Churning (Lesson 18)

Fast is fine, but accuracy is everything – Wyatt Earp.

Churning refers to agitating. It is commonly used with the dairy industry to refer to the process of turning liquid cream into butter. The churning process breaks down the fat membranes, allowing the fats to join together. In effect, churning means to work the liquid into a solid. With investing, churning has two different connotations. The first is the more common negative connection to brokers getting their clients to buy and sell frequently to increase overall commissions for the brokerage. The positive connotation is rarely used, and it refers to working one’s portfolio of investments to maximize overall return. That is what this lesson is about. How does a value investor work their portfolio to maximize overall portfolio return?

The ideal method to maximize return is buying low and selling high at the right time with investments that have quick recovery time frames. Ideally, all the cash proceeds from a sale should be immediately reinvested into new opportunities. Often, this is not the case. When the respective markets, such as the DOW, S&P 500, or the S&P Composite 1500, experience highs, it is difficult to find good quality investments at low prices. This is further hampered when a value investment fund has limited options. In order to provide ample opportunities for reinvestment of cash, value investment funds require at least five pools of industries and a minimum of 40 stocks. The ideal fund will have around eight pools of potential investments with no fewer than 60 potential securities.

The current Value Investment Fund on this site has the following pools and respective stock selections within each pool:

. Real Estate Investment Trusts Insurance

Railways (Residential Rentals) Banks Fast Food Non-Health Care Military Contractors

Union Pacific, Essex Property Trust Comerica Bank McDonald’s Travelers Huntington Ingalls Industries

CSX UDR (United Dominion Realty) Bank of America Restaurant Brands AllState Lockheed Martin Corp.

Canadian National Equity Residential Wells Fargo Starbucks Progressive Raytheon Technologies

Canadian Pacific AvalonBay Communities JP Morgan Chase Jack In The Box Cincinnati Insurance Northrop Grumman

Kansas City Southern Mid-America Apartment Communities Fifth Third Bank YUM Brands Old Republic General Dynamics

Norfolk Southern Corporation American Homes 4Rent CI A Bank of New York Wendy’s L3Harris Technologies

. Dominos Pizza

. Shake Shake

This particular investment fund has six pools with 37 different stock selections. Even with this many selections, the Fund still has times where it holds large amounts of cash for extended periods because all of the respective opportunities are priced in excess of intrinsic value. The key is to have a large enough selection so that at any given time, one or more of the opportunities have a market price below intrinsic value, allowing an investor to reinvest cash earned from the sale of securities. In effect, the cash is always invested and working to improve the overall fund’s return.

There are two key requirements to successfully churn an investment fund. The first is selection; i.e., ensure a diverse portfolio of opportunities such that at any given moment there are always opportunities to buy. Secondly, understanding how timing impacts returns on investment. When an investor understands how these two requirements interact with each other, an investor can take advantage of this knowledge and successfully manage and churn a good return (remember, a good return means annual returns above 30%).

As always, a reminder is required here. Value investing is not about getting rich quickly; it is about creating a methodical buy/sell program that generates good returns year after year with very little, if any, risk associated with the capital invested.

Pools of Potential Investments – Selection

A common risk reduction tool in securities management is diversification. Here, the professionals discuss specific types of risk associated with actually owning the respective securities. The goal is to reduce volatility and correlation risks such that no single investment will expose the owner to a significant loss. The results are interesting, with at least 18 different security positions. A portfolio manager reduces this risk by 90%. Having 30 different positions improves risk reduction to 99%.

However, with value investing, the goal isn’t volatility. After all, value investors are buying the respective security at less than its intrinsic value; therefore, the chance that the particular investment will go lower and stay low for an extended period of time has already been practically eliminated. The risk value investors are seeking to eliminate is that with a portfolio of securities to choose from, all the respective opportunities are above their intrinsic value. In effect, there are no opportunities to buy low. Value investors need one or more of these potential opportunities to drop below intrinsic value and acquire some margin of safety, such that a purchase can be made to utilize excess cash. Thus, how many stocks must exist within the selection pool such that there will always be opportunities to buy, and therefore the portfolio rarely has cash, which earns a pittance return in comparison to capital gains.

