Investment Fund (Lesson 15)

“Courage taught me no matter how bad a crisis gets … any sound investment will eventually pay off” — Carlos Slim Helu.

An investment fund is a collection of capital from one or more individuals and is used to purchase financial instruments of various companies or other funds. The most common types are brokerage funds that allow incremental purchases from members. These funds are often dedicated to a certain group or type of investment with similar attributes. Some funds are dedicated to stocks from only small-cap companies. Other funds focus on a sector or industry within the economy. For example, there are utility funds, real estate funds, and retail-based funds.

The primary goal of a fund is to restrict the purchases of financial instruments to a certain investment group or type, believing that this group or type is dynamic enough to earn a good return for its members who contribute the capital to buy rights to companies.

There are two forms of investment funds. The first form is an open fund. This means that it continuously allows new investors into the fund, and its capital base can expand over time. Most brokerage funds are open as they are used with many retirement plans. The opposite of this is a closed fund. Here, a preset sum is invested, and the fund grows off this limited capital investment. Ownership of the fund may change as a member has the right to sell their respective position in this fund.

This site’s investment fund is closed. It is owned by the site and does not allow others to join. Only the activity of the fund is documented and reported on this site to demonstrate how value investing works and how it continuously grows the investment. Furthermore, the fund’s respective information is available to club members. They have the right to use the information for their investment fund.

When a value investor creates their fund, they utilize pools of similar investments in their fund to enhance the fund’s overall performance. It is encouraged to have at least three pools of investments in a fund and no more than six pools. A well-designed fund uses the attributes of the respective pools to reduce risk, improve overall performance, and minimize the holding of cash. The following three sections cover these three pooling benefits and how they achieve the overall goal of value investing.

The club’s Value Investment Fund consists of five pools of investments. Each pool is a set of companies in a similar industry. All potential investments belong to the top 2,000 companies traded in the market. The three pools and their corresponding members are:

. Railways Real Estate Investment Trusts (Residential Rentals) Banks Fast-Food Insurance (P&C)

- Union Pacific Essex Property Trust Comerica Bank McDonalds Travelers

- CSX UDR (United Dominion Realty) Bank of America Restaurant Brands AllState

- Canadian National Equity Residential Wells Fargo Starbucks Progressive

- Canadian Pacific Avalonbay Communities JP Morgan Chase Jack-In-The-Box Arthur J. Gallagher

- Kansas City Southern Mid-America Apartment Communities Fifth Third Bank YUM Brands Old Republic International

- Norfolk Southern Corporation American Homes 4Rent CI A Bank of New York Wendy’s

- Shack Shack

- Domino’s Pizza

There are no least 30 potential corporate investments. Each pool has its own dedicated set of resources, spreadsheets, formulas, and supporting documentation in its respective section of the website. You must be a member of the club to gain access. It is encouraged for members to create their pool and have that pool validated by the facilitator and in a forum of other members. Once completed, that pool may be posted to this site with the creator’s permission. If you desire to have your pool posted here, you will be considered the expert for that pool; any interactions with fellow club members related to that pool are controlled by you.

Investment Fund – Risk Reduction

As explained and illustrated in Lesson 14, pools of similar investments reduce risk primarily driven by a requirement to have a comprehensive understanding of that industry. It is difficult for a single individual to have a comprehensive understanding of more than five industries due to the extensive time commitment required. When the investment fund has several pools in it, the overall risk factor can be further reduced just by the sheer volume of selection of potential investment options. In effect, intrinsic value for each company in each pool can be set one to three percent lower for all potential investments, as there are often several potential investments at or near their intrinsic values at any given time. To illustrate, this table identifies at least five of the above 18 potential investments that are below, at, or near their respective intrinsic values. Today is January 22, 2021, and the DOW Jones Industrial Average is at or near its all-time high of 31,250. At closing, the DOW is at 30,998.

