McDonald’s Intrinsic Value

A Value Investment Fund White Paper on McDonald’s Corporation

“to be our customer’s favorite place and way to eat and drink” – McDonald’s Mission Statement.

The President, Chief Executive Officer, and Director of McDonald’s Inc. said it best in the earnings call in late January 2022 we are “… witnessing the beginning of the next great chapter at McDonald’s, …“. He continued with “2021 was a record-setting year for McDonald’s on many dimensions, …” Simply put, McDonald’s (MCD McDonald’s Corp. stock) had the best financial performance ever in its history during 2021. It just didn’t marginally exceed records; McDonald’s dramatically surpassed all financial records in its entire history. McDonald’s was already the standard bearer in the informal-eating-out industry; it took this standard to a whole new level. When a company has net profits of more than 20%, it is labeled a ‘darling’; over 25%, it is just unheard of with financial results; in 2021, McDonald’s net profit was greater than 32%, and this is after taxes. This sets such a high standard for fast-food restaurants; it is unlikely to be matched by others – EVER.

When a company performs to this level, intrinsic value soars. Intrinsic value is built on a company’s inherent worth. The more stable and reliable a company, the greater the intrinsic value for that company. The reason is simple: the discount rate used in evaluating earnings improves because management demonstrates that it can indeed perform, and in this case, perform at exceptional levels. The discount rate is synonymous with risk; as risk decreases, the discount rate decreases.

What is even more fascinating is this:

If you look at McDonald’s balance sheet, total assets on 12/31/21 are $53.8 billion; total liabilities are $58.4 billion. McDonald’s has a NEGATIVE EQUITY POSITION OF $4.6 BILLION. You read that correctly. In simple layman’s terminology, this is called ‘Bankrupt‘. Every business textbook used in college defines bankruptcy as liabilities exceeding assets. This makes McDonald’s performance just that more impressive. They are so solid, even creditors ignore this situation and will still loan money to McDonald’s. During 2021, McDonald’s was able to acquire long-term loans totaling $1.154 billion. To further validate the incredible worthiness of McDonald’s, from page 57 of their filed SEC Form 10-K (annual report), “There are no provisions in the Company’s debt obligations that would accelerate repayment of debt as a result of a change in credit ratings or a material adverse change in the Company’s business.” You can only count on one hand the number of companies that have this level of credit.

Even without a positive equity position on the balance sheet, McDonald’s is still financially rock solid.

Knowing this, how does a value investor go about determining intrinsic value for McDonald’s? You can’t use the typical balance sheet formulas; technically, they are bankrupt, and most definitely none of the equity formulas will work, except dividend yield. Thus, a value investor must turn to either income statement-based formulas or cash flow models. But before exploring these two alternatives, a value investor must first understand McDonald’s business model.

The business model is critical when evaluating intrinsic value. Knowledge of the business model greatly affects the intrinsic value formula discount rates (to be explained), and the business model provides some insight into how McDonald’s makes their money. With knowledge of the business model, value investors then determine the discount rate. This is done through a set of steps, and in turn, a narrow discount range is calculated. Once the discount rate is computed, value investors turn towards the appropriate intrinsic value formula to apply and then can build a matrix of intrinsic value outcomes. From these outcomes, a range of intrinsic value is developed and then narrowed further via some objective testing. Once a reasonable window of intrinsic value is established, a value investor can then set a margin of safety, and now a value investor has a buy price and intrinsic value. Finally, the model helps to determine yearly step-ups (adjustments) to the intrinsic value outcome with certain preset requirements, allowing the value investor to have a buy/sell decision model that will work for three to five years.

For those of you that want updated information and desire a video on this subject:

The first step is to understand McDonald’s business model.

McDonald’s Business Model

If you ask the common person what McDonald’s does, they will state that McDonald’s is a fast-food restaurant. Well, that part is undeniable. But if you research their financial statements, notes, and management responses to inquiries, you’ll discover that McDonald’s has three distinctly different businesses within their organization. Interestingly enough, the food service component is the worst financial performer of the three lines of business! The reality is this: the fast-food business isn’t that profitable.

