Value Investment Fund – End of Year Report

12/31/2022

The Value Investment Fund dropped in value by 11.35% from the start of the calendar year. Even with this drop in value, the Fund performed dramatically better than all other indices:

- The NASDAQ 100 lost 32.97%;

- The S&P 500 lost 19.44%;

- NASDAQ lost 33.1%.

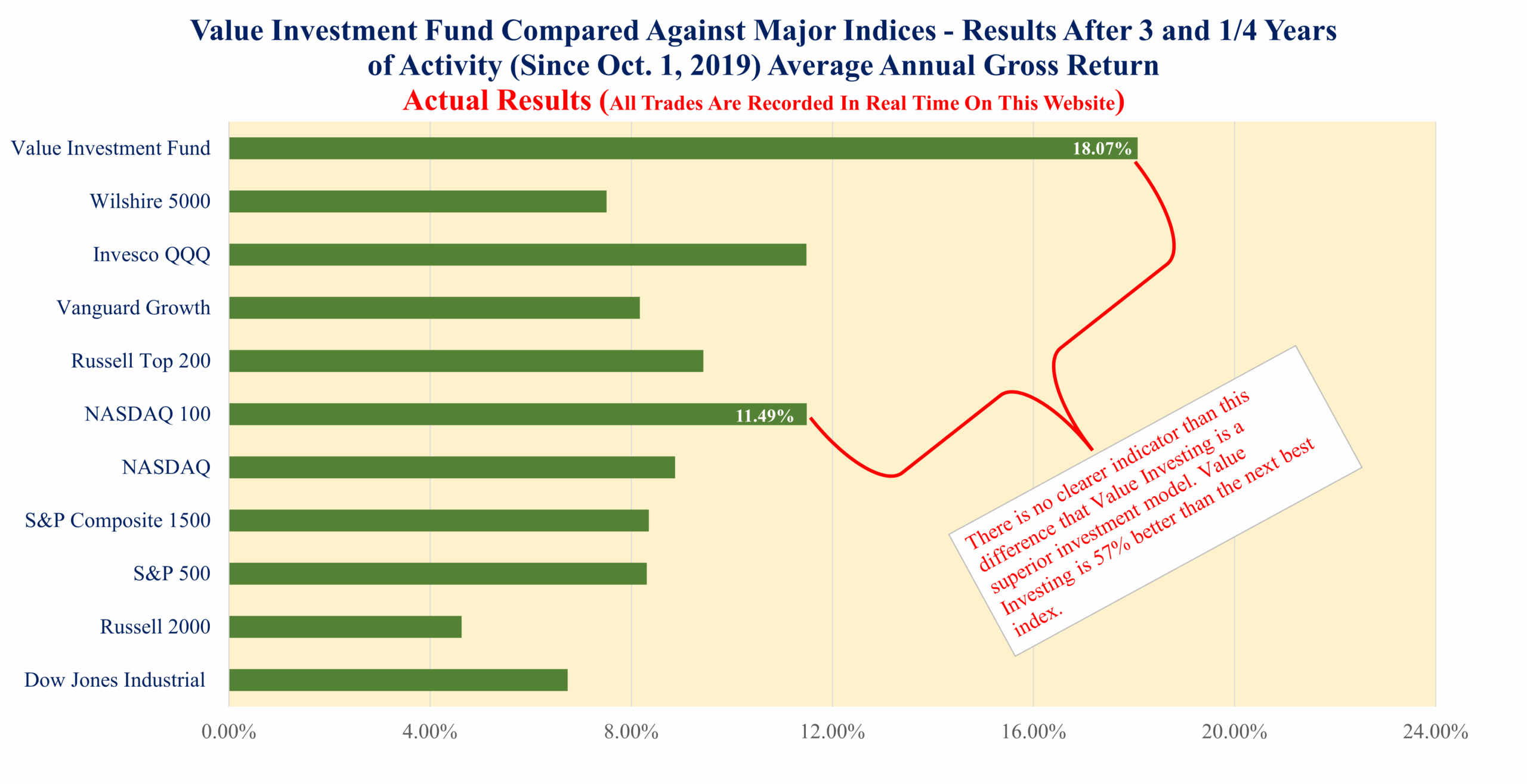

In the three and one-quarter years since inception, the Value Investment Fund’s annual average return is more than just ahead; it is 57% superior to the NASDAQ 100. The principles of value investing generate outstanding returns with minimal risk.

