Value Investing – Reasonable Expectations (Lesson 1)

If I want to be great, I have to win the victory over myself… self-discipline. – Harry S Truman

One of Aesop’s fables tells the story of the tortoise and the hare, whereby the tortoise wins a race between the two of them due to the hare’s ego. The persistence of the tortoise prevails, and thus, the moral of the story is that slow and steady wins the race. This is an excellent description of value investing.

Value investing is a systematic process of investing in high-quality stocks when those respective stocks have significant market price discounts in comparison to recent highs for that same stock. If the underlying net assets are productive and the company’s financial performance is steady, buyers in the market will ultimately bid the price back to prior market values. In effect, the stock price depression is a reflection of either the company falling out of favor or some other market concern affecting the company’s share price.

Market price fluctuations occur frequently. Value investors simply wait for price depressions with good quality companies to buy stock, and once the price recovers, sell the stock and take their respective gains. With a systematic regimen of buying low and selling high, value investors slowly but persistently outperform all other forms of market programs. Other market programs include:

- Day Trading

- Yield-Based Investors (including dividend-based purchases)

- Index Funds

- Growth-Based Stocks

- Position Trading

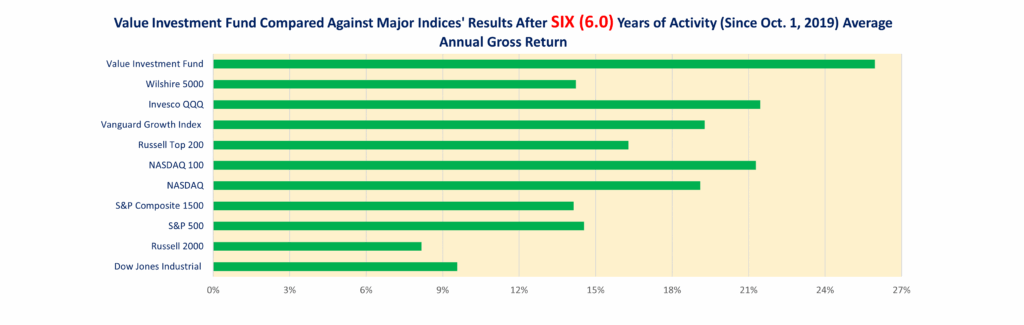

There are many others. Many of them proclaim quick rewards or wealth accumulation in a short period. Value investing is not about quick returns on your investment. It is about a slow and methodical process to accumulate wealth. It is a program for life. A simple graph illustrates this slow and steady approach.

This site started a Value Investment Fund on October 1, 2019, six years ago. As of September 30th, 2025 (six later), it has grown to $399,246.

If you start with $10,000 today and use the value investing program and earn 20% annual returns on average, your portfolio will be worth $380,000 after 20 years. This is after income taxes at 28% on all gains. For comparative purposes, over the last 20 years, the DOW Jones Industrial Average returns have averaged slightly better than 8% per year, and this excludes taxation. If you started with $10,000 in the DOW Jones Industrial Index Fund, it would be worth about $50,000 after 20 years, after taxes. Thus, for comparative purposes, value investing earns two to three times what a top-of-the-line index fund earns over a similar time frame with similar income tax rates.

In effect, the investment doubles in value in slightly more than every three years (3 Yrs).

The key to value investing is that it will beat major market indices year after year. How?

Value investing utilizes four key principles for success.

- Risk Aversion – By purchasing only high-quality companies can an investor can truly limit losses;

- Intrinsic Value – identify price points for stock whereby intrinsic value exists in the stock, thus validating the buy low concept;

- Financial Analysis – utilize financial metrics and business ratios to set good financial performance outcomes, confirming market price increases will occur;

- Patience – waiting the necessary time to buy and sell stock.

Yes, true value investing is superior to other investment models over long periods of time. In the short run, volatility can paint a false picture of success for other methods of investing. Adherence to core principles and preset buy/sell points will win, not in large increments, but will prevail over an extended time in years. The key is to have reasonable expectations from the results of an investor’s hard work. Don’t be mistaken, value investing does require some commitment by investors. An investor should be willing to invest one to two hours per week on their portfolio, most of this reviewing financials and implementing the buy/sell orders to the broker.

What are the reasonable expectations?

There are three reasonable outcomes a value investor expects. The first relates to actual returns on the investment, net of fees and taxes. Secondly, value investors will also experience less stress than other forms of investing. This is a reflection of setting up financial boundaries and simply allowing time to do its job. Finally, don’t kid yourself; this is not an easy program. It does require some work. A reasonable expectation is one to two hours per week for a portfolio less than $1 million. Once you understand the system, it is relatively easy to methodically follow a regimen of checking resources and verifying compliance with the plan. The following three sections cover these reasonable expectations with a little more clarity.

Reasonable Expectations – Just Good Returns

With value investing, now and then, circumstances allow for a great return on one’s investment – read about the one-day buy/sell transaction with Comerica Bank. The only factor that creates this higher-than-expected return is time. If a value investor was fortunate enough to buy low and suddenly the stock price hits a prior peak price within a few weeks, the actual annualized return can be incredibly high. However, this is not normal. Since the sell point is preset, once that stock hits that price, it is automatically sold in the market. The price could jump another eight to ten percent that same day, but it will not improve a value investor’s return on their investment. They sell at a preset price. Therefore, earning exceptional returns is rare; it does happen, but they are infrequent.

What works for value investors is that they are counting on the share price to return to normal within a reasonable period; therefore, earning rewards that effectively equate to higher-than-normal annualized returns on investments. An illustration is warranted here.