Simply stated, how many different securities must exist in the overall portfolio such that there is ALWAYS an opportunity to buy low? Thus, when a sale of an investment is made, the cash proceeds are immediately reinvested in a new opportunity.

Furthermore, the ideal situation provides more than just one or two opportunities to buy. Value investors want to see several potential investments below intrinsic value, such that one or more of the securities provide a greater margin of safety when purchased. Then the value investor reinvests in the security with the greatest potential to recover quickly and earn an outstanding return on the investment. The result is constant agitation of the portfolio to maximize overall return for the portfolio.

So, how many potential investments must exist to always have continuous opportunities to buy? Remember, value investors are only interested in the top 2000 publicly traded companies, and all of them must have good histories of operations and earnings. With top corporate operations, the market rarely allows the securities’ price to drop below intrinsic value. Thus, these attributes make it difficult to find opportunities to buy low.

If a value investor could have two thousand-plus opportunities, it would be ideal. This would indeed provide continuous opportunities to buy low, such that the cash will always be at work. However, it is unrealistic. It takes about 20 to 30 hours of work during the initial phase to learn about an industry and then another eight to 10 hours to analyze each potential member within that pool. Once the initial work is completed, it takes about four to eight hours per year to maintain the analysis for a pool of five to eight members. In effect, it requires about five hours on average per year for each potential investment to conduct initial analysis and then maintain that analysis. If a value investor has a pool of 50 possible individual securities, then on an annual basis, this investor would need to spend around 250 hours of work to maintain the analysis necessary for intrinsic value, margin of safety, and, of course, market recovery price.

To make matters worse, 50 possible individual securities would mean about seven to nine pools of investments (six to ten potential stocks in each pool). Learning about and understanding seven to nine industries will add another 200 hours of work per year.

The result is that it is ideal to have several hundred potential investments with their respective value points (intrinsic, buy, and sell); but, it is unrealistic to think that any single individual can realistically expend the resources necessary to develop and maintain such a diverse portfolio of pools of industries, and of course, each pool’s members.

What is the minimum required?

Based on experience and some supporting input from Graham and Dodd (Security Analysis), a value investor needs at least 60 potential investments spread over no less than eight pools of industries. The only possible way to have such a diverse portfolio is if the value investor participates in a club whereby each member establishes and monitors a single industry and provides the information to fellow club members. This, in turn, allows all members access to a diverse portfolio of pools of industries and a broad base of potential investments.

Churning with value investing is the ability to maximize returns to the maximum extent possible. This requires a large pool of potential investments. Not only is a wide selection pool required, but the investor must select those available investments that have faster recovery time frames over those with longer recovery periods.

Churning – Timing of Investments

Churning refers to the continuous utilization of cash into investments with the best recovery cycle, such that the entire investment portfolio is growing at the fastest rate possible. In order for this to be possible, a value investor must be able to time the purchase at a low point below intrinsic value. In addition, preference must be given to those investments with faster recovery time frames over investments with slower or extended recovery periods. Thus, timing involves buying at a low price and giving preference to those potential investments with faster recovery cycles. Each of these two attributes is explained further.

Buying Low

Value investing uses the term ‘Margin of Safety’ to refer to buying the security at a good price. Margin of safety is typically a percentage of value below intrinsic value. Of course, intrinsic value is the securities’ real value, i.e., the maximum value which a reasonable investor would pay to own the respective rights the security provides. In effect, intrinsic value is a ‘Fair Value’ for the investment. When a value investor purchases this investment for less than its intrinsic value, it affords additional risk protection that the particular investment’s market price will go lower and/or stay below this price for an extended period of time. Think of the margin of safety as an insurance policy.

