Intrinsic Value of The Walt Disney Company

A White Paper on How to Determine The Walt Disney Company’s (DIS) Valuation

The intrinsic value of The Walt Disney Company has continuously improved over the last 100 years. Founded in October of 1923, Disney has grown into an entertainment behemoth that today includes ABC, ESPN, 21st Century Fox, Star Wars, Marvel, and its traditional amusement parks. Its revenues have grown steadily since inception, and the company will break the $90 billion threshold at fiscal year-end 2023. To give you an idea, this places Disney in the top 100 companies in the world based solely on revenues (FedEx is at $92 billion).

The Walt Disney Company is a member of the Dow Jones Industrial Index and currently holds the 17th position for market capitalization, just behind Nike and McDonald’s. Its market capitalization at $87/Share is $162 Billion. At $100/share, its market capitalization improves to $183 billion, moving it up one spot. Just a few years ago, Disney was one of the top ten companies based on market capitalization.

There is no doubt, this is a solid company. Therefore, intrinsic value calculation is quite complex. It isn’t a simple formula tied to growth or net profits or even cash flow. Intrinsic value for quality companies like this is a function of multiple methods, and these methods are weighted in order to create a conservative and reliable result. If you use the Benjamin Graham formula of:

Value = Earnings times (a constant of 8.5 plus two times an average expected growth rate over the next seven years).

In mathematical shorthand:

V= Earnings (8.5 + 2g)

Based on average earnings over the last nine years at $3.76 per share (includes COVID) and a growth rate approximating 7% (based on sales). The result is:

$3.76 (8.5 + 2(7%)) = $3.76 *22.5 = $84.60

If adjusted for COVID, earnings are $5/share:

$5.00 * 22.5 = $112.50 per share

Thus, value investors can expect intrinsic value to end up somewhere between $85 and $140 per share, depending on the assumptions used. The key is to be reasonable with one’s assumptions so that the result is conservative and reliable.

The first step in determining intrinsic value is understanding Disney’s business model. Next, reasonable assumptions must be made for the various formulas. Finally, a weighted model must be designed that gives due credit to the one or two best formulas to result in an accurate and reliable intrinsic value.

To start, understand Disney’s business model.

The Walt Disney Company – The Business Model

The best resource to comprehend any company’s business model is to look at the annual report. Typically, companies identify the model early on in their report. Disney states their model starting on Page 2. The all-encompassing statement is that Disney is “… a diversified worldwide entertainment company with two operating segments …”. Those two segments are its Parks/Products and Disney Media/Entertainment Distribution. It is the latter that drives revenues. It is the former that drives profits. Here’s a segmentation profit and loss summary:

The Walt Disney Company

Segmentation Report

2022 (*In Millions)

. Parks/Products Disney Media/Entertainment Totals

Revenues $28,705 $55,040 $83,745

Costs 20,800 50,824 71,624

Segment Operating Income $7,905 $4,216 $12,121

The park’s segment generates 34% of the revenue, yet 65% of the operating income. The key is to get the Media/Entertainment segment’s operating income to match, i.e., improve to 27% like the parks segment. When there, it will add another $8 billion to the bottom line.

This then begs the question: “What is the problem with the media/entertainment segment?”.

The media/entertainment segment is divided into three divisions: 1) Linear Networks (TV Stations), 2) Direct to Consumer (Disney Plus and ESPN Streaming), and 3) Content Sales/Licensing. It is the Direct to Consumer (DTC) division that is the anchor holding the company back from generating outstanding profits. This division generated $19.5 billion in sales in 2022, but lost $4 billion. Had this single division generated a 27% operating income, its profit would have been $5.2 billion; thus, a delta of $9.2 billion with segment operating income will add at least $8 billion to the bottom line.

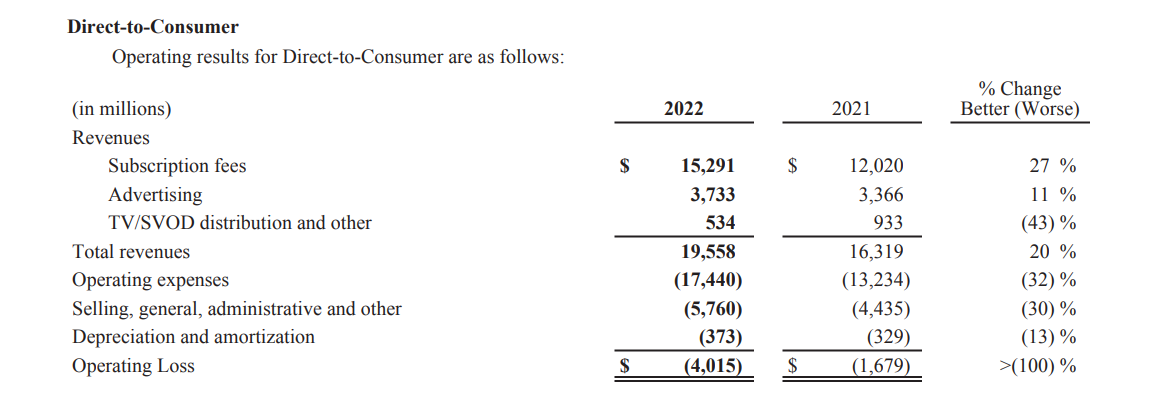

Why is this division having difficulties? Look at this division’s P&L from the last two full years:

