Target Corporation – Sold PUT Options

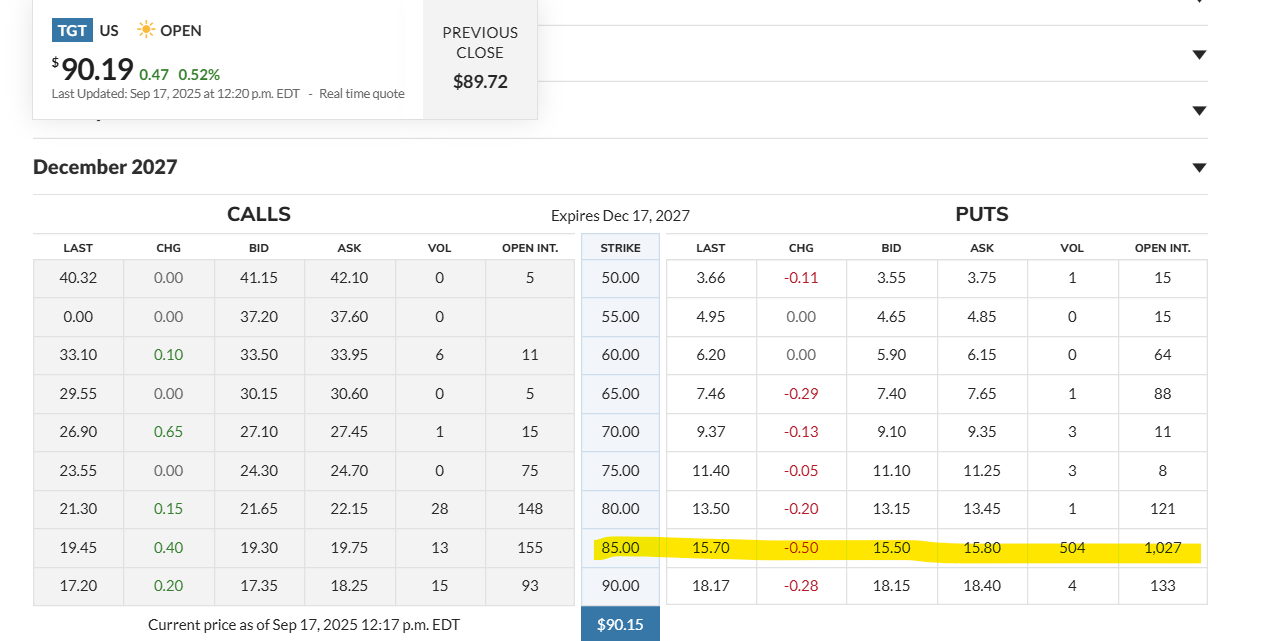

Today, 09/17/25, the Value Investment Fund sold 1,000 PUT Options for Target Corporation. The strike price is $85.00 each with an expiration date of December 17, 2027. The selling price is $15.50 each, netting $14.50 after the transaction fee per share.

PUT options are comparable to an insurance arrangement. The seller, the Value Investment Fund, assumes the risk that the market price per share could drop to or below the strike price during the time period of coverage. In this case, if the share price drops below $85.01, the owner of the insurance, i.e., the buyer of the PUT option, can force the Value Investment Fund to buy those shares from the holder of the option. Take note, the owner can continue to own the stock while the market price fluctuates before the termination date. Most holders of the put option will defer any kind of enforcement of the insurance arrangement right up to the time of the termination date. The reasons vary, but basically, when the price drops below the strike price, in this case $85, the risk to the holder of the PUT option is none. It is conceivable for the price to suddenly improve above $85 per share, and as such, we would want to hold the right until the last possible moment. Another reason to delay the decision is due to dividends. The option holder may wish to continue collecting the dividends even though the market price is less than $85 per share.

For the seller of the PUT option, there is a legal obligation to buy the stock at $85 per share if the holder elects to exercise the option and force the sale of the stock to the maker of the PUT. In this case, this site’s Value Investment Fund is legally obligated to buy the Target stock from the holder of the option. This obligates the Fund to the future for as much as $85,000. However, in this case, the Fund is receiving $14,500 right now ($15.50/Option less $1.00/Option transaction fee). Thus, if the Fund were forced to buy, the actual net purchase price would be $70.50 per share for Target.

