Sold PUTS on Huntington Ingalls Industries

Today, 01/07/22, the Value Investment Fund sold an options contract (PUTS) for 116.9591 shares of Huntington Ingalls Industries at $5.90 per share, netting $4.90 per share. The strike price is $170 per share, which is 4% lower than the buy price as set for this particular member of the Military Contractors Pool. The intrinsic value of Huntington Ingalls Industries is currently calculated at $185 per share. The current market price today, January 7, 2022, is $192 per share.

As with all tranches purchased by the Value Investment Club, this particular contract exposes the Fund to a potential outlay of $20,000. The Fund currently carries over $97,000 in cash and has two existing $20,000 potential commitments for two other option contracts (PUTS on Union Pacific and Norfolk Southern Railway). One of those contracts expires on January 21, 2022.

For those of you who are members, PUTS are explained in more detail in Phase Three of the lesson sets on this site.

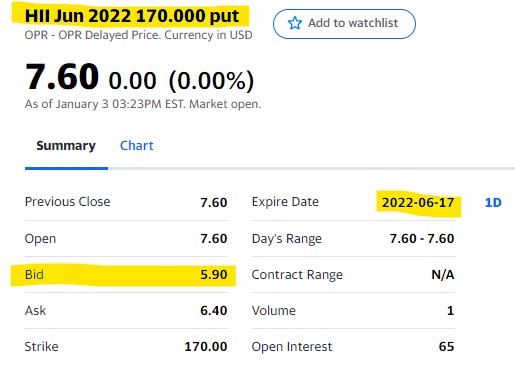

As evidence of the financial requirements of this transaction, here is a visual depiction of the option:

Bids are $5.90 per share for a June 17, 2022, expiration date. Thus, with a transaction fee of $1 per share (Club’s standard transaction fee for all activity), the Club nets $4.90 per share on 116.9591 shares or $573.10.

The financial obligation, if required (market price drops to $169.99 per share), is to pay $170 plus $1 per share for the transaction fee or $20,000 total ($20,000/$171 each = 116.9591 shares).

For those of you reading this post, please review the following articles to fully understand why the sale of this options contract is so lucrative for the Club. The Club WANTS to own this stock at any price less than $176 per share.

Huntington Ingalls Industries – Market, Intrinsic, and Value Investing Prices

Purchased Huntington Ingalls Industries

One last important note of interest. Assume this contract is enforced by the buyer. At the point of purchase by the Club, the actual net investment into the shares is $171 less the net earned of $4.90 or $166.10 per share. In effect, the Club would own this stock at a 10% discount against Huntington Ingalls Industries’ intrinsic value price of $185. The margin of safety is $18.90 per share. Again, owning this stock at such a low price will reap long-term value for the Investment Fund. Act on Knowledge.