Intrinsic Value – Core Concept

In business, cash is king. To truly determine intrinsic value, the investor must calculate the cash equivalent of the existing overall operation and assign a prorated share to the security under examination. This is the core concept of intrinsic value, compute the true worth of a security.

Securities exist in three groupings: debt, equity, and derivatives. For this series of articles, intrinsic value will refer to equity securities. Equity securities exist in many different forms; most of them are tradable in the market. They include common stock, preferred stock, treasury stock, warrants, and repurchase agreements. All of these convey certain rights of ownership to holders, and customarily, only common stock includes the right to vote for changes in the management team of the company.

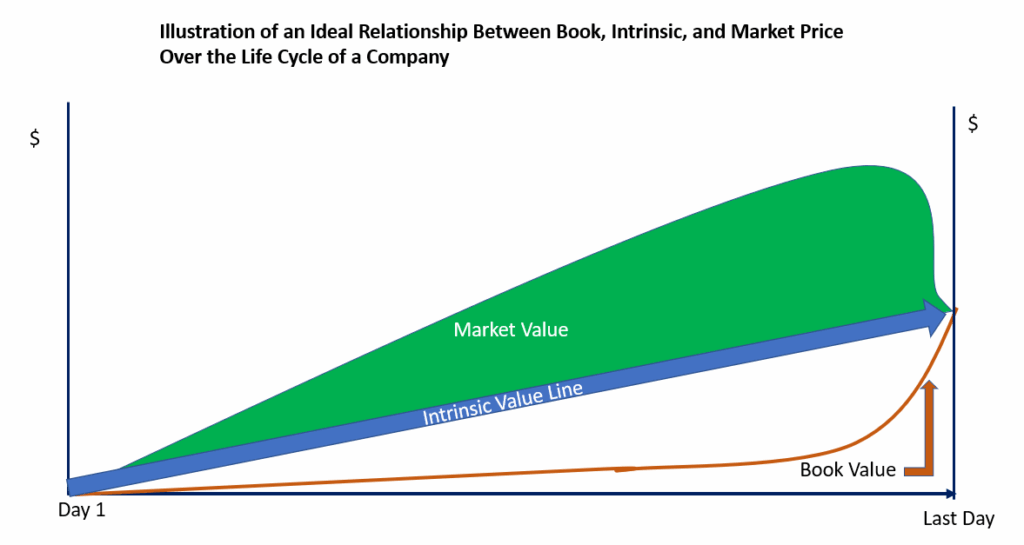

With intrinsic value, there are only two points in time where intrinsic value equals equity in a company – the day the company is created and the day the company dissolves. This is the only time that determining inherent value is easy and simple. At these two moments, at its core, intrinsic value is equal to the cash on hand.

Ideally, intrinsic value will be a continuously steady improving price line over the life of the company. In addition, book value improves over time due to retention of earnings. As the entity heads towards its last day, the day of dissolution, all three value points will converge. If intrinsic is calculated properly, it will not deviate. Whereas the market price will drop, reflecting the true adjustments for asset values as they are sold and disposed of. Book value will improve to the intrinsic value point at the moment when the only asset left is cash and all liabilities are paid. Thus, the only remaining step is to distribute to the shareholders their proportional share based on their respective ownership rights.

The core concept of intrinsic value is turning the entire company’s operation, from earnings, cash flow, and assets, into a current cash amount. From this, subtract all debt so that the only asset that exists is cash. This cash value is then divided up among all those with ownership rights (common, preferred stock, warrants, and repurchase rights) based on the respective contractual arrangements.

For the reader, the first key to understanding this core concept is to understand the balance sheet. Then, this tutorial will walk the reader through the first day of business and illustrate how it is the first of two moments in a company’s existence, whereby intrinsic value equals equity. From this point onward until the last day in business, intrinsic, book, and market value diverge from each other. Depending on decisions made by the management team, market conditions, and so forth determines the monetary price of the three different value points.

