Choice Hotels – Value Investing Price Points

Choice Hotels is one of the six potential Value Investment Fund members within the Hotels Industry pool of investments. There are four standard value investing price points for the reader to consider, along with three key performance indicators. A value investor takes into consideration all of these price points, performance indicators, and additional subjective considerations to determine actions. Overall, Choice Hotels is a buy at any price less than $65 per share as of October 8, 2025. The optimum selling price for stock is $125 per share.

Choice Hotels is almost exclusively a franchising operation. As with the other hotel systems, it operates a reservation system and therefore has several revenue streams, including revenue generated from its solely owned hotels. The most impactful is its franchising fee program as the franchisor. Furthermore, it manages many properties and charges initial startup fees for new sites.

Choice Hotels is almost exclusively a franchising operation. As with the other hotel systems, it operates a reservation system and therefore has several revenue streams, including revenue generated from its solely owned hotels. The most impactful is its franchising fee program as the franchisor. Furthermore, it manages many properties and charges initial startup fees for new sites.

Up to two years ago, the Value Investment Fund had a buy price for stock at any price less than $110 per share. Back in early March of 2024, the Fund purchased 100 shares at $109.46 and then sold them a week later at $126 each, netting $1,454 after transaction fees. The graph below illustrates the market price during that time frame:

There were two more iterations of the price dropping below $110 and then recovering back into the $120 range during 2024, and the market price peaked at $155 per share in February 2025. The current market price is $114 per share. Many factors impact the intrinsic value price point, and the much lower buy price that this site’s facilitator advocates. The following sections will go into detail related to the impact factors for the respective value points. These first include the revenue drivers and a substantial operating cost reduction against revenue for Choice Hotels. Secondly, the net profit’s overall decrease per revenue dollar is driven by a few cost drivers. Third, the overall debt of the company has dramatically changed over the last five years. Simply put, it has doubled, and this changes the risk factor greatly. Next, the book value per share is now negative, which raises one’s perception of this company’s management philosophy. Lastly, and very importantly, is the revenue generated per day per available room. This key performance indicator identifies a serious management concept that must be addressed.

Given all the above, the Value Investment Fund is updating the respective value points for Choice Hotels, and they are as follows:

- Book Value – ($0.57) *Negative 57 cents per share as of 06/30/25

- Intrinsic Value – $82.00/Share

- Safety Margin Risk Factor – 23% Minimum

- Buy Price – <$63.00/Share

- Sell Price – >$125.00/Share

- Expected Recovery Time Frame – 3 years

This is a sharp downgrade of this potential investment from historical calculations. It is driven by the four factors as explained in the following detailed sections here:

Choice Hotels – Revenue Drivers

Before digging deeper into the respective drivers, please review the historical total revenue along with the number of hotels in the portfolio over the last five and a half years:

Year Revenue Hotels Rooms Revenue/Room

2025 (six months) $759.3 million 7,481 644,400 $2,356 *1/2 year; extrapolated from $1,178 for six months actual

2024 $1,584.8 million 7,586 653,810 $2,424

2023 $1,544.2 million 7,527 632,986 $2,439

2022 $1,401.9 million 7,487 627,804 $2,233

2021 $1,069.3 million 7,030 579,746 $1,844

2020 (COVID) $774.1 million 7,147 597,977 $1,295

2019 $1,114.8 million 7,153 590,897 $1,887

For purposes of clarity, the revenue per room represents the fees Choice Hotels charges as a franchisor; this is not the actual total revenue each room earns in a year. On average, a room earns more than $21,000 per year ($98/Night X 365 days X 59% occupancy rate).

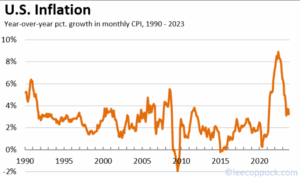

The above chart is a general presentation to assist with clarification of the respective segment revenue. The revenue per room per year is growing at around 3.7% annually. Much of this growth is driven by inflation and not by additional services or fee structure improvements. Thus, for Choice Hotels, real growth is a function of additional rooms in the portfolio.

Choice Hotels utilizes five separate revenue segments:

- Royalty, Licensing & Management Fees – the average fee is about 5% of sales for this revenue segment;

- Procurement Services – platform operations, including travel agency and online booking service providers;

- Initial Franchise Fees – startup fees for new franchisees;

- Owned Hotels – Choice Hotels owns or directly manages approximately thirteen (13) properties; thus, this revenue is the entire annual revenue per room.