Value Investment Fund – Status on December 31, 2022

. December 31, 2022 November 30, 2022 December 31, 2022

. # of Shares Cost Basis Net Market Price* Net Fair Market Value* Net Fair Market Value*

REITs

. – Essex Property Trust, Inc. (Tranche #1) 71.6846 $20,000 $210.92 $15,726.16 $15,119.72

. – Essex Property Trust, Inc. (Tranche #2) 77.7000 20,000 210.92 17,045.83 16,388.48

. – Essex Property Trust, Inc. (Tranche #3) 100.0000 22,221 210.92 21,938.00 21,092.00

. – Essex Property Trust, Inc. (Tranche #4) 180.0000 44,980 210.92 39,488.40 37,965.60

. Sub-Totals 429.3846 107,201 $94,198.39 $90,565.80

Entertainment

. – The Walt Disney Company (Tranche #1) 180.1801 20,000 $85.88 $17,454.04 $15,473.87

. – The Walt Disney Company (Tranche #2) 200.0000 21,200 85.88 19,374.00 17,176.00

. – The Walt Disney Company (Tranche #3) 198.0198 20,000 85.88 19,182.18 17,005.94

. Sub-Totals 578.1999 61,200 $56,010.22 $49,655.81

Banking

. – Wells Fargo 100.00 4,267.50 40.29 $4,695.00 $4,029.00

Dividend Receivables (Wells Fargo) 30.00 -0-

Cash on Hand (Basis, Gains, Dividends, PUTS) 1,615.11 161.02

Totals (Starting Cost Basis = $100,000) $172,668.50 $156,548.73 $144,411.63

Accrual adjustment for taxes 4,974.17 7,957.01

Totals Net of Taxes (Recapture) $161,522.89 $152,368.64

This portfolio’s value is AFTER TAXES of 28% on all realized gains. Total taxes paid to date 25,924.50 28,323.59

Comparative Gross Return Since Inception $187,447.39 $180,692.23

Unrealized Earnings (Value of Respective Market Prices Less Cost Basis/Fees at Point of Sale) $(17,764.88) $(28,417.89)

*Net of transaction fees of $1.00 per share; thus, the amount in the schedule equals the actual market price per share at closing, less $1.00 per share.

Value Investment Fund – Potential Obligations

The Value Investment Fund’s current exposure related to PUT options is as follows:

- Union Pacific Railroad – sold in Feb 2020 with a strike price of $155/share and an expiration date of January 21, 2023 $20,000

- JP Morgan Chase – sold in May 2022 with a strike price of $80/share and an expiration date of June 16, 2023 $20,000

- Norfolk Southern Corporation – sold in September (200 Shares) with a strike price of $145 and an expiration date of January 21, 2024 $29,000

- Essex Property Trust – sold 12/30/22 (100 Shares) with a strike price of $170 and an expiration date of July 21, 2023 $17,100

- Union Pacific – sold 12/30/22 (200 Shares) with a strike price of $145 and an expiration date of August 18, 2023 $29,200

- L3 Harris Technologies – sold 12/30/22 (100 Shares) with a strike price of $150 and an expiration date of October 20, 2023 $15,100

- Marriott Hotels – sold 12/30/22 (100 Shares) with a strike price of $90 and an expiration date of January 19, 2024 $9,100

*Total financial commitment = $139,500

Market prices on December 31, 2022, are:

- Union Pacific Railroad (Expiration on 01/21/2023) $207.07 (Strike Price of $155.00) Current Deviation = 33.59%

- JP Morgan Chase (Expiration on 06/16/2023) $134.10 (Strike Price of $80.00) Current Deviation = 67.62%

- Essex Property Trust (Expiration 07/21/23) $211.92 (Strike Price of $170.00) Current Deviation = 24.66%

- Union Pacific (Expiration 08/18/23) $207.07 (Strike Price of $145.00) Current Deviation = 39.35%

- L3 Harris Technologies (Expiration 10/20/23) $208.21 (Strike Price of $150.00) Current Deviation = 38.80%

- Marriott Hotels (Expiration 01/19/2024) $148.89 (Strike Price of $90.00) Current Deviation = 65.43%

- Norfolk Southern Corp (Expiration on 01/21/24) $246.42 (Strike Price of $145.00) Current Deviation = 69.94%

*Deviations > 25% are considered favorable.