Operating expenses increased $4.2 billion over 2021. From the annual report, this is a result of increases in production and programming costs for the DTC division as follows:

- More content on Disney+ + $2.1 billion of the $4.2 billion

- More content on Hulu $900 Million

- Adding NHL to ESPN $330 Million

The difference is a reflection of subscriber fees for programming the respective Live TV services. Since direct-to-consumer services are relatively new, is this division showing improvements year to date in 2023? Here is 2023’s report for one half of the year:

Revenues $10,821 (10.6% increase)

Costs 12,533

Operating Income (Division) $(1,712) (15% improvement year to date over 2022)

It would appear that the worst is behind Disney for this division. This has a positive impact on determining intrinsic value. Overall, the business model for The Walt Disney Company is tied to the two major operating segments. The media/entertainment segment is held back due to the direct-to-consumer division, which is a child of the new technology for streaming. As this division matures and more subscribers are added and subscription rates increase, the financial results will turn around for this division, and it will greatly affect the bottom line and ultimately the intrinsic value.

With an understanding of the business model, the next step requires a value investor to determine some reasonable assumptions for use in the intrinsic value formulas.

The Walt Disney Company – Reasonable Assumptions

Four assumptions must be determined to calculate intrinsic value. The first is the growth rate of Disney. This is the single most impactful assumption a value investor uses in determining intrinsic value. A second and also important assumption is the earnings per share. There are lots of methods or processes used by many sophisticated analysts to determine earnings per share. All of them rely on historical data and commonly average the history of earnings to determine earnings per share. There’s a problem with this in that COVID greatly affected earnings for Disney during the years 2020 and 2021. Thus, averaging earnings means including the negative impacts from COVID, which greatly affect outcomes.

The third assumption is the discount rate. This is the value an investor utilizes to adjust future earnings/cash flow into current dollars. In general, it is the minimum desired return on one’s investment.

The final assumption, and an important one for this company, is the overall sector of entertainment in our economy. Will it continue to grow, or will it plateau, or worse, will it diminish over time? The entertainment sector is highly dependent on discretionary dollars; without discretionary income, consumers opt out of quality entertainment venues and select more frugal entertainment platforms to save money. Since this impacts the other two assumptions, let’s start with the entertainment sector’s growth within our economy.

Entertainment Sector

The gross domestic product (GDP) is divided into 20 sectors. Entertainment is a subpart of the Arts, Entertainment, Recreation, Accommodation, and Food Service sector of the GDP. Overall, this sector is 3.6% of GDP. From the Department of Commerce, the Arts, Entertainment, Recreation, Accommodation, and Food Service Sector (AERAFS) has experienced the following historical relationship with GDP.

Year GDP AERAFS Ratio

2012 $16.25 Trillion $622.7 Billion 3.83%

2013 $16.84 Trillion $652.3 Billion 3.87%

2014 $17.55 Trillion $691.9 Billion 3.94%

2015 $18.21 Trillion $747.7 Billion 4.10%

2016 $18.69 Trillion $790.5 Billion 4.22%

2017 $19.48 Trillion $828.2 Billion 4.25%

2018 $20.53 Trillion $869.6 Billion 4.23%

2019 $21.37 Trillion $914.2 Billion 4.27%

2020 $20.89 Trillion $672.1 Billion 3.2%

2021 $22.99 Trillion $839.6 Billion 3.6%

Disney’s sales in 2021 were $67.4 billion, 8% of the entire AERAFS sector of the economy. If the AERAFS sector returns to the 4% ratio and the economy grows to $25.5 trillion in 2023, Disney’s sales will approximate at least $82 billion. By the end of the 2nd quarter report for 2023, Disney’s sales will approximate $90 billion for the fiscal year 2023 ending September 30, 2023. Thus, Disney’s sales are exceeding the expected outcome tied to the historical values based on GDP and the Arts, Entertainment, Recreation, Accommodation, and Food Service Sector.

The key to the above data is that this sector of the economy is indeed growing and will settle somewhere just over 4% of the entire economy. Therefore, a reasonable assumption for growth tied to the entertainment industry is two to three percent per year into the near future (the next five years). Assuming Disney’s market share will stay the same, this will add around $2 billion per year in sales just from the near-term growth in this sector of the economy.

In addition, not only is the sector growing, but the economy as a whole is too. The economy is growing at around 2.5% per year, and this looks like it will continue for the near future (three to five years). Combined with the economy, it is reasonable to expect Disney’s sales to increase by around $4 billion per year, tied to just the economy and the entertainment sector. This is considered a conservative estimate and is likely to continue for three to four years.

Now we need to determine the reasonable growth of Disney over the near term and the long term.

Disney’s Expected Growth Rate

Typically, companies of this size and tenure grow at slower rates. Often, they grow just slightly greater than the average growth rate as senior management is cautious when exploring new possibilities or risking a misstep. The Walt Disney Company is different. It embraces change as exemplified by the purchase of 21st Century Fox in 2019 and embracing the new world of Direct-to-Consumer (DTC) streaming.

