Intrinsic Value – Required Attributes

Intrinsic value requires certain attributes to accelerate the monetary outcome above book value and move the result closer to market value. With most publicly traded companies, these attributes exist, as without them, companies would fail or go bankrupt. These attributes include a well-defined mission/purpose, effective management, efficient production, and sustainable growth. Other secondary-level attributes impact intrinsic value, but these are not as critical as the four primary attributes. If any of the primary attributes are functioning poorly, intrinsic value will undergo a severe monetary adjustment. It is vital to the company’s success and overall demeanor that the four attributes exist and are dominant in the company’s culture. The following four sections explain these four attributes in more detail.

Intrinsic Value Attribute – Mission/Purpose

Every company must have a purpose, commonly referred to as its mission. It is the reason for the company’s existence and acts as the guiding principle for all customers, employees, and shareholders. All successful operations have a well-thought-out purpose as promulgated from their mission statement. Some great examples are:

Newport News Shipbuilding (A Division of Huntington Ingalls Shipbuilding)

“WE SHALL BUILD GOOD SHIPS HERE,

AT A PROFIT, IF WE CAN,

AT A LOSS, IF WE MUST,

BUT ALWAYS GOOD SHIPS.”

This shipyard builds aircraft carriers and submarines. Quality is their priority as the lives of the US Navy’s sailors are at risk.

This rock with the mission statement plaque was installed at the front gate in 1917 by the shipyard’s founder, Collis P. Huntington, for all yard workers to see as they enter each day.

Johnson & Johnson

“To improve health for humanity by blending science, heart, and ingenuity. We believe good health is the foundation of vibrant lives, thriving communities, and forward progress.” J&J’s credo was written way back in 1943 by Mr. Johnson, and he starts by stating: “We believe our first responsibility is to the patients, doctors and nurses, to mothers and fathers, and all others who use our products and services. In meeting their needs, everything we do must be of high quality.”

McDonald’s

“This is how we uniquely feed and foster communities. We serve delicious food people feel good about eating, with convenient locations and hours and affordable prices, and by working hard to offer the speed, choice, and personalization our customers expect.”

“… entertain, inform and inspire people around the globe through the power of unparalleled storytelling, … that make ours the world’s premier entertainment company.”

Naturally, there is more to it than just having a well-developed mission statement; the company must have policies, systems, standard operating procedures, products, services, employees, and so much more that adhere to this mission. It must be heartfelt, and ultimately, the consumer must sense it and immerse themselves in the mission. This works so much easier and better when there is an excellent management team to lead the company.

Intrinsic Value Attribute – Good Management

The second required attribute of intrinsic value is a solid management team. Management plays an essential role in the success of any company. Their job is to make good decisions, set policies, and hire the best folks to carry out the mission of the organization.

There are countless examples of major corporations bringing in a new CEO, and the company’s overall financial success exceeds expectations. A perfect example is Harold S. Geneen. He took International Telephone and Telegraph from a medium-sized operation in 1959 to a $17 billion conglomerate in 1970. ITT’s growth rate averaged 10% per year for several years in a row.

In the latter half of the 1900s, Northwestern University’s Kellogg School of Management estimated that a CEO was worth about 10% of the overall organization’s profitability. Today, it is closer to 20%. The leadership role has evolved into stewardship of the company versus the historical role as the sole decision maker. The modern leader requires a diverse executive staff with more specialists and an ever-growing data stream of current and accurate information. So when the modern CEO says or does something, the market reacts instantly with the markeet price per share.

To illustrate, back in August into early September 1997, Coca-Cola’s market price dropped from $35 per share to $28 per share due to news of throat cancer for its CEO, Roberto Goizueta. This is a 20% drop in value attributed to the CEO’s health. At that time, 2.4 billion shares were trading in the market. Thus, this one person’s unfortunate life change reduced the market value of Coca-Cola by $16 billion. This is the value of an outstanding CEO of a top-notch corporation. This illustrates how one person can impact the market price of a corporation.

