Wendy’s – Intrinsic Value of Stock

November 2021

‘Quality is still our recipe’ – Dave Thomas, Founder of Wendy’s

Wendy’s is the second largest publicly traded informal eating-out (fast-food) hamburger chain. Its current market capitalization places it at around $5 billion. Therefore, it falls into the mid-cap arena of stocks. At the time of this article’s inception, November 2021, Wendy’s was trading on the NASDAQ at $23 per share. Its intrinsic value is a little less than half the market value, and a value investor’s buy point is around $8 per share. The company does pay a small dividend. The current dividend yield is slightly less than 2%. Overall, the company is profitable but stagnant in terms of growth. Stated succinctly, Wendy’s is nowhere near worth the current market value of more than $20 per share.

This company runs the industry financial model commonly used by other fast-food restaurant chains. It has three revenue and expense segments of operations. The first and core segment is the traditional corporate-owned locations. Wendy’s has 361 company-owned stores. As such, they have a traditional profit and loss calculation associated with this segment. A second segment and the real driving force of profit is the franchising arm of the company. There are 6,467 franchisees, with corporate-owned stores, Wendy’s totals 6,828 restaurants. This segment is driven by the 4% franchise fee placed on all sales of the franchisees. Similar to McDonald’s, the core source of profitability stems from the franchising aspect of operations. A third, and not as profitable as franchising, is the real estate arm. Just like McDonald’s and other well-managed restaurant chains, Wendy’s negotiates long-term leases of property in ideal locations and, in turn, negotiates beneficial long-term leases with franchisees to pay rent for the use of that land. The franchisee uses their capital to build the store, equip it, and initiate operations at that site.

Unlike McDonald’s, Wendy’s has failed to generate any profit from its corporate-run segment. The corporate-run stores generate a 14.9% operating margin, but once you add this segment’s share of depreciation, G&A, and other allocated costs, this segment loses money for Wendy’s. In comparison, McDonald’s generates an 11.4% net profit after taxes from this same segment. This greatly impacts the intrinsic value formula, as will be illustrated later. For now, it is important to look at the overall picture. How much is a corporate-owned store worth, and how much is a franchisee store worth to an investor?

Wendy’s – Intrinsic Value of Stock Driven by Asset Valuation and Royalties

A well-run fast-food operation site is worth between $1.3 million and $1.7 million net of associated liabilities for the physical assets. This net worth includes the long-term rights to a particular geographic location and access to a stable and qualified workforce. To provide a conservative approach to valuation, a mid-range value is used to approximate the value of each of the corporate-owned restaurants. Using a $1.5 million valuation (the name Wendy’s bumps the site locations’ value higher than a recognized name) and with 361 stores, Wendy’s corporate-owned assets have a reasonable fair market value in the range of $525 million to $550 million.

The second piece, and more lucrative to Wendy’s, is the franchising arrangement. Here, a different application principle is applied. In a franchising arrangement, the franchisor is getting paid for the use of the name. Four percent of all sales equates to $415 million in 2020. In addition, Wendy’s receives a license fee from the franchisees, which equates to an additional $30 million. However, much of the costs associated with franchising are directly tied to the license and not so much with royalties. Since a typical well-run establishment will earn an 11.4% profit after taxes without a royalty fee, and assuming a reasonable 28% cumulative tax rate, the actual profit before royalty expenditure is around 15.8%. Thus, a 4% royalty is about 1/4 of the restaurant’s value. Therefore, it is reasonable to deduce that a franchisee-operated store is worth about $375,00 (1/4 of $1.5 million valuation). With 6,467 franchisees and a franchisee asset valuation of $375,000 each, this equates to a total combined value of $2,425 million ($2.425 billion) for the franchise locations. A value investor would ask if this is reasonable. Let’s look at this in a slightly different way.

A typical Wendy’s will generate around $1.7 million of revenue in a year. With a 4% franchise royalty, each location must pay Wendy’s $68,000 per year in royalties. Thus, Wendy’s gets its $375,000 of value every 5.5 years, which is indeed reasonable. Therefore, the asset valuation principle used above for franchisees is a fair viewpoint or estimate of total value.

The last segment is land leasing. Wendy’s owns the rights to the leases and collects fees from franchisees. The difference between rental income and rental lease costs is around $107 million. Assuming some reasonable costs associated with monitoring and administering this program, Wendy’s is easily clearing $50 million per year from this segment of revenue sources. Using a basic multiplier of 6X of this value, this adds another $300 million to the overall asset and royalties’ valuation.

Thus, in total, Wendy’s asset valuation is as follows:

Value of Corporate-Owned Stores $550 million

Value of Franchisees as an Asset 2,425 million

Value of Land Lease Rights 300 million

Total Asset Valuation of Wendy’s $3,275 million ($3.275 billion)

There are currently 226 million shares outstanding in the market. Thus, each share is worth about $14.50.