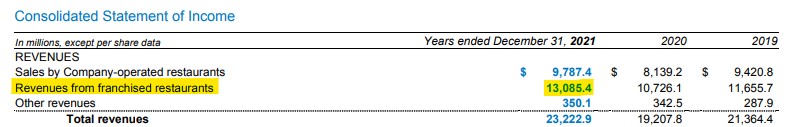

Take a look at McDonald’s three sources of revenue:

The consolidated income statement shows three revenue sources. The first are sales by company-operated stores. There are 40,031 McDonald’s restaurants worldwide. Of these, 2,736 are company-owned and operated. That $9.8 billion represents the sales at full menu price at these 2,736 locations.

The third line of $350 million represents technology fees charged to franchisees and sales from non-restaurant products. For example, if you go to the grocery store and buy McDonald’s ground coffee for your home consumption, that sale is what is recorded in that line. Overall, this line is insignificant and is not one of the three distinct business lines for McDonald’s.

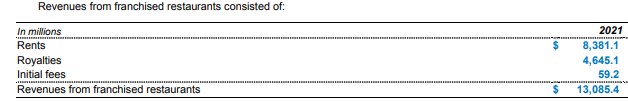

Revenues from franchised restaurants are two distinct sets of sales. Look at this breakout for sales from franchised restaurants:

Everyone is aware that franchisees pay a 4% fee to McDonald’s to use their name and sell their products. Thus, unlike company-owned stores, when a sale is processed, the sale is recorded on that franchisee’s income statement, and then they, in turn, pay a royalty to McDonald’s at the corporate level. This royalty is what is recorded as the mother company’s revenue. Thus, in reality, total worldwide sales of products in the aggregate are not $23 billion as stated above; total sales exceed $110 billion. McDonald’s at the corporate level is recording $9.8 billion from their company-operated stores and another $4.6 billion for royalties from the other 37,295 locations. Why is this so important?

Notice that so far, there are two distinct lines of revenue: first, corporate-level sales, then royalties. Thus, of the $23.2 billion in sales, $14.4 billion is directly related to the sale of food.

Look at the top line of sales from franchised restaurants. Notice that it states rents? This is the third line of business for McDonald’s. McDonald’s earns 36% of its revenue as a landlord!

McDonald’s is a franchising business, and this franchising is fully inclusive. Not only are they charging for the use of the name, but they also charge many of their franchisees for the land/building that the franchisee is operating from. McDonald’s is more of a real estate company than it is a franchisor.

This is critically important when determining intrinsic value. Real estate model formulas are dramatically different than other intrinsic value formulas. To explain this, one must understand the profitability related to each of these three distinct revenue streams. From evaluating the financial statements, the author has determined that these are the contribution margins for each of the respective three revenue streams:

*In Millions

Distinct Revenue Stream Corporate Operated Restaurants Royalties Real Estate

Revenue $9,787.4 $4,645.1 $8,381.1

Costs 8,047.3 260.4 2,335.0

Margin $1,740.1 $4,384.7 $6,046.1

. 17.78% 94.39% 72.14%

The key is the volume of absolute dollars the real estate arm injects into the company’s overall gross profit margin. Assuming all overhead expenses are equally allocated, then real estate is just slightly more than 50% of the total net profit McDonald’s generates each year. This means McDonald’s is a real estate company first, then a franchisor then it runs fast-food restaurants.

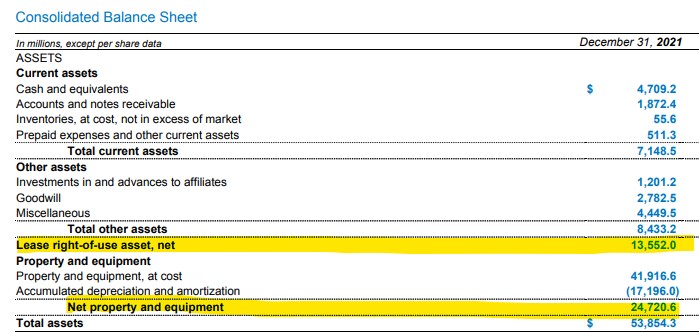

To validate this business model, look at McDonald’s balance sheet, specifically the tangible assets section.

