Principle #2: Intrinsic Value (Lesson 7)

It’s a bubble. It has to have intrinsic value. You have to stretch your imagination to infer what the intrinsic value of Bitcoin is. I haven’t been able to do it. Maybe somebody else can – Alan Greenspan.

This is considered the first market crash. Notice the key similar elements of a modern crash. First, lots of buyers, specifically inexperienced traders, enter the market. Secondly, the smarter and bigger players exit the market (they stop buying), effectively taking their gains. And third, and most importantly, buyers recognize that the price for the particular stock (in this case, flower bulbs) doesn’t match the real value of a flower bulb.

The lesson here is straightforward: intrinsic value is merely the real value of the respective asset you are buying. With tulip bulbs, it isn’t hard to figure it out. However, with a large institutional corporation like Walmart, it is a lot more difficult to fathom what you are buying.

With stocks, what exactly are you buying? There are four commonly accepted responses to this question:

- A buyer of stock is purchasing future cash flows (dividends) of the company.

- A buyer is purchasing the current book value of the stock.

- A buyer is purchasing the fair market value of the net assets.

- A buyer is willing to pay more for the whole as an ongoing enterprise than for the sum of its parts.

The sections below cover each one of these responses and how they independently tie to intrinsic value. The final section puts all of them together to provide an overall understanding of intrinsic value related to stocks, specifically related to high-quality companies, which is advocated by value investing.

Future Cash Flows

This particular valuation concept is tied to a similar concept known as an annuity. With an annuity, a buyer pays a lump sum and receives cash payments in return over an extended time. Similarly, with stock, the stock buy price is the initial capital outlay, and in return, you receive dividends, and any net earnings remaining will increase the retained earnings position in the equity section of the balance sheet.

Cash flow in business often refers to what is commonly known as ‘Free Cash Flow’, which is merely the net profit earned reduced by investment requirements. Almost all of the top 2,000 companies, which are the value investors’ target group, earn more than $1 billion per year in net profit after taxes. These earnings are then, in turn, used to reduce debt by making principal payments or buying back bonds; purchasing new fixed or intangible assets; making dividend payments to shareholders; and/or increasing the equity position of the company. In every case, it is customary to use free cash flow to do a combination of all four uses of net earnings. Take note, two of the uses benefit the shareholder directly, whereas the other two benefit the company’s financial position. The reality is that all four do benefit the shareholder; any investment use (debt reduction or the purchase of new assets) indirectly benefits the shareholder in the future with additional net income.

With this form of intrinsic value calculation, specifically the future cash flows valuation, the formula incorporates all four of the above uses of net cash flow. Some conservative investors only count the dividend portion of the future cash flows in their formula. This is understandable. For value investors, using such a strict interpretation reduces the intrinsic value point, thus practically eliminating investment opportunities. An illustration is best here to explain this point.

Assume XYZ, Inc. earns $1 billion per year after taxes. The governing board agrees to distribute 30% of the earnings to its shareholders each year. Therefore, $300 million is distributed each year. The company has no growth, nor decline; it simply earns $1 billion per year. If there are 150 million shares outstanding, then each shareholder earns $2 per share. Assume a conservative investor uses a discount rate of 5%. Using the financial formula of discounted cash flow, the stock to the conservative investor is worth about $32 per share.

Thus, the conservative buyer earns $2 per year on a $32 investment, equating to an annual return of 6.25%.

However, investors at the other end of this concept state that all $1 billion improves the shareholders’ position. Here, the earnings are the actual per-share amount of $6.66 ($1 billion/150 Million Shares). Using the same 5% discount rate, a more liberal investor will say the stock is worth closer to $98 per share. This position is defendable because each dollar of earnings is used in some way to improve the overall financial position of the company and/or shareholder. Remember the concept of book value; the use of earnings includes reducing debt, purchasing assets, or simply retaining cash. This improves the book value of the respective company, thus improving the book value per share for shareholders. For help with this understanding, review Lesson 6 in this series.

