Value Investment Fund – June 30, 2023

Value Investment Fund – Status on June 30, 2023

. June 30, 2023 May 31, 2023 June 30, 2023

. # of Shares Cost Basis Net Market Price* Net Fair Market Value* Net Fair Market Value*

REITs

. – Essex Property Trust, Inc. (Tranche #1) 71.6846 $20,000.00 $233.30 $15,416.49 $16,724.02

. – Essex Property Trust, Inc. (Tranche #2) 77.7000 20,000.00 233.30 16,710.16 18,127.41

. – Essex Property Trust, Inc. (Tranche #3) 100.0000 22,221.00 233.30 21,506.00 23,330.00

. – Essex Property Trust, Inc. (Tranche #4) 180.0000 44,980.00 233.30 38,710.80 41,994.00

. Sub-Total 429.3846 107,201.00 $92,343.45 $100,175.43

. – AvalonBay Communities 100.0000 17,083.80 189.27 $17,298.00 $18,927.00

Railroads

. – Norfolk Southern Railroad 100.0000 21,012.00 225.76 $20,718.00 $22,576.00

Entertainment

. – The Walt Disney Company (Tranche #1) 180.1801 20,000.00 $88.28 $15,668.46 $15,906.30

. – The Walt Disney Company (Tranche #2) 200.0000 21,200.00 88.28 17,392.00 17,656.00

. – The Walt Disney Company (Tranche #3) 198.0198 20,000.00 88.28 17,219.80 17,481.19

. Sub-Total 578.1999 61,200.00 $50,280.26 $51,043.49

Banking

. – Wells Fargo (Tranche #1) 100.0000 4,267.50 41.68 $3,881.00 $4,168.00

. – Wells Fargo (Tranche #2) 400.0000 15,804.00 41.68 15,524.00 16,672.00

. Sub-Total 500.0000 20,071.50 $19,405.00 $20,840.00

Dividend Receivables (Essex/AvalonBay) -0- 1,156.88

Cash on Hand (Basis, Gains, Dividends, PUTS) 1,458.44 684.86

Totals (Starting Cost Basis = $100,000) $226,568.30 $201,503.16 $215,403.65

Accrual adjustment for taxes 7,323.04 3,641.79

Totals Net of Taxes (Recapture) $208,826.20 $219,045.44

Margin Account (AvalonBay/Norfolk Southern Purchase) (36,986.22) (36,986.22)

This portfolio’s value is AFTER TAXES of 28% on all realized gains. Total taxes paid to date 35,150.98 35,508.50

Comparative Gross Return Since Inception $206,990.96 $217,567.72

Unrealized Earnings (Value of Respective Market Prices Less Cost Basis/Fees at Point of Sale) $(26,153.72) $(13,006.39)

*Net of transaction fees of $1.00 per share; thus the amount in the schedule equals the actual market price per share at closing less $1.00 per share.

Value Investment Fund – Potential Obligations

The Value Investment Fund‘s current exposure related to PUT options is as follows:

Norfolk Southern Corporation – sold in September (200 Shares) with a strike price of $145 and an expiration date of January 21, 2024 $29,000

Essex Property Trust – sold 12/30/22 (100 Shares) with a strike price of $170 and an expiration date of July 21, 2023 $17,100

Union Pacific – sold 12/30/22 (200 Shares) with a strike price of $145 and an expiration date of August 18, 2023 $29,200

L3 Harris Technologies – sold 12/30/22 (100 Shares) with a strike price of $150 and an expiration date of October 20, 2023 $15,100

Marriott Hotels – sold 12/30/22 (100 Shares) with a strike price of $90 and an expiration date of January 19, 2024 $9,100

Essex Property Trust – sold 03/17/23 (100 Shares) with a strike price of $200 and an expiration date of October 23, 2023 $20,100

Huntington Ingalls – sold 03/17/23 (200 Shares) with a strike price of $185 and an expiration date of September 15, 2023 $37,200

*Total financial commitment = $156,800

Market prices on June 30, 2023 are:

- Essex Property Trust (Expiration 07/21/23) $234.30 (Strike Price of $170.00) Current Deviation = 37.82%

- Union Pacific (Expiration 08/18/23) $204.62 (Strike Price of $145.00) Current Deviation = 41.11%

- Huntington Ingalls (Expiration 09/15/23) $227.60 (Strike Price of $185.00) Current Deviation = 23.03%

- L3 Harris Technologies (Expiration 10/20/23) $175.92 (Strike Price of $150.00) Current Deviation = 30.51%

- Essex Property Trust (Expiration 10/23/23) $234.30 (Strike Price of $200.00) Current Deviation = 17.15%

- Marriott Hotels (Expiration 01/19/2024) $183.69 (Strike Price of $90.00) Current Deviation = 104.10%

- Norfolk Southern Corp (Expiration on 01/21/24) $226.76 (Strike Price of $145.00) Current Deviation = 56.38%

*Deviations > 25% are considered favorable.

