Intrinsic Value Does Not Equal Book Value

Understanding intrinsic value is crucial to effectively applying value investing principles. There are several misunderstandings about intrinsic value. One of the most common statements presented by so-called experts on investing is that intrinsic value is directly related to book value. Intrinsic value does not equal book value; there isn’t even a mild correlation to book value. Look at the following case concerning McDonald’s Corporation.

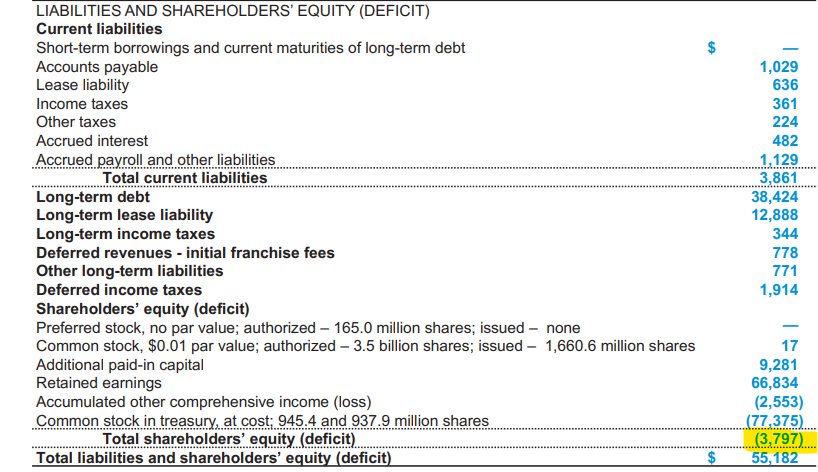

At the end of Fiscal Year 2024, McDonald’s balance sheet revealed that McDonald’s had a $3.8 billion deficit.

Stockholders hold 715.2 million shares. Each share’s book value equals a negative $5.31 ($5.31). Again, for clarity, McDonald’s is by textbook definition ‘bankrupt’ (liabilities are greater than assets). Each shareholder would receive ZERO if the company stopped operations tomorrow. The company has had an upside-down balance sheet for the entire current century.

What do you think is McDonald’s intrinsic value?

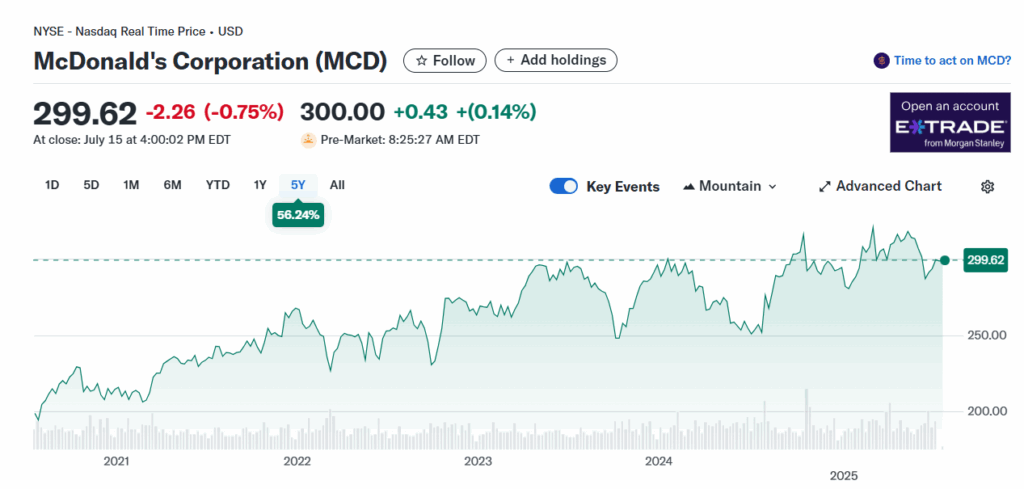

It isn’t a negative $5 (book value). Based on McDonald’s history of earnings, strong cash flow, and unique liabilities structure, McDonald’s intrinsic value is approximately $196 per share. In effect, the intrinsic value is $200 greater than book value. McDonald’s is a DOW Industrial (one of the top 30 companies in the world). It has net earnings of more than $8 billion after taxes, earning around $11 per share per year. The market price for McDonald’s has hovered in the $250 to $320 range over the last three years; see the graph below:

In general, with almost all corporations that have market values greater than $5 billion, intrinsic value will not equal book value. With extremely small companies and new start-ups, there is a higher correlation of intrinsic value to book value. This is because these types of entities do not have a strong history of earnings or proven stability. Stability, consistent earnings, and solid operations generate intrinsic value, and these attributes develop a separation between intrinsic value and book value.

Now, with that stated, there are some exceptions to the rule. Some industries are highly susceptible to market conditions or are thinly capitalized, and as such, the nature of their operations will not allow stability or consistency with earnings. A good example is the banking industry.

One of the fundamental rules of determining intrinsic value for banks is that intrinsic value will never exceed 1.25 times book value. The underlying assets are loans. Loans will rarely appreciate like real estate or market share. As such, the intrinsic value for banks has a strong correlation to book value. Furthermore, banks are thinly capitalized, highly regulated, and susceptible to interest rate changes as set by the Federal Reserve.

As an example, Wells Fargo’s book value per share is approximately $42 per share as of June 30, 2025. It is earning $6 per share annually. These past three years have been exceptional for Wells Fargo, even with the regulatory penalty for growth imposed. Wells Fargo’s intrinsic value is estimated at $48 to $50 per share, which is pushing the 1.25 multiplier of book value. It is currently selling at around $80 per share. Look at the history of market value:

During the last twelve months, Wells Fargo’s market price has jumped to $80. Its underlying fundamentals have not changed one bit during this period. The book value improved from $31 per share back in 2015 to the current $42/share. In effect, it took ten years to improve $11 with book value.

The following are the site’s Value Investment Fund’s various dollar points for Wells Fargo:

- Book Value $42/Share

- Buy Point $44/Share *Assumes a reasonable default rate with loans

- Intrinsic Value $48/Share

- Sell Point $67/Share

- Market Price (07/16/25) $79/Share

In summary, intrinsic value starts out equal to book value on the very first day of business. As a company grows and matures, intrinsic value begins a slow increase in separation from book value. Once a company moves towards a higher market valuation, intrinsic value begins to accelerate with its separation from book value. Stability of earnings, steady growth, and consistent operations will support a much higher intrinsic value over book value. As with any principle, there are exceptions to this rule. Some industries have a closer correlation between book value and intrinsic value. These include banking, insurance, and professional services.

For purposes of value investing, intrinsic value does not equal book value. Act on Knowledge.