Balance Sheet – Simple Format and Presentation

The balance sheet represents the monetary status of the entity at a certain moment in time. It has two halves. The upper half is, of course, assets. The bottom half represents how those assets are funded. Funding is customarily done with either debt or equity. Therefore, the bottom half has two sections – liabilities and equity. Here is a very simple and basic presentation of a balance sheet that one can generate:

. XYZ, Inc.

. Balance Sheet

. Date

ASSETS $ZZZ,ZZZ

LIABILITIES & EQUITY

Liabilities $ZZ,ZZZ

Equity ZZ,ZZZ

TOTAL LIABILITIES & EQUITY $ZZZ,ZZZ

Again, two halves exist. The upper half represents ASSETS and has a total assigned monetary value. The lower half is comprised of two subsections of liabilities and equity.

As an analyst or investor, you will never see a presentation this simple. However, you will always see TOTAL ASSETS and at the bottom TOTAL LIABILITIES AND EQUITY.

The report is labeled ‘Balance Sheet’; there are other names, including ‘Statement of Financial Position’ or ‘Statement of Financial Condition’. With publicly traded entities, the most common term used is balance sheet. Take note that there is always a date, and that date represents 11:59 PM.

When referring to book value, it is strictly the equity section of the lower half of the balance sheet. For those of you interested in learning more, please read ‘How to Read a Balance Sheet – Simple Format’.

With this knowledge, the reader will see how book, intrinsic, and market value equal each other at the inception of business.

At Inception – Book, Intrinsic, and Market Value are Equal

When a company starts, it is typically a private event, i.e., no publicly traded financial instruments are involved. It is a very common business transaction. Somebody wants to start a company, and they register this company with their state’s Secretary or some other state authority responsible for entity creation.

The most common step is to sell stock for cash to raise capital (equity) so the business can start operating. When this happens, the company has cash in a bank account and has issued stock for it in exchange. Thus, the moment this is completed, the balance sheet looks like this:

. XYZ, Inc.

. Balance Sheet

. Day One – Date

ASSETS

Cash $ZZ,ZZZ

TOTAL ASSETS $ZZ,ZZZ

LIABILITIES & EQUITY

Liabilities $-0-

Equity

Common Stock ZZ,ZZZ

TOTAL LIABILITIES & EQUITY $ZZ,ZZZ

Note that both cash and common stock are equal.

At this moment in time, the market value for this corporation is equal to total assets less liabilities, which happens to also equal equity. In addition, intrinsic value, which represents true worth, also equals the cash in the bank. Since there are no other assets or any form of liabilities, the true or inherent worth of the company matches the cash in the bank. If you go back to the definition of intrinsic value, specific entity-related assumptions are required; in this case, you can see that there are no assumptions to make. Generating an objective monetary value is straightforward. Recall the definition of intrinsic value:

Intrinsic value is an entity-specific price derived from an investor’s analysis and assumptions. The goal is to assign an objective monetary value to inherently subjective criteria. In contrast to fair market value, which relies on a voluminous batch of transaction data, different methods, formulas, factors, and assertions are analyzed to generate the most probable true worth of a business operation.

This is one of two moments in a company’s life cycle where the book, intrinsic, and market value are equal to each other. From this point, the three value points will diverge and begin their own separate price line until they reconverge on the last day of business.

Book, Intrinsic, and Market Value Diverge – Day 2 of Business

The moment the business begins to create transactions, the business begins to either earn profits or lose money. All three value points begin to fluctuate. With well-managed operations, all three value points begin to improve. If the operation is pure, the three value points will initially stay together. But invariably, this isn’t the case. Almost all of the time, some conditions, restrictions, or nuances exist that cause the three value points to deviate and, in some instances, deviate quickly from each other.

To illustrate this, an example covers how easy and quickly it is for each of the three value points to diverge from the other.

Five Brothers House Flipping

Five brothers agree to start a company flipping houses, i.e., buying distressed properties, making improvements, and then selling the house at fair market value as quickly as possible.