. Values

Railways Intrinsic Market

- Union Pacific $180 $206.93

- CSX $67 $87.64

- Canadian National $84 $106.06

- Canadian Pacific $225 $339.26 *5:1 Stock Split in the Summer of 2021

- Kansas City Southern $135 $217.58

- Norfolk Southern Corporation $205 $244.22

Real Estate Investment Trusts (Residential Rentals)

- Essex Property Trust $255 $243.45

- UDR (United Dominion Realty) $42 $39.11

- Equity Residential $67 $61.56

- Avalonbay Communities $158 $164.73

- Mid-America Apartment Communities $98 $134.18

- American Homes 4Rent CI A $23 $31.25

Banks

- Comerica Bank $44 $62.16

- Bank of America $26 $31.55

- Wells Fargo $34 $31.90

- JP Morgan Chase $104 $133.79

- Fifth Third Bank $22 $30.90

- Bank of New York $42 $41.93

Of the 18 potential investments, five are currently trading on the market at less than their intrinsic value. With such a wide array of potential investments and so many at less than intrinsic value, a value investor can easily adjust the buy point to two to three percent less than intrinsic value and still have plenty of potential investments available to select for purchase. This further reduces risk as risk aversion is strongly correlated with intrinsic value. Any difference between intrinsic value and market price below intrinsic value is considered an additional margin of safety.

Of the three industries, two are having difficulties right now and are frowned upon in the market. Banks are out of favor due to the impact of the pandemic and some historical misrepresentations of the public. The pandemic also affects the REITs industry, specifically the apartment complex holdings that the above pool holds. With several different pools in the portfolio, there is always an opportunity to buy a good investment, and at the same time, one or two investments are doing well with their market price. For example, this site’s investment fund purchased Norfolk Southern back in October when the intrinsic and market value at that time was $204 per share and sold them 13 days later at $231 per share. Right now, railways are performing well, and all of the potential investments in that pool are at their all-time highs. Thus, it will be several months before this industry sees any significant decrease in its respective market values approaching intrinsic value. This industry-wide ‘UP’ is offset by the two other industries in the ‘Fund’. Thus, opportunities exist at all times. The best part is that opportunities always exist at or near intrinsic value, which greatly reduces risk for the entire fund.

Investment Fund – Improves Overall Performance

Enhancing the overall performance of an investment fund is essential to improve the cumulative return. Improving overall performance starts with selecting highly defined pools for investments. To augment performance, ensure that the respective pool’s economic cycles are different. Some industries experience market fluctuations that are extended; others have quick frequencies of highs and lows. Having a mix of market price cycles allows a value investor adequate opportunities to buy low and sell high with less volume of potential investments.

It is important to note certain drawbacks to this concept. Awareness of these drawbacks forces the value investor to pay attention to market conditions and utilize preset computer orders to ensure proper timing and return. To assist in understanding, the following three subsections explain the drawbacks of extended, desired, and shorter market cycles. In the next section, this lesson covers how to maximize return utilizing pools and how their respective market and economic cycles impact value investing.

Extended Market Fluctuations

When a stock’s market fluctuation cycle exceeds one year, this is considered an extended cycle. In effect, the most recent low and high exceed one year and in some industries can approach three years in duration. The most common industries that exemplify this cycle period are high fixed asset-based companies with long lives that earn revenue consistently. Examples include real estate-based operations, shipyards, and publicly traded toll road operators. Companies like this are highly focused and rely on large initial capital outlays to purchase the necessary long-lived assets and associated intangibles (worker skills, logistics, market position). In return, they receive a consistent and reliable source of income. Their profitability is tied to their ability to efficiently produce their product or provide the service.

For illustration, here is Huntington Ingalls Shipyard’s stock price over a five year period. Notice the distinct extended low price of stock and the cycle time between these lows.

The deep lows occur every 15 to 18 months. The unique high stock prices also occur between the distinct low points. Naturally, this isn’t a permanent pattern, but it does illustrate how this company has an extended cycle time for distinct highs and lows related to the stock market price.

The deep lows occur every 15 to 18 months. The unique high stock prices also occur between the distinct low points. Naturally, this isn’t a permanent pattern, but it does illustrate how this company has an extended cycle time for distinct highs and lows related to the stock market price.

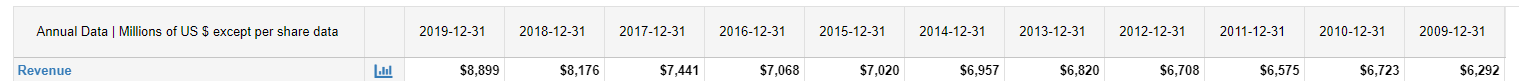

Furthermore, large companies like this earn consistently improving revenues over their respective lives. The next exhibit illustrates how Huntington Ingalls has a pattern of continuously improving revenue over time.