This method of valuation is asset-driven and not income-driven. Income-driven valuations use a different formula to determine intrinsic value.

Intrinsic Value of Stock Based on Income

Valuation based on income requires several underlying elements to be present to have confidence in the outcome. Wendy’s satisfies these elements:

- The entity must have completed one or more economic cycles (10 to 14 years);

- Income must be positive from normal operations consistently, i.e., more than 75% of the years in operations;

- The entity must be financially stable; this is vouched from the balance sheet; AND

- The entity must have backup resources to provide liquidity during lean times.

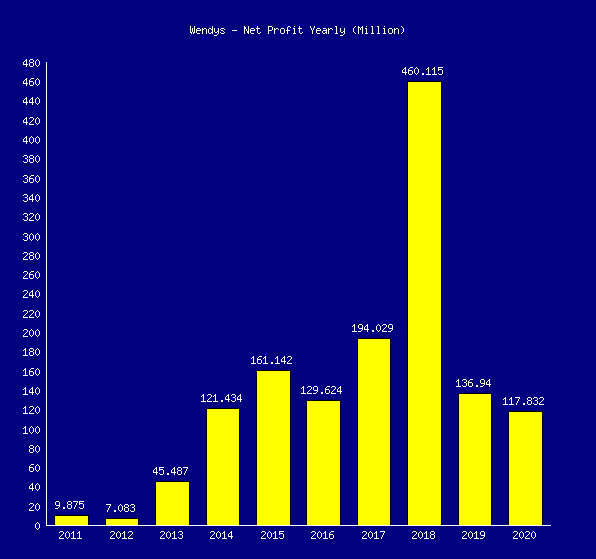

Wendy’s satisfies all the required elements. The company has been in business for 52 years. Secondly, it rarely generates a loss. See this historical depiction:

2018 is an anomaly associated with the spin-off of Wendy’s rights in Arby’s.

2018 is an anomaly associated with the spin-off of Wendy’s rights in Arby’s.

The most important piece of information to gather from this is that Wendy’s is indeed profitable from year to year. It isn’t wildly profitable, but it is profitable.

In addition, the company has borrowing capacity along with over $500 million of equity to withstand an extended economic downturn. Therefore, it is acceptable to use an income-based formula to determine intrinsic value.

A sidebar is appropriate here. Many readers will wonder why not use the free cash flow of the company adjusted for growth and discount the future free cash flow. This is one of the most common tools readers discover when asking about intrinsic value. However, utilizing a discounted future cash flow stream is highly dependent on accurately estimating future cash flow for the entity in question. This is easy for DOW and Large-Cap companies. For Mid, Small, and Penny stock categories, it is an attempt at frustration. Look at Wendy’s cash flow for the last three years. It is highly volatile, and worse, it is inconsistent from line to line for cash flows from operations. Thus, any outcome from this tool would require the user to make lots of adjustments to the cash flow value to generate a reliable result. Most readers are not CPA’s and, as such, are not aware of how to make these adjustments when performing this step. The outcome would be untrustworthy.

Now the question is: ‘How much is Wendy’s income?’.

In 2018, Wendy’s sold off its ownership rights carried over from 2012’s divestiture of Arby’s. Adjusted for income taxes, Wendy’s gain from the sale of that investment approximated $360 million, again, net of taxes. Thus, in 2018, normal operations for Wendy’s netted $100 million ($460M – $360M). Using the past seven years of income, including income reported through the third quarter of 2021 (released on 11/10/21), Wendy’s averages $145 million per year as net income after taxes. This even includes the impact of COVID-19 in 2020 and early 2021.

To value this average $145 million per year net income, a second piece of information is required. It is called the ‘discount rate’. In effect, it is a value applied against a known to determine its long-term outcome (result). The ‘discount rate’ application is an inverse operation. The higher the discount rate, the lower the resultant value. The final formula is a finance formula called Net Present Value. Basically, we assume the net income will exist at a similar value indefinitely, and those payments out into the future are discounted back to a value in today’s dollars. With each successive year, the current value of that longer time out into the future is significantly less tied to this discount rate. Once the formula starts discounting beyond the 18th year, the additional inclusive discounted value falls below four cents per share. In effect, it isn’t necessary to determine the net additional contribution amount beyond 20 years, as it will have no bearing on the end decision related to intrinsic value for this stock. In addition, over this extended period of time, there will be economic recessions, and this may produce negative profits during those respective years. Thus, for investment of this nature, using the current average of the most recent seven years is a reasonable expectation of future earnings.