With the above two extreme opposing interpretations of future cash flow to determine stock price, the results are at opposite ends of a spectrum of stock value. Remember, if the determination is too low, ‘conservative approach’, it is unlikely the market price for the respective stock will dip to this extreme, especially for such a consistently performing company. In Lesson 6, stability of earnings is the most prized value determined by stock investments. Therefore, any dip to this extreme low value for a share of stock is unlikely with high-quality stocks. Therefore, there are no opportunities to buy low and then sell high.

If the determination is too high, the result is that value investors will buy at an unreasonably high price, defeating the purpose of the buy low, sell high tenet of business; review Lesson 5. In effect, they will not make a good return on their investment. Therefore, the answer lies somewhere in between these two extremes.

Notice how, with this example, the company earns the same amount each year, and the governing body imposes the same use of funds. There are several flaws here, and therefore, it is important to compare and contrast the differences between the above easy model and, of course, the real world.

- Stagnant Business Environment – With an annuity, the cash payments are the same every month for the agreed-upon period. In effect, with an annuity, you are merely receiving your interest earned along with an amortized portion of the original principal invested. With XYZ, the same cash flow exists, a 50-cent dividend ($2.00 per year paid quarterly) each quarter for perpetuity. With stock in the real world, it is much different. The company you purchased exists in an ever-changing environment. There are hundreds of conditional changes; no one can predict the volume of sales five or six years from now. Therefore, the profitability will change. This greatly impacts the formula used to determine the current value of future cash flows from the investment. Many investors have to use some form of dampening factor to be conservative in determining future cash flows. Dampening factors include a lower growth rate, higher discounts for the individual cash flows, and, in some cases, a limited future time range. This conservative approach greatly reduces the intrinsic value outcome.

- Growth Rate – Annuity purchases eliminate all variables; they are simple, straightforward returns on your investment for letting a second party use your money. The same goes for XYZ Inc. above; there is no growth rate for revenue or net income. With stock purchases, assuming a desire to earn future cash flow, there must be an assumption of growth for the company. Larger entities tend to grow consistently or at least maintain a comparable position to the economy as a whole. The small and mid-caps are the stocks where large growth rates are found. Since value investing ignores small and mid-caps, the growth rate rarely exceeds 9% for value investments. Furthermore, growth rates compound the formula used to determine future cash flow. Here, too, a dampening factor must be incorporated into the formula to compensate for the unknown in the future.

- Dividends Change Over Time – An annuity’s payment stream is pure; it does not change from one time period to the next. With stock, not only is the income different from one year to the next, but the dividend payout to stockholders also changes from one time period to the next. With larger companies, it is easier to determine the approximate dividend in the near term (over five years), but beyond that, any deviation greatly affects the current amount to pay for this stream of future cash flows. With this stated, the more conservative investor’s formula would have to consider this. Thus, the price would move higher given that traditional dividends continue to increase. In general, most companies see improvements of 50% plus every 10 years with dividend payments. Many of your larger stable entities see almost a doubling effect of dividends every 10 years.

- Use of Earnings – In the XYZ example above, the governing board uses 70% of net earnings to reduce debt, purchase assets, or retain the money for cash. This continuously improves the book value of the company. DOW and large-cap stocks use the net earnings for similar purposes. Many try to maintain a certain debt-to-equity ratio, thus allowing a greater expansion of operations via fixed asset purchases.

- People, Product, and Processes – Over time, all of these change, too. With larger organizations, the product line is diverse, so any single product change will rarely move the needle in any direction. The same is true with people and processes; however, sometimes investors see significant movements within the industry or the company as consumer tastes wane or shift. The same goes with employees; unions may negotiate better wages and conditions for their members; thus, all of these do change and can impact the net earnings of the company.

This is why many value investors compromise between the two extremes, as illustrated above with XYZ, Inc. Value investors will often simply use the free cash flow value as the basis of their formula. A common tool is to assume a reasonable growth rate (one of the dampening factors explained above), a discount rate, and a set short-range period to determine intrinsic value utilizing future cash flows. For this purpose, an illustration is helpful:

Assuming XYZ, Inc. has historically had a growth rate of 1% greater than the economic growth rate, and value investors like a conservative discount rate of 6%, what is the intrinsic value of XYZ’s stock? XYZ’s free cash flow is $650,000,000 per year (the board uses $350,000,000 per year to reduce debt and purchase additional fixed assets to replace worn-out assets and improve processes).