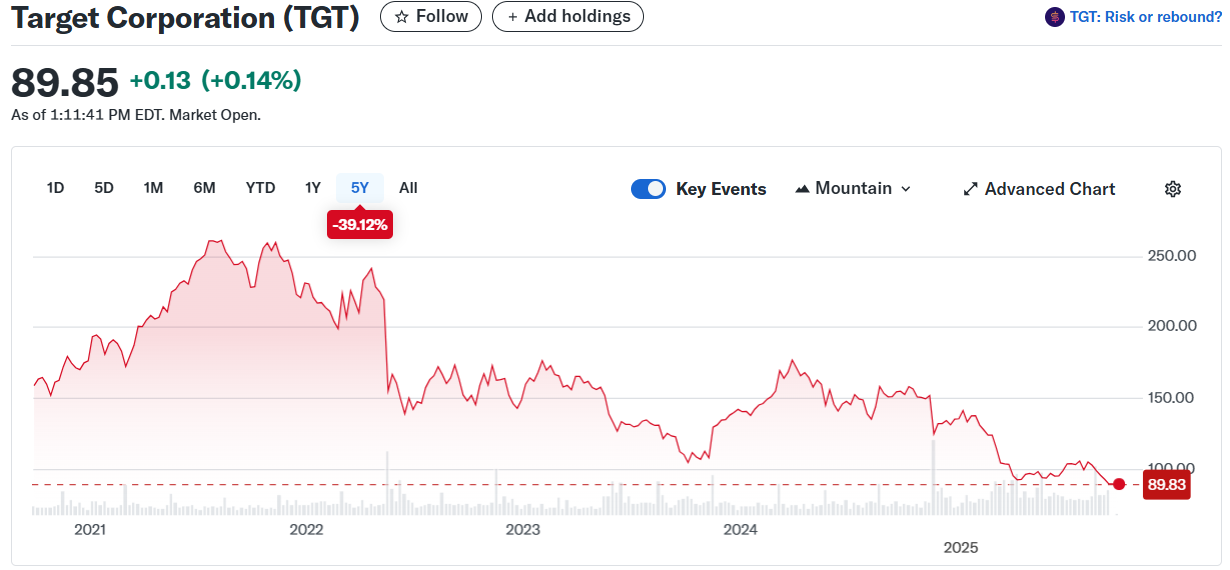

The key to this entire transaction is based on determining the intrinsic value of Target. Will Target’s intrinsic value slip below $85 a share over the next 27 months? Currently, intrinsic value is set at $102 per share with a discount rate of 12%. Target is paying dividends at the rate of $4.48/year and is expected to earn no less than $3.2 billion by fiscal year-end 2025. There is no doubt, 2025 is a rough year, and this is why the market price has dropped from a high of $160 per share down to the current $90/SH. Look at the market price history over the last five years for Target:

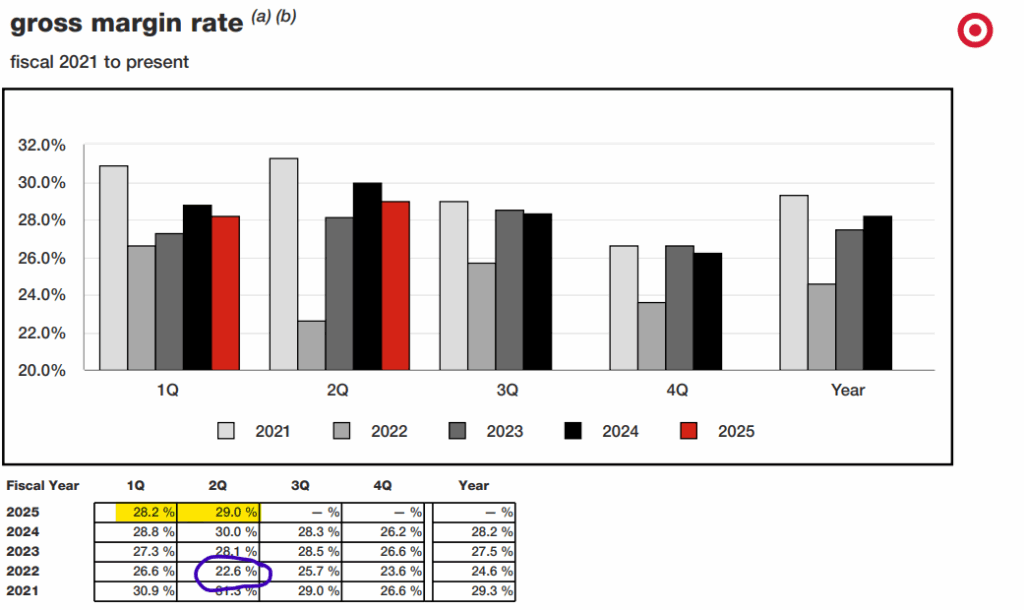

Look at the above graph. The market price downward shift started right after the 2nd quarter report for 2022. In that quarter, Target reported a dramatic drop in its gross profit margin rate from above 25% to 21%. This is a key performance indicator and has the greatest weight with valuation principles and the corresponding algorithms. As of the end of the 2nd quarter 2025, this gross profit margin rate is above 28% for all of 2025 to date. See the table below:

Circled in blue is the 2nd quarter gross margin rate drop to 22.6% which is the lowest rate across the 18 reported quarters.

This corresponds to the dramatic market price drop in 2022 in the above graph, when the market price dropped from $219 per share to $155 per share.

What is fascinating is that Target netted more than $4B per year in 2023 and in 2024.

Yet the market price is still depressed and continues to drop further in 2025. This is tied to the negative consumer campaign against Target due to the political stances taken by many consumers.

Although sales are down about 4% overall during the last two years, the sales reduction would need to double to keep the market price lower than $85/SH.

The simple math is that even if Target only nets $3.2 billion per year, it equates to earnings of $7.02 per share per year. Assuming a P/E ratio of 12, this equates to a market value of $84 per share. In effect, the upside value is dramatic, and the downside risk for these PUTs is practically nonexistent. For the market price to drop below $71 per share (the net remaining requirement), earnings would need to drop below $2.5 billion per year. Any positive key performance indicators will cause the market price to improve well above $100 per share. These include:

- Increases in Sales

- Gross Profit Margins >29%

- Decreases in G&A Expenditures

- Addition of New Stores

Value investors recognized that value is derived from more than just one or two financial pieces of information. Value is derived from the proper interpretation of many details and how each factor impacts the final intrinsic value. The selling of PUT Options for Target adds $14,500 of value to the Investment Fund, improves the overall annualized return on the portfolio, and exposes the Fund to very little risk to earn this $14,500. Act on Knowledge.