lululemon athletica inc. – Book, Intrinsic, Buy, and Sell Value Points

lululemon athletica inc. (the company purposely does not capitalize its name) designs, distributes, and retails athletic clothing, footwear, and other sports-related accessories. It is more oriented towards the female gender (63% of sales). The company has over 750 stores worldwide and employs 39,000 people. North America has 462 of the stores, and China has 151 locations.

Financially, the company is impressive. Gross profit margins improved in 2024 to 59% from 58% in 2023. Sales jumped 10% to $10.6 billion in 2024. The most interesting financial metric is that the company has ZERO long-term debt, with only $1.6 billion owed for leases over the next six years. Total assets equal $7.6 billion, with $4.3 billion of that in the form of equity. In effect, the company is financially solid as of the end of January 2025.

Currently, the Value Investment Fund owns 300 shares purchased at $161 each, including transaction fees. The fund purchased these shares on 09/16/2025 as stipulated in its six-year financial report.

lululemon – Book Value

lululemon has 124 million shares outstanding. With equity at $4,324,047 ($4.3 billion), the book value per share is currently $34.87. The company is in the process of buying back shares. During both 2023 and 2024, the company spent nearly $2.0 billion each year. During fiscal 2024 ending February 2, 2025, lululemon bought back 969 thousand shares, paying on average $345 each.

lululemon – Intrinsic Value

lululemon has been publicly traded since 2007 and has NOT reported an earnings loss since inception. Here’s the company’s profits over the last 10.5 years:

Profit Schedule:

-

- Six Months to Date 2025 $685 million

- 2024 $1,814 million

- 2023 $1,550 million

- 2022 $855 million

- 2021 $975 million

- 2020 $589 million

- 2019 $646 million

- 2018 $484 million

- 2017 $259 million

- 2016 $303 million

- 2015 $266 million

There are more than a dozen methods to determine intrinsic value. Each has its own merits and is only considered under certain criteria. For a young company like lululemon that doesn’t have long-term debt and has lease obligations, a value investor would place more emphasis on near-term earnings plus existing equity less any Board-directed expenditures.

In this case, the formula will be this:

Next five years of earnings discounted at a reasonable rate; PLUS, equity of $4.3 billion; MINUS, the stock buy-back program estimated at $4 billion.

Estimated Number of Shares Outstanding

To be conservative with the outcome, it is expected that net earnings will approximate what will be earned in 2025’s fiscal year, which is $1.3 billion per year for the next five years. Thus, at a reasonable discount rate of 12%, the results for this part of the equation are:

1) Year 2025 = $1,300,000,000

2) Year 2026 $1,300,000,000 at 12% discount = $1,144,000,000

3) Year 2027 $1.3 billion 12% discount 2/yrs = $1,036,352,000

4) Year 2028 $1.3 billion 12% discount 3/yrs = $925,314,000

5) Year 2029 $1.3 billion 12% discount 4/yrs = $826,173,000

The total estimated earnings over the next five years at an annual 12% discount rate are approximately $5,231,839,000, or, for conservative measures, it equals $5.231 billion.

Add to this the $4.3 billion of existing equity and subtract $4 billion for the buy-back program, and the net ending result is approximately $5.5 billion of value for this company. The only remaining step is to determine the estimated number of shares remaining in five years.

Currently, there are 117 million shares outstanding. The $4 billion buy-back at $250 per share (an estimate of what will be paid per share) equals a buy-back of 16 million shares, leaving about 101 million shares outstanding five years from now.

The result is as follows:

$5,500,000,000

101,000,000

= $54.76 per share on 01/31/26

This appears extremely low given that the current book value is $34.87 as of February 2, 2025. Take note of the many conservative variables used to determine this $54.76 intrinsic value per share:

- Only five years of future earnings are considered;

- Future earnings exist at the current year’s expected total.

- No growth;

- A strong 12% per year discount rate;

- Buy-back program at a very high amount of $250 per share per year.

When combined, these factors limit the intrinsic value of lululemon to $5.5 billion. Reconsider if the buy-back program were eliminated. The formula would be:

$9,500,000,000 = $81.20/Share

117,000,000 Shares

The buy-back program reduces the value per share by $26. This alone is a big unknown. The Board of Directors would discontinue this program if the company were going to limit its future to just five years. And this is key to intrinsic value calculation. The future is truly unknown, and so long as the future looks unblemished, the Board can return equity to shareholders by buying back shares. Of course, this author disagrees and believes it is far better to be equal to all shareholders and pay out dividends. At $4 billion across 117 million shares, that is equal to $26 per share over five years or about $5.25 in dividends per year.