Disney started this DTC division back in 2018 with the acquisition of BAMTech, a streaming technology and content delivery service. In a mere five years, Disney now notes its subscription membership count in its annual reports. Take note of the subscription count:

Unique Subscribers (*In Millions) – Domestic and International Markets Combined

Year ESPN Disney

2019 65 227

2020 53 196

2021 76 238

2022 74 225

Although the subscription count hasn’t improved dramatically, the subscription rate has increased from $5 per month to $8 per month over the last three years. Thus, the growth of revenues for this division is driven by the subscription rate and not necessarily the subscription volume. Based on the data of growth for the DTC division and its dramatic contribution to the overall revenue of The Walt Disney Company, this particular division will continue to grow at least 7% per year for the foreseeable future. However, it is only 22% of the total revenue stream. It is imperative to understand the Parks segment and the balance of the Media Segment. To do this, compare the changes in revenue for the respective segments/divisions over the last three years:

2023 (Estimated) 2022 2021 Estimated Growth

Parks/Products $33.0 Billion $28.7 Billion $16.5 Billion 11%

Media/Entertainment:

. Linear Networks $27.5 Billion $28.3 Billion $28.1 Billion 0%

. Direct-to-Consumer $21.5 Billion $19.5 Billion $16.3 Billion 7%

. Content Sales/Other $9.1 Billion $8.1 Billion $7.3 Billion 7%

Don’t forget, a good portion of this expected growth is tied to economic expansion plus the growth rate for the entertainment sector of the GDP. In the aggregate, including the growth for the economy and the entertainment sector, it is fair and reasonable to expect Disney to grow at around 6% per year for several years. Utilizing the law of diminishing returns, growth rates of 5% are reasonable for years six and beyond.

Growth is not entirely dependent on revenue. Revenue is considered the optimum growth indicator. In reality, profit is the best indicator, as this includes changes in costs per dollar of sales. But, before profit is explained, a value investor must understand the discount rate to apply.

Disney’s Discount Rate

A discount rate is a cost-of-money factor. It is mostly used to determine the current value of a set of future inputs. A simple way to think of a discount rate is to envision it as the cost of money due to inflation. Thus, future receipts of cash are not worth as much as a current receipt is at this moment. Intuitively, we know that $100 today is worth $100; but, a $100 receipt 10 years from now is not worth $100 today. There will be inflation in the interim. Thus, that $100 receipt might only be worth $70 today.

In addition to inflation, there are other factors to consider; most of these other factors play a greater role than traditional inflation and will force the discount rate higher. Other factors include:

- What kind of return does the receiver of money want for their investment? In this case, a shareholder is willing to pay a certain sum to hold a share of stock in The Walt Disney Company. Thus, how much of a return does an equity position owner desire, and what is fair?

- How easy is it to dispose of the investment? The more difficult it is to sell your equity position, the higher the risk, and as such, the discount rate must go up, too. For example, for those who own small businesses, how difficult and time-consuming is it to sell your ownership in a small business in comparison to selling stock with a DOW level equity position? With Disney, there are always willing buyers for this company; therefore, there is very little risk that this will be an issue seven or ten years from now.

- What is the risk tied to the industry this company operates within? Remember, from above, Disney is in the entertainment industry. This industry is highly dependent on discretionary dollars and a prosperous economy. With Disney, the discount rate tied to this risk component is marginally greater than industries tied to consumer needs, think of housing or utilities. For those of you who have completed economic courses, entertainment is elastic, whereas consumer needs (housing/transportation/food) are inelastic.

- Size factor also affects the discount rate. The larger the organization and the more geographically spread out, the lower the overall risk associated with this element of computing the discount rate. In effect, economy of scale has a dramatic impact on risk reduction. For Disney, growing larger doesn’t necessarily reduce risk via economies of scale; the fact that they diversify into other areas of entertainment is what helps to reduce this risk.

There is a five-part formula for setting discount rates for every entity. The following walks the investor through the five steps applied to The Walt Disney Company.

Step I – Perfectly Safe Investment Yield

Use the core government bond yield to acknowledge the discount for a perfectly safe investment. This should match the closest time frame related to the time frame for the discount application for the respective investment. In this step, a long-term yield is desired. The current 30-year no-risk yield is 3.7%.

Step II – Additional Yield for a Pure Equity Position

The next layer of discount reflects what a reasonable individual would desire for a pure dividend yield for their investment. A respectable amount is around 2.75%. Anything less than 2.4% is unreasonable for high-quality investments, and anything greater than 2.9% is unusual, although sought after. Unlike other DOW companies, Disney is NOT currently paying dividends due to the impact of COVID-19 on the balance sheet.

Step III – Risk Factor to Dispose

In the overall scheme of security investments, stocks are typically the most risky group. Thus, a risk premium is applicable. The more market capitalization involved, the less of a risk factor exists. The Walt Disney Company is a DOW Jones Industrial Average stock, and as such, DOW members are considered the least risky of all stock securities. Here, only a .25% additional discount is necessary to adjust for this position within the market.

Step IV – Industry Risk Factor

The entertainment industry has had an interesting history related to its risk element. COVID brought out the industry risk factor. The government will likely shut down travel in the future during other similar worldwide epidemics. Thus, the risk factor here is much higher than the disposal risk. However, Disney has taken steps to mitigate this with their streaming service. But a shutdown will create a dramatic drag on future profits from the Parks/Products segment. Thus, for Disney, this risk factor is much higher than for other DOW companies and is set at 1.75%.

Step V – Economy of Scale

Disney is utilizing diversification as an alternative to economies of scale. This diversification in the entertainment industry includes the Direct-to-Consumer division and sports (ESPN). Exercising these divisions of the media segment has helped to squelch the risk. However, streaming still has a long way to go to finally become profitable. Although diversified and as the largest entertainment enterprise out there, caution is still required. Therefore, the factor for this element of setting the discount rate is 1.25%.