- Other Revenues – reimbursable charges from franchisees and managed properties.

Each of these revenue segments has its own cost structure.

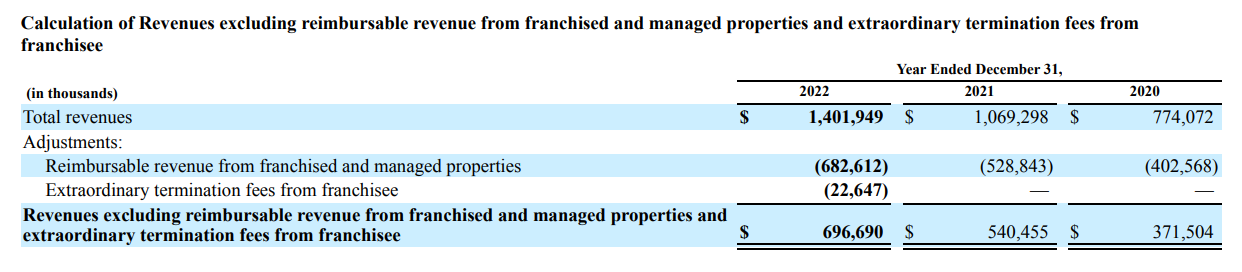

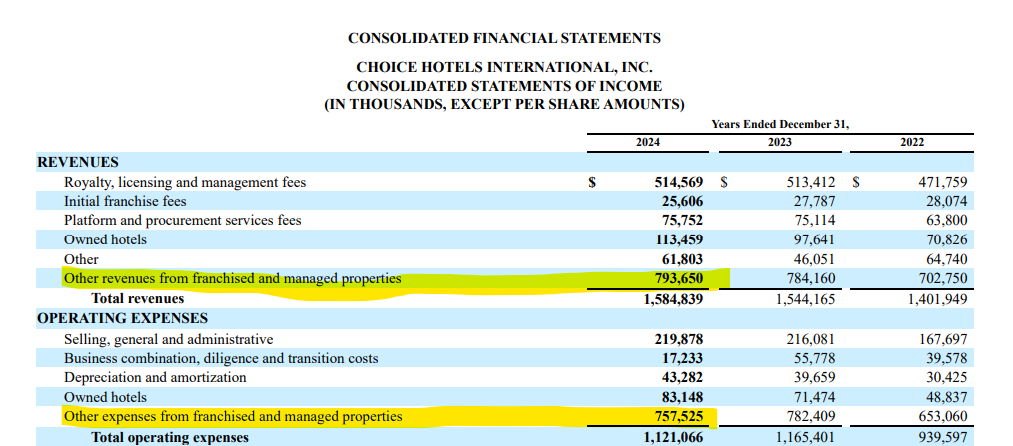

‘Other’ revenues are almost 100% offset by the associated costs to generate that segment’s revenue. Since this segment is entirely reimbursable charges, it is a wash. Before 2022, this segment’s revenue was reported as an offset in a note to the financials, as illustrated here:

With current financial reports, the associated costs are reported in the operating expenses section as a single line item, as highlighted in this illustration:

Owned hotels generated $30 million of operating margin in 2024, $26 million in 2023, and $22 million in 2022. This revenue stream is enhancing the overall profit margin and is improving from year to year.

The other four streams generated $678 million in 2024 with associated costs of $280 million, netting $398 million operating profit contribution. In 2023, these four streams contributed $351 million to the operating margin. Notice that in 2024, the business combination, diligence, and transition costs are nearly $38 million lower than in 2023. YTD in 2025, this pattern continues through six months as business combination, diligence, and transition costs are $16 million lower than through the same time period in 2024. This operating cost driver impacts the aggregated contribution margin dramatically. In 2023, the total contribution margin was $379 million, with $56 million of business combination costs. In 2024, the contribution margin improved to $464 million with only $17 million in combination costs. Thus, contribution margin improved $85 million in one year, driven by the $38 million reduction in business combination, diligence, and transition costs.

The dramatic reduction in business combination, diligence, and transition costs reflects the termination of the Wyndham acquisition that started back in 2023. Essentially, Choice paid more than $40 million in pursuit of combining Wyndham as one of the brands for Choice over the course of three years of reporting financial results. The current business combination costs reflect the final steps of completing the Radisson acquisition.

From the contribution margin, other expenses are subtracted to derive income before taxes. These other expenses continue to grow and impact the bottom line.

