The Walt Disney Company – Sold PUT Options

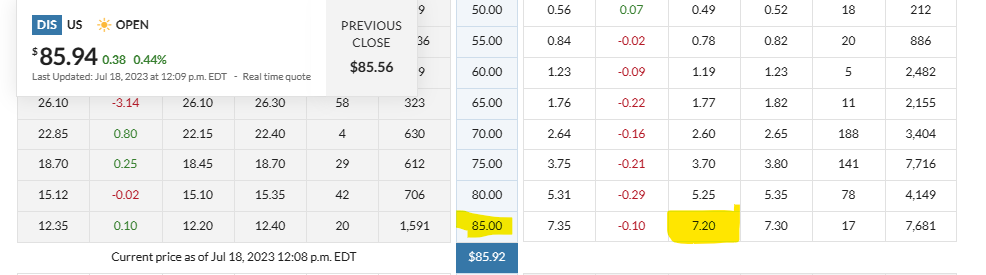

Today, July 18, 2023, the Value Investment Fund sold a PUT Option for 300 Shares of The Walt Disney Company with a strike price of $85.00 and an expiration date of June 21, 2024. Total gross receipts equal $2,160. The Fund assesses a $1 per share transaction fee to cover the operating costs of the Fund. Thus, the net earnings from the sale of these PUT options equal $1,860.00.

The facilitator of the Fund has determined that the intrinsic value of The Walt Disney Company is approximately $116. Thus, ownership of The Walt Disney Company at $85 a share is a 27% discount from the intrinsic value. Furthermore, the sale of the puts earns the Fund a net value of $6.20 per share. Thus, the net purchase price is $78.80, and this is a 34% discount against the intrinsic value.

The Walt Disney Company

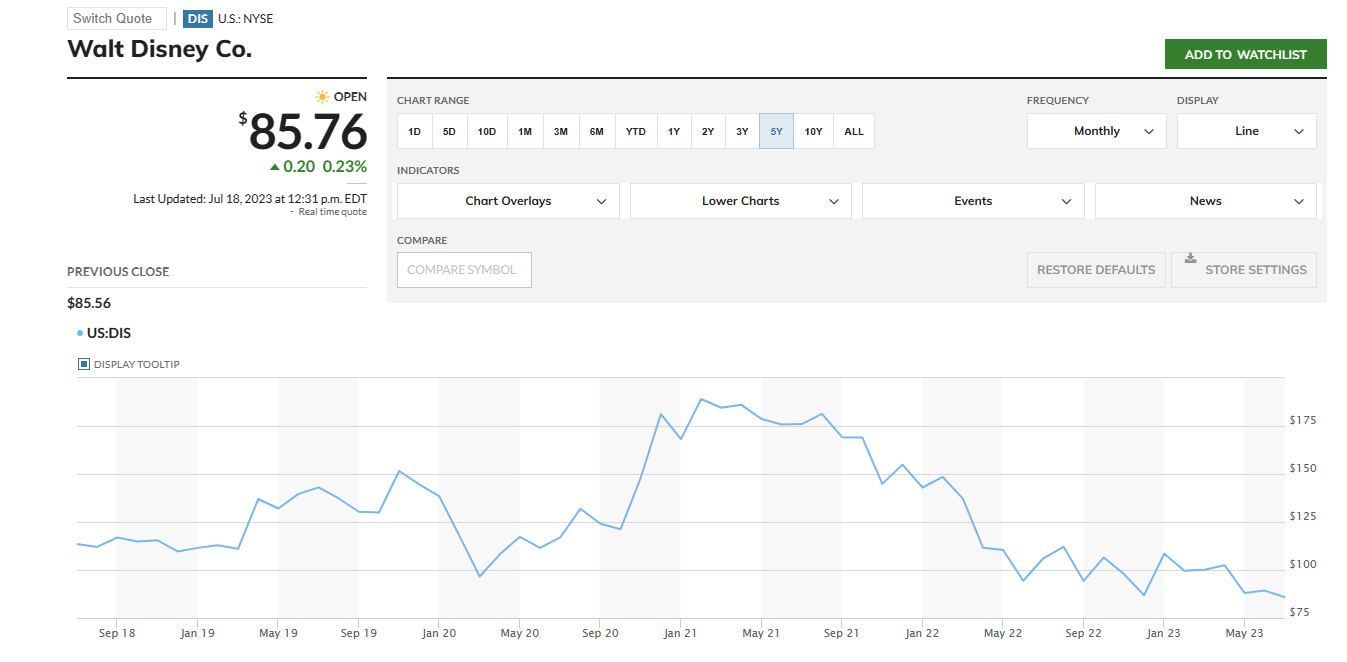

The best time to sell PUTs is when a company’s stock price is highly depressed. This is The Walt Disney Company’s five-year look back at the market price:

There a several contributing factors causing this market price dip for The Walt Disney Company. The company is experiencing some turmoil in senior management as Bob Igor has come back a few months ago, park attendance is down, and there is a legal battle with Florida via the governor. The reality is that The Walt Disney Company is a massive conglomerate with annual revenues exceeding $90 billion. It continues to earn profits, and it is just a matter of time before the market price returns to a price greater than $140 per share. Act on Knowledge.