The economy grows at around 2.3% per year; therefore, XYZ’s growth is 3.3% per year, and all of this falls to the bottom line. Thus, in Year 1, net earnings are $1 billion, and in Year 2, net earnings improve to $1,003,300,000. Therefore, free cash flow in Year 2 improves to $653,300,000. What is the present value of this free cash flow, assuming this pattern continues?

This makes the company worth approximately $13.1 billion (the formulas for this are provided during Phase 2 of this program). With 150 million shares outstanding, each share is worth approximately $88. Notice how this falls between the two extremes identified above ($32 and $98)? Why did this tend towards the higher end, though? The answer is that the company can maintain its relative position to the economy as a whole. Let’s change it slightly to illustrate. Assume that it only grows at the economic rate of 2.3%. What is the stock’s intrinsic value based on cash flows? The answer: $81. Therefore, the ability to maintain its economic position or a slight improvement can affect a stock’s value by about 8 to 9%.

A higher discount rate by the value investor lowers the share price. A simple 1% increase in discount reduces the share price $6 for XYZ, Inc.

For value investors, they only work with the top 2,000 investment opportunities and are selective within this group to only those that have stable earnings and can maintain or slightly improve their economic position within the overall group of 2,000. The intrinsic value outcome is going to tend towards the more liberal outcome, as illustrated in the XYZ, Inc. example at the beginning of this section. Value investors should expect the share price to be within 15 to 20% (lower) of the more liberal interpretation of how much future cash flows are worth.

This concept is covered in more detail during Phase Two of this program and is incorporated into the spreadsheets provided. For the reader, it should make sense. Notice how it is reasonable in business to have results somewhere between the extremes, but tend towards the full value of future cash flows and not the ultra conservative outcome that pure dividend-only conservative investors rely on for their determination of value? If you only use the discounted dividends formula, even assuming growth with dividends over time, the outcome for intrinsic value is too low.

Because dividends are only one of the uses of the earnings, the other uses also add value to the discounted dividends-only formula with higher quality stocks. Lower quality stocks have an increased risk of poorly investing the unused portion of net earnings after payment of dividends. One of these additional uses is the amount that the unused earnings add to the book value of stock.

Intrinsic Value – Book Value

A second popular intrinsic value definition is that stock is worth the company’s book value. Book value is merely all assets, less all liabilities. It is also referred to as the equity section of the balance sheet. However, with large corporations, the equity section can get a bit complicated. Often, there are three owners, each with certain rights. The first group of owners is preferred shareholders or preferred stockholders. In effect, they get paid first before traditional common stockholders. The second group of owners is what is referred to as minority shareholders. Here, when a large corporation exists, it often owns subsidiary corporations. But, it doesn’t own 100% of these smaller corporations; thus, the other owners of these other corporations are known as minority interests. Lastly, there are, of course, the traditional common shareholders. Thus, the term here, book value, refers to the common shareholders, i.e., the publicly traded shares.

The formula is simple: it is this part of the equity section of the balance sheet divided by the number of outstanding shares. Many of the popular brokerage sites include this value in a company’s snapshot of financial metrics.

Many so-called value investors use this particular dollar amount as the perceived purchase point for stock. As explained in other lessons and reiterated here, top-quality stocks rarely sell at book value. You find book value prices commonly with small-caps and penny stocks. Thus, book value is NOT the target price for high-quality stocks nor large caps. The book value concept applies to other stock tiers. This is why, when you read about value investing from other sites, they claim intrinsic value equals book value. This is not true with high-quality stocks.