Choice Hotels – Other Expenses

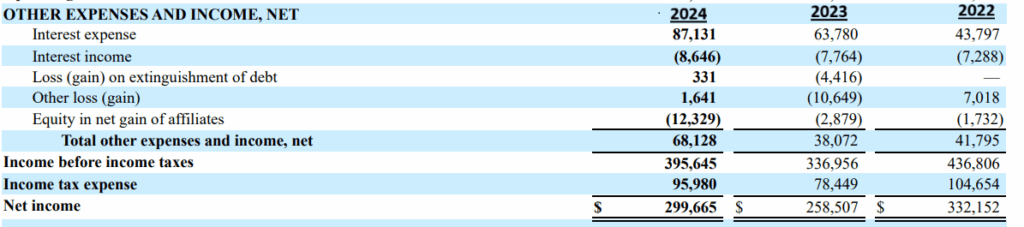

The following report is from the annual financial report for Choice Hotels, specifically from the Consolidated Statements of Income. The respective values are in thousands of dollars.

Take note how other expenses have jumped $20 million since 2023. It is a direct result of paying more interest to service the debt. From above, it was mentioned that Choice Hotels increased its long-term debt position $700 million from $1 billion at the end of 2023. Thus, interest in servicing that debt increased $24 million. It is anticipated that in 2025, interest will increase by another $5 million from $87 million to more than $92 million. As of June 30, 2025, Choice Hotels has already expensed $44 million for interest.

With 46.3 million shares outstanding as of June 30, 2025, interest is costing a little more than $1 per share per year over the costs incurred back in 2022. This alone impacts the value per share at $10 to as much as $14, depending on the perceived value impact from various formulas used by value investors.

The $12 million in parentheses represents ‘Equity in net gain of affiliates‘. This refers to the recognition of a gain from the disposition of assets of one of the 20+ affiliates (LLCs) in Choice Hotels that has an ownership interest. This particular line represents the aggregated net result of the respective ownership positions in those 20-plus affiliates.

In effect, this additional interest is a direct reflection of the mindset Choice Hotels’ directors have set to purchase back existing stock, i.e., creating treasury stock. Since 2022, Choice Hotels has spent almost $1.2 billion to buy back 5.4 million shares. Basically, Choice has bought back these shares at an average cost of more than $135 per share. This is referred to as value shifting by value investors. Whenever a company pays out more than intrinsic value to purchase shares back (treasury stock), the company is literally paying a premium to own its own stock. It is a disservice to the remaining shareholders.

Look at this from a different perspective: in 2022, the intrinsic value was determined to be approximately $113 per share. Choice Hotels purchased 5.4 million shares for $1.2 billion that had an intrinsic value of $615 million. Thus, at least $500 million of value left the balance sheet of Choice Hotels over the course of three years. This is equivalent to reducing the intrinsic value of all remaining shares by $11 each. Thus, this is a double value reduction. When a company pays more than its intrinsic value AND borrows money to pay this, intrinsic value shifts lower quickly due to debt service and premium paid out for the shares. Risk goes up, and this, too, affects intrinsic value.

The buyback program of Choice Hotels has driven the book value of its stock to less than a negative 57 cents per share.

Choice Hotels – Book Value of Stock

Book value does play some role in value investing. There is typically a strong, almost pure correlation between book value and intrinsic value during the inception of a company. As the company matures and begins to stabilize, typically decades after formation, intrinsic value accelerates faster than increases in book value. Furthermore, book value is not a pure and simple formula. Dividends, treasury stock, preferred stock, and other equity section activity impact book value. This is the case with Choice Hotels.

Choice Hotels went public back in 1997. On 12/31/97, Choice Hotels had issued 60 million shares. Each share had a book value of 82 cents. Each year, this book value was impacted by earnings and reduced via dividends when paid beginning in 2004. At that time, Choice paid 8 cents per share per quarter. On October 1, 2025, this dividend was recorded at 29 cents per share (per quarter).

