The Walt Disney Company – Sold PUTs

“It’s always fun to do the impossible” – Walt Disney.

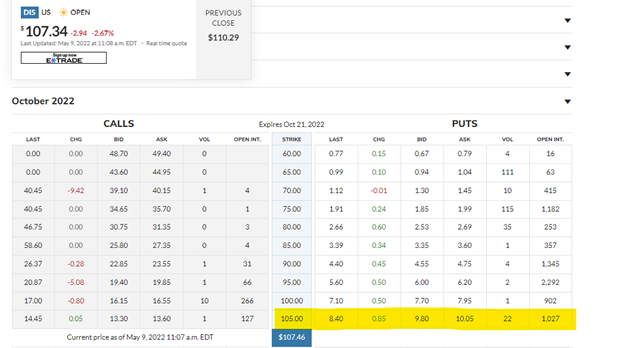

Today, May 9, 2022, the Value Investment Fund sold 200 PUTs of The Walt Disney Company. Market price at 11:06 AM was $107.34. The Fund has set the intrinsic value at $116 per share with a ‘Buy’ point of $110, a 5% discount from the intrinsic value. On Friday the 6th, the Fund bought 180 shares at $110 each for a total investment of $20,000, including transaction fees. The current options trading matrix is below. For a buy price of $105, current PUTs are selling at $9.80 each. Thus, the Fund will net $8.80 per PUT contract. This totals $1,760 in realized earnings for a strike price of $105 through October 21, 2022 (5 1/2 months).

Since the Fund wants to own this company at $110 per share but doesn’t want to risk a significant exposure, an alternative is to sell put options. A PUT is an insurance arrangement for the buyer. A typical buyer owns The Walt Disney Company and wants to ensure that their worst-case scenario is selling the stock at $105, no matter how low the price dips. Thus, the buyer will pay money for insurance, requiring the seller (in this case, the Value Investment Fund) to purchase the stock at this price.

If this PUT is exercised, the Fund must pay $105 per share plus a $1 transaction fee per share for 200 shares. This means the Fund has a potential investment position costing $21,200. As noted in the year-end report for December 31, 2021, the Fund is allowed to sell PUTs, obligating the Fund for a maximum of $62,603. The Fund currently has exposed positions as follows:

- Union Pacific Railroad – Sold in Feb 2020 with a strike price of $155/share and an expiration date of January 21, 2023 $20,000

- Huntington Ingalls Industries – Sold in Jan 2022 with a strike price of $170/share and an expiration date of June 17, 2022 $20,000

- JPMorgan Chase & Co. – Sold in May 2022 with a strike price of $80.00/share and an expiration date of June 16, 2023 $20,000

- The Walt Disney Company – Sold in May 2022 with a strike price of $105.00/share and an expiration date of October 21, 2022 $21,200

Current market prices (05/09/22) for the respective possible commitments are:

- Union Pacific Railroad – $225.25 Strike Price $155.00

- Huntington Ingalls Industries – $210.08 Strike Price $170.00

- JPMorgan Chase & Co. – $121.77 Strike Price $80.00

- The Walt Disney Company – $106.89 Strike Price $105.00

Total maximum draw on cash is $81,200, which is $18,600 more than the Fund’s protocols allow. Given the five weeks to the expiration of Huntington Ingalls’s position (June 17, 2022, expiration date) and a current remaining cash position of $102,623 before receipt of the $1,760 for the sale of The Walt Disney Company PUTs, the Facilitator is allowing a deviation. In order to reduce exposure and overall risk, the Facilitator agrees not to sell any more positions (PUTs) in the interim.

The interesting math associated with PUTs is that the amount earned acts as an offset for the purchase if activated. In this case, the purchase price is $105 per share. However, the Fund has already received $8.80; thus, the net effective purchase price if enforced would be $96.20.

The interesting math associated with PUTs is that the amount earned acts as an offset for the purchase if activated. In this case, the purchase price is $105 per share. However, the Fund has already received $8.80; thus, the net effective purchase price if enforced would be $96.20.

Owning such a high-quality company at this price is an opportunity. Overall, The Walt Disney Company has a long history of stability and continuous growth. They have a very strong market share of the streaming industry, and given their history of gaining new customers via entertainment packages, the Facilitator can see this company hitting $100 billion per year in revenue within five years.

One last note, after the market closes on Wednesday, the 11th of May, The Walt Disney Company will release its 2nd quarter financial results. There is a very good likelihood that revenues will show a dramatic increase (> 5%) over last year’s same quarter report. This will drive stability, and there is a good chance the market will respond favorably. Even if there are some negative outcomes, given this company’s history, it will be short-lived. Thus, owning additional shares at less than $100 per share could come to fruition, which is an opportunity a value investor will find difficult to ignore. Act on Knowledge.