Combined Discount Rate

To sum up the discount rate, add all the respective values together:

- Step I – Perfectly Safe Investment 3.7%

- Step II – Desired Dividend Yield 2.75%

- Step III – Disposal Risk .25%

- Step IV – Industry Risk 1.75%

- Step V – Economy of Scale 1.25%

Cumulative Discount Risk Factor 9.70%

There are some general guidelines related to the overall setting of discount rates for investing purposes. First, expect the range to be as low as 8% to as high as 13% for value investment-related securities. Securities that are in the penny stock to small cap range will have discount rates much higher than 13%. At the other end of the spectrum are the DOW Jones Industrial Companies. They will range from 8% to as high as 11% depending on their management team, production performance, and their overall stability. Remember, the more stable and well-managed a company, the lower the discount rate. Top-end operations such as McDonald’s, Coca-Cola, Apple, and Verizon will have discount rates between 8% and 9.5% (this adjusts up or down due to the 30-year bond yield for government bonds). The reasons Disney didn’t hit the lowest (best) mark of 8% are directly related to the industry risk factor and the current issues with the Direct-to-Consumer division.

With the discount rate set, a value investor can now proceed to determine average earnings.

Earnings Per Share

Another reasonable assumption that must be determined is earnings per share. This is a simple formula: net profit divided by the number of shares. The key here is determining the average net profit historically to apply it to the various intrinsic value formulas. To start, review the history of the company’s financial performance for several years.

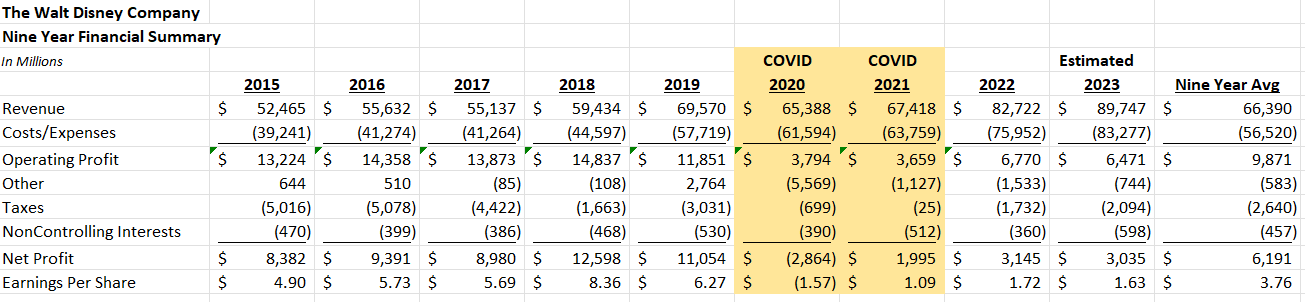

Take a look at Disney’s nine-year running average for profit in this table:

Sophisticated analysts give more credence to current periods of earnings over earnings from several years ago, i.e., more weight is assigned to more recent activity. COVID greatly impacted Disney’s ability to earn good profits from 2020 through 2021 and partially into 2022. In addition, the costs associated with Direct-to-Consumer services generated big setbacks for profitability during this period. Given the impact COVID had on earnings per share, the nine-year average is highly conservative as the basis for earnings per share.

For purposes of calculating intrinsic value, a reasonable assumption would be to eliminate the two COVID periods and recalculate the net earnings per share for the seven years. This equates to $5.14 per share. Thus, to remain conservative and realistic, the intrinsic value formula will use $5 per share as the starting point with the respective formulas.

One last note on how $5 of earnings per share is conservative. Go back to the delta of $9.2 billion for DTC. Notice the improvement in 2023 year-to-date of 15%. Using $20 billion as the revenue for DTC in 2024, at 15% improvement, this equates to $600 million, or 32 cents per share (1.85 Billion Shares Outstanding). Thus, $5 per share is a very conservative estimate for average earnings. There is a lot of validity to using $6 per share as the average earnings. However, when calculating intrinsic value, it is wise to be conservative as value investors try to establish reasonable outcomes, and then, with a safety margin, the buy point is set at a very conservative dollar point, and there is a high level of confidence that the outcome will greatly benefit the portfolio when the security is sold. This ties directly to the primary tenet of business – Buy Low/Sell High.

The Walt Disney Company – Weighted Model for Intrinsic Value

There are three groups of intrinsic value formulas: balance sheet, income statement, and cash flows. Each group has at least three different formulas. In total, there are over 20 different formulas a value investor can use. For those of you new to value investing, NEVER RELY SOLELY ON A SINGLE FORMULA TO DETERMINE INTRINSIC VALUE. Always use at least four, and the author encourages six to eight formulas.

Balance Sheet Group

When discussing intrinsic value, there is a vast misunderstanding about the term. One of the key issues is whether intrinsic value reflects the historical accumulated value as of today or the future values discounted to today’s dollars. If a value investor places more emphasis on the historical accumulated value, then value investors defer to the balance sheet formulas over all others. The balance sheet represents the company’s lifetime-to-date accumulated value. The drawback to this is that this lifetime-to-date accumulated value is heavily weighted by the use of historical dollars. Thus, if a value investor defers to the balance sheet for intrinsic value, the values on the balance sheet must be restated in current dollars. Here is an example:

In 1995, The Walt Disney Company paid $19 billion to merge ABC and its affiliates into the company. This was 27 years ago. The bulk of this price, about 65% has been depreciated/amortized as an expense during this period. This means that of the $204 billion in assets, ABC represents about $7 billion on the books. It is estimated that ABC is currently worth between $24 billion and $30 billion. If using the lower conservative value, there is most likely $17 billion of value NOT on the balance sheet. This $17 billion of value divided by the 1.85 billion shares is an additional $9 per share of value to a shareholder.