CEO’s set the tone, including production. The more efficient the model, the greater the profitability.

Intrinsic Value Attribute – Efficient Production

Efficient production is financially measured by utilizing the gross profit margin. The gross profit margin reflects revenue less direct costs to produce that revenue. Direct costs of production are different for each industry, so there is no universally accepted standard. The industry sets the standard. Here are some examples of different industries and their better player performance standards:

Industry Company Gross Profit Margin

Retail Walmart 24%

Entertainment The Walt Disney Company 30%

REITs Equity Residential 31%

Banking JP Morgan Chase 32%

Railways Union Pacific 45%

Fast-Food McDonalds 55%

You can’t compare Union Pacific to Walmart. Their business models are entirely different. Naturally, a 45% gross profit margin is so much more comfortable to work with than a 24% margin. Yet Walmart is a DOW company, and Union Pacific is ranked as the 88th company in the S&P 500. This difference is attributable to the volume of revenue involved. With Union Pacific, revenue in 2024 was $24 billion; thus, the gross profit was around $11 billion.

With Walmart, sales in 2024 were $681 billion. At a 24% gross profit margin, gross profit in 2024 was $169 billion. It is easy to understand why Walmart is ranked as the 12th-largest company in the world. This goes back to a basic tenet of business: it’s about the absolute dollars generated and not the percentages.

With intrinsic value, the investor is looking at the strength of the gross profit margin in comparison to similar companies within that industry. To illustrate, let’s compare different retailers against each other within this industry:

Walmart 24%

Home Depot 32%

Target 26%

Walgreens 18%

Lululemon 59%

Even though Home Depot has a stronger gross profit margin than Walmart, its annual sales are about 28% of Walmart’s. So, even at the retail industry level, it is difficult to compare gross profit margins as the retailers are different. Walmart sells consumer goods, Home Depot sells construction materials. Thus, value investors are careful not to use comparisons as absolute standards.

The key to efficient production is the ability to improve or stabilize the financial metric that measures efficiency. For example, look at Walmart’s history of its gross profit margin:

Walmart 2025 YTD 25.05%

Walmart 2024 24.85%

Walmart 2023 24.37%

Walmart 2022 24.14%

Walmart 2021 25.09%

Walmart 2020 24.83%

Notice the continuous improvement in the gross profit margin from 2022 to 2025 Year to Date? It looks like Walmart set the standard in 2021 (calendar year 2020, just before the impact of COVID). In fiscal year 2022, the gross profit margin dropped dramatically and has slowly improved back to the standard set in fiscal year 2021. When determining risk and intrinsic value, analysts look at details like this to ensure that efficient production exists. Little deviation from the standard is what value investors seek.