Tangible assets equal $38.3 billion (the two highlighted lines added together). Of the $38.3 billion, lease rights are 35% of tangible assets. In addition, within the property and equipment line, about $13.3 billion of that value is for improvements on leased land. Thus, in the aggregate, $26.8 billion of the $38.3 billion is associated with the real estate arm of McDonald’s. In the aggregate, about 50% of McDonald’s total assets are directly tied to the real estate function.

What McDonald’s is doing is acting as a real estate broker. They seek out prime spots in good locations and proceed to acquire long-term rights via leases to this property. Then, they infuse some capital to develop the site, including access/egress, utilities, zoning, and in some cases, site preparation (clearing, drainage, curbs, sewage lines, etc.). Once the site is fully ready, a franchisee is approached to sub-lease the site from McDonald’s and build a restaurant.

The rent charged is about four times the amortizable cost associated with that site. It is a very powerful model for real estate management. What is outstanding is this: it locks in revenue for a certain period (at least 20 years). Locking in revenue streams is one of the key characteristics of stability. Stability is the number one determinant of risk. The more stable a company, the less risk is involved, which in turn reduces the discount rate.

It is this discount rate that is used in multiple versions of the intrinsic value calculation.

Intrinsic Value – Setting the Discount Rate

A discount rate is a cost-of-money factor. It is mostly used to determine the current value of a set of future inputs. A simple way to think of a discount rate is to envision it as the cost of money due to inflation. Thus, future receipts of cash are not worth as much as a current receipt is at this moment. Intuitively, we know that $100 today is worth $100; but, a $100 receipt 10 years from now is not worth $100 today. There will be inflation in the interim. Thus, that $100 receipt might only be worth $70 today.

In addition to inflation, there are other factors to consider; most of these other factors play a greater role than traditional inflation and will force the discount factor higher. Other factors include:

- What kind of return does the receiver of money want for their investment? In this case, a shareholder is willing to pay a certain sum to hold a share of stock in McDonald’s. Thus, how much of a return does an equity position owner desire, and what is fair?

- How easy is it to dispose of the investment? The more difficult it is to sell your equity position, the higher the risk, and as such, the discount rate must go up too. For example, for those that own small businesses, how difficult and time-consuming is it to sell your ownership in a small business in comparison to selling stock with a DOW-level equity position? With McDonald’s, there are always willing buyers for this company; therefore, there is very little risk that this will be an issue seven or ten years from now.

- What is the risk tied to the industry this company operates within? Remember, from above, McDonald’s is more of a real estate broker than a fast-food operation. Fast-food operations are at a greater risk than real estate brokers. When determining this risk element in the discount rate formula, McDonald’s discount amount will be much less than Shake Shack’s because Shake Shack is not a franchisor (they have 11 out of the 360 locations, which in the overall scheme of things means they have no franchisees). Both McDonald’s and Shake Shack are in the Informal-Eating-Out industry, yet one’s discount rate tied to this risk component is significantly lower than the other party’s.

- Size factor also affects the discount rate. The larger the organization and the more geographically spread out, the lower the overall risk associated with this element of computing the discount rate. In effect, economy of scale has a dramatic impact on risk reduction.

There is a five-part formula for setting discount rates for every entity. The following walks the investor through the five steps.

Step I – Perfectly Safe Investment Yield

Use the core government bond yield to acknowledge the discount for a perfectly safe investment. This should match the closest time frame related to the time frame for the discount application for the respective investment. In this step, a long-term yield is desired. The current 30-year no-risk yield is 2.46%.

Step II – Additional Yield for a Pure Equity Position

The next layer of discount reflects what a reasonable individual would desire for a pure dividend yield for their investment. A respectable amount is around 2.75%. Anything less than 2.4% is unreasonable for high-quality investments, and anything greater than 2.9% is unusual, although sought after.

Step III – Risk Factor to Dispose

In the overall scheme of security investments, stocks are typically the most risky group. Thus, a risk premium is applicable. The more market capitalization involved, the less of a risk factor exists. McDonald’s is a DOW Jones Industrial Average stock, and as such, DOW members are considered the least risky of all stock securities. Here, only a .25% additional discount is necessary to adjust for this position within the market.

