Value Investing – History and Modern Day Concept

There are tens of different definitions or interpretations of value investing. There is no single finite definition, as even Benjamin Graham or David Dodd didn’t even use the term in their famous book, Security Analysis. What Graham and Dodd advocated in their writings was how to use multiple different financial tools, formulas, principles, and economic concepts to determine the underlying value of any of a company’s financial instruments sold in the market. Given the wide variety of financial instruments (stocks, bonds, options, preferred stock, convertible debentures, and more) available for sale, an investor must understand the proper methods to determine intrinsic value for the respective instrument. Furthermore, much of this is predicated on an understanding of how to value a company’s assets, liabilities, equity, and income statement sections to truly determine the intrinsic value of a company.

The key term used by Graham and Dodd is intrinsic value. Intrinsic value is essentially the most likely and probable price point most informed, sophisticated buyers are willing to pay for the respective ownership privilege.

The key term used by Graham and Dodd is intrinsic value. Intrinsic value is essentially the most likely and probable price point most informed, sophisticated buyers are willing to pay for the respective ownership privilege.

There are two common price points in the securities market today. The first is called ‘market price’. Market price represents the exchange value among a large group of knowledgeable buyers and sellers for a respective financial instrument (security). It is influenced by many circumstances that change daily. The key is that there must be many buyers and sellers willing and able to purchase/sell the respective asset, in this case, a financial instrument. Furthermore, all the buyers and sellers have access to all of the facts and circumstances surrounding the sale of the respective asset; thus, no single buyer or seller has a distinct advantage over others. The only modern-day system with which this is considered normal is the stock market, which includes the sale of all kinds of financial instruments.

The second price point infrequently used is ‘intrinsic value’. Intrinsic value IS NOT a value determined by group input. Intrinsic value represents the most likely dollar amount a security/financial instrument will provide in a worst-case scenario. In effect, it is a reasonable and logical determination of the underlying value of the respective financial security or instrument. It is commonly stated in the form of dollars per common share of stock. It is adapted to other forms of financial securities from this stock price value. There are multiple definitions from a myriad of sources, including:

- Book Value – a balance sheet formula representing all assets sold at face value in the market, less payment of all liabilities divided by the number of shares outstanding.

- Tangible Book Value – similar to traditional book value, tangible book value is all physical assets sold at face value less liabilities, divided by the number of shares outstanding.

- Liquidation Value – this dollar amount represents the sale of all assets at a fair market price, assuming the sale is done within a reasonable period, thus no discount of the fair market value of the respective asset. Similar to book values, proceeds from liquidation are used to pay off liabilities, and any remaining dollar amount is proportionally paid out to shareholders.

- Fire Sale Value – similar to liquidation value except that the respective assets are sold at a discount to swiftly dispose of the assets.

- Present Value of Discounted Earnings – unlike the above four values, discounted earnings assumes the holder of the financial security will hold the respective financial instrument and receive the respective amounts per the terms of the financial instrument. For stockholders, this means that over an extended period of time, the holder will receive the value of the respective earnings. This particular intrinsic value formula assumes an infinite holding period whereby dividends and the corresponding yield over many years will equal this present value.

- Dividend Yield – unlike the present value of discounted earnings, dividend yield represents a purely conservative value reflecting dividends from a stock. This particular formula is rarely used with intrinsic value calculations.

- Cash Flows Plus Terminal Value – this respective formula assumes the existing entity backing the financial instrument will operate in the near term but will terminate its operations over a reasonable period in the future.

- Others – there are about half a dozen more common definitions found.

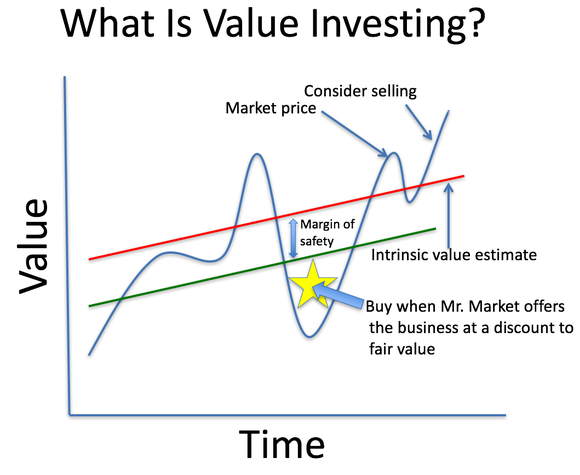

The above different intrinsic value points and their respective formulas are applicable in particular situations under certain circumstances. Thus, there is no single correct formula for intrinsic value. The reality is that intrinsic value is a slim corridor of dollar amounts that is a reasonable expectation of worth for the respective financial instrument/security. In almost every case, intrinsic value is significantly less than the historical market high price for the respective financial instrument. Market price fluctuates wildly even in the near term; intrinsic value does not fluctuate significantly in the near term. Intrinsic value shifts slowly higher or lower depending on the performance of the entity in question. It is possible for intrinsic value to suddenly fluctuate as underlying asset values can suddenly change due to market conditions for the underlying asset(s); however, this is uncommon. Think of intrinsic value as a trend line of value, either improving or declining, correlating to the financial integrity of the organization backing the respective financial instrument.

This particular illustration identifies the two respective price points. Notice that, market price fluctuates with greater dispersion than the red line representing intrinsic value.

In order to reap some financial reward for one’s purchase, an investor must buy this financial instrument for less than its intrinsic value and then sell it at its intrinsic value or higher. In effect, buy low and sell when the market price fluctuates towards an extreme high. This is known or referred to in the world of investing as value investing. Value investing is not restricted to just stocks; it is used with all sorts of financial instruments sold in the market. Graham and Dodd were simply informing all parties as to how to properly value these respective instruments and their underlying assets that support the resultant value.