As a value investor, this type of pattern is greatly beneficial. The key is to understand how to take advantage of this pattern and earn excellent returns. Since it is impossible to accurately time the respective deep highs and lows, an alternative method must be utilized. Assuming the investor has done their due diligence with calculating intrinsic value and the corresponding reasonable market recovery price, what can a value investor expect as a return on their investment? Let’s walk through this.

Assuming a reasonable intrinsic value of $190 per share and a market recovery price of $230 per share, what would be the respective return on the investment over the first two cycles?

Looking at the share price line, the price dips to $190 in about April of 2017. The buy is then made. In November of the same year, the stock peaks suddenly to $240, passing the sell point of $230 within a couple of weeks. Thus, the transaction earns $40 (sold at $230/share less basis of $190/share) over eight months. In effect, the return on the investment equals about 30% on an annual basis. In November of 2018, the price drops past the $190 buy point, and the stock is purchased again. It looks like the price rose past $230 a share in November of 2019. Thus, the next cycle earns $40 per share over a full 12 months. The annual return on the investment approximates 21% due to the longer recovery period.

Two key points of interest here. First, although the full economic or market cycle is extended, the actual buy/sell period is significantly shorter. Value investors are not holding the stock from one low point to the next. At some point, the stock price recovers before it dips back to another low. Thus, a long extended cycle does not mean a long holding period for the value investor. It just means that the investment opportunities exist in a long cycle, and the actual full transaction is completed within this cycle. Secondly, the shorter period between buy and sell points dramatically improves the annual average return on the investment. This is explained in Lesson 3 of this series. This important principle is elaborated further in Phase Two of this program (development series).

Extended cycles are riskier for investors due to the possible long market recovery period from a low purchase price. If this cycle extends into two and three years, the return on the investment drops below 10% annually. Therefore, it is important to pay attention to these cycles and how they can impact the performance of the investment portfolio. The ideal pool would have shorter cycles and greater differentials between high and low stock prices.

Desired Market Fluctuations

The ideal stock investment is one that has a recurring pattern and is not influenced by the general economic situation or industry conditions. It would have a perfect sinusoidal waveform of ups and downs, and its frequency would be every six months. See Lesson 9 and its explanation of cycle patterns. The respective peaks and troughs would also have enough differentiation that acting on the respective investments at proper buy points and sell points generates more than 35% annual returns.

This ideal set of conditions in a single or a set of similar stocks does not exist in the market.

However, there are industries that happen to have reasonable cycle patterns that occur every six to twelve months, allowing an investor the opportunity to earn good gains with each transaction. The key is that the industry itself may not have this cycle, but this cycle will exist with one of its potential investments or moves from one company to another within the pool membership. Finding an industry with this type of action generates not only good returns but also greatly reduces risk.

Ideal changes would be more than 20% from one extreme to the other within three months; thus, it would fully cycle every six months or so. Changes less than 20% from one extreme to the other make it difficult to earn a reasonably effective return due to transaction costs. Here is an example.