One last note to include about the use of this formula. Many mathematical professionals will tell you that the future income stream for Wendy’s will increase, referred to as a growth rate into the future. The author agrees with the concept of using a growth rate, but disagrees that it is applicable in this case. Look at the pattern above for Wendy’s income. First, it is highly volatile; secondly, Wendy’s has not demonstrated real growth of any sort during the last seven years. Growth of one or two percent is not real growth; it isn’t even keeping up with the overall growth of the economy. A value investor has to be realistic; real growth means three and four percent per year, year over year. This is simply not happening with Wendy’s. Thus, including a growth rate with Wendy’s formula isn’t going to really make any real difference in the result. It may change it by one or two percent, but one or two percent on a $10 outcome is only 20 cents or so. It isn’t going to change a value investor’s decision model. Thus, there is no need to determine and include a growth rate in the formula.

The question now is: ‘What is an appropriate discount rate?’ The answer is a function of four core elements of determining the discount rate. They are as follows and include a simple definition:

- Risk-Free Rate – This is the rate that exists with Treasury notes. It is what most investors will accept without any risk.

- Equity Risk Rate – A rate an investor is willing to accept given the position they fall within the spectrum of ownership rights, i.e., equity positions range from 4% to as high as 7%. Bondholders are in the 3% to 5% range. Secured bondholders have less risk involved and are in the 2.7% to 3.5% range.

- Size Premium – An additional 1% to 4% depending on the size of the company. For example, Walmart’s size premium is around 1%. Mid-Cap investments are in the 2% to 3% range, whereas penny stocks are slightly more than 4% premium.

- Specific Risk – A factor associated with the purpose of the investment and the ability to sell the respective investments promptly. In this case, Wendy’s is stable, and it is easy to dispose of a stock position with Wendy’s. A bond position would require a higher specific risk. Overall, specific risk ranges from 0% (McDonald’s stock position) to as high as 4% for an over-the-counter stock purchase.

For Wendy’s, the discount rate (November 2021) is determined as follows:

- Risk-Free Rate 2.25%

- Equity Risk Rate 6.25%

- Size Premium 2.00% (Mid-Cap Value)

- Specific Risk 1.00%

Therefore, a reasonable discount rate for a Wendy’s investment is around 11.5%. Again, the higher the value, the lower the result with the discount formula. What is the market value of Wendy’s income?

Formula: Net Present Value of Future Earnings

= $1,117,924,000

If Wendy’s discount rate were higher, 14%, the income stream’s value would be less at $961,000,000. At 8%, the result is $1,424,000,000. This is important to understand: there is a $463,000,000 spread between the two extremes. With 226 million shares in the market, this spread can impact the value by as much as $2.05 per share. As stated multiple times in the lessons about value investing, intrinsic value calculation is NOT an exact science. It is a range; your goal is to try and keep that range as narrow as possible to provide a high level of confidence with its outcome.

Using income to determine intrinsic value for Wendy’s, the final result is $1,118 million divided by 226 million shares, or about $4.95 per share. At the high end (8% discount), the value equates to $6.30/share; at the low end, it is $4.25/share. Thus, Wendy’s is a good investment if the value investor relies solely on income to determine an appropriate intrinsic value, AND the market price per share could dip below $5 per share.

Using income to determine intrinsic value for Wendy’s, the final result is $1,118 million divided by 226 million shares, or about $4.95 per share. At the high end (8% discount), the value equates to $6.30/share; at the low end, it is $4.25/share. Thus, Wendy’s is a good investment if the value investor relies solely on income to determine an appropriate intrinsic value, AND the market price per share could dip below $5 per share.

Many of you, especially investment analysts, are having a difficult time accepting an intrinsic value of $5.00 per share, especially since Wendy’s market price has exceeded $10/share for the last six years. The income method is extremely conservative when determining value. It is highly reliant on the average of many years of income, thus recent higher earnings are dampened by their impact due to the averaging effect. Therefore, the formula’s outcome could be relatively understated if the company’s net income continues to improve shortly, and of course, the outcome value will have the opposite impact if the company’s recent earnings are declining, which is the case with Wendy’s. In effect, the $5 per share intrinsic valuation is generous. Overall, this intrinsic value method provides a high level of confidence when stating intrinsic value. With Wendy’s, $4.25 is the valuation, or for the sake of simplicity, $5 per share. There is a high level of confidence that Wendy’s is worth at least $5 per share. Still, this appears and feels low for such a highly visible company. After all, we are talking about 6,828 restaurants.

Are there other alternative intrinsic value methods?

Wendy’s – Intrinsic Value of Stock Based on Book Value and Dividend Yield

Another commonly accepted method to determine value is combining the existing book value and the result of the dividend yield.

