Huntington Ingalls Industries – Sold PUTs November 2024

During the morning of November 1, 2024, Huntington Ingalls Industries – HII reported its third-quarter results. HII had several financial setbacks, causing the market price of this stock to drop dramatically. Within 30 minutes, the stock price dropped $60 from $250 to below $190.

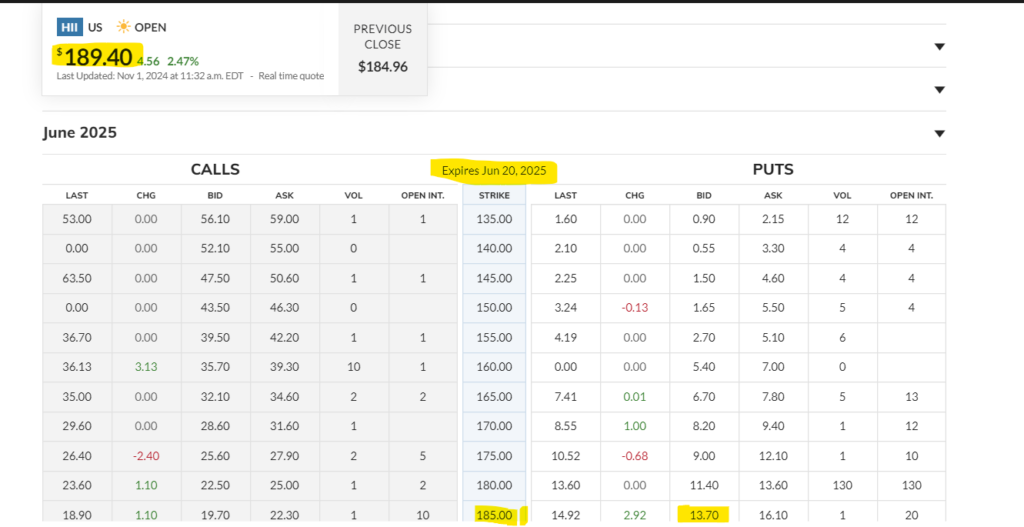

When a stock price drops this much in a short period of time, it is an opportunity to sell PUTs and make some quick cash. The Value Investment Fund sold 500 PUTs @13.70 each. Each PUT costs $1 for the respective transaction fee. The Fund netted $6,350. The strike price is $185 with a June 20, 2025, expiration date. In effect, the Fund is projecting that the market price will be above the strike price of $185 and thus, the PUTs will simply expire at that time.

Here’s the market price for June 20, 2025, PUTs:

If the market price for HII is less than $185 per share, the Fund must spend upwards of $185 per share for 500 shares or up to $92,500 to comply with the terms of the PUTs.

Recall from a prior article, PUTs are similar to an insurance arrangement. The buyer agrees to pay the seller a certain value to protect their investment if the price goes below a certain point – the strike price. During the last five years, Huntington Ingalls Industries’ stock price has been below $185 for a total of twelve months due to the market setback driven by COVID in early 2020 through the end of 2020. See this graph for evidence:

The Value Investment Fund has determined the intrinsic value to be approximately $200 per share, adjusted to 2024 from the intrinsic calculation performed in 2021. This is a highly stable and solid investment with very little downside risk. Simply stated, it is a wonderful investment if the market price drops below $195 per share. Furthermore, selling PUTs with long windows of time to recover from the current depressed market value is an opportunity to make some quick cash. Act on Knowledge.