They each contribute $5,000 and get equal shares of stock in the company. Thus, on Day 1, the balance sheet looks as follows:

. Five Brothers Inc.

. Balance Sheet

Day 1

Cash in a bank account $25,000

Total Assets $25,000

Capital Contributed from Brothers $25,000

Total Liabilities and Equity $25,000

The brothers have excellent credit and negotiated a six-month loan from their bank and guarantee repayment. The bank doesn’t require collateral and agrees to lend $100,000 for $103,000 when the loan is paid off or at the end of six months, whichever comes first. Now the balance sheet changes to the following:

Five Brothers, Inc.

. Balance Sheet

Day 2

Cash in the bank $125,000

Total Assets $125,000

Loan from bank $100,000

Capital Invested 25,000

Total Liabilities and Equity $125,000

A sophisticated analyst or investor will immediately recognize the beginning of the deviation between the three value points. With this business, there are already issues that arise. In this situation, the bank requires an interest payment of $3,000 over six months or upon repayment of the loan before six months. So, just on the first day of the loan (Day 2 of Business Operations), the five brothers will owe the bank $3,000. From above, the terms of the loan are $3,000 of interest upon repayment or the entire principal and interest of $3,000 six months later. In effect, if the company were to stop operations at the end of Day 2, Five Brothers Inc. would owe back to the bank $103,000.

Fair market and intrinsic value immediately drop $3,000. Book value is still $25,000 because the $3,000 isn’t recorded in the books yet as an expense. If the brothers stop business on Day 3 and pay back the bank the $103,000, the only asset left on the books is cash at $22,000, and equity would decrease $3,000 due to the cost of the paid off loan. Recall from above, book, intrinsic, and market values are the same on the first and last day of business.

The brothers proceed to continue business on Day 3.

Day 3 of Business – Value Points Begin to Deviate From Each Other Dramatically

It is the next decision the brothers make that dramatically impacts all three value points, as this illustration exemplifies.

On Day 3, the brothers agree to purchase a distressed property for $65,000. Closing costs are $2,500. The brothers estimate that after renovations of $25,000 that they’ll easily sell this house for $150,000, earning them a tidy profit. At the end of Day three, the balance sheet looks like this:

Five Brothers, Inc.

. Balance Sheet

Day 3

Cash in the bank $57,500

Property For Sale 67,500

Total Assets $125,000

Loan from bank $100,000

Capital Invested 25,000

Total Liabilities and Equity $125,000

Take note, the only thing that has happened is that the assets now exist in a different form. It is no longer purely cash. This is where intrinsic and market values really begin to change. As an important caveat, notice that the equity section (capital invested) remains at $25,000; as such, book value remains at $25,000. The key questions are, what are the realistic intrinsic and market values for this situation on Day 3?

Now, assumptions come into play with the model. Unlike intrinsic value, market value assumes the brothers will follow through with their plan, renovate, and sell the property. Let’s see how this would unfold for the five brothers:

Reasonable Assumptions Made to Determine the Market Value of the Company

- Actual Costs to Renovate $32,000

- Market Price to Sell the Home Quickly $145,000

- Home is Sold Within Six Months

- Closing Costs Including Agent Fees $10,700

A potential investor wanting to buy the business is making reasonable assumptions per above and comes up with this market value for this business:

Sale of Property $145,000

Closing Costs (10,700)

Net Proceeds from Sale of Property $134,300

Costs

Purchase Price $67,500

Renovation Costs 32,000

Total Costs $99,500

Profit on House Flip $34,800

Interest to Bank (3,000)

Profit from Operations $31,800

Cash Analysis

Starting Cash $125,000

Costs (Includes Interest) (102,500)

Proceeds from Sale 134,300

Principal Payment on Loan (100,000) *Interest payment is included with costs.

