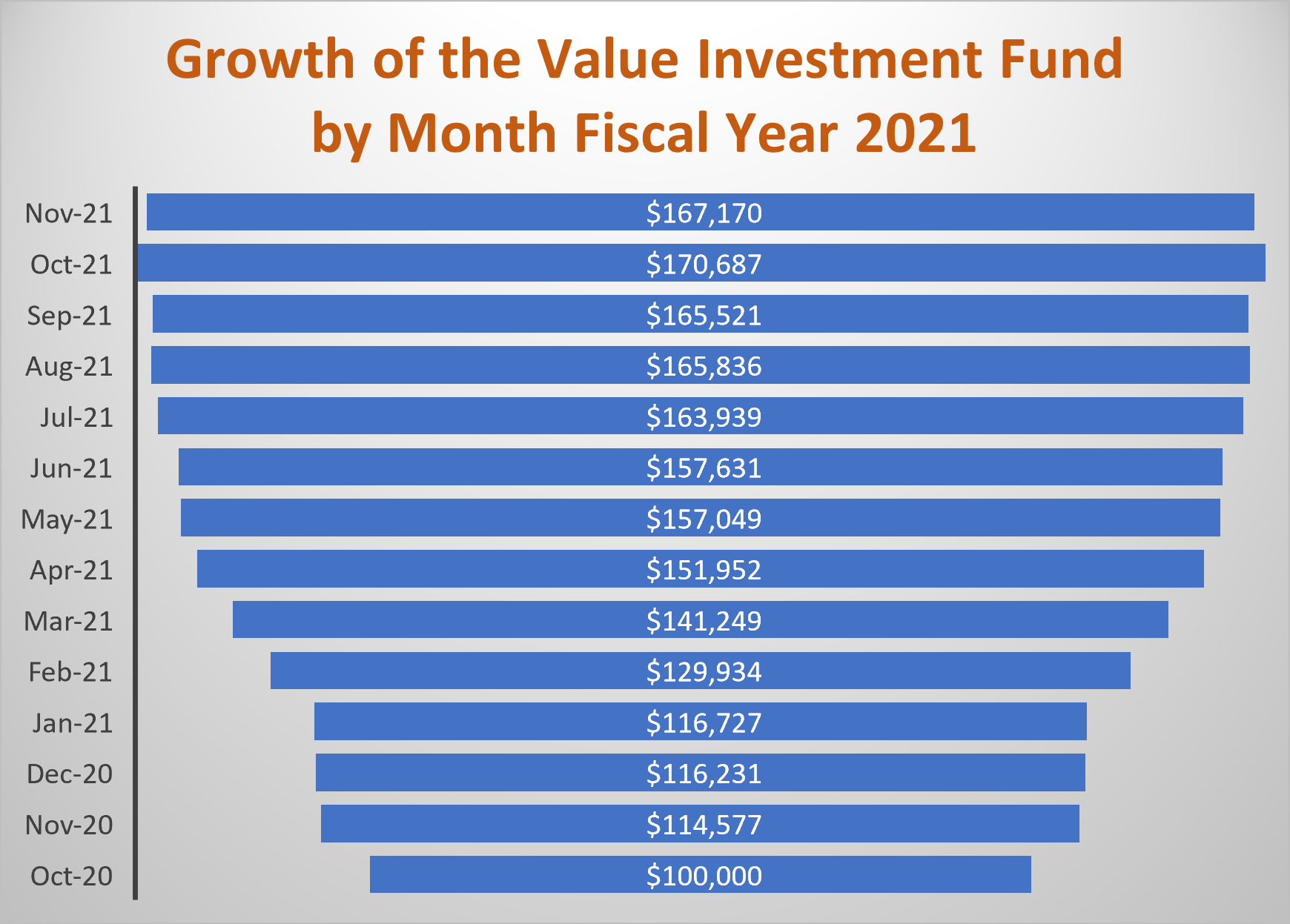

Value Investment Fund – Status on November 30, 2021

“Legend-class National Security Cutters (NSC) are the flagships of the U.S. Coast Guard. They are the largest and most technologically advanced ships in the Coast Guard’s fleet, with capabilities for maritime homeland security, law enforcement, and national security missions” – Huntington Ingalls Industries.

During November, the Value Investment Fund continued to hold Wells Fargo as an investment from the Banking Pool. As stated in other articles related to Wells Fargo, this is a long-term investment tied to the removal of the Federal Reserve penalty, now going into its fourth year. This penalty is designed to prevent Wells Fargo from growing beyond its current $1.9 trillion of assets. In the interim, Wells Fargo has improved the quality of its balance sheet by enhancing its percentage of non-interest-bearing deposits and the quality of loans. The Fund updated the sale price for this security from $58 to $63 per share. Initially, it was hoped that the Federal Reserve restriction would be lifted by year-end 2021, but that is looking unrealistic now. If the restriction is lifted by the end of June 2022, the stock should reach the target goal of $63 per share, thus generating an estimated $27,292 return on a $40,000 investment basis over a course of approximately 18 months. This equates to an annual return of about 43%.