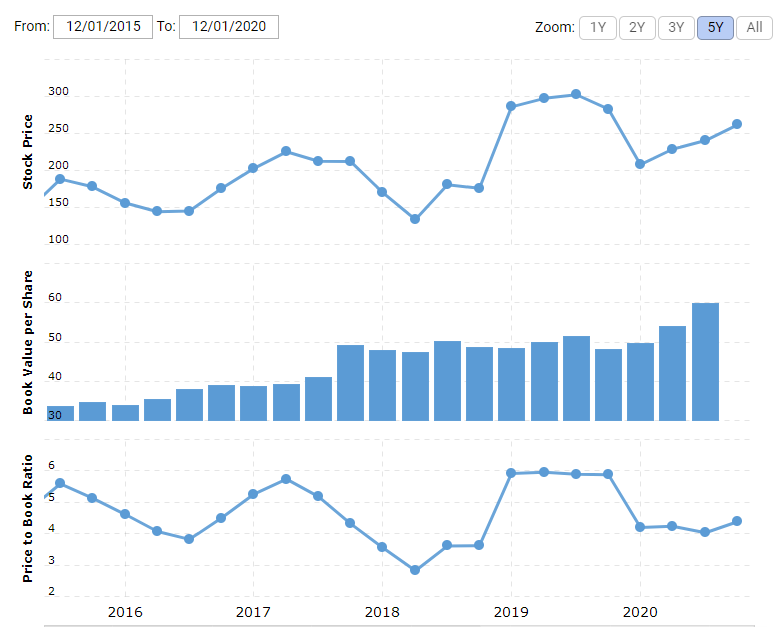

There are two uses of book value when used with determining the intrinsic value for a company. First, it is often the floor value of the stock. It is encouraged that value investors understand this floor value because, as the price for a quality stock decreases towards the floor value, the stock becomes an obvious target for purchase by value investors and a multitude of other types of investors (institutional, market funds, pensions, etc.). A second use of book value is with the business ratio of price to book. This ratio is customarily a trend line to compare the current price to book to the historical average, to discover opportunities to buy. Rarely will value investors pay more than three to one for a stock unless this particular company is a standard bearer in their respective industry. To illustrate, look at Coca-Cola’s price-to-book over five years.

Coca-Cola is considered one of the best companies out there in the market; it is a DOW company. This company is more than 100 years old and rarely records quarterly losses. It is simply one of the best companies in the world. Thus, the most recent history rarely finds a price to book at the end of any quarter less than 3:1.

When the price drops towards 3:1, it becomes enticing for buyers, given its record of stable earnings since 1919, the year the company went public.

*Notice in the first quarter of 2018 how the price-to-book dropped to 3:1? Well, it actually is due to the tax code change in December of 2017. Coca-Cola went ahead and recaptured historical offshore income and paid federal income taxes at a lower rate. In that respective quarter, Coca-Cola lost $2.2 billion, and many ill-informed investors fled the stock, lowering its price (see the stock price in the upper section of the three graphs). This was an opportunity to buy and make a lot of money, as the tax payment had no impact on market share, processes, or the management team. Look at how fast it recovered. This is what value investors understand and calculate with their models.

This particular chart is updated every quarter. If this particular stock is included within a pool of investments containing the various non-alcoholic beverage companies, it would be the standard bearer. In addition, the price-to-book trend line would be weekly, so upwards and downward trends can greatly assist the value investor with the decision model.

Most of the quality investments used in the respective industry pools will have a standard bearer with a high price to book ratio, and the others will have ratios ranging from 1.5:1 (stated as ‘1.5 to 1) upwards to 2.5:1.

Remember, the reason price-to-book ratios are higher with this program is that the pool is composed of low-risk, highly stable, profitable companies. Therefore, the stock price will rarely, if ever, dip down to pure book value. It doesn’t mean it can’t happen; it would take extenuating economic circumstances along with industry issues to depress the market price towards the book price with these types of companies.

Many folks get a tad confused with book value by equating it to net asset value. Technically, they are the same. The textbook definition of book value is assets less liabilities, which equals net assets. This next section will explain how reality is far different than a textbook answer.