On January 29, 2020, Norfolk Southern Railroad’s share price peaked at $219.88. The railways pool of the value investment fund had a preset buy order for Norfolk Southern if the price dropped at least 8% from this peak price. On February 24th, the price dropped to $202.29, which is the 8% discounted buy trigger. Interestingly, Norfolk Southern’s share price dropped to $113 a share by the third week of March. Notice here, if the fund could have purchased at this ridiculously low share price, it could have indeed earned gains well over reasonable expectations when the stock finally recovered in price. On September 14, 2020, Norfolk Southern’s share recovered to its prior peak price of $219.88, and the computer order automatically sold the shares at that trigger point. Here, it took seven months to finally get back to the original peak point. The actual return ended up at 7.6% ($15.59/share net of fees with an investment of $203.29 including transaction fees of $1/share). The effective annual return equals 14.9%.

Had the value investor waited for a larger discount, the effective return would be in the 30 to 40% range and not the actual 15% return. Due to the inherently structured parameters that value investors set, the chance of achieving incredible returns is unlikely.

With value investing, investors may expect annual returns from ten to thirty percent. Depending on the portfolio and the risk factors involved, value investing will rarely have wildly high returns, but at the same time, there is very little risk of having low or negative returns. Even during market depressions extending over a few years, high-quality stocks continue to perform well. Value investment funds just perform with good returns year after year. This site’s Value Investment Fund has currently tracking at over 22% per year since its inception six years ago.

In future lessons, you will learn about how time impacts the value investment fund’s return on its basis. In addition, other lessons cover risk issues and the importance of only high-quality stocks; again, refer to the four principles of value investing stated above.

As you can imagine, the value investor’s emotions related to Norfolk Southern’s rapid price decline and then its final recovery swung from one extreme to the other.

Reasonable Expectations – Emotional Control

It is normal to feel excited when hard work pays off. For value investors, there will be many victories and very few, if any, losses. This is because value investors exercise the four principles, reducing stress commonly found when the stock price goes south, especially when it drops 40 and 50 percent from prior highs. However, if you review these kinds of dramatic price plunges, they are customarily tied to the overall economic environment. Go back to the example above with Norfolk Southern. There, the price dropped from $220 a share to $113 a share in a matter of one month. The driving force wasn’t the company; it was the COVID-19 pandemic fear. The entire stock market was experiencing deep declines in all quality stocks.

A value investor is aware of this possibility. They simply ignore it because they have no control over the entire economy. They can only control the investments they buy. Again, the purchase of high-quality stocks reassures investors that when the market does recover, their respective stocks will recover faster than mid-caps or small capitalization stocks. Furthermore, the intrinsic value of the underlying assets (covered in future lessons) assures that, ultimately, the stock will recover to a reasonable stock market price. It is just a matter of time. This still doesn’t negate or eliminate the roller coaster effect of dread due to the depressed share price. Over time, value investors become secure in their decisions, and the emotional extremes dissipate, and there is calm related to the investment portfolio.

In the long run, value investing is less stressful than other forms of investing due to the quality of the investments; value investors are assured of success just by minimizing losses. There will be many positive highs from good gains when the respective stocks recover to the sell points set by the financial analytical work value investors perform. This brings us to the third expectation of value investing. There is some hard work involved.

Value Investing – Requires Time Commitment

Anything good in life requires work. Value investing is no different. It isn’t hard work, but it does take some time to perform the necessary steps. The most time-consuming step is the development of a comparative analysis for a pool of similar stocks (economic sector/industry and market capitalization). Once done, the pool’s buy/sell trigger points are updated annually. There is typically one day a year when value investors spend the day updating their respective pools (typically six to eight companies), triggers to buy and sell the respective stocks. From there, about once a quarter, value investors review the financial statements looking for anything unusual and spend a few minutes each week updating their respective computer directives with their brokers.

Altogether, a value investor will spend about 60 to 80 hours per year monitoring and maintaining their investment fund. Some value investors participate in a club, like the one sponsored here, and get access to several different pools. This allows them to broaden the scope of potential investments without having to do the legwork involved.

The initial eighteen lessons in this series introduce the reader to the concepts and underlying principles involved with value investing. Later, in Phase Two, the reader learns about pools of investments and how to read and interpret financial information presented by a company. In addition, templates are provided for the value investor to create their pool and generate a set of financial and performance metrics to measure the respective potential investments.

Summary – Reasonable Expectations Associated With Value Investing

For active participants in value investing, there are several reasonable expectations. First, the annual returns are good, not great, just good. This is directly attributable to the preset buy/sell points for stock. This setting of limits practically eliminates losses, but it also sets a ceiling on gains from any given stock. Therefore, any expectation of substantial gains is unrealistic. They may occur if there is a quick turnaround from a discounted buy price to the prior peak price of any respective stock. However, this is unusual; value investors should only expect good returns.

On the flip side of good returns is a significantly reduced chance of losses from trading stocks in the market. The typical value investment fund will excel at earning good returns over long periods (years). Expect annual returns of teens to twenty-five percent. Here and there, you may be fortunate and get upwards of 40% return on the investment pool. However, expect reasonable returns in the lower twenty percent range year after year.

Because value investing is based on intrinsic and financial analytics, there is less emotion involved, and any stress related to trading is appreciably lower. After a while, many value investor traders just shrug their shoulders, even when there are good gains made on stock trades. In effect, it was already known how much gain was expected; it was just the time duration for the gain to materialize. This is covered in a later lesson in this Phase of the program.

Finally, every person involved with value investing should expect to spend some time managing and reviewing their portfolio of investments. It is reasonable to expect to spend one to two hours each week on average working on your portfolio.

If you adhere to the program’s disciplines, you can expect outstanding returns in your long race to accumulate wealth. Persistency is rewarded. Act on Knowledge.