Sold Union Pacific PUTs

“We want to hear the iron horse puffing through this valley” – Brigham Young, 1867.

Union Pacific is a high-quality stock. Over the last twenty years, this company has never failed to earn a profit. During this period, there have been two recessions. The simple fact is that Union Pacific is a solid investment. The company has paid a dividend for the last thirty years. Its current yield at $210 per share is 1.83%.

Union Pacific’s intrinsic value is estimated at $185 per share. Thus, any opportunity to own Union Pacific for less than $185 per share is considered an excellent buy.

According to the Lessons Learned article for the Value Investment Fund’s 2020 performance, one additional tool to leverage a higher annual return for the Value Investment Fund is to sell put options. A PUT is an option for the holder of the PUT to sell an asset, in this case, stock, for a preset price referred to as the strike Price. The seller of the PUT is basically selling an insurance policy that if the market price drops to the strike price, the seller of the PUT is willing to buy the stock at that price. PUTs are a viable alternative to owning stock at less than its intrinsic value.

The Club’s Investment Fund desires to own Union Pacific. Why? Union Pacific is considered the best performer of all publicly traded Class I Railways (six companies). Railroad companies:

- All generate a profit, the lowest net profit within the group is 22.8%;

- All have positive operational cash flow and good free cash flow;

- All issue dividends to their shareholders;

- All have gross profit margins > 34.5% with the average over 37%;

- All have low administrative overhead, generating high operational profit margins; AND

- All have similar 10-year growth lines related to share price.

Any chance to purchase a high-quality stock at a good price is almost considered stealing. Selling PUTS provides this opportunity to basically purchase a good company at a low price and then simply wait for market recovery and sell high.

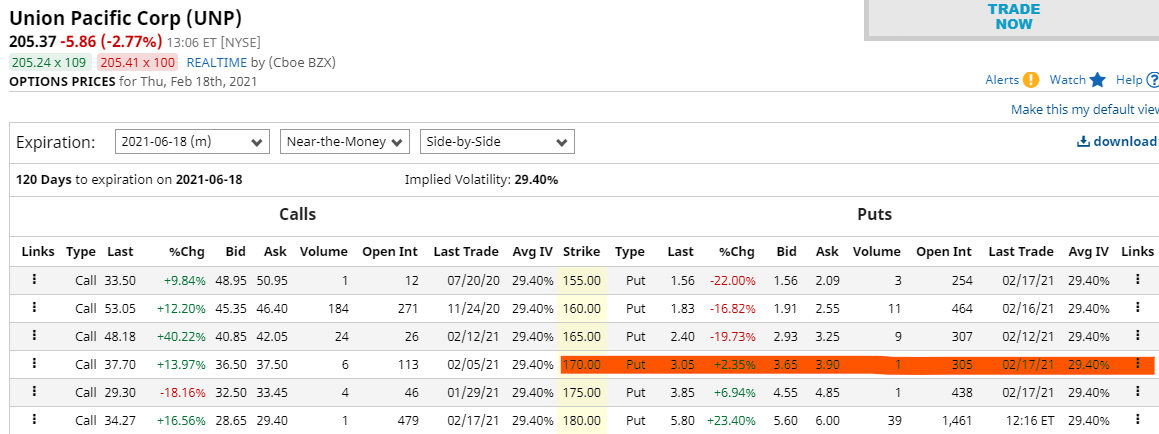

The Value Investment Fund sets up these opportunities by selling PUT options. In this case, on Thursday, the 18th of February 2021, the Railways Pool of the Fund sold two sets of PUTS. The first are short-term PUTs with an expiration date of June 18, 2021 (four months) with a strike price of $170 per share. Basically, the Fund wants to buy Union Pacific for $170 per share if the opportunity arises during the next four months. Here is the options report from the 18th of February, 2021.

The last selling price is used, $3.05 per share. The Fund is interested in owning $20,000 worth of stock at $170 per share and a trading fee of $1 per share. Thus, the total cost per share is $171, which means the Fund sold 116.959 shares and netted $2.05 per share (remember, each transaction costs $1 per share). From this short-term option, the Fund nets $239.77.

