Essex Property Trust, Inc. – Sold PUTs

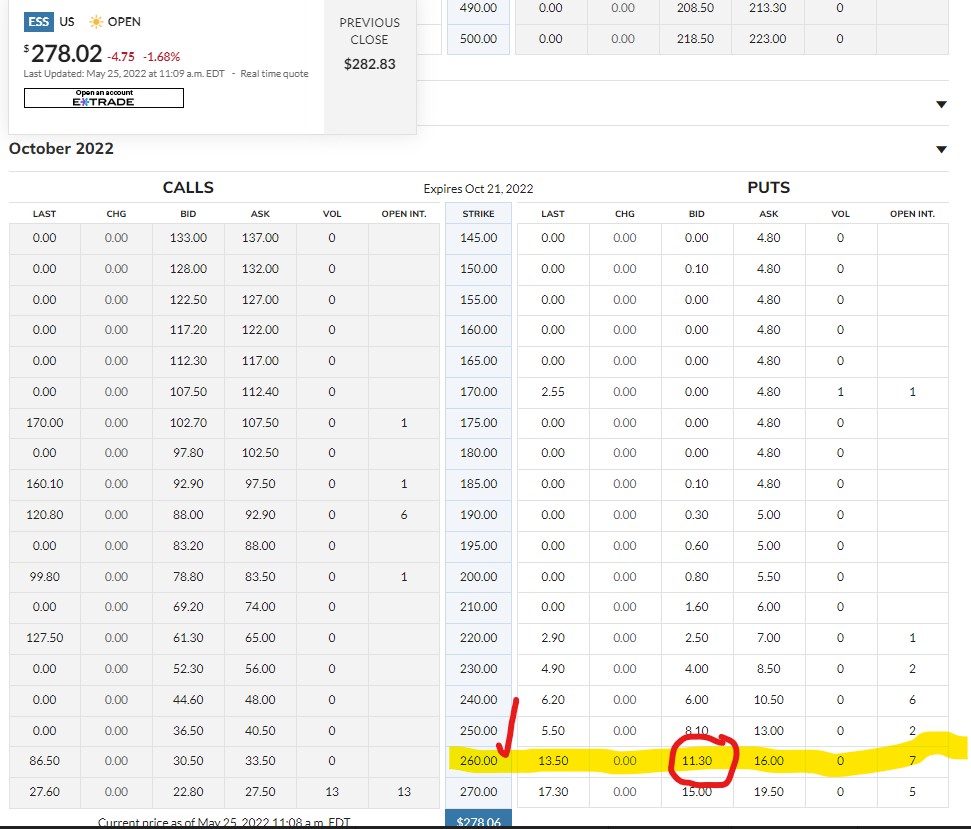

This morning at 11:14 AM (05/25/22), the Value Investment Fund sold 80 PUTs on Essex Property Trust, Inc. at $11.30 netting $10.30 each after transaction fees. These PUTs have a strike price of $260 each and expire on October 21, 2022.

The Fund uses options, specifically PUTs, to augment the income and boost the overall return of the Fund. The concept is simple. The Fund wants to own certain pre-qualified investments at certain prices; that is, market prices that are well below intrinsic value as calculated for the respective investments. These investments are basically the top 2,000 companies trading in the United States, have a good history of performance, and are highly stable. Currently, there are 49 researched potential investments spread among 8 different industry pools. Within the REITs Pool sits a well-respected and well-managed REIT, Essex Property Trust, Inc.

In January of 2021, the Fund evaluated Essex Property Trust and determined intrinsic value at about $256. It updated the intrinsic value calculation to $286 this past week. Yesterday, the Fund purchased 71.6846 shares at $278 a share and a $1 per share transaction fee. As the market price for a particular investment goes down, the option price for a PUT increases. Thus, a seller of a PUT, in this case, the Fund, can sell this insurance policy to a buyer at a better price. In this case, the strike price is $260 per share, and a buyer is willing to pay $11.30 to the seller to force the Fund to buy this stock from the current owner at $260 per share. Naturally, the owner would only exercise this option if the price ever falls below $260 per share; typically, it would need to fall at least $5 per share lower to make the owner (buyer) enforce the policy; that is, make the Fund buy the shares from the holder of the PUT. The current owner of the stock is concerned that the price will continue to fall and wants to get out of their position for $260 per share.

As noted in the year-end report for December 31, 2021, the Fund is allowed to sell PUTs, obligating the Fund for a maximum of $62,603. The Fund currently has exposed positions as follows:

- Union Pacific Railroad – Sold in Feb 2020 with a strike price of $155/share and an expiration date of January 21, 2023 $20,000

- Huntington Ingalls Industries – Sold in January 2022 with a strike price of $170/share and an expiration date of June 17, 2022 $20,000

- JPMorgan Chase & Co. – Sold in May 2022 with a strike price of $80.00/share and an expiration date of June 16, 2023 $20,000

The Walt Disney Company – Sold in May 2022 with a strike price of $105.00/share and an expiration date of October 21, 2022 $21,200Exercised on May 12th- Essex Property Trust, Inc. – Sold in May 2022 with a strike price of $260.00/share and an expiration date of October 21, 2022 $20,880

Total obligation if all four positions in PUTs are exercised at once: $80,880. However, please note that the Huntington Ingalls Industries position expires in three weeks. The Fund’s Facilitator authorized a deviation from the limit due to the fact that two of the positions in PUTs are more than 28% less than current market prices. It is so unlikely the market will drop this much during the next five months when the Essex Property Trust, Inc. option expires. In addition, the Fund is currently sitting on $44,000 of cash to comply with any fulfillment requirements for the two options currently ‘near the money’, i.e within within 15% of the strike price. The closest being Essex Property Trust, Inc., at 8.5% of the strike price ($260 X 1.085 = $282). The Fund’s Facilitator agrees to hold back a minimum of $20,000 until Huntington Ingalls Industries’ option expires June 17, 2022. In effect, only $24,000 is currently available to take advantage of any possible opportunities to buy low. Given the resistive nature of high-quality companies to mirror the market as it takes deep dives in valuation, it is highly unlikely any of these option positions will have to be exercised. However, it would be welcomed if any of them could come to fruition, as value investing is structured around buying securities at extremely low prices.

Current market prices (05/25/22) for the respective possible commitments are:

- Union Pacific Railroad – $217.42 Strike Price $155.00

- Huntington Ingalls Industries – $206.07 Strike Price $170.00

- JPMorgan Chase & Co. – $127.25 Strike Price $80.00

- Essex Property Trust, Inc. – $284.17 Strike Price $260.00

Finally, REITs are excellent investments due to their legal requirement to distribute earnings to shareholders. Under the U.S. Tax Code, REITs must distribute as dividends at least 90% of earnings each year. Essex Property Trust’s next dividend is July 15th for holders of record on June 30th. The dividend is $2.20, making this particular stock’s dividend yield at $260 per share a smart 3.38% annually. Act on Knowledge.