This is the book value change over the last five years since 12/31/19:

. 12/31/2020 12/31/2021 12/31/22 12/31/23 12/31/24 06/30/25

Beginning Book Value/Share (01/01) ($0.42) ($0.11) $4.78 $2.96 $0.72 ($0.96)

Earnings Per Share 1.35 5.15 5.99 5.07 6.20 2.68

Other .12 .43 1.48 1.18 1.41 0.73

Impact of Treasury Stock Buyback (0.72) (0.24) (8.33) (7.33) (8.13) (2.44)

Dividends Per Share (0.44) (0.45) (0.96) (1.16) (1.16) (0.58)

Ending Balance on 12/31 Per Share ($0.11) $4.78 $2.96 $0.72 ($0.96) ($0.57)

On 06/30/25, the shareholder’s deficit (negative equity balance) was $26 million, with 46 million shares in the market; each share’s book value is approximately a negative 57 cents. The table basically tells the reader that during this five-and-a-half-year time frame, Choice Hotels earned $26.44 per share and used $27.19 per share to buy back stock as treasury stock. In effect, all accumulated value via earnings was used to reduce the volume of existing shares in the market. On 12/31/19, there were 55.7 million shares issued and out in the market. On 06/30/25, there remain 46.3 million shares in the market. The net reduction was a mere 9.4 million shares. In total, Choice Hotels spent $1,273,965,000 to reduce the overall portfolio of shares in the market by 9.4 million. This equates to $136 per share on average.

Book value for Choice Hotels as of 06/30/25 is a negative 57 cents per share. Value investors understand that this negative equity no longer directly impacts intrinsic value as it relates to the lodging industry. However, it does impact RISK. Risk increases dramatically because the company is reliant on debt to capitalize growth. This goes against basic business principles. Furthermore, any long-term recession will impact earnings and could easily cause losses in income. When the economy goes south, lenders are apprehensive about loaning money to cover losses when a company doesn’t have any equity to mitigate negative earnings.

This increased risk affects the discount rate when exercising discounted future earnings or cash flow formulas to determine intrinsic value. Four years ago, Choice Hotels’ discount rate was approximately 14%. Today, that discount rate jumps to 23 – 25%. This alone impacts intrinsic value calculations upwards of $18 per share.

It is difficult to understand management’s philosophy of driving book value negative and borrowing money to run the company. Proper capitalization requires an appropriate debt-to-equity ratio of 3:1 or 2:1 in this industry. Full capitalization of Choice Hotels solely using debt increases doubt related to growth. If Choice Hotels wants to purchase another brand of hotels, are they going to do a leveraged buyout? They could reissue existing treasury shares to raise capital as an alternative. But they would need to reissue the stock at no less than $135 per share to properly recover the money spent to date buying these shares back from the market.

One more element affects intrinsic value. These are the key performance indicators. For Choice Hotels, the most impactful KPI is the revenue generated per day per available room.

Choice Hotels – Key Performance Indicators

The hotel industry has three critical key performance indicators (KPI’s). One of the three dominates as the primary KPI, Revenue Per Available Room (RevPAR). The other two KPI’s include unit growth and average royalty fee rate. The following three subsections go into these respective KPI’s and their impact on Choice Hotels’ value.

Revenue Per Available Room – RevPAR

Revenue per available room is a function of two separate revenue drivers. The first is the average daily room rate that a hotel charges. The second is the occupancy rate. If either revenue driver improves, then RevPAR increases. Both drivers impact the outcome significantly, with a minor improvement. To illustrate, assume the average daily room rate is $80 across the entire spectrum of hotel brands for Choice Hotels. Assume the average occupancy rate is 50%. The RevPAR results are as follows:

Example: Average Daily Rate times Average Occupancy Rate = $80 X .5 = $40

Now assume the occupancy rate jumps to 52%. The modified formula is $80 X.52 = $41.60.

This may appear insignificant. But Choice Hotels has over 511k rooms in its portfolio. This $1.60 per night change increases the entire operation’s revenue by $817,000 per night. Choice charges a franchise fee of approximately 5%. Thus, Choice Hotels increases its revenue per day by more than $40,800 per day. Extrapolate this out for 365 nights per year, and you get an impressive increase in revenue of $14 million.

In 2022, the average room rate was $95.13. For 2024, it increased to $96.67, a 1.6% increase over three years. However, the occupancy rate dropped from 58.0% to 56.4% forcing the overall average revenue per available room down to $54.54 from $55.16. This is a 1.1% decrease in total system-wide revenue.

What is fascinating about this particular KPI is that, in general, Choice Hotels can only marginally influence the outcome, if at all. This particular KPI is really a function of economics. The consumer is only going to tolerate certain rates for lodging, and depending on discretionary income, how often they will travel, and utilize hotels for overnight stays. As pointed out in the Revenue Drivers section, real growth for Choice Hotels requires increasing the number of units available for lodging.

