Value Investment Fund – Status on July 31, 2021

“You simply have to put one foot in front of the other and keep going. Put blinders on and plow right ahead.” – George Lucas.

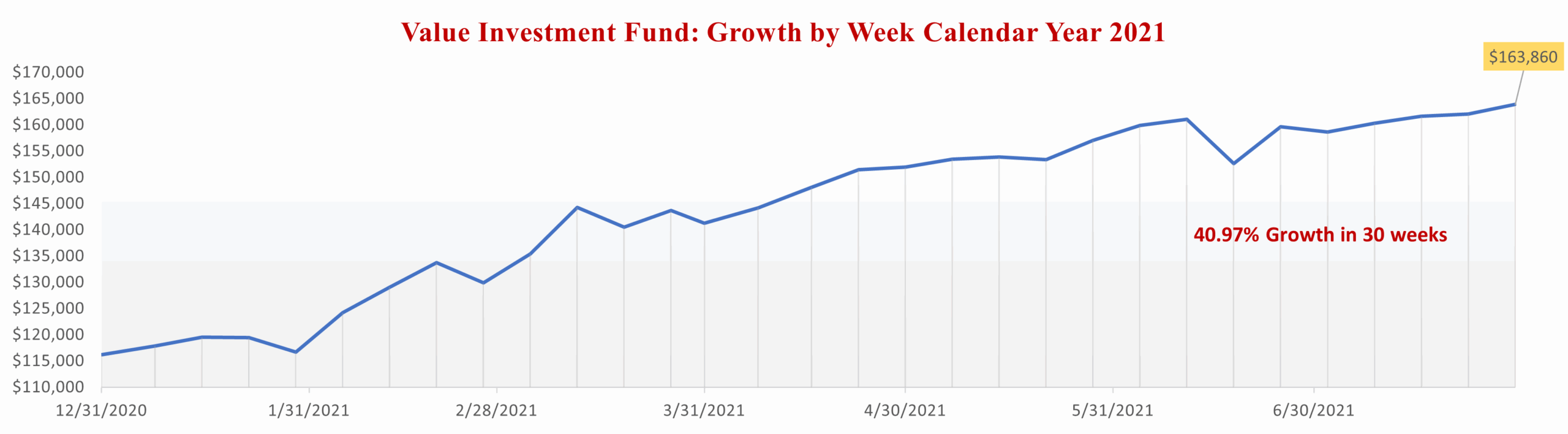

The Value Investment Fund keeps moving forward. During July 2021, the Fund’s balance improved $6,308, a 4% gain over the prior month. During July, the Fund sold both its holdings in Equity Residential and UDR. Both stocks reached their preset expected sales price, triggering the sale of the stock.

As stated multiple times throughout the lessons and tutorials, high-quality stocks have less risk and thus, resist remarkably well when the market goes down or is stagnant and recover quickly upon market rebound. Furthermore, high-quality stocks provide many opportunities to earn good rewards if properly purchased at less than intrinsic value and sold upon market price recovery. Here is the Value Investment Fund’s status report for the end of July 2021.

Value Investment Fund – End of Month Report

. July 31, 2021 June 30, 2021 July 31, 2021

REIT Pool # of Shares Cost Basis Market Price* Fair Market Value* Fair Market Value*

– Equity Residential 574.459 – – $43,658.88 Sold

– Essex Property Trust (Tranche #1) 48.9644 – – Sold Sold

– Essex Property Trust (Tranche #2) 43.2994 – – Sold Sold

– UDR 606.9803 – – 29,122.91 Sold

Sub-Totals – $72,781.79 -0-

Railways Pool

– No Stock Holdings (All six railroads are at or near their all-time highs)

Banking Pool

– Bank of New York 232.9373 10,000 50.33 11,700.44 11,723.73

. – Wells Fargo (Tranche #1) 292.0560 10,000 44.94 12,935.16 13,125.00

. – Wells Fargo (Tranche #2) 558.9715 20,000 44.94 24,756.85 25,120.18

. – Wells Fargo (Tranche #3) 234.3292 10,000 44.94 10,378.44 10,530.75

. Sub-Totals 50,000 59,770.89 60,499.66

Dividend Receivables (Bank of New York) 346.40 79.20

Cash on Hand (Basis, Gains, Dividends, PUTS) 24,732.15 103,360.22

Totals (Starting Cost Basis = $100,000) $50,000 $157,631.23 $163,939.08

*Net of transaction fees of $1.00 per share; thus, the amount in the schedule equals the actual market price per share at closing, less $1.00 per share.

On July 15th, the Fund sold 574.459 shares of Equity Residential, netting $82 per share after transaction fees. Net gain earned was $17,106. This equates to an annual return of 78%. This particular transaction generated the greatest volume of realized earnings fiscal year to date. The original basis invested was $30,000 back in late October 2020, and net proceeds equaled $47,106; overall, an excellent return on the investment.

On July 12th, UDR was sold for realized earnings of $10,956; this equates to a 77% annual return. During these last nine months, the Fund invested $70,000 and realized $37,918, including dividends. This approximates a 72% aggregated annualized return. The risk associated with the investments was extremely low due to the underlying value (intrinsic value) of the assets (properties held by the trusts). This is what value investing is all about. Getting good returns with minimal risk.

Value Investment Fund – Activity

During July, the following transactions occurred.

- Dividends were recorded for UDR for $220.03;

- Dividends were recorded for Bank of New York for $79.20;

- Sold Equity Residential for a realized gain of $17,105.64;

- Sold UDR for a realized gain of $10,956.00.

To date, the fund has realized earnings as follows:

Gains

Gain on sale of Norfolk Southern $2,678.26

Gain on sale of Union Pacific Railroad 4,620.06

Gain on sale of Comerica Bank 3,677.40

Gain on sale of Essex Property Trust (06/18/21) 7,863.67

Gain on Sale of Equity Residential (07/15/21) 17,105.64

Gain on Sale of UDR (07/12/21) 10,956.00

Sub-Total Gains $46,901.03

Dividends

Norfolk Southern (Nov) 92.39

Union Pacific (Dec) 111.50

Equity Residential (Dec/March/June) 1,039.20

Essex Property Trust (Dec/March) 294.58

Comerica Bank (Dec) 251.57

UDR (Jan/April/July) 658.87

Bank of New York Mellon (Jan/May/July) 223.62

Wells Fargo (Feb/May) 170.20

Sub-Total Dividends $2,841.93

Sale of PUTs

Expired PUTs (See Prior EOM Reports for List) 1,592.16

Union Pacific (Feb @$155/Sh) Expires January 20, 2023 1,769.23 – Market price is currently at $218.76.

Norfolk Southern (March @$190/Sh) Expires January 21, 2022 335.07 – Market price is currently at $256.16.

Sub-Total PUTS $3,696.46

Total Realized Earnings $53,439.42

Total dividends earned in Year Two year-to-date equals $2,841.93. Realized earnings and dividends receivable plus $50,000 of the original $100,000 of basis equals the total capital available for investment in other securities. In effect, the Fund now has a very strong cash position of $103,360. Almost all of the available options for investment are at or near their all-time highs. Thus, without more available selections, the Fund will have difficulty with good returns in 2022. The pressure is mounting to build two more pools of investments, broadening the overall opportunities from 18 to more than 30. Act on Knowledge.