Lessons Learned – Value Investing Fund Year One

A primary tenet of good business management is to constantly and consistently evaluate outcomes of decisions made; make adjustments and reevaluate the new results. This pattern continues indefinitely as conditions and criteria are constantly changing in our business environment.

During the first year of the Value Investment Fund, I laid out a goal and set some principle guidance to achieve this goal. The goal was to get a 30% return on the initial investment of $10,000. Actual results were 23.5% return. However, this particular annual cycle included the market collapse tied to COVID-19. Thus, I can’t confirm if I did well. BUT, I did outperform all other major market indicators as follows:

Value Investment Fund 23.5%

DOW Jones Industrial Average 6.5%

S&P 500 14.6%

Russell 2000 5.3%

The guiding principles during this period were as follows:

- Utilized a single fund of similar companies, in this case, I chose Class I railways (six companies);

- Set buy/sell triggers at the beginning and adhered to them;

- Maintained patience as I relied on research and business ratios to increase my confidence in my decisions;

- Wanted fewer than 10 full cycle trades.

During the year, I conducted five full trades and earned over $2,200 in gains after fees. The fund received dividends of $150 during the period.

With the results now recorded, I want to know why I didn’t achieve the success desired. I learned three important lessons during this time frame.

Lessons Learned – Average Cash Balance Exceeded a Reasonable Level

During this one year, my average cash balance was $2,189.51. Given the weighted factor effect, the average cash balance was almost 20% of the fund’s original investment of $10,000. This means the fund was not working efficiently during this period. Had I been able to invest this cash and received a similar return as the balance of the fund, my overall return would have cleared 28%. Thus, having cash sit idly in the fund significantly affects the fund’s overall return.

The chief reason is that I had a limited pool of potential investments to work with. Six separate companies are too small a pool of potential candidates. Interestingly, I only purchased four different companies during this period with five full trades. This means that for me to incremental increase my return, I must have more potential companies to select from to exercise the cash.

Thus, for year two of this experiment, the overall fund’s initial balance will reset and start with $100,000. I will try to keep the actual cash balance to less than $2,000 overall. Thus, instead of a 19% cash position, the cash position will be a meager 2%. This means I must expand the number of potential investments to provide adequate opportunities.

During Year Two, I am adding two more distinct pools of investments. I will continue with the railways in the Railroad Pool. I am adding another high fixed asset balance investment pool with REITs, which I explain in a separate article. The REIT pool will also have six companies I will track. A third pool, again, another high fixed asset balance investment pool, has yet to be set, but I will have a group by October 31, 2020. My overall goal is to have 18 different companies to select from among three different pools. This will allow me to exercise the cash within the fund and ultimately increase my return.

Lessons Learned – Greater Dispersion

The single most important concept of business is to buy low and sell high. The greater the difference between the two points, the more profit from the trade is generated. With value investing, the investor uses business ratios to set up thresholds of value, i.e., extreme points of value that may happen. The potential company is reviewed over a long period to discover common dispersion (highs & lows), and then trigger points are set.

During the past year, I used a set of relatively conservative trigger points, approximately 80% of the predetermined set points. It turns out that had I been more aggressive with my buy/sell trigger points, I could have easily exceeded the 30% return on the investment. This means, greater dispersion will generate greater returns. The problem is, of course, the increase in the risk factor of losing opportunities. For example, assume an investment price dips to 80% of the predetermined buy point. The stock price then recovers. Had the investment fund been purchased at the 80% point, it would have gained on the sale of the particular investment. Thus, an increase in dispersion is at an increased risk of reduced trades. Furthermore, I have not evaluated the recovery time frames; in many cases, when a stock price dips significantly, it takes more time to recover. Thus, capital is held in an investment that could be used with more trades of reduced dispersion. More full trades accelerate earnings.

During Year Two of the value investing program, I have decided to increase the dispersion to 90% of all set buy points and utilize a 103% sell point (prior peak).

With additional pools of companies for buy/sell opportunities, I can offset the risk associated with missed opportunities as stated above.

Lessons Learned – Leverage the Investment Fund Without Increased Risk

I need to leverage the fund without increasing overall risk. One tool available is using a ‘PUT’ option. Before explaining a PUT, let’s first remind ourselves of what we desire with value investing.

First off, all the investments are sound, high fixed asset-based companies. In addition, all of the companies I use in the various pools have a market capitalization in excess of $1 billion. This means they are actively traded and, in general, are considered high or mid-cap stocks. In effect, they are all in the top 2,000 companies available on exchanges. High fixed asset-based investments have lower variable costs; thus, the contribution margins generated from each dollar of revenue make it easy for the respective company to maintain solvency, earn profits, and have long-term business models. Thus, any erosion of equity is slow, and it is easy to recognize with financial statements. Overall, these types of investments have a very low risk of default or bankruptcy. They are good quality investments.