Intrinsic Value – Net Assets at Fair Market Value

‘Net assets’ means all assets less all liabilities. This is also referred to as ‘Book Value’. Be careful here, in this case, book value refers to the entire equity section of the balance sheet, as net assets less liabilities refers to all remaining book value of assets. Thus, common stockholders may not have rights to all of the net assets. Those equity holders in a higher position, think as preferred and minority shareholders, have greater rights to net assets than common shareholders. Thus, true net assets equal:

Net Assets for Common Stock Holders = All Assets Less All Liabilities Less Apportioned Value for Preferred and Minority Shareholders

As will be stated multiple times throughout this series of lessons, textbook definitions and actual application are two different outcomes, especially when dealing with value investing.

Thus, net assets with value investing means the net assets’ dollar amount apportioned to common stock. This net asset amount is then divided by the number of common stock shares outstanding to determine the net assets’ value per share. This mirrors the definition of book value as explained in the section above. So why do we need to understand the difference between net assets and book value if they are the same?

Book value, as stated above, assumes that the entity is an ongoing operation and the dollar amount refers to the accrual basis value of the company in its current state of existence. Net assets are slightly different. With value investing, net assets mean the value of the assets if the company ceases to exist and disposes of the assets into the market. Therefore, net assets really mean all assets at fair market value, less liabilities, less apportioned amounts of equity to minority interests, ending with an acquired value that is then allocated per share to the existing common stock shareholders. To put this in another way, think of net assets as equal to the liquidation value less payment of all liabilities and apportioned amounts to senior equity stakeholders.

If you spend some time on this thought process, older, more mature, and stable companies have fixed assets that are fully depreciated and thus on the books of record, have no or limited dollar value attached. For those of you unfamiliar with depreciation and its impact on the balance sheet, please read articles on this website related to depreciation (simply type in ‘depreciation’ in the search field on the home page). But in reality, these fixed assets have a fair market value that far exceeds the book value. Younger companies, those still in the penny stock or small-caps tiers of stocks, typically don’t have a large differential of value between what is recorded on the books and what is the true fair market value of the respective assets.

Since value investing only deals with the top 2,000 companies, most of these are mature and highly stable operations. Rarely will you find any one of these companies aged less than 30 years. Thus, their assets, including intangible assets, have a fair market value that often greatly exceeds their recorded value on the books of record. To illustrate, look at XYZ’s balance sheet values and, of course, the fair market value of the corresponding assets.

XYZ, Inc.

. Balance Sheet

. 12/31/2020

($000’s) Net Assets

ASSETS Book Value Fair Market Value

. Current Assets $2,435,000 $2,418,000

. Fixed Assets 5,055,000 6,115,000

. Other Assets 410,000 450,000

. Total Assets $7,900,000 $8,983,000

LIABILITIES 3,410,000 3,410,000

EQUITY 4,490,000 5,573,000

# of Shares 150,000 150,000

Value/Share $29.93 $37.15

Take note, with the fair market value principle, the liabilities do not change; only the assets’ value changes. The fair market value of total assets for XYZ, Inc. adds another $7.22 of value per share for common stock.

This additional value greatly impacts the intrinsic value calculations that value investors use to determine the floor value of a stock’s market price. However, it is essential to understand this principle. It is more applicable to certain industries than other industries. For example, service-based operations or high current assets-based companies (banking, insurance, and construction) generally have fair market values that match book values. Look at XYZ above. Its current assets at fair market value are slightly less than book value; this is due to the cost to liquidate those assets. This same liquidation cost applies to those companies with strong current asset-based balance sheets.

However, for companies with strong fixed asset-based balance sheets, the fair market value often exceeds the book value of the corresponding fixed assets. Good examples include real estate investment trusts – REITs. Many REITs have strong depreciation schedules for their fixed assets (buildings, improvements, etc.), but the actual fair market value customarily improves over time for real estate. Other examples of this principle include resorts, hotels, food service (think of the ever-increasing value of the land where the restaurants sit), and manufacturing. Again, this is more common with mature companies, those in the top 2,000 companies worldwide.

Notice that in some situations, the fair market value of net assets exceeds the book value of net assets. But this assumes liquidation as the source of value. Mature, highly stable companies are not going to liquidate; they are going to continue operations as an ongoing concern. This is because the sum of the assets is more valuable taken as a whole than sold off individually.