A more reasonable approach is to extend the earnings out to 10 years, a fairer discount rate of 9%, and no buy-back program. Again, no growth and future earnings remain flat at $1.3 billion per year. The outcome for earnings is as follows:

1) Year 2025 = $1,300,000,000

2) Year 2026 $1,300,000,000 at 9% discount = $1,183,000,000

3) Year 2027 $1.3 billion 9% discount for 2 Yrs = $1,094,184,000

4) Year 2028 $1.3 billion 9% discount for 3 Yrs = $1,003,838,000

5) Year 2029 $1.3 billion 9% discount for 4 Yrs = $920,952,000

6) Year 2030 $1.3 billion 9% discount for 5 Yrs = $844,911,000

7) Year 2031 $1.3 billion 9% discount for 6 Yrs = $775,148,000

8) Year 2032 $1.3 billion 9% discount for 7 Yrs = $711,144,000

9) Year 2033 $1.3 Billion 9% discount for 8 Yrs = $652,426,000

10) Year 2034 $1.3 billion 9% discount for 9 Yrs = $598,556,000

Thus, over the next 10 years, inclusive of fiscal year 2025, earnings at 9% discount rate are worth approximately $9 billion. Add to this the current equity position of $4.3 billion, and with no buy-back program, the total value is estimated at $13.3 billion. With 117 million shares outstanding, each share is worth approximately $114. Thus, assuming a 9% discount rate, 10 years of earnings on a flat $1.3 billion per year, and no buy-back, intrinsic value per share jumps to $114 each on January 31, 2026.

Is this still too conservative? No growth, a 9% discount rate, and no buy-back program. This is strictly a retention concept; all money is held as cash to be disbursed at the end.

There are a couple of important and financially critical considerations to think through. First, on the balance sheet sits $1.6 billion in lease obligations. The net earnings would be AFTER amortizing the leases. Thus, over the next ten years, lululemon will completely eliminate this lease liability or at least get down to less than $200 million owed. This is another $1.4 billion of value to the shareholders as these leases are extinguished (see the cash flows statement for amortization of lease obligations).

Value Investing – Key Concept (Debt)

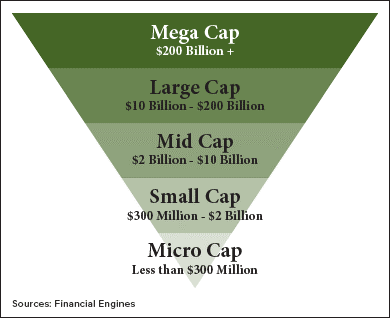

Debt is a risk factor when determining value. The stronger the debt ratio against tangible assets, the higher the risk involved and the requirement to utilize increased discount factors when determining intrinsic and buy values for securities. Ratios of more than 75% are considered the transition points for increasing discount rates at an ever-increasing rate. There are exceptions to the rule; strong cash flow operations such as REITs and fast-food restaurants allow for higher ratios. For example, McDonald’s has more debt than assets. Yet, its cash flow is so strong at $10 per share that the company can easily pay 60 cents on the dollar of earnings and still service its debt. McDonald’s is simply a gold nugget amongst debt-heavy companies. REITs have strong cash flows, allowing for payouts of dividends at 90 cents on the dollar of earnings (a requirement to maintain their tax-free status). Here’s a quick look at Lululemon Athletica Inc.’s long-term debt to tangible assets ratio at 06/30/25:

Total Assets $7,603 million

Less: Intangible Assets (171 million) *Includes Goodwill

Tangible Assets $7,432 million

Long-Term Debt $1,342 million *Almost 95% lease obligations

Long-Term Debt to Tangible Assets Ratio = 18.1 %

Act on Knowledge.

A second, and just as important, is the accumulation of cash over these ten years. A prudent business would invest this excess cash in government securities and earn a fair and reasonable interest rate of 2.5% per year, utilizing short-term securities. Assuming a starting point of $1 billion at the end of year 1 and adding about $1.5 billion per year in securities, lululemon will earn approximately $150 million net of taxes over these ten years. Just in year nine alone, it will invest $10 billion and earn more than $25 million.

When you add these two additional financial improvements over these ten years, you will have a company worth at least $15 billion. There will be 117 million shares outstanding, making each share worth $128.

The $128/share intrinsic value assumes the following very conservative factors:

- No Growth;

- 9% Discount Rate;

- No Additional Obligations as Liabilities;

- No Going Concern After 10 Years;

- All Excess Cash is Invested in Gov’t Securities.

- No Buy-Back of Shares;

- No Increase in Sales Volume.

The reality is that lululemon is a going concern. This means it will conduct itself as any good business would and will add more locations, expand its marketing program, and improve sales volume. Furthermore, the company has a strong balance sheet with no long-term debt and only lease obligations as a long-term requirement. The company is currently growing at more than 5% per year. It is unlikely it can maintain this strong growth rate indefinitely, but, in the near term, it appears it can continue to expand at around 4% per year for several years into the future.

It has a very high profit margin at 59% and is selective about its physical expansion into the market. The $128 intrinsic value calculation assumes an orderly continuity of operations with no expansion, and it strictly favors cash generation over typical corporate thought. With lululemon, this is not the case. They want to continue their growth, expand their footprint, and reach deeper into the customer base (they use the term ‘guests’).