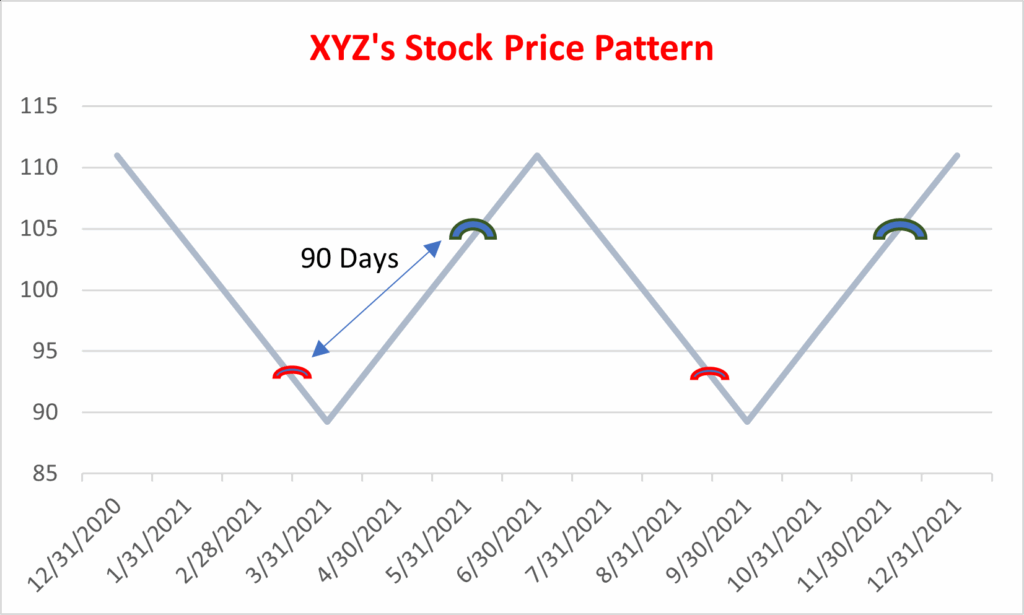

XYZ Company experiences market price fluctuations from $89 to $111 twice a year. To protect the fund, the value investor selects $93 as the buy price to ensure acquisition of stock at a good price and sells at $105 per share to protect against the inability of the market cycle to fully reach the prior peak price. Assuming a $1 per share transaction fee, the actual investment is $94, and the net proceeds are $104. Thus, the actual realized gain is $10 per share on an investment of $94. Assume the market cycle is pure with two full cycles per year. The buy is made as the stock heads towards the low of $89 and sold as it heads towards the peak of $111. The effective holding period per completed transaction is approximately 90 Days. Thus, each year, $94 is invested to get a cumulative return of $20 (twice a year, each time earning $10). The actual return is 21%, and the effective annual return is 42%. Look at this graph for an illustration of the timing of the buy and sell points.

Thus, $94 is invested for 90 days each twice a year, Mid-March to Mid-June and Mid-September to Mid-December. Again, there is a 20% market price change four times a year, two declines and two recovery periods. This allows two full opportunities to buy low and sell high. With market price fluctuations of 20%, an investor can expect about a 40% return on their investment. If the market price fluctuations are less than 20%, and the cycle is similar, an investor cannot reap the rewards given the risk factors involved.

Thus, $94 is invested for 90 days each twice a year, Mid-March to Mid-June and Mid-September to Mid-December. Again, there is a 20% market price change four times a year, two declines and two recovery periods. This allows two full opportunities to buy low and sell high. With market price fluctuations of 20%, an investor can expect about a 40% return on their investment. If the market price fluctuations are less than 20%, and the cycle is similar, an investor cannot reap the rewards given the risk factors involved.

Therefore, it is important to understand that there are two critical aspects of market price fluctuations. First, the ideal situation would allow for TWO full cycles per year, and secondly, the price change must be at least 20%.

It is also important to note that in order to get an effective 42% return per year, the value investor would need a second company that has a similar pattern but shifted by 90 days in either direction. Thus, upon the sale of one stock, the opportunity to buy exists with the other stock. This keeps the capital invested full-time for the entire year.

The drawback of ideal market price fluctuations is that they simply do not exist. If it did, everybody would follow this pattern, which would change the pattern. This is why, as a value investor, you must find an industry that has at least a 20% price fluctuation change from peak to lows and with frequency. It doesn’t have to be perfect; it just needs to be common, and if common among the industry membership, the greater the chance to improve overall performance for the investment fund.

With the current Club’s Investment Fund, the railways pool provides these ideal market fluctuations regularly. NO, it isn’t perfect, but the pattern does exist, and given the six companies in the pool, there are enough frequent opportunities to earn good returns. Again, value investors are not looking for great returns; great returns require UNACCEPTABLE RISK. Value investors are looking for good returns with minimal risk. The railroad fund is used as one of the examples to illustrate finding an ideal pool of similar investments that have predictable patterns and earn good returns with minimal risk. This is covered in detail in Phase Two of the membership program on this site.

The continued drawback for both the extended and ideal cycle patterns is that cash is held during certain times while the fund waits for the proper buy point to materialize. Therefore, a value investor’s fund needs more frequent opportunities in order to ensure as much capital is invested as possible. Thus, a good investment fund will also have a pool of investments that have high peaks and lows in order to exercise available capital during interim periods of time.

High Frequency Market Fluctuations

Since it is so difficult to find companies with ideal stock price fluctuations, value investors turn to the opposite of extended market price-based pools and utilize pools with more frequent ups and downs to improve overall investment fund performance. In general, high-frequency pools experience a complete cycle within a few months. The respective industries are typically popular with consumers, and often the respective companies introduce new products in order to compete. If you were to review their balance sheets, the respective companies have greater portions of their current assets as a ratio of total assets. Thus, their risk factors are slightly higher than longer-term and single-focus entities. Furthermore, the intrinsic value tends towards book values for these companies. Price to book ratios rarely exceed 2:1, and often the price to book is less than 1:1. Examples of industries that have more frequent fluctuations include those in the financial sector, construction, and transportation sectors.