For those of you who are not familiar, dividend yield is simply the value of receiving a lifetime of dividends from an investment. In this case, Wendy’s pays about 38 cents per year in dividends. Since dividends are an equity risk, an investor could apply an acceptable minimum discount rate and determine the value of all future dividends. In this case, a 6.25% discount rate (see equity risk rate from above) is reasonable. With a 6.25% equity discount rate, 38 cents per year is worth approximately $5.75 per share.

Current book value for Wendy’s is $2.40 per share. Add the two together, and the stock’s intrinsic value under this method is $8.15 per share.

There are some drawbacks to this method. First, the book value is predicated on the ability of Wendy’s to liquidate reasonably and end up with $2.40 per share of cash to distribute to the shareholders. The key here is that Wendy’s is more valuable as a going concern than its assets sold and liquidated. A perfect example is McDonald’s. McDonald’s book value is a negative $5 per share. Thus, McDonald’s is worth zero if liquidated. McDonald’s real value comes from its name and brand. Therefore, book value with a highly stable, long-lived company is not indicative of the value of the assets liquidated and the liabilities paid off.

Wendy’s name and brand have value that another entity would snap up if Wendy’s had financial troubles. Overall, Wendy’s, just like McDonald’s, is worth more than its book value. The question is how much more?

Intrinsic Value of Stock

What this does tell us is that when combining book value and dividend yield together, an intrinsic value of $8.15 is going to be low. This also lowers the confidence that the income method result of $5 per share is also low. If a value investor relies solely on the asset valuation, including the value of the royalties, $14.50 per share seems high. Under that method, there are a lot of assumptions associated with the leases on the properties; reliance that all franchisees run good operations and generate after-tax profits of 11.4%; and an assumption that the net value from the real estate segment is high. Thus, the value derivative of the asset valuation along with royalties is liberal with its outcome.

The intrinsic value of Wendy’s lies somewhere between $8.15 per share, driven by book and dividend yield values, and $14.50 based on asset valuations. Remember, the key to determining intrinsic value is to narrow the range. $14.50 is too high; we know it is overstated, but not by some unreasonable amount. Adjusting it downward 25% (an 80% factor) improves our confidence in the outcome dramatically. Using an 80% factor, this price drops to $11.60, and we know that $8.15 is low because Wendy’s brand name and going concern are not issues related to long-term operations. There is no doubt, the company will be around in seven years. Thus, it is safe to improve this value 25% to $10.20 per share.

The outcome is that intrinsic value on the low end is $10.20 and on the high end $11.60. It isn’t necessary to derive an exact number. Intrinsic value is a base value, and therefore, using $11 as our base is quite reasonable.

There is one last check mechanism. The founding fathers of value investing (Benjamin Graham and David Dodd) developed a simple formula to determine the value of a security. The formula is to take the current earnings and multiply them by a factor of 8.5 plus 2 times the anticipated future growth. Assuming Wendy’s experiences great growth for the next seven years and this growth rate is a factor of three percent (see above with the net present value formula), what is the value for Wendy?

Earnings of $145 Million (from above) times ((8.5 plus (2X3% growth rate)) = $145 Million X 14.5 or $2,102,500,000. On a per-share basis, this equals $9.30 per share.

Thus, even under the formula advocated by the fathers of value investing, the $11 per share value outcome is high. And, the formula assumes a very strong three percent growth rate per year for the next seven years. A three percent growth rate is somewhat risky to assume, given that Wendy’s has only experienced a one to two percent growth per year over the last few years. So, how does a value investor mitigate this risk?

For value investors, risk reduction is essential. The number one tool to reduce investment risk is to buy stock with a high margin of safety, a strong discount to the intrinsic value. A good and very effective principle is to reduce intrinsic value by at least 25%. Setting the buy point at $8 per share and increasing it by around $1 per share every two years is a reasonable approach for the near future (six years or so).

Given that the current market price is over $23 per share and the last time Wendy’s stock price was $8 per share was back in 2014, value investors are going to have a long wait to have an opportunity to buy. Yes, you could buy the stock at $11 or $12 a share and still have a high level of confidence that this investment will reward you. All you have done is simply increase your risk that if it takes a long time for the market price to recover high enough to sell, your effective annual return will be decent, not great, just decent. At $8 per share, it will not take long for the market price to recover to a reasonable market price of $16 or more per share. The return on the investment will be extremely high.

In general, Wendy’s is not a good investment for value investors. It is not necessary to depend on a single stock to determine the outcome for a value investment portfolio. The key is to determine buy points for several members of a similar pool of investments and wait patiently. At some point, one or more of the members will dip to the preset buy point, and a value investor has an excellent opportunity to generate an outstanding return on their investment. For Wendy’s, a value investor may have to wait a few years to see the market price dip to $8 per share. But when it does, it becomes an excellent investment and will provide a very high return when it is ultimately sold. Act on Knowledge.