Converting the formula from a conservative approach to a more moderate thinking, intrinsic value improves to greater than $180/share. For example, assuming a 4% growth and a 12% discount rate, in year seven, earnings are worth nearly $1 billion. Furthermore, ten years is not the window of time considered; more moderate thinking changes the window to 20 years. Thus, another ten years of discounted earnings are considered. It is conceivable for lululemon to be worth as much as $28 billion with more moderate considerations. At $28 billion, each share is worth more than $235.

This facilitator will not go to that level, as many economic-wide issues can and will arise over the next 20 years. The industry will experience setbacks, and the company will have to deal with many different internal and external pressures. Thus, a more reasonable and comfortable estimate for intrinsic value is $180 per share.

Intrinsic Value for lululemon athletica, inc. is estimated at $180 per share.

The facilitator of this site’s Value Investment Fund has read through all the notes to the financial statements. lululemon uses some very conservative approaches towards estimating costs with its leases and customer accounts. This further reaffirms the moderate result of $180. The facilitator disagrees with the definition of cost of sales, as retail employee wages and benefits are a cost assigned to selling, general, and administrative (SG&A) expenses with lululemon and should be included in cost of sales. Other retailers include retail employee costs in the costs of sales. Thus, it is difficult to compare gross profit margins among retailers; this explains the strong 59% gross profit margin. Other common cost of sales values include transportation of products to the stores, which lululemon excludes from cost of sales; they include transportation with SG&A.

lululemon – Buy Price

A fair and reasonable margin of safety for purchasing lululemon is 12%. Thus, the buy price for lululemon is set at any value less than $160 per share.

lululemon – Sell Price

In December of 2023, the market price for lululemon peaked at $510 per share. This target is unreasonable as that thinking takes into consideration super sales growth of 10% per year for an extended period of time (> 5 years). A more realistic recovery point is $370 to $380 per share, as the market price did recover from $236 per share in July of 2024 to more than $400 per share in January 2025. This facilitator is quite comfortable in stating that a recovery price of $320 per share within two years is achievable.

Sell price is typically established using security analysis, i.e. in-depth review of business ratios and comparison to similar companies. The goal is to determine actual recovery expectations. For lululemon, here are the positive security features:

- Very Little Debt – long-term debt only exists in the form of leasse obligations;

- Profits Every Year – since 2007, lululemon has never reported a loss with earnings;

- Strong Growth Rate – lululemon has experienced at least 10% sales growth year over year since 2020 and current year indicators point to a 6% improvement over 2024;

- Solid Gross Profit Margin – Over the last five years, the worst gross profit margin was 55%. In 2025 YTD is running 58%;

- Strong Operating Cash Flows – $210 million YTD in 2025;

- Growth in Locations – lululemon will add at least 40 stores in 2025 and will hit 800 locations worldwide in early 2026;

- Earnings per Share – $6.88 in 2022 and $14.67 in 2024, expected to be at least $11.50 in 2025.

There are a couple of concerns. First, the buy-back program increases the risk to the remaining shareholders. The company is literally moving value from the company by paying market price for shares that are higher than intrinsic value. This is at the detriment of remaining shareholders, and honestly, that cash can be used to further improve the balance sheet, expand operations, or just simply pay dividends, which is equal to all shareholders.

Secondly, the company has an employee stock purchase and incentive programs. The current unrecognized compensation for the programs stands at $123 million. This amount will get recognized over the next 1.5 years. This is about $1 per share impact. The company provides a very employee-oriented plan to the detriment of existing shareholders. This author is pointing this out to the reader so any consideration of investing in lululemon athletica inc is made with full knowledge.

Since the company is still young and growing fast, recovery will be sudden when it does happen. Basically, young companies like lululemon are either in favor or misunderstood by investors which creates volatility in market price. Furthermore, the average volume of activity is about 5.2 million shares daily. This is a pretty high volume given 117 million shares in the market. For comparison, Walmart’s average daily activity is 17 million shares out of 8 billion outstanding, i.e., a mere .2% in comparison to 4.4% for lululemon.

Given the many positive financial features, a limited set of concerns, and the volitility for the shares, it is expected that the company’s market price will suddenly rise past $320 per share within two years. That will be the time to sell and take the good return on the investment.

Summary lululemon athletica inc. – Book, Intrinsic, Buy, and Sell Value Points

- Book Value $36.88/Share as of 06/30/25

- Gross Profit Margin 58.41% *Outstanding, was at 57.6% at fiscal year end 2022.

- Earnings per Share $11.30 *Estimated for 2025, $14.67 (2024), $12.20 (2023), $6.68 (2022)

- Total Debt Ratio 43.12% *Includes current liabilities

- Profit Schedule:

- Six Months to Date 2025 $685 million

- 2024 $1,814 million

- 2023 $1,550 million

- 2022 $855 million

- 2021 $975 million

- 2020 $589 million

- 2019 $646 million

- 2018 $484 million

- 2017 $259 million

- 2016 $303 million

- 2015 $266 million

- Intrinsic Value $180/Share

- Discount Factor 12% *Margin of Safety

- Buy Price <$160/Share

- Sell Price >$320/Share

- Expected Time Frame – 2 Years to Recover to $320/Share

- Anticipated Return on Investment at Two-Year Point – 40% Annually

Act on Knowledge.