The drawbacks to these companies are two-fold. First, the difference between the peaks and lows within the cycle rarely hits more than 12%; thus, there must be greater attention to current key performance indicators that create value. Secondly, as market fluctuations increase in frequency, risk increases. Thus, it is essential to ensure an accurate calculation of intrinsic value to prevent losses. In general, value investors must utilize a greater safety margin (buy at less than intrinsic value, typically in the 80% or less range of intrinsic value). Worse, when it comes time to sell, the sell point is set lower than prior market peaks to ensure capture of gains and prevent the risk of sudden reversal of price increases, forcing the value investor to hold the stock for longer periods of time to wait for proper recovery of the stock price.

All of this affects the return on the investment. To further reduce gains, the cost of transaction fees impacts overall gains and lowers the final return on the investment.

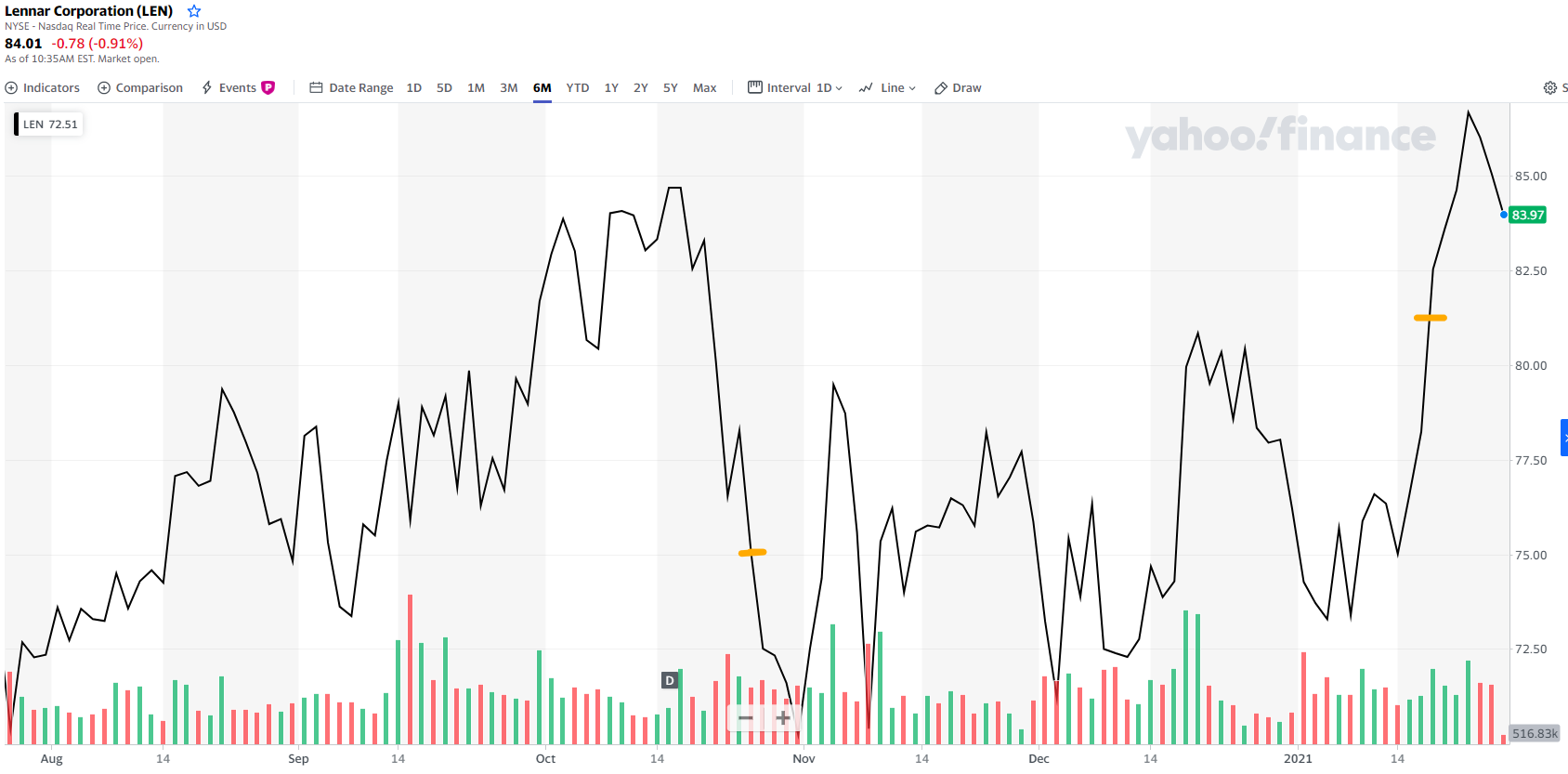

To illustrate, take a look at Lennar Corporation’s stock price fluctuation over the last six months. Lennar is one of the top five home construction companies in the United States. In this case, Lennar’s book value on 11/30/2020 was $61.24. Intrinsic value was calculated at $75 per share for 2020. Thus, the buy point is $75 per share. The reasonable market recovery point (sell point) was set at 8% higher than the intrinsic value. Thus, the buy point is $75 and the sell point is $81. Assuming a $1 transaction fee per trade, the net gain equals $4 per full cycle on a $76 investment (the intrinsic value point plus $1 for the transaction). Thus, with each full cycle, the gain equals 5.3%. Take a look at Lennar’s stock price chart over a six month period.

In this case, the value investor is waiting for the price to drop to $75 after it peaks at $81 per share. It peaks at $81 at the end of September 2020 and peaks just past $84 in mid-October 2020. Then drops to $75 per share on 10/26/2020 (see gold cross-hair). The buy is made on this date. The price recovers to the sell point of $81 on January 20, 2021(see gold cross-hair).

In this case, the value investor is waiting for the price to drop to $75 after it peaks at $81 per share. It peaks at $81 at the end of September 2020 and peaks just past $84 in mid-October 2020. Then drops to $75 per share on 10/26/2020 (see gold cross-hair). The buy is made on this date. The price recovers to the sell point of $81 on January 20, 2021(see gold cross-hair).

The full cycle is completed in 88 days, not quite one quarter. Thus, the cycle generates a 5.3% return on the investment in 88 days for an annual return of 21.8%.

Notice how this more frequent cycle, but with less disparity between buy and sell, doesn’t generate the desired annual return of more than 30% on investments for value investors. It is good, but not at the level wanted. So why include pools of investments that have market characteristics like this if the end goal is to generate 30% or more return on capital in the investment fund?