ABC isn’t the only asset; the book value currently on the balance sheet is less than its fair market value. Look at this asset holdings depiction and think about all the other subsidiaries Disney has purchased over the years (including purchase price) and what their current fair market value is in comparison. This is a picture depiction of Disney’s Holdings.

- Star Wars (Lucas Films) $4 Billion

- Pixar $7.4 Billion

- Marvel Entertainment $4.4 Billion

- Muppets $75 Million

- Fox $2.9 Billion

In the aggregate, the accumulated purchase prices adjusted for inflation create a difference between the recorded cost values (no depreciation/amortization included) of at least $35 billion (20 + acquisitions over the last 30 years). Thus, a reasonable step up in value for all these assets, including adjustments for depreciation/amortization, is easily twice as much, or $70 billion. The current equity value on the books for shareholders is $95 billion. Add to this another $70 billion for all these assets adjusted to current value based on inflation only, and you have at least $165 billion of valuation. One could easily argue that the values should be adjusted to fair market value, as the net value from a sale is no different from the approach used with real estate assets. One could argue that The Walt Disney Company is worth at least $200 billion if parceled out and sold; this is, after all, debt is extinguished and all fees are paid. Therefore, intrinsic values under these methods are as follows:

- Book Value – $95,008 Billion $51.50/Share

- Cost Value Inflation Adjusted – $165 Billion $89/Share

- Cost Value FMV Adjusted – $200 Billion $108/Share

If a value investor did a deep dive into valuing the respective subsidiaries adjusted to fair market value, then adjusted again for the cost to dispose/sell the respective divisions, it is quite possible to hit $240 billion of value for The Walt Disney Company. At this valuation, the company is worth $130 per share.

The balance sheet group is much more reliable for younger companies and those dramatically reliant on fixed assets to generate income (think of REITs, Utilities, Mining, Manufacturing) than those that are current or intangible-based (Disney’s intangible assets are just over 50% of the book value for total assets). Furthermore, large caps and DOW companies are not in the business of buying and selling companies; they are driven by the going concern business principle. This principle forces the value investor to place greater reliance on profitability over the balance sheet.

Income Statement Group

Most so-called experts who calculate intrinsic value utilize either the discounted earnings or the discounted cash flow to determine intrinsic value. They solely rely on or emphasize only this discounted formula to determine intrinsic value. This is a highly flawed approach. In order to do this, the formulas take future earnings or cash flow out 30 years and then discount them back into today’s dollars. This may work well for bonds, as the payments are written and known as facts. Predicting earnings in 20 years, along with inflation and growth of the respective company, is not only risky but just downright an exercise in frustration. Benjamin Graham, the father of value investing, placed greater emphasis on predicting the future in the near term, i.e., seven years out. His formula is to simply predict the future near-term growth and have knowledge of current earnings, and one can determine value. From above, Graham’s formula is:

V= Earnings (8.5 + 2g)

Using $5 as the average earnings per share and 7% as the growth rate, The Walt Disney Company is worth $112.50 per share. With modern-day value investing, a discount rate is applied to future earnings rates over 20 to 30 years, depending on how conservative the value investor’s approach is. The more conservative, the lower the number of years. For readers, please be aware, the DISCOUNT rate and the GROWTH rate are different. The discount rate is explained in detail above. For The Walt Disney Company, the discount rate is 9.7%. In addition to these discounted earnings, a terminal value is also set, and this final value is also discounted back to today’s dollars. The reason a terminal value is applied is because earnings are net of depreciation/amortization, which most companies reinvest this value back into their existing assets in order to maintain their physical/market value. Thus, a terminal value is added to reflect the sale or continued use of these assets beyond the period exercised.

For Disney, it is determined that in the first year earnings will be $5 per share, and this is discounted back to today at 9.7%. This means that in Year 1, the $5 received will be worth $4.55. In Year 2, the $5 of earnings will grow 6% (see above where it was determined that growth for Disney is 7% but to determine value, 6% is used in years 2 through 6, and then 5% growth in all following years. Thus, Year 2’s earnings are $5.30, and when discounted back two years to today, it is worth $4.41 in today’s dollars.

This pattern continues for four more years through Year 6. Total discounted value after Year 6 is $25.14. Now, growth slows to 5%. Remember, predicting growth is difficult and impossible to be accurate. Thus, it is always best to be conservative and reduce the growth rate the further one goes out from the current period. This is a good conservative approach and adds to the credibility of the result. Thus, for this formula, Disney’s growth is 5% for years seven through twenty. These next fourteen years add $39.27 for a cumulative value of $64.41 for twenty years of earnings. Review the following table:

YEAR 1 ($5 of Earnings, Discounted at 9.7%) $4.55

YEARS 2-6 ($5 of Earnings Growing at 6%/YR, Discounted at 9.7%) $20.59

Accumulated Value After Six Years $25.14

YEARS 7-20 ($6.68 Earned in Year 7 Growing at 5%/YR, Discounted at 9.7%) $39.24

Accumulated Value After Twenty Years $64.41

It is difficult to believe that Disney is only worth $64.41 after twenty years of earnings. However, the formula isn’t complete yet. There is still one more part remaining. With discounted earnings, the formula requires some form of terminal value after Year 20, and this value is discounted back to today’s dollars to add to the total value of the earnings during these 20 years. Why is this done? Well, think of the going concern principle. Disney is NOT in business to stop conducting business 20 years from now. This company will continue to grow and continue as a profit-generating corporation, per the demand of the shareholders. Thus, 20 years from now, there will still be assets out there, and these assets have value. The question is this: what is going to be the value of those assets 20 years from now?