Margins of safety are calculated depending on several attributes. Companies with strong current asset-weighted balance sheets have a lower margin of safety because of the liquidity afforded by current assets over fixed assets. Liquidity refers to the ability to unwind the business in a reasonable time frame. Whereas fixed asset-intensive operations require deeper margins of safety due to the market’s understanding of fixed assets and the unease of turning a fixed asset into cash. In effect, it takes much longer to liquidate fixed assets than current assets, which in turn requires a greater margin of safety when buying fixed asset-intensive companies.

There are other contributing factors affecting the margin of safety, including:

- The Respective Industry

- The Industry’s Financial Model

- Economic Factors (Inflation, Interest Rates, Unemployment, GDP, Growth, etc.)

- Federal Compliance and/or Restrictions

With this site’s Value Investing Fund, the following pools have these respective margins of safety ranges:

. Pool Balance Sheet Margins of Safety Range

Railways Fixed Asset Intensive 9% to 19%

Fast-Food Mixed 5% to 35%

Banking Current Asset Intensive 4% to 14%

P&C Insurance Current Asset Intensive 3% to 8%

REITs Fixed Asset Intensive 8% to 18%

Military Contractors Fixed/Intangible Intensive 5% to 12%

Overall, current asset-intensive pools start with lower margins of safety and tend to top out with a margin of safety that will rarely exceed 15% of intrinsic value. Whereas, fixed asset-intensive models start higher and top out at more extremes than intrinsic value. This reflects the risk associated with the liquidation of assets. The greater the risk of liquidation in a shorter window of time, the more important it is to reduce this risk by increasing the margin of safety.

Thus, when buying low, the value investor should wait until the margin of safety price is reached by the market prior to purchasing the security. As an example, Union Pacific’s intrinsic value is currently $197; the Railways Pool has determined that an appropriate margin of safety for Union Pacific is 9% or about $18 against intrinsic value. Therefore, Union Pacific’s current buy price is $179 per share. The risk that the price will drop lower than $179 exists, but as the price continues to drop, other forces kick in to minimize its continued downward spiral. For example, the dividend yield at $165 per share is 2.85% which is extremely strong. At $150 per share, the dividend yield increases to a rarely found 3.15%. Furthermore, the deep sell-off of Union Pacific during mid-February to late March 2020, driven by the COVID pandemic, identified a maximum market price reduction for this company of around 37% against its prior peak market price. Again, this sudden price drop was against the current market price, which had just recently reached the highest ever recorded for Union Pacific just before this drop. Thus, buying Union Pacific at a 9% discount against an intrinsic value that is commonly much lower than the market value provides adequate protection against a market price that will continue to drop dramatically lower than this preset buy price and acts as a very defensive position that this deep discount price will stay low for an extended period.

The idea of buying at such a low price is one of the four principles of value investing. Buying low is the best risk-reduction tool available to any investor. In addition, buying low generates greater returns once the security is finally sold. Creating great disparity between the buy price and the sale price begins with buying low. The lower the buy price against intrinsic value, the greater the absolute return on the investment once it is sold.

One last note related to buying the security below its intrinsic value. With a typical portfolio of 60 to 80 potential investments, only about two to three investments will be at these low prices. Remember who we are talking about here. These are the top 2,000 companies with a very stable history of earnings and performance. There may be other driving forces that may have more than three out of 80 potential investments, whereby the current market price is dramatically lower than their respective intrinsic values. These include economic recessions/depressions, industry-wide issues (new federal compliance requirements, resource availability, consumer attitude towards the industry’s product/service, and/or competition). But the more common scenario is only two to three out of 80 potential investments. Thus, which one does the investor choose to buy low?

Recovery Time Frames

The second attribute of timing related to churning of one’s portfolio of investments is the recovery period. This is the common time frame for a company to have its securities’ market price recover to a prior peak price. The shorter the time recovery period, the greater the annual return on the investment. This is key for any churning function of any portfolio. Ideal recovery time frames are three to six months. Some investments will have longer recovery time frames, in some cases up to three years.