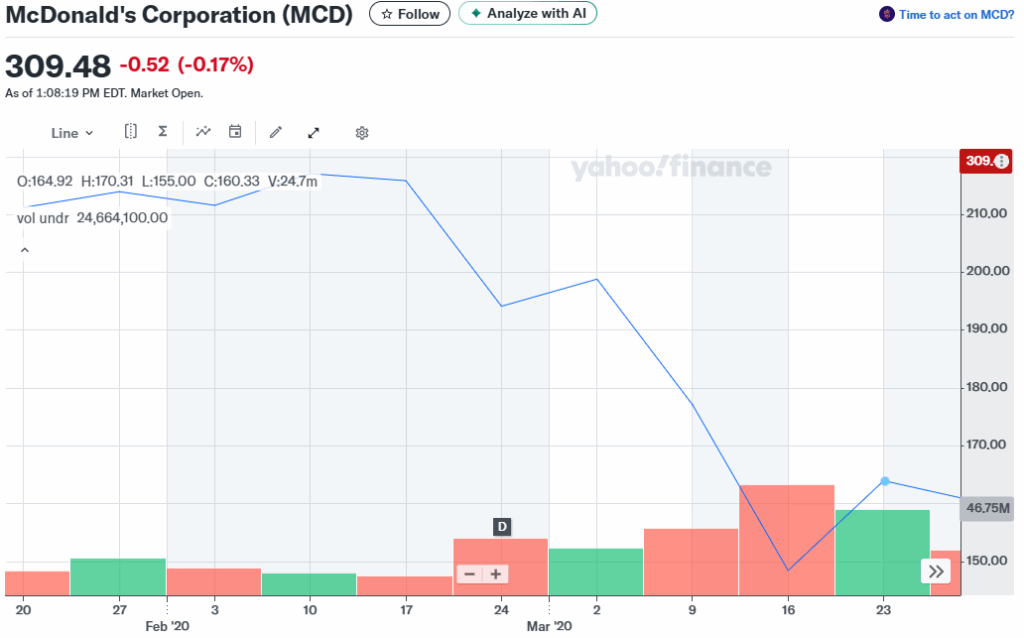

Naturally, stronger margins are preferred. Strong margins reduce risk, which is the number one principle of value investing. The problem is that those companies with strong margins are less likely to have volatility with their market prices, providing opportunities to buy low. When it does happen, value investors jump on the fortunate chance to own a quality company at a low price. Look at McDonald’s, with a 55% gross profit margin. If its market price drops suddenly, like it did during the COVID period, value investors didn’t hesitate. Owning such a high-quality company at a reasonable price is the goal of value investing. Understanding the intrinsic value point and setting a buy price below the intrinsic value sets the threshold for wealth accumulation.

In February of 2020, McDonald’s intrinsic value was approximately $145 per share. The market price for McDonald’s had peaked at $218 in August of 2019. During February of 2020, the market price was about $210 per share. Suddenly, starting in the first week of March, the market began to drop across the board, and even strong companies like McDonald’s saw the market price drop. It bottomed out on March 16 at $125 per share. Value investors would have a 10% discount for margin of safety against intrinsic value and would have a buy order set at around $131 per share for McDonald’s. A value investor would have picked up this stock at $131 per share. The market price recovered to $180 per share within a month.

Solid companies with consistent margins reduce risk and are sought out. It is rare to have the opportunity to buy, but when it does occur, wealth accumulation is almost automatic.

What makes solid companies so attractive is the ability to generate efficient production. In addition, good companies grow. The last required attribute for intrinsic value is sustainable growth.

Intrinsic Value Attribute – Sustainable Growth

Growth is a required attribute when determining intrinsic value. Any form of retrenchment (negative growth) is a red flag. Retrenchment in any form, such as product mix change, reduction in locations, reduced sales per visit, and/or volume adjusted for inflation, is a sign of serious problems with any company. Growth must exist, and it has to be sustainable for an extended time to calculate intrinsic value with a high level of confidence. It is important for the reader to understand what growth really means and the importance of sustainable growth.

First, growth must be absolute. This means that the current change must be adjusted for inflation and the number of outlets that sell the product. What a value investor seeks is true growth in sales per visit/customer, increases in the actual number of customer visits, and improvement with actual dollars spent per visit. Most companies report these details in the notes to their financial statements or in the section of the annual report referred to as management discussion. Common growth indicators include:

- Same Store Year Over Year Sales – new locations typically require a full year of activity to get up to speed; eliminating their sales provides a true comparative of volume of sales.

- Actual Customer Visits/Engagement – within the notes are statements about the number of customer visits and their actual average purchase value per visit or the number of units the customer purchases per visit.

- Change in Online Volume

- Occupancy Rates by Region/Units Available for Sale – every industry has its own key performance indicator, with REITs, it is occupancy rates, with hotels, it is revenue per avaiable room (RevPAR).

- Increase/Decrease in Backlog – this KPI is more common in construction and with military contractors.

Secondly, growth must be adjusted for extraordinary events. These can include disasters, recurring natural events (hurricanes, tornados, hail, cold spells, heavy rain, etc.), or government-imposed economic changes (COVID, shutdowns, and/or military actions). Some internal events are recorded separately in the financials, including sales of divisions and property. Thus, growth is measured with traditional sales and not with costs or nontraditionl activity.