Before approaching this step, many of you are wondering, why in this case, didn’t the formula go out further in time? Two reasons: first, one more year of earnings in YEAR 21 is $13.89 (includes the 5% growth in Year 21). This $13.89 discounted back 21 years at 9.7% per year adds $1.99 to the total value. If the formula designer did this for Years 21 through 30, it adds a mere $16.45, making the total value for earnings $80.86 over 30 years. Thus, the law of diminishing returns is kicking in, and each subsequent year isn’t really adding enough value to justify continued reliance on forecasted growth and the thought of the discount rate staying stable at 9.7%.

The key is the terminal value. Here, the formula designer will utilize a very large value and discount this back to today’s dollars. This value will overshadow the continuation of the value associated with earnings during Years 21 through 30 and beyond, discounted back to today’s dollars.

Thus, what is the best terminal value to use? The answer highly depends on the designer of the formula and their core belief system for business. One model of belief is that the net profit reflects the application of depreciation/amortization towards the continued maintenance of the existing balance sheet assets. To illustrate, in 2022, The Walt Disney Company’s combined depreciation and amortization was $5.16 billion. Customary maintenance of existing assets is about 3% of the asset’s value per year. Therefore, total fixed and intangible assets at the end of 2021 were $170 billion. To maintain $170 billion from one year to the next at 3% is equal to $5.1 billion. Thus, Disney’s depreciation/amortization maintains the existing assets of this organization. And this is further reinforced by the value from the ‘Investing’ section of the cash flows statement, whereby Disney paid out $5 billion to maintain their parks, resorts, and all other property. Therefore, the net earnings of $5 in Year 1 end up as cash in the bank or some form of current assets. After 20 years, the balance sheet will simply mirror the current balance sheet, assuming the respective earnings are used to pay dividends and eliminate all the debt. In effect, after 20 years, what will remain are the NET ASSETS, or what is commonly referred to as equity. This means Disney’s terminal value will match the current Disney shareholders ‘ equity position of $95 billion or $51.35 per share. Simply insert this with Year 20’s earnings to get a final value. Since it would take a year to cash out the assets, most formula designers just insert this value as earnings in YEAR 21.

If inserted in Year 21, this $51.35 is worth $7.35 in today’s dollars. Thus, the total intrinsic value utilizing the Discounted Earnings Method (Book Value as Terminal Value) is as follows:

YEAR 1 ($5 of Earnings, Discounted at 9.7%) $4.55

YEARS 2-6 ($5 of Earnings Growing at 6%/YR, Discounted at 9.7%) $20.59

Accumulated Value After Six Years $25.14

YEARS 7-20 ($6.68 Earned in Year 7 Growing at 5%/YR, Discounted at 9.7%) $39.24

Accumulated Value After Twenty Years $64.41

Terminal Value Utilizing Book Value Per Share in Year 21 $7.35

Total Intrinsic Value (Discounted Method/Book Value as Terminal Value) $71.76

There are still other, more sophisticated thinking. One stipulates that Disney would eliminate all debt as it earned its profits, and this, in turn, would reduce future interest costs, which would improve net profits further. In addition, the existing assets would continue to grow or at least mirror inflation over these twenty years. This is similar to Cost Value Inflation Adjusted from the balance sheet section above. Thus, instead of $51.35 per share as the terminal value, $161 per share would be the terminal value ($89 per share currently at 3% inflation rate for 20 years), which adds $23.04, making the total intrinsic value $87.45 per share.

Others will argue that the Cost Value FMV Adjusted amount of $108 per share and a 3% inflation for twenty years is the proper terminal value. Under this concept, the $108 per share is worth $195 in Year 21, and at a 9.7% discount rate, makes the terminal value worth $28 per share. Thus, the total intrinsic value is now $92.32 using the Discounted Earnings Method (FMV Terminal Valuation).

Here’s a summary of the results for income statement-based intrinsic value formulas:

- Benjamin Graham’s Model (@ 7% Growth) $112.50

- Benjamin Graham’s Model (@ 6% Growth) $102.50

- Discounted Earnings (Book Value @ Termination) $71.76

- Discounted Earnings (Cost Value Inflation Adjusted @ Termination) $87.45

- Discounted Earnings (FMV Adjusted @ Termination) $92.32

There is a $41 delta from one extreme to the other. Furthermore, if one includes earnings during years 21 through 30, an additional $14 needs to be included. The results are spread out and unreliable, given all the assumptions required and the lack of trust in what the future holds for earnings. Take note, all the assumptions are highly conservative; earnings in Year One are the basis of determining the earnings in Years Two through Twenty. These $5 in earnings in Year One are extremely conservative; thus, the outcomes are very conservative. If $6 is used as the starting earnings, the final result utilizing Book Value at Termination equals $77.27, $5.51 more for each of the respective termination values. If the designer increases growth to 7% utilizing the discounted method, the results will increase by around $6 per share. Furthermore, one could argue that the discount rate is very strong. Decreasing the discount rate 1% also adds about $6 per share. Thus, it is quite possible under optimum thinking of starting out at $6 per share earnings, with a seven percent growth rate throughout the entire 20-year time period and an 8.7% discount rate that the discounted earnings method with FMV valuation at termination generates a $109 intrinsic value result.