Thus, preference is given to those potential investments with shorter recovery time frames, allowing the investor to sell upon recovery and begin the churning process all over again with this new inflow of cash into the portfolio.

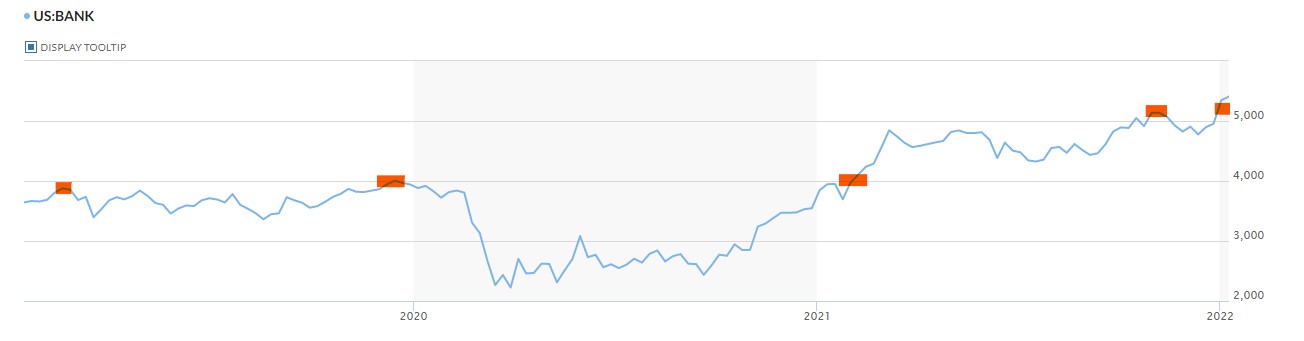

As an example, here is the Banking Index over a three-period. Notice the period from one peak to the next. Once the stock is purchased at some point within that cycle at a deep discount to intrinsic value, the recovery time frame is anywhere from two months to nine months. As an example, if an investor bought banking during March of 2020, they would have to wait until early February of 2021 to sell their investment and reap their reward. This was eleven months, which is slightly longer than the expected nine months maximum. It doesn’t change the absolute dollars earned; it only changes the annual return on the investment due to the longer time frame to complete the recovery cycle.

Other industries take much longer to recover. Look at military contractors:

With military contractors, recovery time frames are much longer; short time frames are about one year, and extended time frames are just longer than two years.

As a value investor, each investment will have its recovery time frame. Give preference when buying to the investment that has shorter recovery periods over those with longer recovery time frames.

In the sophistication phase of this program, the value investor learns about how to calculate the various inclines found with a security’s market price. Those investments with steeper price declines and recovery periods are given greater preference over those with shallow inclines.

The reality for the attribute of recovery is that, as a value investor, you will rarely have to address this as a part of your decision model. Odds are that you will only have one potential investment in your portfolio of investments to invest excess cash. Without a large portfolio of at least 60 or more potential investments, most likely you will not have anything available when you have excess cash to churn. If your portfolio of potential investments is less than 30, it is very likely you will have to sit on cash for extended periods of time while waiting on the market or a particular industry to falter, providing the value investor with an opportunity to buy low. Remember, value investing’s fourth principle, patience.

Summary – Churning

With value investing, churning refers to maximizing the use of cash in the portfolio. To properly churn the investment portfolio, the value investor must always have one or two investments waiting for the cash investment. In order to do this, the portfolio of potential investments must be vast and diverse. A typical portfolio of 60 or more potential investments will customarily provide two to three opportunities to buy low. If this exists, the value investor will always prefer the investment with the shorter recovery period for market price recovery. The key is to maximize the overall return of the portfolio by having as much cash invested as possible and optimizing the portfolio by selecting securities with faster recovery time frames. Remember the primary tenet of business: buy low, sell high. Act on Knowledge.