Lastly, growth must be measure against the change in growth for the particular industry. For example, the transportation sector is divided into several industries, including trucking. The government records via the Department of Commerce state that the trucking industry grew 3.2% over the prior year. XYZ Trucking reports to its shareholders that the company’s absolute gain in trucking was 3.7%. This means that in comparison to other trucking companies, XYZ Trucking’s true growth is .5% year over year. Don’t misinterpret this step, actual growth for XYZ Trucking was indeed 3.7%; however, growth in comparison to XYZ Trucking’s competition was only .5%. Here, the investor is seeking a key indicator of positive or negative comparative growth that impacts the discount rate the investor utilizes to measure intrinsic value and the corresponding ‘BUY’ value point.

An important perspective requires notation here. Every company goes through a life cycle. Really good operations will last 100+ years, think of Coca-Cola, Johnson & Johnson, GE, and so forth. But all of them will experience strong growth during the early years, no differently than how children mature into adults. Thus, early on, strong growth rates can not be maintained indefinitely. Usually, by the time a company can become a legitimate value investment consideration, the company is 20+ years old and has experienced these accelerated growth rates, and is now beginning to follow closer to the respective industry’s growth rate. There will always be exceptions to this rule, and value investors should always be skeptical of strong growth rates continuing into an extended future time frame (beyond five to seven years). A perfect example is lululemon athletica, inc. (the company purposely doesn’t capitalize its name). Since its inception back in 2007, the company has been experiencing 10% plus growth rates through 2024. In 2025, it is now beginning to see a slower growth rate at slightly less than 6%. Realize that even at 6%, this is an incredible growth rate. A value investor will realize that this cannot and will not continue indefinitely. A more practical approach is to think of excellent growth rates for measurement purposes in the four to five percent range for future sales.

There is no hard and fast rule about growth. The key is that good companies will have a positive growth rate, and it should be better than the industry’s growth rate. Try to filter out the noise and get a true absolute growth rate, and determine if the result is fair and reasonable. Finally, determine the sustainable period of time for this growth rate as this does impact setting the discount rate for many of the various formulas used with intrinsic value calculation.

Summary – Intrinsic Value Attributes

Intrinsic value customarily exists between the ‘BUY’ point and the current market value. Determining intrinsic value is first keyed to the four required attributes:

- The company in question must have a stated purpose, i.e., a MISSION. This mission must be a product/service that is sought out by consumers; the more in line this mission is with needs over wants, the more likely the intrinsic value outcome shifts towards market value.

- The right people in the right places make all the difference with a company’s ability to succeed. Good MANAGEMENT ensures that this principle of business is carried out.

- EFFICIENT PRODUCTION is the third attribute required for a strong intrinsic value outcome. This is customarily measured with the gross profit margin. Value investors look for consistency or an improving gross profit margin year over year. Any improvement is a positive indicator of success.

- REAL AND SUSTAINABLE GROWTH is the fourth attribute. Growth is measured in absolute change, i.e., growth is adjusted for inflation, new locations, and other false indicators of growth. Furthermore, this growth must be sustainable well into the future, i.e., at least five to seven years.

All four attributes are subjective interpretations of actual information provided. Value investors ascertain as much information as possible about each attribute and turn this information into objective data where possible. The result for each attribute is an outcome that provides reinforcement that the company is indeed operating up to its potential. When all four attributes indicate positive, then the intrinsic value outcome will be higher due to less risk, which is customarily addressed with the discount rate used in many of the intrinsic value formulas.

Concern comes to bear in a value investor’s thoughts when any of the four attributes are negative or doubtful. The result is a much higher risk exposure and a dramatic drop in intrinsic value. All four are required to generate a reasonable and good intrinsic value. Approach answering the four attributes with caution and think conservatively to generate an indicator for each attribute. Act on Knowledge.