Step IV – Industry Risk Factor

The informal-eating-out industry has had an interesting history related to its risk element. In an unusual display of resilience, right after the recession started in 2008, for some reason, fast-food restaurants experienced a surge in sales. The thinking is that fast food substituted for sit-down restaurant-style eating. In effect, people shifted their eating-out habits but continued to eat out. Still, this industry is highly susceptible to unusual and infrequent circumstances. COVID proved this, and of course, supply chain issues do exist. Thus, the risk factor here is much higher than the disposal risk. For McDonald’s, this risk factor is around 1.25%.

Step V – Economy of Scale

Just recently, the Russian-Ukrainian War has demonstrated the exposure McDonald’s has to international locations. McDonald’s has pretty much lost the revenue and profitability related to the almost 1,000 corporate-owned locations in Russia and Ukraine. Although the locations in Ukraine will reopen in several years, the locations in Russia are closed permanently due to the worldwide economic exclusion of Russia.

This is a big hit to revenue tied to these locations; however, it will not impact the bottom line significantly. The reason is due to the profitability of corporate-owned locations (see Business Model above). The net maximum impact for those stores may be around $250 million per year on the bottom line. With a net profit in 2021 of $7.5 billion, the loss of Russian locations will impact future profits by a negative 3.1% for the foreseeable future. This is an example of the impact (risk factor) tied to the company level. Naturally, the larger and more geographically diverse the company, the less risk is involved. The war is an example of unique circumstances and highly unusual. But this just further solidifies the need to be geographically dispersed as much as possible in order to minimize the impact of unusual events. Given the situation, McDonald’s is still geographically spread out and as such, a risk discount value of .5% is appropriate for the economy of scale. Remember, McDonald’s still has over 39,000 restaurants remaining worldwide. For comparison purposes, only Starbucks comes close with almost 34,000 locations. Wendy’s has around 6,800 restaurants; Chipotle has around 3,000 stores. Thus, McDonald’s is in the best overall position for economies of scale.

Combined Discount Rate

To sum up the discount rate, add all the respective values together:

- Step I – Perfectly Safe Investment 2.5%

- Step II – Desired Dividend Yield 2.75%

- Step III – Disposal Risk .25%

- Step IV – Industry Risk 1.25%

- Step V – Economy of Scale .5%

Cumulative Discount Risk Factor 7.25%

There are some general guidelines related to the overall setting of discount rates for investing purposes. First, expect the range to be as low as 7% to as high as 13% for value investment-related securities. Securities that are in the penny stock to small cap range will have discount rates much higher than 13%. At the other end of the spectrum are the DOW Jones Industrial Companies. They will range from 7% to as high as 9% depending on their management team, production performance, and their overall stability. Remember, the more stable and well-managed a company, the lower the discount rate. Top-end operations such as McDonald’s, Coca-Cola, Apple, and Verizon will have discount rates between 7% and 7.5%. The only reason McDonald’s didn’t hit the lowest (best) mark of 7% is directly tied to the loss of the restaurants in Russia due to the sanctions placed on that country. It was an acknowledged risk many years ago when this venture was pursued, and unfortunately, it will not pan out for McDonald’s.

With the discount rate set, a value investor can now proceed to utilize the best formula to evaluate the total value for McDonald’s.

Intrinsic Value – Appropriate Intrinsic Value Formula

There are about a dozen or so popular intrinsic value formulas. No particular formula fits all situations. When calculating intrinsic value, it is best to use several formulas and weight them according to their overall importance given the nature of the company’s business model and financial matrix.

Balance Sheet Formulas

McDonald’s is somewhat unique in that most of the balance sheet intrinsic value formulas will not work. This is due to the negative equity position the company carries. A dividend yield of 2.75% would generate an intrinsic value of around $201; a desired yield of 2.5% would set the intrinsic value at $222. Given the nature of this company with its well-run operation, a dividends-based investor would want something around 2.9% as the dividend yield; thus, the buy price would be around $191 per share. Therefore, the dividend yield thinking would bring a value range of $191 to $222.

Since balance sheet-based formulas are impractical, other types of formulas are better alternatives. The initial thinking is to use cash flow as the basis of determining intrinsic value.

Cash Flow Formulas

Discounting cash flow is the most common intrinsic value formula used. The reasoning is based on the theory that ownership of an asset (in this case, a security) is worth all the future cash inflows discounted to a current value. However, this particular financial formula is designed to assess whether the price of a producing asset is worth the expenditure today. The future cash inflows are discounted based on a desired rate, typically the cost of capital for the company. With the traditional application, cash inflows are relatively accurate and reliable.