Ending Cash $56,800

The estimated ending cash equals initial capital contribution from the sale of stock of $25,000 plus the profit from operations of $31,800 for a total of $56,800. Thus, for market value, this business is worth $56,800* using the assumptions made above. It could be higher if the assumptions are too conservative, or it could be lower if the assumptions are incorrect and renovation and/or closing costs are much higher than assumed. Notice how market value incorporates the future elements assumed, that this property is sold within six months, and that there are no other unforeseen complications.

*In reality, since this business has no history, an investor would dramatically discount this $56,800 to alliviate the risk associated with all new startups.

Whereas, with intrinsic value, the monetary outcome reflects what this is worth today. Thus, an entirely different set of assumptions is used. Here, worst-case scenarios are made, and it is today’s value.

Here are the intrinsic value assumptions:

- The brothers disagree on how to move forward.

- It is agreed to sell the property as is to another house flipper;

- A fair and reasonable price to dispose of the home quickly to another flipper is $62,000;

- Closing costs for selling to another flipper are $1,200.

Now let’s review the financial results.

Sale of Property $62,000

Closing Costs (1,200)

Net Proceeds From the Disposal $60,800

Interest to Bank (3,000)

Cash to the Bank Account $57,800

Cash Analysis

Beginning Cash $125,000

Cash to Buy Property (67,500)

Cash From Disposal of Property 57,800 *This includes the interest payment to the bank.

Principal Payment to Bank (100,000)

Ending Cash Balance $15,300

The brothers lost $9,700 on the house; they purchased it for $67,500 and were forced to dispose at $57,800 after interest, which is a loss of $9,700. This loss shows up in the equity section of the balance sheet as a loss to retained earnings. The outcome is a $15,300 value in total equity.

Since cash equals equity, the intrinsic value is $15,300.

Similar to how market value is determined, when calculating intrinsic value, it is off the balance sheet, i.e., the assumptions made have not actually happened; they are just what the investor/analyst feels could happen based on current information. The balance sheet is still as displayed above. Equity is $25,000.

The three value points are now:

- Book Value $25,000 *Per the balance sheet actual.

- Intrinsic Value $15,300 *Per the assumptions of winding up the business operation via a transfer to another flipper.

- Market Value $57,800 *Reasonable assumptions that the brothers will follow through, but with some additional costs.

Notice the dramatic deviations from the balance on Day 2.

Summary – Intrinsic Value Core Concept

When a company first starts, book, intrinsic, and market value are equal. This is because there is only one asset on the books, cash. As the management team begins to conduct business, these decisions weigh on the thinking of investors and analysts. For those involved with market price, assumptions about the future are generally more favorable towards creating value. Whereas, intrinsic value is more conservative and gives a lot of credence to current worth over future outcome.

The core concept of intrinsic value is to create true worth by turning all existing assets into a cash equivalent. From this single asset, liabilities are deducted, providing a net asset valuation which is customarily equal to book value.

This concept will get more convoluted as a company grows and matures. Different assets and liabilities have different mindsets towards evaluation. Furthermore, modern generally accepted accounting principles demand sophisticated thinking when trying to evaluate the true worth of those accounting applications. As illustrated above, the decisions made by management can and do create dramatic differences among the various value points investors consider.

With the above example, intrinsic value is dramatically less than book value. The reality is customarily the opposite: book value is less than intrinsic value, which may or may not be different from market value. This gets back to the ability of the management team to follow through with the mission of the company. The next article in this series covers the underlying elements that drive intrinsic value. When management can and does perform, intrinsic value improves beyond book value.

For this lesson, the reader needs to remember that intrinsic value is equal to market and book value at the inception of a company. This is the only time when all three are equal until the company dissolves. In addition, the lesson is trying to convey the core concept of intrinsic value; intrinsic value is the true worth of a business based on certain conservative-driven assumptions. One of those assumptions places greater credence on worth as it exists today over the possible future aspect of worth. In general, the assumptions to determine market value and intrinsic value are different. Market values are derived from more liberal points of view, and intrinsic values are much more conservative and require substantial evidence to ease the conservative constraints. Act on Knowledge.