Is there another method that could augment or be more accurate than the discounted earnings method?

Discounted Cash Flows

A very popular and the most commonly used method to determine intrinsic value is the discounted cash flow tool. Here, the thinking is that the company will liquidate itself (consume the existing physical and intangible assets) over an extended period. The idea is that the company’s cash flow will be used to extinguish all debt, and as time moves forward, the company will simply cash out from its operations. The end goal is complete liquidation. Think of this as a systematic method to use up all the assets and turn them into cash.

From the balance sheet, the idea is to liquidate the assets by consuming them, i.e., operating them until they can’t generate cash anymore. All debt is eliminated, all current assets are turned into cash, thus one ends up with a big lump sum of cash left over, and simply distributes this cash out to the shareholders. This is very similar to the discounted earnings method above, except we are using up the existing assets instead of reinvesting in them.

Disney has $170 billion of fixed and intangible assets. It currently has $33 billion in current assets (a third is cash, another third is receivables, and the balance is easily turned into cash within a year). Looking at the cash flows statement, Disney generates about $6.2 billion in cash each year from continuing operations. If one simply takes this amount and grows it at around 3% per year for twenty years and discounts the cash back to today’s cash value at a 9.7% discount rate (same rate as the discounted earnings rate), Disney will generate $66 billion of cash in today’s dollars. Add this to the existing $33 billion of current assets (cash, receivables, other), and Disney will have $99 billion in the bank. During these 20 years, Disney used the difference between the face value of cash earned and the discounted value to extinguish debt. For example, in YEAR 13, Disney generates cash of $8.8 billion, but the discounted value is only worth $2.8 billion in today’s dollars. Thus, the $6 billion difference was used to extinguish debt¹.

(1) This is a complex equation when using future dollars to eliminate debt; the cited statement is merely a generality, but does resemble the outcome that the result is $66 billion of cash (in today’s dollars) in the bank and total elimination of debt. In effect, the discounted differential is used to eliminate debt.

With $99 billion as the only asset remaining and no debt, each shareholder receives about $53/Share. Why is this value so much lower than the others?

The key is the discount rate used. This discount rate reflects the minimum rate a shareholder demands given the risk factors Disney currently encounters across the board. More sophisticated users of this formula argue that the more accurate discount rate is the cost of capital for Disney (currently around 4.6%). Using the cost of capital, the current valuation of cash flow in today’s dollars over twenty years is $102 billion. Similar to above, the existing $33 billion in current assets is added, and the total cash available to the shareholders is $135 billion. From above, the debt is eliminated as a function of the discount rate. Now each share is worth $73.

Again, this still seems low for this company.

There are several contributing factors making the outcome of the Discounted Cash Flows method so low in comparison to the other methods employed thus far in this white paper. First, a very strong consumption rate of five percent per year was used to reflect the cumulative utility of 100% of the fixed and intangible assets (customary utility rates are around three to four percent per year). If the utility rate drops to 3.33% per year, a 30-year cash flow period is incorporated, and this increases the value per share by another $22 to $95/Share. This is because the cash continues to grow at three percent per year, and the cost of capital is used. Thus, each successive year adds a dramatic amount of additional cash to the pool.

A second contributing factor is the cash growth rate. Take note that the cash growth rate should mirror the growth rate incorporated with the discounted earnings method above. That is, 6% for five years and then 5% for the balance. Incorporating this into the formula and limiting the period to 20 years means an additional $23 billion. This makes each share worth around $85. If this growth rate is extended out to thirty years, each share is now worth $121.

A third factor that impacts the outcome is the period used. Twenty years seems rather short, whereas thirty years mirrors a long-term vision; asset utilization rates are more in line with physical utility; and it will take a conglomerate such as Disney that long to unwind its affairs.

Overall, this method is fraught with many risks. However, all the factors considered are conservative, and as such, the most likely real outcome will be an intrinsic value higher than the best result from within this group of discounted cash flow. This is further supported by looking at the details within the cash flow from operations section of the cash flows statement. There, cash flow is impacted by the changes in the various current assets; over the long term, these changes go to zero, and cash flow from operations really only reflects net income plus depreciation/amortization ($8.7 billion in 2022). Thus, the starting point in the above of $6.2 billion is too low by $2.5 billion. To use the $6.2 billion as the starting point, the outcomes are as follows:

- Cash Flow Growth of 3% per Year/9.7% Discount, 20 Years $53/Share

- Cash Flow Growth of 3% per Year/4.6% Cost of Capital Discount, 20 Years $73/Share

- Cash Flow Growth of 3% per Year/4.6% Cost of Capital Discount, 30 Years $95/Share

- Cash Flow Growth of 6/5% per Year/4.6% Cost of Capital Discount, 20 Years $85/Share

- Cash Flow Growth of 6/5% per Year/Cost of Capital Discount, 30 Years $121/Share

There is one interesting fallacy of using this method with a company like Disney. Disney has some assets that will never be consumed. It has the largest repository of movies, classics, and children’s movies, along with dozens of blockbusters. Viewers will want to watch them 40 years from now and will be willing to pay a fee to see them. Incorporate this into their other assets, such as ownership of ABC and their rights under ESPN, and Disney owns legacy assets. Simply put, these assets will never be consumed or extinguished; they are not physical and will always carry value like gold. Furthermore, Disney owns rights to several parcels of land that will always be valuable. The result is that even the best optimal discounted cash flow model from above is so conservative in comparison to reality. Simply put, Disney is worth every penny at around $110 per share. Some skepticism can begin to creep in at $121 per share. But the reality is that The Walt Disney Company is rock solid and paying $121 per share for Disney is sound and considered a reasonable buy. The investor isn’t going to lose money unless they panic and dispose of the asset when the market price is less than $121 per share.