Investment Fund – Maximize Return

With a well-designed fund, maximizing earnings annually is the goal. With a set of diversified pools, the timing of investments and utilizing all the available capital increases the overall return. As illustrated above, finding ideal pools with perfect market price fluctuations is unrealistic. Fund managers must combine the positive attributes of extended and frequent market price changes in order to ensure all the capital is put to work. It would seem that the easiest path would be to simply use all the capital with a single investment if that particular stock is bought at a very low price to intrinsic value with an adequate margin of safety. The problem is that there is no guarantee of market recovery in a reasonable period. Therefore, it is prudent to diversify the portfolio. Diversification requires additional patience while waiting for other possible purchases.

During this temporary waiting period, it is beneficial to put this available capital to work by purchasing an investment from a more frequent cycle pool of investments. The return isn’t as lucrative as the extended cycle investments, but it puts to work the available capital to earn some return.

The ideal fund will have investment pools composed of all three types of market fluctuations. The most difficult type to find is the ideal cycle pool of investments. This site’s fund currently utilizes a railway pool as its ideal pool, but at the time of this lesson production, this particular pool has all six of the potential stocks at or near their respective all-time highs for stock price. In the interim, the available capital is invested in the banking pool, which carries the more frequent cycling attribute necessary for an investment fund.

Overall, the extended cycle time pools of investments provide outstanding gains and high average returns. The ideal pool of investments will sometimes experience highs, and this can go on for many months. The void is filled with investments that have faster cycles, and although not as financially lucrative as the other two pools of investments, the faster cycle pool provides a good haven to invest the available capital during the waiting period.

This whole design goes back to the business investment concept of diversification. Diversification reduces overall risk, but the associated cost is an overall lower return. In the long run, this design of the investment fund ensures good returns with low risk. Remember from Lesson 1, the goal of value investing is to have solid, stable, and good returns with minimal risk involved. This is why this investment method never espouses high returns (>40% annually) but does persistently advocate for good and reasonable returns – greater than 20% annually but more than 25% per year is the goal. Act on Knowledge.