Buy Norfolk Southern Corporation (Railroad)

Today, September 28, 2023, this site’s Value Investment Fund purchased another 200 shares of Norfolk Southern Corporation (Railroad) utilizing its margin account to fund the transaction. The price per share at closing was $197.38. The Fund paid $197.52 per share. Total costs to purchase the 200 shares are as follows:

Market Price/Share @ $197.52 at 3:56 PM (200 Shares) $39,504.00

Transaction Fee/Share @ $1.00 each 200.00

Margin Fee @ 2% for Purchase ($39,704.00 X .02) 794.08

Total Capital Outlay (Fund’s Basis) $40,498.08 ($202.49/Share

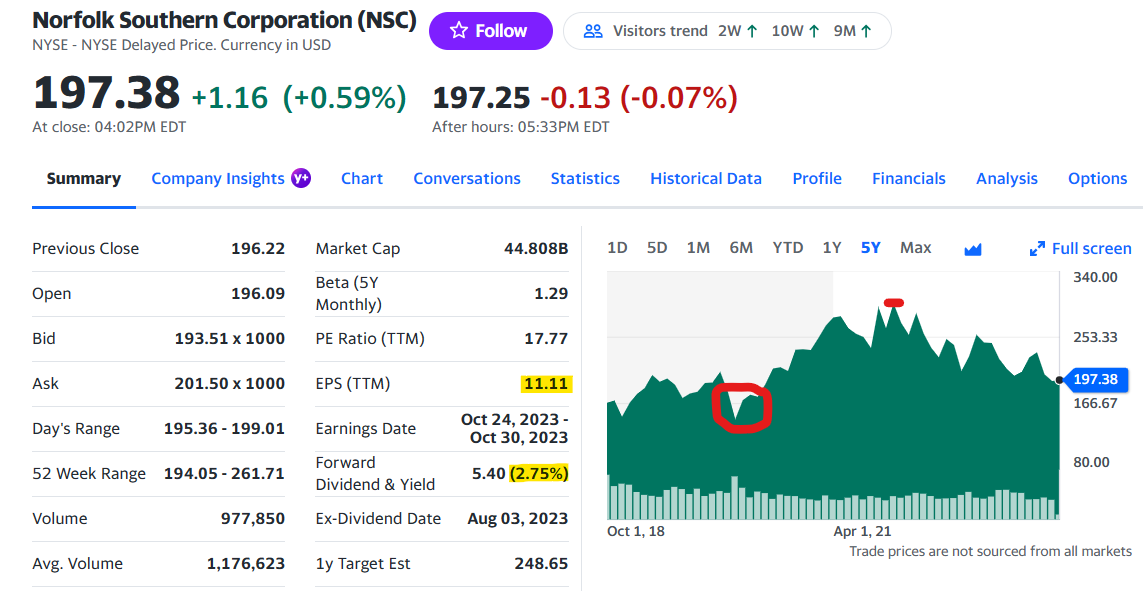

The historical market price for Norfolk Southern Corporation has only dipped below $170.00 per share once in the last three and three-quarters years. This occurred during the pandemic market chaos in March of 2020 (as indicated by the red circled zone). The share price peaked at $271 as marked by the red line. Look at this basic presentation chart:

Take note of two key items. First, earnings per share are $11.11 during the last twelve months. In addition, dividends per quarter are $1.35 or currently tracking $5.40 per year for a 2.73% dividend yield. This is good. One could hold this investment for several years, while a value investor waits for the price to return to $250 per share to sell the security. Assuming it takes two years to get there, the investment will pay $10.80 in dividends, and with a basis of $203.29 (which includes the $1 per share transaction fee to sell the stock), the total return at $250 sales price per share will equal $57.51 per share on an initial outlay of $202.29. This equates to a little over a 13% annualized return on the investment.

Imagine the return on the investment if this happens within one year? It will be over 26%.

This investment matches all the requirements a value investor seeks:

- A high-quality company, a market capitalization of $44 billion, places this company in the top 1,200 U.S. operations;

- Low downside risk associated with the stock’s market price, see the chart above;

- Purchase price is below the intrinsic value of $206 per share;

- Market price recapture capacity is high due to the high, stable earnings of this company.