Earnings realized during April/May/June 2023:

- Norfolk Southern – $1.35/Share, 100 Shares = $135.00

- Wells Fargo Bank – $.30/Share, 500 Shares = $150.00

- Essex Property Trust – $2.31/Share, 429.3846 Shares = $991.88

- AvalonBay Communities – $1.65/Share, 100 Shares = $165.00

1st Quarter Earnings Summary:

- Gains from Securities $20,412.00 *Comerica Bank (See Summary Section Below for Transaction Information)

- Dividends 2,131.53

- Sale of PUT Option Contracts 1,840.00

Sub-Total 1st Quarter Earnings $24,383.53

2nd Quarter Earnings Summary:

- Dividends $1,441.88

Total Earnings to Date 2023: $25,825.41

Realized Return Year-to-Date 2023: 17.88%

Taxes Paid Year-to-Date 2023: $7,231.11 ($25,825.41*.28)

Summary – Value Investment Fund First Half of 2023

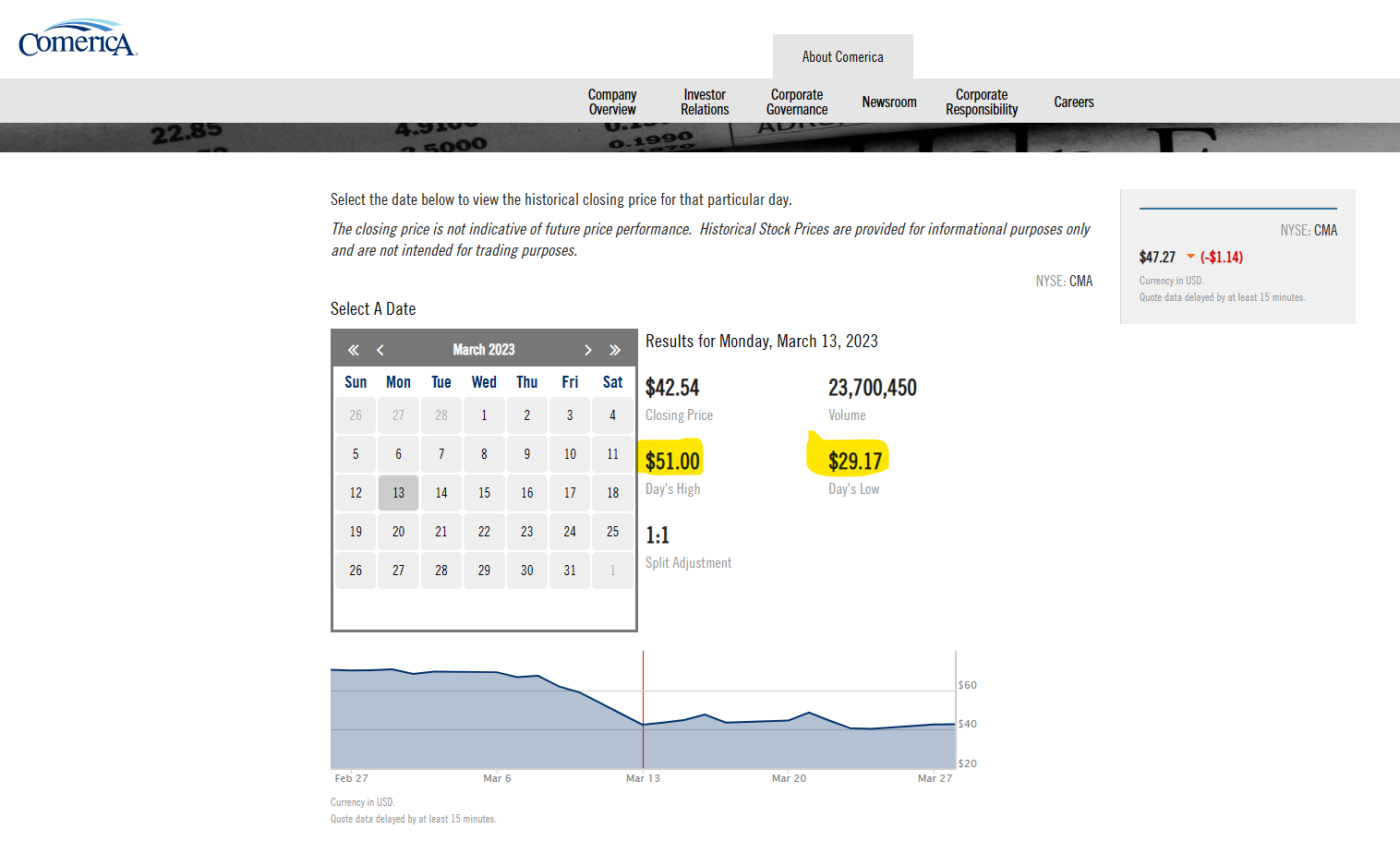

One of the rare positive outcomes of having an in-depth knowledge of a particular industry is the ability to take advantage of an unusual and infrequent wild swing in market price for a particular member within the securities pool of investments. This occurred with Comerica Bank (Comerica Inc.). In Lesson 9 of this site’s Value Investment Program, the facilitator goes in-depth about Comerica Bank and how it frequently has dramatic swings with its market price. Comerica’s book value is nearly $50 per share. Thus, anytime the share price drops quickly and dramatically (more than 5%) it is an opportunity to buy. Well, this happened on March 13, 2023. The transactions were recorded in real time on that day.

Bought Comerica Bank / Value Investing – ValueInvestingNow.com

Sold Comerica Bank Two Hours Later / Value Investing – ValueInvestingNow.com

Look at that day’s swing with market price per share:

The Fund purchased 1200 shares when the price dipped below $30 per share early that morning. By midday, the price had recovered to just over $50 and the Fund sold the shares. This $20 per share differential on 1200 shares less transaction fees and associated borrowing fees generated a net gain of $20,412. This is a direct reflection of having in-depth knowledge about this particular company, the banking industry and intrinsic value. Act on Knowledge.