High Price to Book Ratios – Proper Interpretation and Evaluation

With stock investing, one of the valuation ratios used for comparison purposes is the price-to-book ratio. It identifies the spread between market value and book value for a share of stock. As the spread increases, the ratio increases. A good example is Coca-Cola. Its price-to-book ratio hovers in the 11 range. Coca-Cola is a Dow Jones Industrial top 30 stock. With Coca-Cola, the current book value is $4.37 per share, and it’s currently trading at $52.80. The price-to-book ratio as of today, 11/06/19, is 12.08. Whereas on the other end of this spectrum sits Walt Disney Company. Disney’s price-to-book is customarily low, around two and a half times book value. Its current book value is $50.80 per share, and it is trading today at $132.96, exactly 2.62 as the price to book ratio.

Think about this for a moment, both companies are in the top 30 for market capitalization in the United States, both companies produce profits, and have vast amounts of assets. The question for any investor is: ‘Is there any preferred price-to-book ratio, and if so, why would there be such a big difference with highly respected companies?’

In general, more conservative, value-based investors look for low price-to-book ratios. Why? Well, a low price-to-book ratio minimizes the downside risk associated with the investment. This is very beneficial with stocks that have strong market capitalization positions. For example, Disney’s market capitalization value is around $236 billion, which means there are plenty of holders of the stock; therefore, there is a good market to ditch the stock if something appears off. Coca-Cola has a market capitalization of $226 billion, which means there’s a similar market. Anytime the market capitalization for a company hits more than $10 billion, a seller of that stock will have no problem finding a buyer within a few pennies of the current market price per share. The lower price-to-book ratio simply reduces the overall risk of losing money. Note that it reduces the risk of losing money; it doesn’t necessarily increase the opportunity to make money. Think of a lower price-to-book ratio as a shield when doing battle in the market; it does help to protect your investment. But this still does not answer the question posed: Is there a preferred price-to-book ratio, and why is there such a wide dispersion even among well-respected companies?

This article is going to help the reader/investor understand why there are such differences, but more importantly, how to interpret and evaluate high price-to-book ratios. Can a high price-to-book ratio still be a good investment?

To answer this, first the reader must understand what drives the price of stock higher for some companies and thus generates high price-to-book ratios. Once the reader understands the underlying force of price for the stock, the next step is to evaluate the associated risks of higher price-to-book ratio stocks. With this fundamental understanding, now the investor can develop opportunities or discover common patterns that unfold with high price-to-book ratio investments. With this knowledge, the investor can make better decisions and ultimately increase their wealth with good buy and sell decisions.

Forces That Drive Stock Prices Higher

There’s one single word with investments that drives stock values higher – stability. With business, stability is defined as consistent profits over long periods. For Coca-Cola, celebrating 100 years in business in 2019, they have generated solid profits every year for the last 15 years. The lowest profit during this period was a meager $1.24 billion in 2017. To give you an idea of its stability, the initial shares of Coke sold for $40 each. Had your great-grandparents purchased a single share in 1919, it would be worth approximately $10 million today – Wiederman, Adam J. (August 14, 2012). “One Share of Stock Now Worth $9.8 Million – Is It Possible?”.

Investors have an expectation for the corporate management team to maintain this stability and continue to perform well. Anything less is considered grounds for termination. Shareholders have little to no tolerance for even average management of the company. Good management results in positive business factors that drive stock prices higher. For Coca-Cola, they include:

- Dividends of around $1.60 per year, producing a yield of more than 3% at the current market price;

- Earnings per share of no less than $1.02 during the last 15 years, excluding 2017 (the company took advantage of the new corporate tax rate to pay a lower tax rate on tax deferrals);

- Gross margins over 60% in every year for the last 15 years;

- Only one year with an EBITDA margin less than 25% over the last 15 years; AND

- Operating cash flow of at least $6 billion per year over the last 15 years.

Consistent performance year after year drives the market price higher for the stock. This stability provides comfort to buyers of stock.

Disney is different in several ways, though. Let’s not misinterpret this, just like Coke, over the last 15 years, Disney has had profits every year. Disney is a DOW top 30 industrial stock and has a similar market capitalization. The lowest profit earned was $2.6 Billion in 2006. The differences are the other factors that drive stability. Unlike Coke over the last 15 years:

- Disney’s dividend payout finally exceeded $.50 (50 cents) per share in 2011; thus, the yield has never exceeded 2% in the last 20 years:

- Earnings per share have steadily improved from $1.22 in 2005 to over $8 in 2018; but unlike Coke, which pays out its earnings to its shareholders, Disney holds back most of it via retained earnings;

- Gross margins didn’t exceed 20% until 2013;

- EBITDA margin has averaged more than 25% in only 4 of the last 15 years; AND

- Operating cash flow finally reached more than $6 billion in 2010.

Why is it that Coca-Cola’s price in comparison to its book value is almost six times greater? Go back to the force of stability. Disney’s stability isn’t anywhere near the consistency that Coca-Cola generates. Although Disney is without a doubt a good investment, it can’t match Coke’s aggregated factors:

- Coke’s yield is at least 50% greater than Disney’s.