Value Investment Fund – Earnings Year-To-Date

First Quarter Earnings:

. Sold Huntington Ingalls 03/07/22 Net Realized Gain $5,557.05

. Dividends Earned (First Quarter 2022) 271.34

. Net Earnings from Sales of PUT Contracts 573.10

. First Quarter Earnings $6,401.49

Second Quarter Earnings:

. Net Earnings from Sales of PUT Contracts $3,908.57

. Dividends Earned 607.46

. Second Quarter Earnings $4,516.03

Third Quarter Earnings:

. Net Earnings from Sales of PUT Contracts $1,040.00

. Dividends Earned 654.26

. Third Quarter Earnings $1,694.26

Fourth Quarter Earnings:

. Realized Gains from Sale of Wells Fargo $7,623.19

. Sale of PUT Contracts (Essex Property Trust/Union Pacific/L3 Harris/Marriott) 915.00

. Dividends Earnings (Wells Fargo) 30.00

. Fourth Quarter Earnings $8,568.19

Total Realized Earnings Year to Date 2022 $21,179.97 (12.49% Realized Return to Date)

Taxes Paid to Date 2022 – $5,930.39 (28% of the $21,179.97 Realized Thru December 31, 2022)

End of Year Reconciliations/Summary Reports

Lifetime Earnings/Fund Balance at Market Valuation

Initial Fund Capitalization $100,000

Realized Earnings (2019), 1st Qrt of Activity 2,703

Realized Earnings (2020) 23,608

Realized Earnings (2021) 53,661

Realized Earnings (2022) 21,180

Sub-Total Fund Value Before Taxes and Unrealized Gains/Losses 201,152

Less Taxes Paid Lifetime to Date (28,324)

Less Unrealized Gains/Losses at Year-End (Tax Adjusted) (20,461)

Fund Balance if Cashed Out 12/31/22 (Net of all fees/costs to terminate) $152,360 *Matches Fund Balance Above w/Rounding Error of $2

Lifetime Earnings/Fund Balance at Cost

Total Realized Earnings Lifetime to Date: $101,152

Less Taxes Paid Thru 12/31/22 @28% 28,324

Net Capital Account Balance From Earnings $72,828

Initial Contribution 100,000

Value Investment Fund at Cost $172,828

Cost Basis in Investments $172,669 *See Above Cost Basis Column Status at 12/31/22

Cash in Bank 161

Value Investment Fund at Cost $172,830 *Round Error of $2

Value Investment Fund Summary Report – Earnings 2019 2020 2021 2022 Totals

Realized Earnings from Security Gains $2,327 $22,277 $48,349 $13,181 $86,134

Realized Earnings from Dividends 376 904 2,451 1,563 5,294

Realized Earnings from Sale of PUT’s -0- 427 2,861 6,437 9,725

Totals $2,703 $23,608 $53,661 $21,180 $101,153

Summary of 2022

Calendar year 2022 was profound, with the volume of overall losses for all indices. No single index fund experienced an improvement in value during 2022. The Value Investment Fund also experienced a decrease in value during the same period. However, its respective decrease in Fund value was substantially lower than all other indices. This is a direct reflection of the primary principle of value investing – only purchase high-quality securities. Overall, the Fund earned a 12.57% return on its original beginning-of-the-year Fund balance of $168,430. It ended the year holding three quality investments – Essex Property Trust, The Walt Disney Company, and Wells Fargo. Once the market recovers, the current portfolio will dramatically outperform the other indices. Act on Knowledge.