Railroad Fund – Status as of 11/06/19

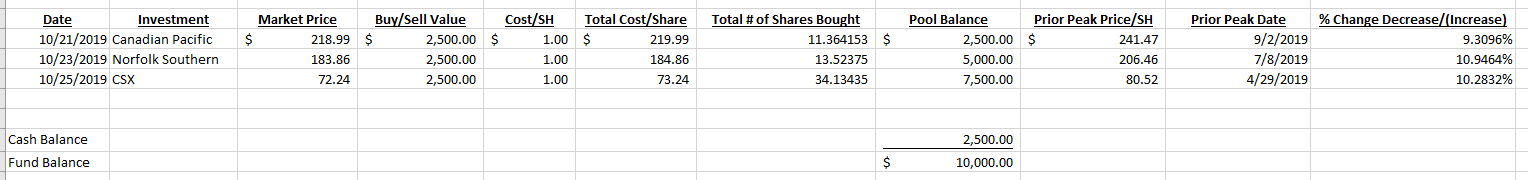

This post simply records the current status of the railroad fund as of today. Here’s my spreadsheet:

A few notes for right now:

a) I am not a professional fund manager; I’m simply testing my value investing concept via various funds using business ratio formulas to set buy/sell points. This is part of a yearly test to determine the growth involved related to various funds. This Railroad Fund is the first of several. I do not have any actual money invested; it is purely a test.

b) I’ve tentatively set my sell points at the prior peak price based on my recent article addressing how to set the sell point for different ratio mixes, specifically a ratio mix tied to railway investments.

c) The above chart identifies my purchase dates and amounts invested.

d) Norfolk Southern is paying a 94-cent dividend per share for those owning shares on Nov 1, 2019. This means the fund has earned $12.71 on that day, which is paid on 12/10/19. The fund will convert the amount earned into shares and sell them immediately if there is no current holding with Norfolk Southern. If the fund is holding NS, the fund will convert the earnings into additional shares.

e) CSX has declared a dividend for any holder of stock on 11/28/19 at 24 cents per share. This investment within the fund will be updated on that day, depending on whether or not the fund holds this investment on 11/28/19.

f) Canadian Pacific paid a dividend back in Sept and will most likely pay a dividend in late December. For now, there is no need to discuss or explain dividends related to CP.

This post serves as a formal record for my value investing concept.

Dave