Unit Growth

Over the last four completed years, Choice Hotels has added 55,211 rooms to its portfolio. This is an impressive 12% improvement over the year-end number of rooms on 12/31/2020. The current portfolio is 511,739 rooms as of 12/31/2024. This substantiates the $43 million increase in royalties and licensing fees since 2022. Furthermore, it has added another six to eight million dollars from platform/procurement service fees.

Although RevPAR influences the overall revenue the most for Choice Hotels, unit growth is the true measurement of growth for this industry.

Although unit growth is essential for long-term growth and its importance in improving revenue, it does come with additional costs. With Choice Hotels, the marginal revenue for royalties and platform fees is approximately $109 million over the last two years combined. Choice Hotels did this by incurring more debt and not using its earnings, as those earnings were used to repurchase shares as treasury stock. The additional interest during this same time period was $64 million. Thus, the net effect is an extra $45 million on the bottom line or about 95 cents per share over two years. Thus, the value of unit growth is almost negated by the corresponding cost of the additional debt. The result is negligible net growth in the form of increased profitability. Value investors take into consideration this marginal increase in net profits against the dramatic increase in risk.

Royalty Fee Rate

A third KPI used in this industry is the royalty rate. The goal of franchisors is to consistently improve the overall rate. Even the slightest improvement can move the revenue needle dramatically. For example, a .1% royalty increase on an average $80 per night rate equals 8 cents. This may appear insignificant, but let’s extrapolate this out on the business model’s overall picture. Eight cents per night multiplied by 511k rooms times 365 days per year times a 50% occupancy rate equals $7.5 million per year in additional royalties.

With Choice Hotels, the average royalty rate has improved from 4.93% to 5.06% from 2022 to 2024. However, it was 5.01% in 2021. Thus, the royalty fee is pretty much holding steady in the 4.9% to 5.1% range. In order to increase this average rate, Choice Hotels will need to improve the brands, which in turn will allow them to charge higher royalty fees. This is highly unlikely in a short period of time (< five years). Therefore, the royalty rate for Choice Hotels neither impacts the value investment formulas in a positive nor a negative direction.

In conclusion, for the key performance indicators, only unit growth appears to indicate a positive value for Choice Hotels. However, this is pretty much negated by the fact that Choice Hotels has taken on unnecessary debt to acquire this growth. Unit growth exists, RevPar is down, and royalties are stable. Overall, the KPI’s indicate no real value improvement, and this appears to continue for at least two to three years, as it will take time to make improvements and move towards continuous improvement. RevPAR peaked in 2023 at $2,439 (see Revenue Drivers section above). Since then, it has decreased by $80 per room per year. When considering over 600,000 rooms, that is an impact of more than $40 million per year. So Choice Hotels has a lot of work ahead to get back on track and grow the company.

Summary – Value Investing Price Points

Current market capitalization for Choice Hotels is now less than $5 billion (46.3 million shares at $100 each = $4.7 billion in value). This step-down automatically increases the discount rate used when evaluating Choice Hotels. Furthermore, the shifting of value to the tune of $500 million out of the company to purchase treasury shares and force the equity of the company into a deficit position of $26 million complicates the overall risk situation.

Current yield is $1.16 against a $100 price, which is a 1% yield. This is an unacceptable dividend yield for a value investor. Overall liabilities are now $2.7 billion, when they were $1.6 billion four and a half years ago. There is no doubt that the company’s risk shifts the discount rate to no less than 20%. With earnings of a little under $6 on average per year and an overall growth rate of two to three percent, the standard Benjamin Graham formula results are:

Value = Earnings times (8.5 + 2 times growth)

Value = $5.75(8.5 + 2*3)

Value = $5.75(14.5)

Value = $83.38

Thus, the real worth, i.e., intrinsic value of Choice Hotels is around $82 a share (the facilitator tends to estimate on the conservative side of the equation). Since the risk factor for Choice Hotels is high due to its debt situation, a discount rate against the intrinsic value of at least 23% is warranted to buy the stock. Thus, an appropriate buy point is less than $63 per share. It will take Choice several years to demonstrate proper management of its earnings and rebuild the book value, and reduce the overall debt situation. It is estimated that it will take at least three years to do this, and the stock price should improve to $125 or more. Even if it takes four years, this is a 100% absolute return on one’s investment in four years, which is the equivalent of a 19% annualized return. During this time period, the shareholder will earn an additional $4.64 in dividends (an annual yield of 1.8%).

Look for improvements to the KPI’s and a shift away from using cash on treasury stock. Once you see these indicators and the price is less than $63, buy the stock. Act on Knowledge.