When using the formula at the equity level of investment, the user must qualify the formula for several underlying elements, plus the fact that not 100% of all inflows will purely benefit equity stakeholders. As stated, the discounted cash flows method assumes future cash inflows are accurate and reliable.

Underlying elements include accrual adjustments, costs to maintain the balance sheet fixed assets, and other types of cash flows statement adjustments. Very few people are trained in how the cash flows statement works. Even among CPA’s that are formally educated in calculating cash flows, only a small percentage truly understand the complexity. Thus, these so-called experts who just arbitrarily use cash flows or even free cash flows to determine value don’t adjust cash flows for all these accrual and other timing differences. The results can be woefully inaccurate. This is just the beginning of how inappropriate it is to simply default to this formula. There is more.

The second flaw with this method is several-fold. First, it assumes that all future cash inflows will be used to 100% benefit the asset owner. The reality is far different. For those companies that pay strong percentages of their earnings as dividends, the discounted cash flows method may have better merit. But most companies allocate their cash inflow to purchasing opportunities or maintaining productive assets, or simply improving the balance sheet by reducing debt or adding cash to the asset side of the balance sheet. Rarely, if ever, is there a true 100% benefit to the equity holders. Secondly, the discounted cash flows method must be qualified for terminal value. Terminal value is quite complicated and is only applicable to operations that utilize long-term assets that generally appreciate over time. This includes real estate, certain territorial rights, licensing privileges, and certain synergetic portfolios (think of railroads, utilities, metro systems, and airports).

McDonald’s doesn’t really qualify for using the discounted cash flows method to determine intrinsic value. Let’s be clear here, most of the franchising arrangements, along with those lease contracts, have definitive ending dates. Therefore, there is no continued use of those assets. Granted, McDonald’s can resell the franchise rights, etc., but they must renegotiate land lease rights at some point in the future. In addition, if you review the cash flows statement, you will discover that if you were to adjust for accruals and other timing differences and then adjust for capital expenditures, you will discover that real cash flows to utilize the discounted cash flows method are LESS THAN earnings on average. As such, using the discounted cash flows method to determine intrinsic value for McDonald’s is a mistake; an error that increases risk for a value investor.

Discounted Earnings Formulas

The best method of determining intrinsic value for McDonald’s is to use one of the variant versions of discounted earnings. There are several variations of this model.

One of the original tools used is the old core model advocated by Benjamin Graham and David Dodd. Their formula is grounded in earnings and a basic growth rate. Their formula is:

Value equals Earnings times ((a factor of 8.5 plus (2 times growth rate));

McDonald’s Intrinsic Value = Earnings X ((8.5 + (2XGrowth));

McDonald’s Intrinsic Value = $10.04 X ((8.5 + (2X3.5)); Assumes a growth rate of 3.5% per year;

McDonald’s Intrinsic Value = $10.04 X 15.5;

McDonald’s Intrinsic Value = $156 per share

The question here is, ‘What is McDonald’s Growth Rate?’ For now, let’s leave this at 3.5% per year. This element of the intrinsic value is explained in a much deeper context further below in this section.

A second and more common version of the discounted earnings method is to average the comprehensive income over the last five years, weighting the respective years. Since COVID is an unusual and infrequent event, it is wise to fully disregard 2020 in the formula. Using a weighted factor of 50% for 2021 and 25% for 2019 and so forth for five full years, the average annual earnings are as follows:

Year Comprehensive Income Weighted % Effective Income

2021 $7,558 Million 50% $3,779 Million

2019 6,152 Million 25% 1,538 Million

2018 5,493 Million 15% 824 Million

2017 6,109 Million 5% 305 Million

2016 4,473 Million 5% 224 Million

Average $6,670 Million

Using this average annual income discounted at 7.25% with a growth rate of 3.5%, the cumulative intrinsic value for McDonald’s equals $139,756,000,000. With 744.8 million shares trading in the market, each share is worth approximately $187.64. Again, the key is IF the growth rate is 3.5%.

With a stronger growth rate, the value will increase dramatically. To illustrate, if McDonald’s growth rate is 4%, each share is now worth $202.90. At a 3% growth rate, McDonald’s share value drops to $174. Thus, the growth rate does play a dramatic role in determining McDonald’s value. So what is McDonald’s growth rate?