Conclusion – Intrinsic Value of The Walt Disney Company

Altogether, 16 different outcomes of intrinsic value were calculated above. The lowest at $51.35 simply reflects the current book value per share. The highest at $130 per share reflects relatively mild factors used in the discounted earnings formula. The result is from varying assumptions; every single one used in this paper was conservative. The following is a list of the assumptions and more reasonable values that a more liberal approach could justify:

ASSUMPTION USED (Conservative) REASONABLE VALUE $ DIFFERENCE/SHARE

Growth Rate 6% 7% $3/Share

Discount Rate 9.7% 8.9% $5/Share

Cash Flow $6.2 Billion $8 Billion $9/Share

Capital Discount Rate 4.6% 4.3% $1/Share

Inflation Rate 3% 2.5% $1/Share

Resell Valuation LOW MEDIUM $14/Share

Earnings/Share $5 $7.20 $11/Share

Imagine the outcome if liberal assumptions were made. These seven different assumptions can be mixed between conservative (used) and reasonable, and a value investor’s outcome would easily increase $5 per share and still be considered conservative overall. The key to determining intrinsic value for any major corporation is the vast number of assumptions the investor has to make with the various formulas. Then, which formula do they rely on to make their decision? The answer is to use a weighted outcome. The author believes that intrinsic value for a large company like Disney should be deferred to balance sheet-based formulas over the income or cash flows-based formulas (this reflects the strong values associated with all the various divisions/assets Disney has purchased over the last 40 years). In addition, it is so difficult to predict the future with high certainty. The author believes the mix for a good and reasonable outcome is 60% balance sheet-based, 20% income statement, and 20% from the cash flows group.

From within the balance sheet group, the most reasonable outcome lies somewhere between Cost Value Inflation Adjusted and Cost Value FMV Adjusted. Thus, utilizing $100/Share valuation (midway between Inflation and FMV adjusted values assigned to the assets) and giving this a 60% weighted outcome is more than reasonable.

As for the discounted earnings method, using the Cost Inflation Adjusted at Termination value of $87.45 per share and weighted at 20% adds $17.50 to the outcome.

With the discounted cash flows tool, the author utilizes their prior experience as a CPA and understands that even the Cash Flow Growth of 6/5% per Year/Cost of Capital Discount at 4.6% for 30 years, is still excessively conservative. Actual cash flows will jump shortly for two reasons. First, the Direct-to-Consumer division will begin to generate profits; and secondly, the cash flow from operations will boil down to simply net profits plus depreciation/amortization, adding at least another $2.5 billion in cash each year. Cash flows will likely jump to more than $10 billion per year within three to four years. This means the $121 per share is very conservative, and the actual value may exceed $150 per share. At $121 per share weighted at 20%, this adds $24.20 to the weight formula. The outcome is as follows:

- Balance Sheet – Cost/FMV Value Inflation Adjusted (60% Weighted) $60.00

- Discounted Earnings – Cost Inflation Adjusted at Termination (20% Weighted) $17.50

- Discounted Cash Flows – Growth of 6/5% per Year/Discount at 4.6% (20% Weighted) $24.20

Total Intrinsic Value using a Weighted Scale $101.70

This outcome is highly conservative, even using the more reasonable discounted cash flows outcome. For the reader, please gather from the above calculations that intrinsic value is NOT a single dollar amount, but a range based on various assumptions. Thus, for The Walt Disney Company, intrinsic value is somewhere from $98 in a very conservative approach to as much as $118 per share when you incorporate more reasonable values in the formulas. Overall, it is reasonable and conservative to state that The Walt Disney Company’s intrinsic value is approximately $108 per share.

A buy point incorporates at least a 12% safety margin to minimize downside risk for this particular investment. A value investor doesn’t want it higher because it will eliminate opportunities to buy the security at a good price. Thus, a good buy point in August of 2023 is $95 per share. This provides a very well-protected investment and assures the holder of a very good return on their investment if the investor is willing to be patient.

In conclusion, The Walt Disney Company’s intrinsic value is $108 per share, and a value investor needs a 12% margin of safety and should buy at $95 per share. Act on Knowledge.

In late July 2023, Disney is selling in the market in the upper $80 range. There are several hindering factors causing this rare opportunity to buy, including concern about the DTC division, the recent low attendance at the parks, and the political battle Disney has with Florida. Even though there is turmoil within the company, this will pass within a couple of years. Thus, owning Disney at $90 a share and the suggested sell point is $150 per share makes for a great opportunity. If Disney can recover to $150 per share within THREE years, this is a $60 gain per share on a cost basis of $90 per share or the equivalent of an 18% annual return, not to mention possible dividends. If the share price recovers within two years, the annual return exceeds 27%. This site’s value investment holds 678 shares in Disney with an average cost basis of $104 each.