Continuing to hold this security is in the best interest of the Fund at this point. There are two good reasons to hold this stock:

- The Fund is already heavy in cash with no alternatives available to buy other stocks at low prices; AND

- Continued market share price growth is expected for at least another six months.

Even if this stock drops in price due to economic-wide decreases or some industry-related matter, once that Federal Reserve penalty is lifted, the stock price will recover to the current price level of $55/share.

If the stock were sold today, total gains and dividends received will result in an annualized return of more than 52%.

Last year, this site calculated intrinsic value for Wells Fargo at around $38 per share. Over the last year, the intrinsic value has increased to around $44 per share, with a buy price set at $39 per share. The updated market recovery sales price is now $63 per share. If the Federal Reserve lifts its penalty before June 30, 2022, the market recovery price will be adjusted to $68 per share.

Value investing works. It is a systematic process of buying securities at low prices and, via financial analysis, waiting for the market price recovery and then selling the stock at that point to reap rewards. Act On Knowledge.