McDonald’s Growth Rate

Before delving into McDonald’s growth rate, there are some general guidelines related to growth, specifically the growth rate during the life cycle of a company. The best descriptive comparison is that with good companies, their growth rate mimics human beings. Growth starts slowly, and it takes four to five years to gain momentum. During those teenage years, companies experience massive growth, and then there is maturity and aging. Thus, as a company heads towards greater stability and maturity, annual growth rates decrease. Thus, value investors should expect to see around three to five percent growth per year for fully mature companies.

Overall, the economy is expanding at two to three percent per year. In addition, each industry experiences growth too. For these two functions, the growth rate is incorporated into the discount rate. As stated in the second section above, take note of the rules/guidelines tied to both economic and industry-related risk factors and their impact on the discount rate. What investors are interested in is the growth rate of the company itself. This can be measured in several different ways. With fast food, you could determine growth based on the number of restaurants or adjust the financial revenue growth by economic growth to determine financial growth. With some industries, growth rates can be determined by the expansion of the primary assets that generate real value.

Remember from above, what is McDonald’s business model? The core profit generator is the real estate arm of operations. To determine this aspect of business growth, compare rent revenues generated 11 years ago to revenue generated this past year.

2010 $5,198 Million

2021 $8,381 Million

This means that over 11 years, total rent receipts increased $3,183 million or about 4.4% per year on average. This 4.4% growth rate is not the growth rate to use. However, it does impact the overall growth rate the most. The second growth rate asset for McDonald’s is the number of franchisees and their growth rate over the same period. In 2010, there were 29,420 franchisees. At the end of 2021, 11 years later, the are 37,295 franchised restaurants. This is an annual growth rate of 2.2%. From the business model above, the real estate arm provides 50% of the profit margin, and franchising provides another 36% of the profit margin. About each other, the real estate aspect of operations is 58% of the value of growth and therefore contributes 2.56% growth. Franchising is 43% of the value of growth and thus, it contributes about .95% of the total growth of McDonald’s. Adding the two items together, it is fair to say McDonald’s is growing at around 3.51% per year. Most likely, it is just slightly higher due to the other revenue streams (corporate restaurants and other income).

Using a 3.6% growth rate is a reasonable and fair growth rate for the purpose of future revenues.

The outcome is this:

Using a 7.25% discount rate and a 3.6% growth rate over 40 years, with a starting point of $6.67 billion comprehensive income, the total market value of McDonald’s is approximately $141,927,900,000. With 744,800,000 shares in the market, each share’s intrinsic value is estimated at around $190.56.

No other intrinsic value formula will get this value as accurately stated as the discounted earnings method with an appropriate growth rate. The question is now, does this, and is this a reasonable and fair assessment of McDonald’s intrinsic value?

Intrinsic Value – Objective Testing

A solid business ratio that provides good insight and objective results is the market price to earnings ratio. The ratio does have flaws, and the key is to properly apply the ratio to minimize or negate these inherent flaws. One of the inherent flaws with this ratio is that it is often used as an instant ratio, i.e., what is the current market price to earnings at this moment? The issue here is, of course, earnings. Earnings fluctuate from quarter to quarter and from year to year. Averaging these earnings eliminates this inherent flaw. With this ratio, it is applied in reverse; here, a value investor seeks an intrinsic value price based on earnings. Each industry has a range (a multiplier) of earnings to determine intrinsic value. The stronger performers in this industry have higher intrinsic values per dollar of earnings. As an example, Shake Shack has hardly earned any money since its inception twenty years ago. Its intrinsic value price to earnings is less than 10:1. Wendy’s earns less than 90 cents per share. Its multiplier is just a mere 12; this sets Wendy’s intrinsic value to less than $10 per share.

From above, McDonald’s average earnings per share are $8.96 per year. The fast-food industry’s price-to-earnings ratio range is broader than other industries. This is due to the higher-than-normal reliance on consumer discretionary income used to make those marginal purchases of meals. Thus, low price-to-earnings ratios of 12 to 14:1 are representative of buy ranges for fast-food securities, and intrinsic value ranges are 16 to 18:1. Since McDonald’s is the standard bearer for the fast-food industry, intrinsic value should and is at the top end of this range. Thus, having an 18:1 or even upwards of a 20:1 intrinsic value price to earnings ratio representing intrinsic value is reasonable. At 20:1, intrinsic value is approximately $179 per share.