In order to reap some financial reward for one’s purchase, an investor must buy this financial instrument for less than its intrinsic value and then sell it at its intrinsic value or higher. In effect, buy low and sell when the market price fluctuates towards an extreme high. This is known or referred to in the world of investing as value investing. Value investing is not restricted to just stocks; it is used with all sorts of financial instruments sold in the market. Graham and Dodd were simply informing all parties as to how to properly value these respective instruments and their underlying assets that support the resultant value.

A sophisticated value investor will use several of the different formulas applicable to the respective industry from which the financial security is issued. The varying intrinsic value points are often weighted depending on the industry and the use of rational expectations and assumptions to determine an approximate intrinsic value. Again, it is impossible to acquire a finite intrinsic value as there are many factors impacting the respective formulas and, therefore, the outcome. It is possible to determine a reasonable value that will endure many tests and pressures from the market.

In the simplest of terms, value investing means to buy low and then sell high in order to reap the reward for the hard work involved with calculating intrinsic value. This buy low, sell high mantra is the core tenet of business, and it is the primary thought with value investing.

Currently, the most accredited individual who has taken this concept of buying low and selling high to the extreme is Warren Buffett. Mr. Buffett was a student in Mr. Graham’s graduate studies class when Benjamin Graham taught at Columbia University. The only difference between Warren Buffett and other value investors is that Buffett really doesn’t sell; he holds the respective financial investment and earns the reward through dividends and other forms of ownership status. Buffett’s company, Berkshire Hathaway, rarely sells their respective ownership position in any financial instrument. The company now just buys entire companies. Yes, it does have strong stock positions or other rights with many of the top companies in the world, and Berkshire Hathaway exercises their respective rights by taking positions on the boards of directors and, in some cases, management roles.

It is unrealistic to think that a small investor can act in this manner. Thus, value investing for small investors means to buy low and sell high and reap the rewards of good decisions. The key to success is understanding and determining intrinsic value for a given industry, and then the respective potential financial instrument for purchase. Acquiring intrinsic value is not simply math. It does require some use of algebra, but the core principle of calculating intrinsic value is to apply common business principles to the respective industry to get reasonable results. The central focus of intrinsic value is to use reasonable assumptions and rational thought when applying formulas.

This takes work, and all intrinsic value outcomes have to be updated regularly, at least annually. In effect, the value investor needs to know the movement of the trend line.

Once the intrinsic value is set, the next step is to look at the respective financial instrument and look at its historical market price. How often does it fluctuate above and below intrinsic value? If the respective financial instrument hovers consistently near intrinsic value, this particular financial investment is avoided by value investors. The respective financial instrument must have a history of market fluctuations around the intrinsic value point. Ideally, the greater the divergence from the intrinsic value price point and the more frequent these divergent extremes, the better the opportunity for value investors. Remember, it is about buying low and selling high.

Since it is impossible to predict extreme lows or highs, value investors turn to reasonable market price points around the intrinsic value. For example, with one particular pool of similar investments on this site’s Value Investment Fund, the reasonable extremes are about 80% of intrinsic value as the buy point and 125% of intrinsic value as the sell point. Both points are not at full divergence, but are at points whereby the market price will dip or rise to the respective point and hold there for a reasonable period before swinging back like a pendulum towards the other extreme.

Overall, the key is to create a systematic process of buying low and selling high, utilizing intrinsic value as the focal point for the respective investment. The value investor utilizes many different tools to determine intrinsic value and the necessary extremes with the market price. Financial analysis is applied to validate the extremely high or what is referred to as a reasonable market recovery price.

In general, the application of value investing does not provide instant wealth. If properly executed, value investing will result in excellent returns over and over against the market as a whole. Driven by the restrictions inherent existing with the four core principles of value investing, the investor will infrequently have outstanding returns for any single investment. It is not for those who are seeking instantaneous improvement in wealth. Odds are that there will rarely, if ever, be any loss associated with the respective investment simply because a value investor buys the stock at or below intrinsic value and waits for the market to recover to a reasonable market price. Even with longer than predetermined market recovery points, returns on investment outperform even the best indices. With luck, the high price point recovery occurs in a short period of time, which means the annualized return on the respective investment accelerates. Time is one of the mathematical factors in the return on investment formula.

There are four principles of value investing.

Quality Companies Only

First, only purchase high-quality stocks with stable earnings; typically, only companies that are in the top 2,000 companies in the market. This provides adequate and accurate financial information to apply intrinsic value formulas. Companies referred to as penny or small-cap do not provide enough information in their respective financial reports to properly apply all the various intrinsic value formulas.

Risk Aversion

Secondly, only purchase stock at or below intrinsic value in order to reduce or practically eliminate risk. The risk referred to here is an extended low market price for the respective financial instrument. High-quality companies rarely have extended depressed stock prices. Value investors purchase the financial instrument at below its intrinsic value in order to provide additional security in a depressed market. This is referred to as the margin of safety in the world of value investing.

Financial Analysis

Third, utilize financial analysis to determine the respective price extremes for the financial instrument. How often can one expect the market price to hit a high in the future? This period is important as it determines the financial return on one’s investment.

Patience

Finally, patience is required. One of the drawbacks to investing is anxiety. Most people think, ‘Did I do the right thing here by buying this investment?’ If one does their homework properly, one simply needs to be patient and allow the market forces to do their part in creating the price change desired.

For readers interested in learning more about value investing, consider joining as a member and going through the program on this site. There are three phases involved. The first phase teaches the core principles and terminology used throughout. In Phase Two, the member learns how to create their pool of similar investments, an industry pool. The final phase of this program teaches sophisticated tools, methods, and formulas to improve the overall performance of their financial investment fund. Act on Knowledge.