The Whole Is Greater Than the Sum of Its Parts

A Gestalt psychology approach and sometimes credited to Aristotle for his quote from Metaphysics 8.6, “For however many things have a plurality of parts and are not merely a complete aggregate but instead some kind of a whole beyond its parts, …”, this thinking defines how a team approach is superior to individualism when resolving problems. Thus, corporations are more capable of providing products/services than what individuals or systems could do on their own. Therefore, when evaluating share price, the value must be greater than either the book value or net assets at fair market value. This is now the new floor related to the share price.

Mathematically, this also makes sense. Assume the net asset value at fair market value is X dollars. This value is today’s value. However, if we leave the system running, knowing full well that the market will buy the product/service tomorrow, we will earn additional marginal value tied to the profits from tomorrow. Extending this out to a reasonable period, the share price should be equal to the current net assets at fair market value plus free cash flow per share over the next few years. Again, this assumes the market will not change significantly over the ensuing few years.

Sticking with the XYZ, Inc. example, suppose the current net asset value at fair market prices equals $37.15. Assuming also that XYZ’s product/service will easily be consumed/purchased by the market over the next three years without any sort of decline, then the value must equal:

Net Assets Value + (Free Cash Flow/#of Shares)Year 1 + (Free Cash Flow/#of Shares)Year 2 + (Free Cash Flow/#of Shares)Year 3

= $37.15 + $4.33($650M/150M Shares) + $4.33 (Year 2) + $4.33 (Year 3)

= $50.15

This formula basically assumes the company will continue in operation as a whole for the next three years and then liquidate its assets, and the common shareholder should receive this value. Many of you are now thinking, well, why wouldn’t the net assets at fair market value not decrease in value in the interim? Well, easy answer: Notice that up in the future cash flows section that XYZ earns $1 billion per year, and the governing board uses $350 million of this to replace exhausted fixed assets or reduce the corresponding debt. Thus, the net asset value at fair market value is at least maintained at current values. To think of it another way, the board is spending $350 million per year to maintain fixed assets worth $6.115 billion, or about a 5.7% maintenance rate. This is more than adequate when one thinks about maintaining long-lived assets in their current condition into the future. The general rule of thumb is four to five percent per year for long-lived assets.

Now, let’s complicate this a tad more. Since value investors can’t really see well beyond the next three years, let’s assume that the company in Year 4 can no longer generate a free cash flow of $650 million but can only generate $150 million. This means in years four and five, the shareholders get $1 per year of value. Don’t forget, the fixed assets continue to be maintained, as free cash flow is determined after covering the costs of replacement/maintenance of existing assets. This adds $2 to the overall adjusted floor value of the stock.

Now it is worth $52.15, and this assumes the company goes out of business in five years on purpose.

Notice how the window of value is beginning to incrementally head towards a distinct intrinsic value. As of right now, assuming some average and worst-case operations, the intrinsic value is somewhere between $88, as illustrated above, assuming reasonable growth and a 6% discount for cash flow over many years, and this ‘whole is greater than the sum of its parts’ value of $52.15. This is still a wide value spectrum ($36) associated with this stock. Without further clarity, an exact intrinsic value is going to be difficult to ascertain.

Intrinsic Value with Stock

The first lesson for the reader dealing with intrinsic value is this: this is not an exact science. As the above illustrates, there are seven different price points already. Let’s review.

Future Cash Flows Method

1) Conservative Position of Discounted Dividends Only = $32

2) Liberal Position of Discounted Net Earnings = $98

3) Free Cash Flow Discounted with a Reasonable Growth Rate = $88

Book Values

4) Traditional Book Value = $29.93

Net Assets Value

5) Net Assets at Fair Market Value = $37.15

Whole Greater Than Sum of Parts

6) Net Assets at Fair Market Value Plus 3 Years of Free Cash Flow = $50.15

7) Net Assets at Fair Market Value Plus 5 Years of Discounted Cash Flow = $52.15

Value investors can agree on two financial points. First, the intrinsic value is not the extreme under number 2 (Liberal Position of Discounted Net Earnings) at $98, nor is it the traditional book value at $29.93. It has already been determined that the net asset value at fair market price equates to at least $37.15. At the other end of the spectrum, it is difficult to accept that the free cash flow discounted with a reasonable growth rate at $88 is the price to use as the optimum buy with this particular company.