- Disney retains much of their earnings, which increases the book value per share, and Coke pays out almost all of its earnings per share as dividends.

- Coke’s gross margin (revenue less cost of goods sold as a percentage of revenue) is often twice as much as Disney’s;

- Coke’s EBITDA is consistently higher than Disney’s; AND

- Coke’s operating cash flow totaled $124.3 billion over the last 14 years; Disney’s operating cash flow during the same period was $118.4 billion. Coke’s operating cash flow is almost 6% higher over time than Disney’s.

These other factors drive Coke’s market price higher than its book value. With this understanding, an investor can now identify risks that exist with higher price-to-book ratio stocks.

Evaluating Higher Price to Book Ratio Stocks

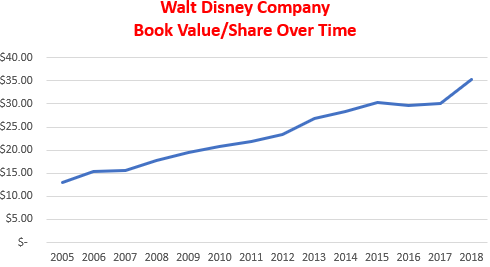

From above, stability drives higher price-to-book ratios. However, a key business ratio factor related to the price to book ratio is, of course, the book value of the share of stock. Notice from above, Disney retains much of its earnings, thus increasing the book value. Look at this historical chart of the book value for Disney and compare it to Coke.

Walt Disney Book Value Per Share

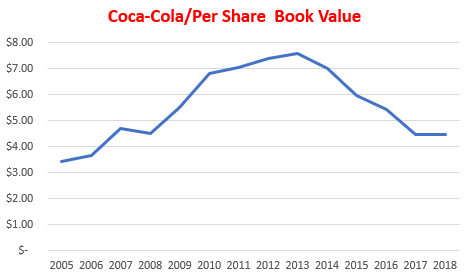

Basically, Coca-Cola’s book value has remained relatively flat over the last 15 years. Disney’s book value has increased by more than $20 per share over the same period of time. These two companies have a philosophical difference related to equity; one allows equity to grow, the other simply distributes earnings to its shareholders.

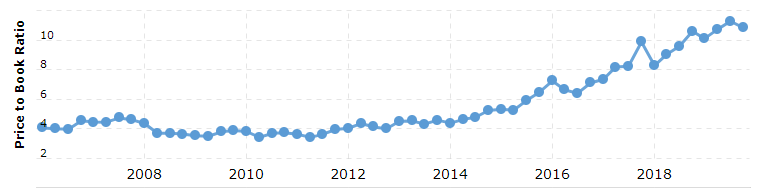

Since Coke’s book value has remained relatively flat, did this affect the market price over the same period of time, i.e., did the price-to-book ratio grow over time? Look at this chart:

It hasn’t always been high; it grew over time, driven by other stability factors. It wasn’t until 2014 that it began to take off at a higher ratio. However, a good part of that increase is directly related to a reduction in the book value from 2014 to 2018; thus, the growth is not purely tied to the market price. But still, the market price does increase, and it is driven by stability and other strong factors of business.

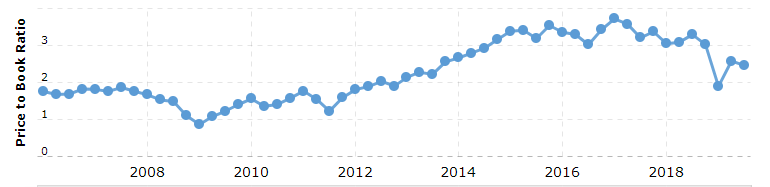

Now let’s look at Disney’s price-to-book over time:

Disney’s price-to-book ratio remains somewhat stable until 2014 and then increases. If you compare it to Coke, it’s the same. Coke is also stable during the period up until 2014. But both begin to increase through 2018, most likely driven by the overall stock market’s increase during this time period. It is interesting how, back in 2009, the book value of Disney was greater than the market value; in a way, it made sense. That was right when the country was in a recession, and of course, the stock market lost some confidence in the entertainment industry, thus dampening the market price of Disney.

With such a high price to book value for Coke, is it possible it is overpriced right now? It is unlikely for several reasons. First off, even at this high price, the yield is very strong at more than three percent. Furthermore, Coke has many strong business factors; remember, its gross margin has exceeded 60% over the last 14 years. Very few companies have that high of a gross margin. It appears that Coke has reached its epitome of value.

What are the risks here with Coke? There doesn’t appear to be any. How can an investor take advantage of high price-to-book-value stocks? What do you look for to trigger a buy?

Many large institutional investors buy more for the yield than the capital gain. A three percent yield is very strong at the current market price. Imagine those who bought the stock back in 2014 for $33 a share. Their yield is almost 5%. Value investors are different; value investors are looking for long-term gains in addition to yield. For those who bought in 2014 for $33 a share, and if they sell their stock today, they would receive almost $20 a share gain. This is at least a 60% gain over 6 years. In the aggregate, those who invested six years ago would earn about 12 to 15% per year as their overall return on their investment. That is acceptable, but value investors want a 30 to 40 percent return on their investments per year.

