Sold 113.6363 PUTS on Union Pacific Railroad

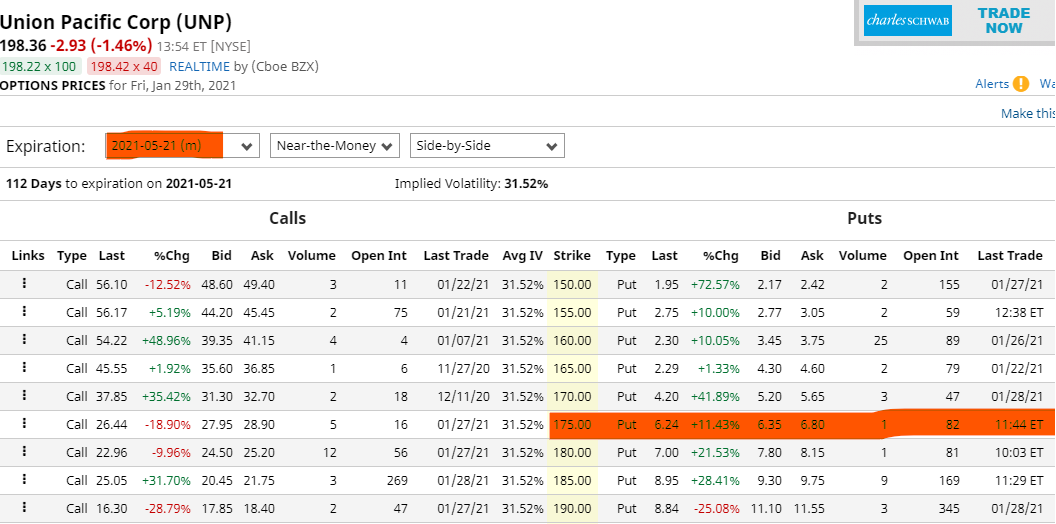

In keeping with the Value Investment Fund’s pattern, on Friday, the 29th of January, 2021, the Fund sold 113.6363 PUTS on Union Pacific Railroad. These PUTS have a strike price of $175 and are currently sold at $6.24 each. The Fund netted $5.24 each after a $1 per PUT fee. Total realized value equals $595.45 (113.6363 * $5.24). See the table below.

Until the end of the day on May 21st, 2021, the railway pool of the Value Investment Fund is obligated to buy Union Pacific Railroad if the market price dips to $175.00 per share. The pool’s current intrinsic value calculation places Union Pacific Railroad’s buy price at $180 per share. In effect, the Fund would welcome an opportunity to purchase the stock at $175 per share. If forced to buy, the Fund would invest $20,000, which is the buy price of $175 plus $1 per share transaction fee. Take note, the action uses the last known selling price of $6.24 and not the ‘Ask’ nor the most recent ‘Bid’.

PUTs are a form of issuing insurance to a current holder of stock. That holder purchases the PUT, ensuring a floor price for their respective shares. If the share price should ever drop to the PUT’s strike price, the holder of the PUT can force the seller of the PUT to purchase that share at that strike price; effectively limiting their loss just like insurance limits someone’s loss in an accident. When used smartly with value investing, value investors can take advantage of this simple option to leverage their annual returns for their respective investment fund.

Union Pacific Railroad’s current market price is near $200 per share and peaked on January 8, 2021 $ at 221.28 per share. Thus, owning such a high-quality company at $175 per share is desirable. During 2020, this Fund bought and sold Union Pacific twice. In February of 2020, the Fund bought Union Pacific for $157 and sold it in June for $183, netting a good return in a short period of time. In October, the Fund bought Union Pacific for $174 per each and sold the first week of January 2021 for $215 per share, again earning a good return on the investment.

Historically, Union Pacific rarely has the necessary deep drops in market price and then market recovery in a short period (less than six months). It is simply one of the best stocks out there to own. The company has very stable earnings, an excellent record of good operations, and is considered the best-run railway of the six Class I publicly traded railways. If the market price were to dip to $175 per share, market recovery to $215 per share would most likely occur within six months. But even at one year, the return on the investment would equal 21.6%.

This follows the Fund’s tenet of buy low and sell high. In addition, it complies with the four primary principles of value investing:

- Reduce risk by only buying high-quality top 2,000 companies that have stable earnings and are well-managed;

- Buy at or below intrinsic value, which for Union Pacific is $180 per share in 2021;

- Sell at or near a reasonable market recovery price;

- Maintain patience; the historical pattern, and of course, the underlying attributes of Union Pacific are there for this to materialize. Act on Knowledge.