Sold PUTS Norfolk Southern Railroad

During the past year, Norfolk Southern Railroad has performed well for the Railways Investment Pool of the Value Investment Fund. During the last year, this is Norfolk Southern’s stock price chart:

The red marks indicate the buy points during the past year, and the green marks indicate the corresponding sell points. The first transaction only earned a mere 15% annual return, whereas the second transaction equated to a 388% annual return. Naturally, the holding period was the driving factor between the two returns.

In effect, the intrinsic value for Norfolk Southern is acceptable at around $210 per share. This means that if the stock price falls to $210, the Railways Fund would indeed purchase this stock.

With options, an owner of stock fears a sudden steep drop in price, and thus they may purchase an option called a ‘PUT’ to force someone to buy the stock from the owner of that stock at a preset price. The key for the owner of a PUT is to set a floor price for their existing stock position. A seller of a put option desires to own the stock at a certain price if it can get there. The Railway Fund sold 94.7868 PUTS yesterday for the right to own Norfolk Southern at what it deems is a fair price per share of $210. If you look at the graph above, the fund has bought the stock at $203 twice during the past year. The most recent high for Norfolk Southern was $247; thus, at $210, the buy price is a 15% discount from that high. Since the selling of puts earns $427 of cash, the net effective buy price is around $205.50 per share, almost near the prior purchase points.

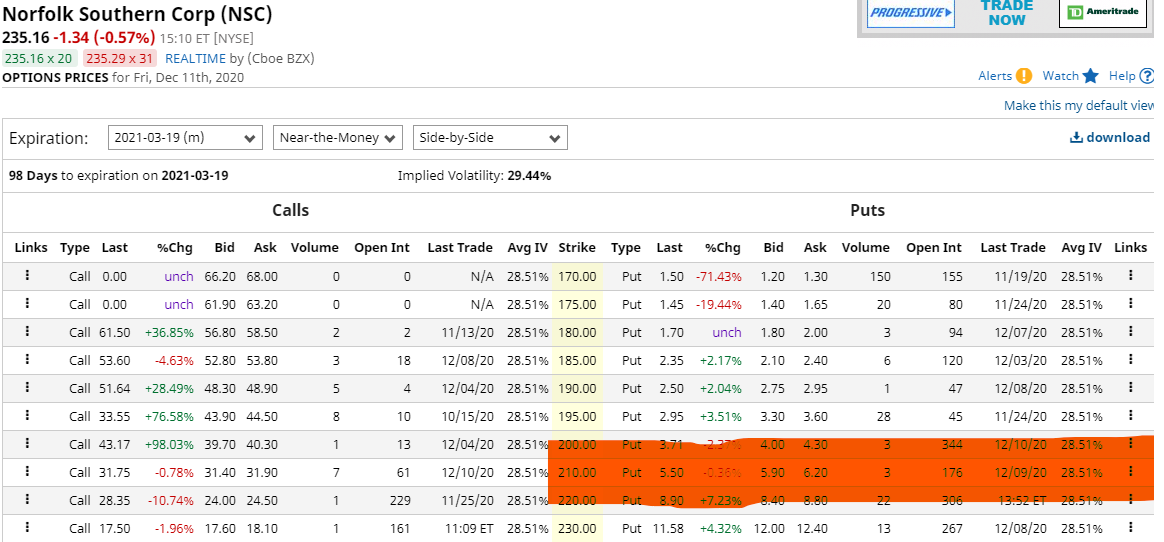

Here is the price sheet:

Highlighted in orange is the PUT at $210. The last transaction was $5.50, which equals $4.50 per PUT sold. The fund sold 94.7867 PUTS to earn $426.54, which bumped up the cash position in the Investment Fund. This requires $20,000 to comply with this transaction if it should occur. The Investment Fund would sell one of its positive unrealized positions in one of its REITs in order to raise the cash to satisfy the demand to buy the stock.

Please note the following from this chart. These PUTS expire on 03/19/2021. The fund could have almost doubled its earnings from the sale of PUTS by opting to sell the $220 PUT, but one of the principles of value investing is risk aversion. Norfolk Southern is an acceptable risk at $210 or less. At $220 per share, the safety margin no longer exists, and thus it defeats the purpose of the primary tenet of value investing – buy low, sell high. Act on Knowledge.