From above, intrinsic value is estimated at $191 per share or a 21.3 to 1 price to earnings ratio. Thus, the outcome based on discounted earnings is slightly higher than the anticipated price-to-earnings ratio. Using the most recent year of $10.04 per share of earnings, at 19:1, the price to earnings ratio estimates intrinsic value at $191 per share. Again, only McDonald’s warrants this high price-to-earnings ratio as it is not only the standard bearer within this industry, but it also outperformed all other similar companies. Thus, only McDonald’s commands such a high price-to-earnings ratio as an objective test to validate the intrinsic value calculated using the discounted earnings method.

A second objective test looks at McDonald’s as no different than a pure flip investment, similar to how house flippers look at their opportunities. House flippers take the current market value for a comparable asset, and in turn, they are willing to spend about 60 cents on the dollar to buy a distressed property and renovate the property. The idea is to invest 60 cents on the dollar and place the asset back in the market and sell it at the expected market price. With securities, this means a value investor would look at the most recent peak market price and would want to buy this asset at 60 cents on the dollar.

With value investing, the buy price is customarily five to as much as twenty-five percent discounted from intrinsic value. The more secure and stable the particular investment, the lower the discount applied against intrinsic value. With McDonald’s, a seven percent discount to intrinsic value is appropriate. First, the company is quite stable, and it is also well managed. Thus, there is limited to no risk involved with buying at a seven percent discount against intrinsic value. This means, with an intrinsic value of $191 per share, a good buy price for a value investor is $178 (7% discount against $191).

This buy price of $178 is then the basis for the 60 cents on the dollar concept. In effect, what is the market price for a security that one is willing to buy at 60 cents on the dollar if that equals $178? The answer is that the market price should have been or is currently near $297 per share. Looking back at McDonald’s market price for the last three years, the highest selling price was $271 per share back in late December 2021, early January 2022. At 60 cents on the dollar, then, the buy price would be approximately $163 per share, and if this is a 7% discount to intrinsic value, intrinsic value would approximate $175 per share.

It would appear that the calculated intrinsic value of $191 per share is about nine to 10% too high.

McDonald’s Intrinsic Value – $184 Per Share

These two objective tests seem to indicate that $191 per share as intrinsic value is strong. For those of you who are not regular members of this site’s course of study in value investing, it is stated multiple times and is taught that intrinsic value is a range supported by more than one formula.

Based on the results with the desired dividend yield, discounted earnings using a reasonable growth rate, and the objective tests, it would appear that the intrinsic value at $191 per share is at the higher end of the intrinsic value range. Thus, intrinsic value is most likely three to four percent lower than $191. Even though the dividend yield range was determined to be between $191 and $222 per share, it is apparent that McDonald ”s greater than 50% dividend payout from earnings is not enough to justify buying this stock at $191 per share.

The result is this: two objective tests indicate that an intrinsic value of $191 is too strong. The dividend yield of 2.9% results in a valuation of $191 per share, too. Thus, investors are indicating that with such a high-performing company like this, dividend yields should be even higher (3.1% to 3.3% range), lowering the intrinsic value slightly.

Based on all the above, McDonald’s intrinsic value is $184 per share. A buy price is set at a 7% discount to this intrinsic value; therefore, it is recommended that value investors buy McDonald’s stock at $171 per share.

As noted throughout the Value Investment Fund articles, posts, and decision matrices, the Fund takes a conservative position overall in estimating intrinsic value. Although $191 per share is justifiable, conservative thinking demands a more prudent valuation, and as such, this site’s Value Investment Fund Fast-Food Industry Pool will use $184 as intrinsic value as of April 2022. In addition, this intrinsic value increases at $2 per share per quarter and is this Value Investment Fund’s buy/sell model for McDonald’s for the next two years. Thus, once the quarterly report is issued in late April, the intrinsic value will increase to $186 per share, and the corresponding buy price will increase to $173 per share.

A reasonable and fair selling price for this stock is $235 per share. Act on Knowledge.