What the Fund desires is a greater safety margin, i.e., purchasing stock for a price that is at least 20% less than intrinsic value. Since intrinsic value is estimated at $185 per share, any opportunity to purchase Union Pacific for less than $148 per share is considered a steal.

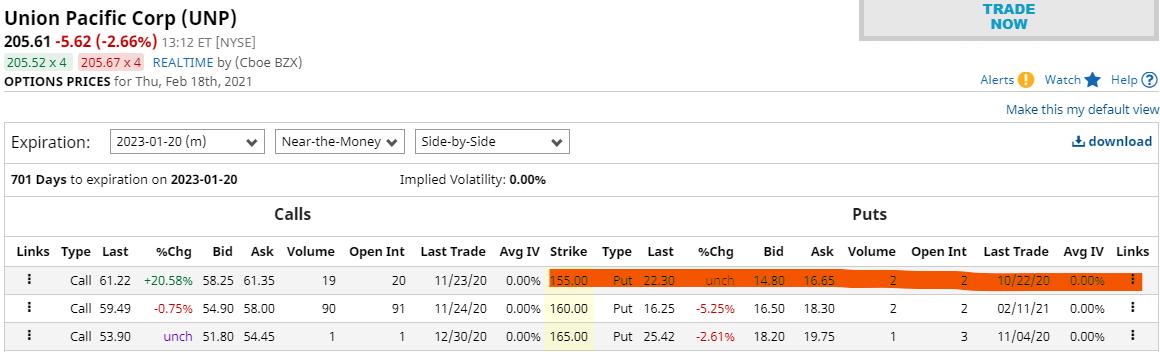

The Fund researched further and discovered a second set of PUTs called Long-PUTs. Here, PUTs are sold for a much higher price per share but have extensive holding or policy periods. For a long-PUT dated January 20, 2023 (23 months out), with a strike price of $155 per share, the current price is $14.80 (most recent bid submitted). The net is $13.80 per share sold.

To own $20,000 of stock at $156.00/share (includes $1 transaction fee per share), the Fund sold 128.2051 PUTs and earned $1,769.23 after a transaction fee of $1 per share.

Many of you reading this are wondering, a good safety margin is to own the stock with at least a 20% safety margin, i.e., 80% of $185 estimated intrinsic value per share. Notice that with this sale of a PUT, the Fund earned $13.80 per share. Thus, if forced to purchase the stock, the effective true strike price is $141.20 (face strike price of $155 less $13.80 earned upfront per share). The effective margin of safety is 23.6%.

The real benefit of this is that in the interim, the Fund can put this $1,769.23 to work and earn a return by investing the net proceeds.

A common inquiry from students is why not sell long-PUTs on all potential investments? It is an excellent way to earn a good return with minimal risk. One of the four principles of value investing is to own high-quality financial instruments at very good prices. Ownership of a security at dramatically less than its intrinsic value is the best risk reduction tool for value investors. The answer is that, if the market declines for any high-quality stock, it is most likely across the board for all members of the investment pool and the other pools. Deep market price drops are driven by economic-wide fluctuations, and rarely, if ever, does a single company in the portfolio drop in price on its own. Thus, if the Fund sold long-PUTs on all its potential investments and there is a deep market price drop, the Fund would be unable to cover the costs associated with the purchase of all positions in PUTs. The absolute maximum face value of PUTs cannot exceed the current basis in the Fund. In this case, the Fund’s current basis is $100,000.

Thus, the sale of long-PUTs should only be done with the best quality stock within each investment pool. Only sell PUTs that can be covered. This business principle is covered in more detail in Phase Three of the value investment membership program.

All total, the sale of PUTs on Union Pacific earned the Fund $2,009, and this was added to the cash account at week’s end, 02/19/2021. As a side note: The Fund owned Union Pacific PUTs that expired on February 19, 2021. Thus, the Fund is currently obligated to pay out $80,000 if all PUTs are exercised. Act on Knowledge.