Sold PUT Options Essex Property Trust

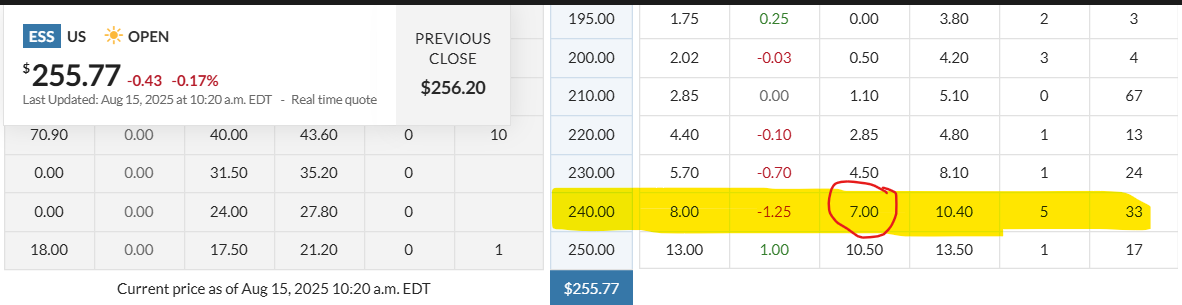

Today, August 15, 2025, the Value Investment Fund sold 400 PUT Options on Essex Property Trust for $7.00 per share. The REITs Pool paid $1 per option as a transaction fee. The strike price is set for $240 each with an expiration date of January 16, 2026. See the chart below of option values:

PUT Options are merely insurance contracts. The Value Investment Fund sells this contract to a buyer who holds this insurance policy. For the buyer, they want to protect their downside risk by preventing their respective position in Essex Property Trust. If the market price drops below $240 per share, that holder can force the seller, i.e., the Value Investment Fund, to buy those shares at $240 each from the holder of the PUT Option. This holder of the PUT Option has until 4 PM on January 16, 2026, to force the seller to purchase the holder’s shares.

For the Value Investment Fund, it has determined that Essex Property Trust has an intrinsic value of $270 per share and is willing to buy shares at a discount to intrinsic value, and has set this buy point at any price less than $255 per share. The Fund has a long history of performing well with Essex Property Trust. It has consistently bought this stock at less than $260 per share and sold it at $300 or more per share over the last six years. Here are the respective posts illustrating the buy and sell points in order:

- 10/24/20 Purchased 48 Shares at $204 Each

- Purchased 43 Shares at $230 Each

- 06/18/21 Sold 91 Shares at $304 Each

- 05/24/22 Purchased 72 Shares at $278/Share

- 06/14/22 Purchased 78 Shares at $257/Share

- 10/10/22 Purchased 100 Shares at $222/Share

- 07/03/23 Complied w/PUT Options 180 Shares at $250/Each

- 02/23/25 Sold 430 Shares (2nd Batch of Essex) at $300/Share

From the first batch, the Value Investment Fund realized $7,864 after fees. From the second batch, the Fund realized $30,970 on a basis of $107,201 for an average annualized return of 11.4%. The REITs pool recently purchased another 200 shares at $252 each. The Fund is willing to purchase 400 shares at $240 per share if the opportunity presents itself. The sale of the PUT Options nets the fund $2,400.00 after fees. This will be added to the existing cash position of the Fund. Act on Knowledge.