As stated in October’s report, the Value Investment Fund created the Military Contractors Pool of potential investments and researched several opportunities. One of those opportunities is Huntington Ingalls Industries. On November 30, 2021, the Fund proceeded to purchase 112 shares of Huntington Ingalls due to the market price hitting the required margin of safety requirements related to intrinsic value. Please read Huntington Ingalls Industries – Market, Intrinsic and Value Investing Prices for more information about this particular company. From this article, even if this investment takes two years to recover to the market recovery price of $251, it will still generate in excess of 23% annual returns.

Again, Value Investing is about earning good returns, year after year. It is not a get-rich-quick scheme; it is a thoughtful well well-laid-out plan to improve one’s wealth over time.

Here is the Value Investment Fund’s status report for the end of November 2021.

Value Investment Fund – End of Month Report

. November 30, 2021 October 31, 2021 November 30, 2021

REIT Pool # of Shares Cost Basis Market Price* Fair Market Value* Fair Market Value*

– No Stock Holdings (All six REITs are at or near their all-time highs)

Railways Pool

– No Stock Holdings (All six railroads are at or near their all-time highs)

Insurance Pool

. – No Stock Holdings (All five insurance companies are at or near their all-time highs)

Military Contractors Pool

. – Huntington Ingalls Industries 112.9943 20,000 176.51 Not Held $19,944.62

Banking Pool

. – Wells Fargo (Tranche #1) 292.0560 10,000 46.78 $14,652.45 $13,662.38

. – Wells Fargo (Tranche #2) 558.9715 20,000 46.78 28,043.60 26,148.69

. – Wells Fargo (Tranche #3) 234.3292 10,000 46.78 11,756.30 10,961.92

. Sub-Totals 40,000 54,452.35 50,772.99

Dividend Receivables -0- 217.07

Cash on Hand (Basis, Gains, Dividends, PUTS) 116,235.10 96,235.10

Totals (Starting Cost Basis = $100,000) $60,000 $170,687.45 $167,169.78

*Net of transaction fees of $1.00 per share; thus, the amount in the schedule equals the actual market price per share at closing, less $1.00 per share.

Value Investment Fund – Activity

During November, there were two transactions:

1) Wells Fargo issued dividends worth $217.07;

2) Purchased 112.9943 shares of Huntington Ingalls at $177/share, including transaction fees of $1/share for a total investment of $20,000.

During 2021, the fund realized earnings as follows:

Gains

Gain on sale of Union Pacific Railroad 4,620.06

Gain on sale of Comerica Bank 3,677.40

Gain on sale of Essex Property Trust (06/18/21) 7,863.67

Gain on Sale of Equity Residential (07/15/21) 17,105.64

Gain on Sale of UDR (07/12/21) 10,956.00

Gain on Sale of Bank of New York Mellon (08/12/21) 2,578.61

Sub-Total Gains $46,801.38

Dividends

Equity Residential (March/June) 692.80

Essex Property Trust (March) 192.83

UDR (Jan/April/July) 658.87

Bank of New York Mellon (Jan/May/July) 223.62

Wells Fargo (Feb/May/August/Nov) 604.34

Sub-Total Dividends $2,372.46

Sale of PUTs

Expired PUTs (See Prior EOM Reports for List) 756.94

Union Pacific (Feb @$155/Sh) Expires January 20, 2023 1,769.23 – Market price is currently at $235.64.

Norfolk Southern (March @$190/Sh) Expires January 21, 2022 335.07 – Market price is currently at $265.27.

Sub-Total PUTS $2,861.24

Total Realized Earnings $52,035.08

Total dividends earned in 2021 to date equal $2,372.46, an effective yield of 2.04% on a $116,231 basis as of 01/01/2021. The Fund carries a strong cash position due to the fact that all 36 potential investments within the six pools of investments are currently trading at or near their all-time highs. The only exceptions to this are a few of the companies within the Military Contractors Pool. Even these are now trading well above their intrinsic value. Thus, so far in the fourth quarter, the Fund is unable to keep up or surpass the growth rates of the DOW, S&P Indices, and others. Continued patience is warranted while the Club waits for the market to experience some downward pressure. In the meantime, the current two investments were purchased well below their intrinsic values, and it is a matter of time before they recover to their prior economic highs. Act on Knowledge.