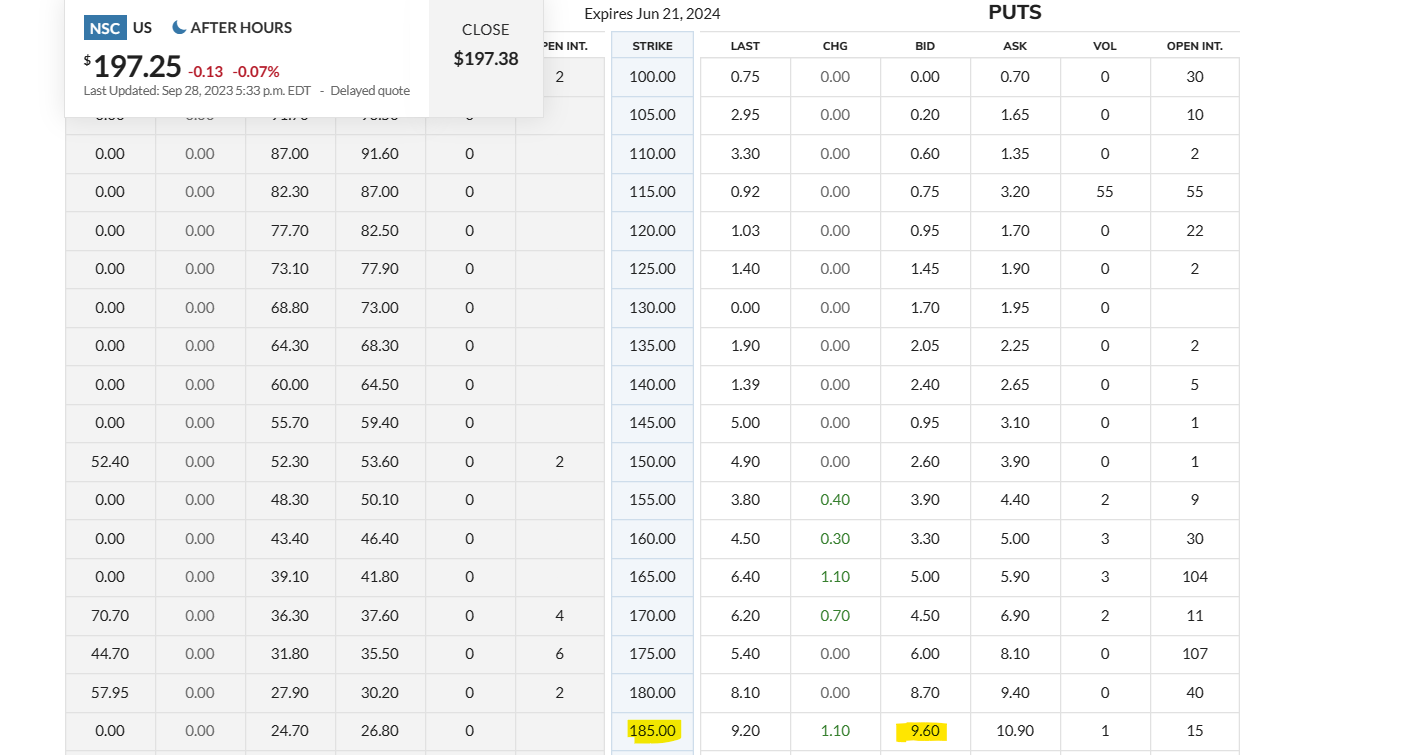

In addition, the Fund has sold a PUT Option contract for 200 shares with an expiration date of June 21, 2024. Gross earnings are $1,920.00 (200 shares at $9.60) with a net return after transaction fees of $1,720.00. The strike price is $185.00 per share.

The facilitator of this Fund has written multiple articles about Norfolk Southern Corporation and has made multiple trades as recorded on this website, all of them successful returns on the respective investment. Furthermore, the most recent financial filing with the Securities and Exchange Commission shows Norfolk Southern Corporation earning $576 million net of reserving $416 million to address the accident that happened in Ohio. Furthermore, key performance indicators show the company is just slightly behind the volume of tonnage at this same point last year. Last year, the price per share was $223 per share.

Thus, the low price per share is temporary, and once the quarterly report is posted in late October, early November for the third quarter, there is a high probability of market price recovery. Act on Knowledge.