Since this company is an ongoing concern, it is reasonable to expect that the absolute worst-case scenario for a floor value to use with buying this stock is $52.15, based on net assets at fair market value plus five years of discounted free cash flow.

Somewhere in between the $52.15 and the $88 per share is a reasonable intrinsic value associated with XYZ, Inc. So, what is a reasonable intrinsic value for XYZ?

Let’s review intrinsic value principles before answering this question.

- First, intrinsic value is not an exact science; the key is to be reasonable in determining the intrinsic value of a stock.

- Intrinsic value tends towards book value in the lower tiers of market capitalization stocks. This is driven by the lack of stability of earnings, which is the number one criterion related to elevating a stock’s value beyond book value for intrinsic value.

- High-quality stocks have a history of earnings and operations; thus, intrinsic value tends more towards the value of future cash flows than traditional book value.

- High-quality companies have stable growth rates, typically less than 5% and commonly exceed the economic growth rate. Thus, reasonable growth rates for DOW and large-cap stocks are between two and five percent per year.

- The going concern aspect of higher quality stocks allows the discount factor for future cash flow to be lower, as there is greater trust that the entity will not fail in delivering free cash flow to its financial stability.

Since book values or any derivative of the book value, including the net assets formula, are used with lower-tier types of stocks, it is reasonable to use future free cash flow discounted by a reasonable amount as the basis for estimating intrinsic value for high-quality stocks. Since this lesson assumes XYZ is a high-quality stock and its products continue to be desired by consumers, a reasonable formula would estimate growth at around 2.7%, effectively a marginal growth rate in comparison to the 3.3% growth rate used above. In addition, a discounted rate of 5% is reasonable. What is the value of the stock?

$81

Here is the table based on certain growth and discounted rates:

* The spreadsheet to calculate these outcomes is provided at the end of this Phase of the program.

Growth Discounted Rates Value

2.7% 5% $81

2.7% 6% $76

2.9% 5% $82

2.9% 6% $76

2.4% 5% $80

2.4% 6% $75

The extremes in this table are $82 at a 2.9% growth rate discounted at 5% and $75 for a 2.4% growth rate discounted at 6%.

Remember, value investors seek a reasonable value to set as the intrinsic value for a stock’s buy point; something that will generate a good reward for the investor once the stock’s price exceeds a certain preset sum as the sell price. Thus, splitting the difference equates to $78 or $79 per share.

Let’s review. The liberal position is $98/share, whereas a conservative net assets value with five years of discounted cash flows without growth equates to $52.15. Settling in at $78 or $79 as the result of intrinsic value is a good compromise given that fact that XYZ, Inc. is a top 2,000 company and demonstrates stable earnings and good management.

In summation, intrinsic value is just one of the four principles of value investing. Intrinsic value sets the ceiling price of the investment; i.e., a value investor wants to buy it for less than its intrinsic value. Any price higher than this intrinsic value must be substantiated by other value investing criteria. In effect, other criteria may increase the buy point upwards of 20% into the low 90s. This is based on other additional positive attributes of XYZ, Inc. to add value to the intrinsic value calculated under reasonable criteria. Ideally, a value investor wants to buy the stock for 15 to 20% less than its intrinsic value, providing a margin of safety; think of it as a cushion that adds a lot of additional return when the stock is finally sold.

Lesson 8 in this series focuses on financial analysis and how its results are driven by trends and not immediate (quarterly reports) results. The financial analysis helps the value investor determine the most likely selling price based on common institutional and investment group requirements. The difference between the selling price and the intrinsic value creates a corridor of most probable stock prices related to the particular company. In effect, value investors would expect to see the stock price fluctuate between the intrinsic value point and a common high price for this company. When the stock’s price exceeds either point, the value investor is buying or selling to reap rewards for their knowledge. Act on Knowledge.