Secondly, relying on quality investments means that the fund wants to buy stock when the market price to book value is low. In general, high fixed asset-based investments have good market value for the respective fixed assets. This means the actual liquidation value of the stock is greater than the book value of the stock. Review the two pools I have in this fund to date:

- Railways own land, tracks, equipment, and depots. In general, the land and existing tracks have a fair market value that exceeds the initial cost basis.

- REITs are also another example of a fixed asset-based operation. The respective buildings and associated land are generally worth more over time than the original cost basis. This is no different than the typical homeowner; after about five years, the home begins to have equity built into the home’s value if sold.

Thus, the key to value investing with high fixed asset-based companies is to buy low, i.e., when the price to book is low or in optimum acquisition value. In effect, the fund wants to buy and own the stock when the stock price is low. The problem is that you have to wait for this to happen. So why not own some insurance that says you can buy it and own it at such a low price?

This is where PUTs come in handy. A PUT is an option contract whereby the seller (in this case, the fund) sells the option to someone currently holding the particular investment you want to own. You are basically saying to the buyer of your PUT that if the price drops to this point, I’ll buy it from you for this price. That price is called the ‘Strike Price’.

An example is appropriate here. The fund wants to own Union Pacific railroad. Why? Because Union Pacific is the granddaddy of railways. It has been around for over 100 years, makes a profit all the time, even during recessions, and its risk of going out of business is pretty much nil. Based on the metrics determined for Union Pacific, a 17% or more drop in market price warrants ownership of that stock. The current 17% price point for Union Pacific (today: 10/26/2020) is $174 per share. There are owners of this stock, which is currently on the market at $189/share, who don’t want the price to drop to $170 share and are willing to buy insurance that basically says that their respective worst-case scenario is that they sell their stock for $170 a share. Thus, the investment fund simply sells an insurance policy to them for this. After all, the investment fund would love to own this stock for $170 each. Why? We know based on the history of this company that the stock price will recover to the original peak within two years, but most often within six months.

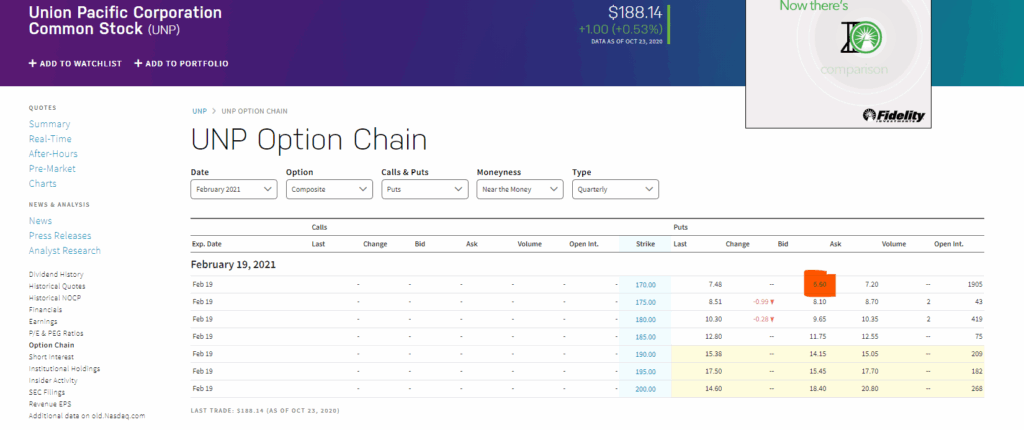

Thus, the investment fund sells to the current owner a PUT that allows the current owner to force the fund to buy the stock at $170 each. I’m good with that; I want this to happen. Thus, I can now sell a PUT to the buyer for $6.60 that is good until February 19th, 2021; see the chart below:

Notice that the current bid price is $6.60. Assuming the broker takes one dollar for each PUT I sell, I net $5.60 each. Thus, I can leverage my position by selling PUTs. Now, if the price drops to $170 per share before February 19, 2021, the fund will own Union Pacific at the price preset for the buy point. It’s a win-win for the fund; it earns money selling PUTs, and hopefully, the stock price drops, and the fund will own Union Pacific at a price desired.

The value investment fund will now begin to sell PUTs on potential investments to earn money while it waits for the market price to drop for the respective investments.

Summary – Lessons Learned

During the first year of the value investment fund, the fund didn’t achieve the financial return desired. Several mistakes were made. First off, the fund held too much cash. This means that this cash did not earn money for the fund. Reducing the cash position as a percentage of the fund’s value is necessary to increase the effectiveness of the overall fund’s investment.

Secondly, the fund adhered to the buy/sell points that were relatively conservative buy/sell trigger points. Increasing the dispersion of the buy/sell points will earn more returns for the fund. However, this comes with some risk that there will be missed opportunities at the more conservative buy/sell points. To mitigate this risk, additional pools of companies are now available (the fund has added REITs to its portfolio), which provide additional opportunities, thus offsetting the risk of the more aggressive buy/sell points.

Finally, the investment fund is now going to sell PUTs to own the respective investments at the desired buy points. This achieves two important goals: first, it earns money selling PUTs, and secondly, it provides greater assurance of owning the stock at the respective strike price. Act on Knowledge.