High price-to-book ratio investments rarely provide high returns for value investors. Value investors must wait for the price to drop. With high price-to-book ratio stocks, the market price’s volatility is the only way to buy a good investment at a good price. Look at Coke’s market price over the last five years:

Only twice in the last five years has Coke dropped below $40 per share. It dipped to $39.23 back in June of 2015. The volatility of the market price just doesn’t exist. A value investor must be patient related to this particular stock. Naturally, if the price drops below $45 a share, it’s a buy (under current corporate financial results). But the reality is that as the price drops, more buyers are interested in the stock given its stable history.

Downward trends in market price are long and slow to occur. Unless something significant happens related to the stability factors for Coke, it is unlikely that there will be a sudden and remarkable decrease in the share price. But when it happens, it is time for value investors to jump on the opportunity. This same principle applies to all high price to book ratio stocks. Wait for sudden and significant decreases in the stock price. Look at the underlying reason for the change, and if it is an unusual event, then it may be time to act. Here’s a good example.

Apple Inc.

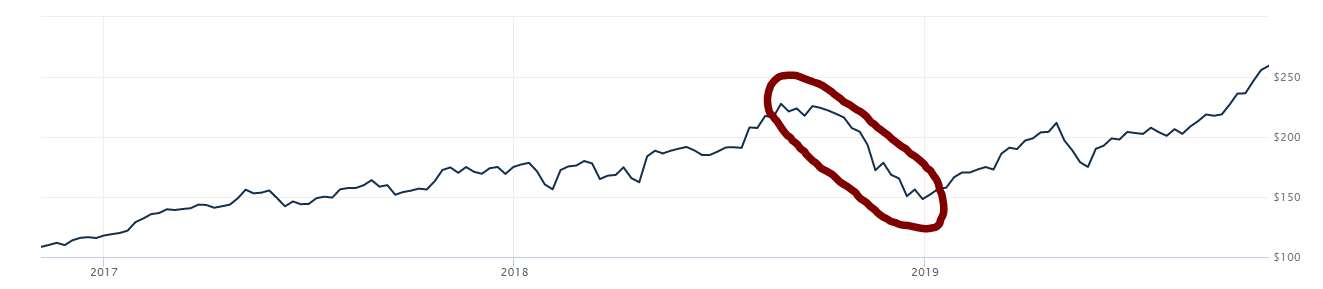

In September of 2018, Apple’s share price hit $227.63 per share. Three months later, on 12/30/18, the price dropped to $148.26, a whopping 35% decrease. Look at this share price chart for Apple:

Look at the circled period. What drove this share price decrease?

Look at the circled period. What drove this share price decrease?

From mid-October to mid-November 2018, the price took the biggest fall, going from $216 on 10/21/18 to $172 on 11/18/18.

On November 5, 2018, Apple filed its Form 10-K reporting its annual financial results. There were no notable changes in their financial results to drive this stock price decrease. So what caused this?

There were several market concerns that arose, affecting Apple’s stock price. First, there was heightened concern about Chinese and US tariffs; secondly, the market indicated concern about continuing iPhone sales. Finally, there was some general worry in the market about the overall economy and its impact on Apple. In effect, the price decrease had nothing to do with Apple’s financial performance; it was strictly a worry among existing owners of stock and the market as a whole.

The simple reality is that the share price should be tied to the financial performance of the company. Apple does have a high price-to-book ratio, currently around 12. A value investor builds a model and uses that model’s trigger points to buy and sell the stock. With Apple, the trigger point for a buy might be a 21% decrease from the prior peak. Remember from above, to reap financial gain, an investor must look for a sudden and deep decrease in the high price-to-book value stock. In the above chart, the prior peak was $228.36 on 08/31/18. The 21% decrease equates to $180.40, which occurred on 11/20/18. Once bought, the value investor simply waits for the stock to recover to a certain point. Suppose in this case the investor decides on a 14% increase over the buy price. This means the value investor sells at $205.66, which happens on 04/23/19, about 6 months later. With this model, the investor makes $25.26 per share capital gain and earns about $1.50 per share in dividends during this 6-month holding period. Altogether, the investor’s return on his investment is $26.76 on $180.40 or a straight 14.8% return. However, if annualized, this equates to almost a 30% return on the value investor’s money.

The lesson here is straightforward. When thinking about buying high price to book ratio stocks, you must wait for deep and sudden decreases in the stock price. If this happens, look at the financial fundamentals; if they are unchanged, then it is time to buy. The trigger point must be a remarkable decrease, more than 20% in order to justify the investment. As with most high price-to-earnings ratio stocks, it takes a long time to recover due to the rule of stability. The greater the stability, the less likely an investor will find 20% decreases in stock price, but when it happens, it is a great opportunity to make a good return on your investment. ACT ON KNOWLEDGE.