Sold Comerica Bank Two Hours Later

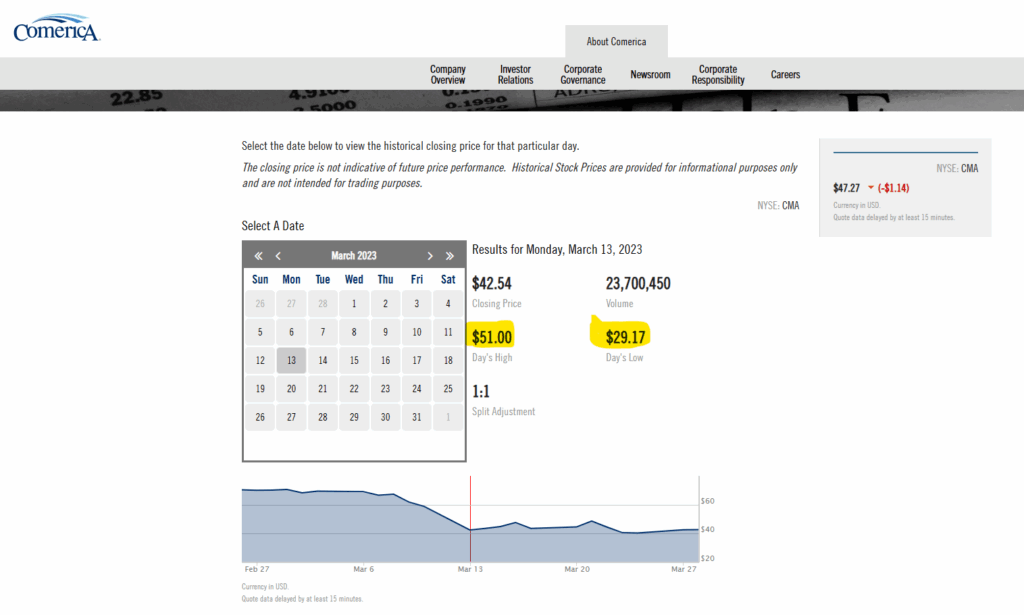

One of the advantages of value investing utilizing pools of similar stocks from a single industry is that, now and then, like once a decade, a unique opportunity will present itself to take advantage of the knowledge and hard financial analysis work one does. In this case, it happened today. Comerica Bank experienced a roller coaster price drop and recovery in one day. Its intrinsic value was calculated to be greater than $40 per share, and the price dropped this morning to just below $30 per share.

The Fund did not have a buy order for this particular security, but around 10:30, the Fund Facilitator looked online at the banking pool of securities and noticed a dramatic downward price drop with Comerica. Prior experience with this company and keeping track of its financial status created an opportunity. It was decided at that moment that $30 was the trigger point; if the stock fell below this price, a buy would occur. Because the stock is worth at least $50 per share, it would most likely recover pretty quickly. The Facilitator’s thinking was two to three months. It happened in less than two hours!

At 11:43 AM, the price recovered to $50 (hit $50.85 at 11:47 AM), and the sale of this security was triggered. Here are the results of today’s activity.

Purchase Costs:

Market Purchase Price 1,200 shares at $29.99 each $35,988

Cost of transaction at $1.00 each 1,200

Cost to utilize Margin Account 1,200

Total Purchase Price $38,388

Net Sales Price:

Market Sale’s Price @$50/each $60,000

Less: Costs to Trade @$1/each (1,200)

Net Return $58,800

Gain on Sale of Comerica Bank $20,412

Return on the investment: 53%

Annualized Return: immeasurable due to the time involved.

Act on Knowledge.