Value Investment Fund – 12/31/25 Report

Each month, the Value Investment Fund reports its results through the last day of that period. The following is a report of all activity during the December 2025 period, along with the current financial status of the Value Investment Fund.

During December 2025, the Value Investment Fund had two transactions. The Fund earned two dividends totaling $1,348.65 as follows:

The Walt Disney Company 12/15/2025 $.75/Share 678.1999 Shares = $508.65

Wendy’s 12/01/2025 $.14/Share 6000.00 Shares = $840.00

No PUT Options were sold. No current positions were sold.

Net Fund Balance on 11/30/25 = $306,096

Value Investment Fund

Balance Sheet

12/31/25

ASSETS

Cash $17,271

Dividends Receivable (Disney) 509

Securities Portfolio #of Shares Basis Market Value

Target 700 $63,700 $67,725

Lululemon 300 48,300 62,043

Wendy’s 6,000 57,750 48,480

Disney 678.2 70,031 76,494

Essex Property 200 50,616 52,136

Subtotal $290,397 $306,878 306,878

TOTAL ASSETS $324,658

LIABILITIES

Tax Deferral on Unrealized Gains/(Losses) of $16,481@28% 4,615

NET FUND BALANCE $320,043

The following schedule reflects the cash reconciliation for the month:

Cash Balance on 11/30/25 $16,234

Dividends Rcvble Paid 1,638 *Target’s Receivable of $798 & Wendy’s $840

Taxes @28% on Dividends Earned (601) *Paid Taxes on accrued earnings, including Disney’s outstanding receivable at year’s end.

Cash Balance on 12/31/25 $17,271

The Fund currently has two open PUT Option contracts; the following schedule provides the current status:

Name # of Shares Strike Price Expiration Date Financial Exposure Current Market Value Status

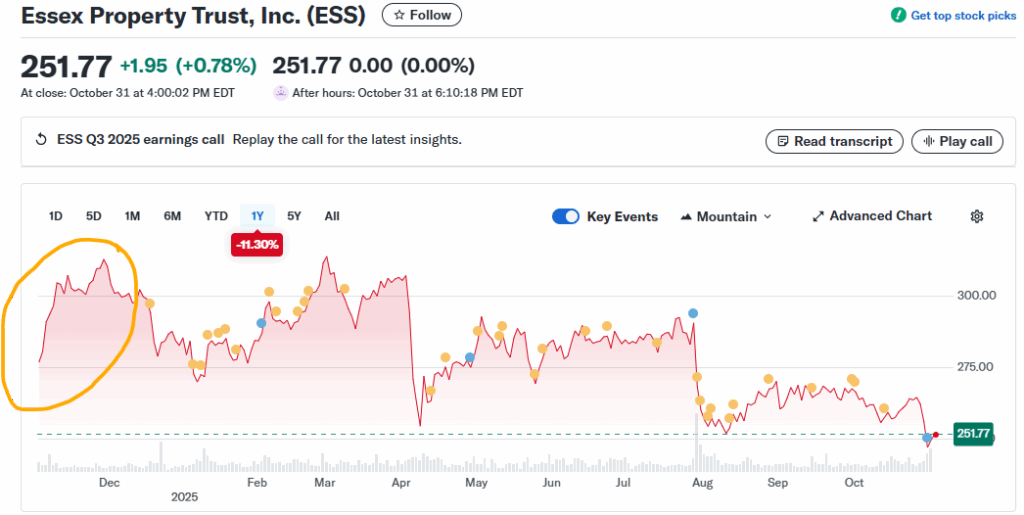

Essex Property Trust 400 $240.00 01/16/2026 $96,400 $260.68 8.6% Safety Margin

Target* 1,000 $85.00 12/17/2027 $86,000 $96.75 13.2% Safety Margin

*Target’s PUT Options are referred to as LONG PUTs due to the expiration date being 24 months out. Thus, the margin of safety is irrelevant in the overall risk status.

There is a strong possibility that the Fund will have to comply with the Essex Property Trust exposure. Essex Property Trust reported financial results for the third quarter of 2025 on Thursday, October 30, 2025. Through nine months, Essex’s gross profit margin is $48 million ahead of the same period in 2024. In 2024, the market price was $312 per share and rose to over $275 by the end of December 2024. The facilitator feels that the risk exposure for Essex is low, considering how much this aligns with 2024. The market price chart here illustrates the same time period last year.

After 6.25 years of activity, the Value Investment Fund is averaging a 24.9% annualized return.

During December 2025, the Value Investment Fund improved $13,947, a 4.5% improvement on the ending balance on 11/30/25. Act on Knowledge.